Best Fixed Deposit Rates Singapore (Dec 2024): UOB, OCBC, DBS, Maybank & More

●

There are a lot of places to park your money. And sometimes, you just have a considerable amount of cash lying around that you don’t really wanna risk.

Enter fixed deposits (or time deposits), an extremely low-risk way to grow your money without losing your capital. It is where you can leave your money, forget about it, and return later to collect the interest. Every bank offers different interest rates, which typically vary according to the minimum deposit amount and agreed-upon tenure.

So, which bank offers the best fixed deposit rates in Singapore? Let’s find out!

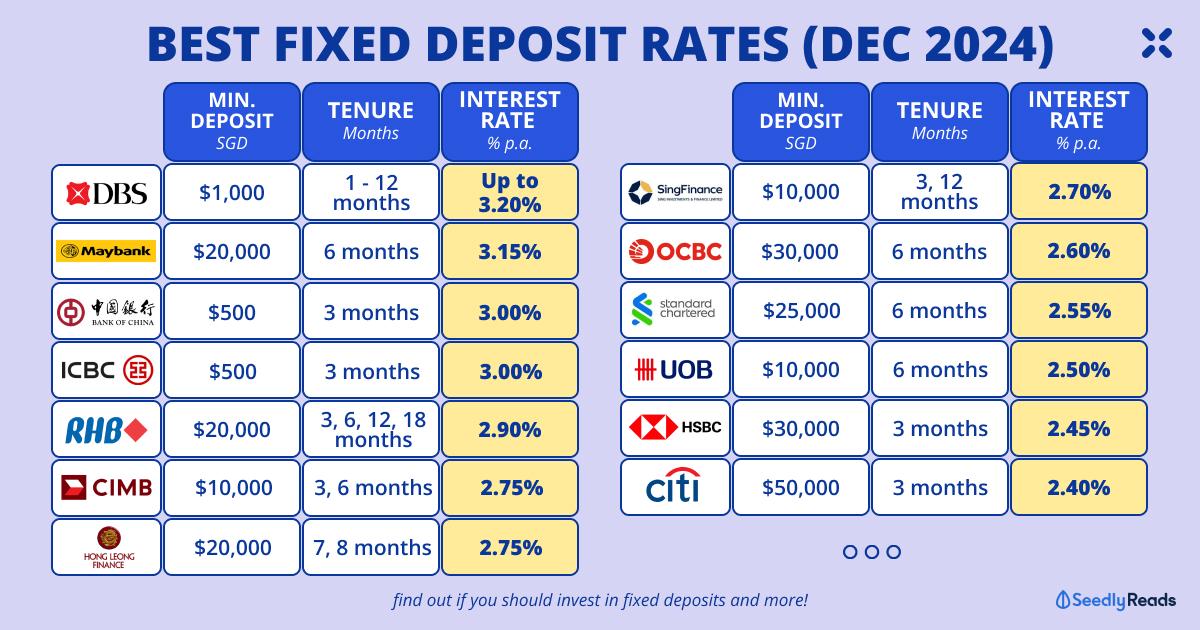

TL;DR: Best Fixed Deposit Rates Singapore (Dec 2024)

- Best 3-month fixed deposit rate: 3.00% p.a. by Bank of China with a minimum deposit of $500

- Best 6-month fixed deposit rate: 2.90% p.a. by DBS/POSB Bank with a minimum deposit of $1,000

- Best 12-month fixed deposit rate: 3.20% p.a. by DBS/POSB Bank with a minimum deposit of $1,000

The best rates above are for minimum investment amounts below $50,000 and for new-to-bank customers without fulfilling special criteria, i.e. priority/preferred banking.

| Banks | Promotional Interest Rate (p.a.) | Tenure (Months) | Promotion's Minimum/ Qualifying Amount (SGD) | Valid Till |

|---|---|---|---|---|

| DBS/POSB Fixed Deposit Rates | 3.20% | 12 months | $1,000 | Further notice |

| Maybank Fixed Deposit Rates | 3.15%* | 6 months | $20,000 (Fresh funds) | Further notice |

| Bank of China Fixed Deposit Rates | Mobile Banking: 3.00% Over the Counter: 2.90% | 3 months | $500 and above (Via Mobile Banking*) $10,000 and above (Over Counter) | Further notice |

| ICBC Fixed Deposit Rates | E-banking: 3.00% Over Counter: 2.85% | 3 months | E-banking: $500 Over Counter: $20,000 | Further notice |

| RHB Fixed Deposit Rates | Premier Customers: 3.00% Personal Customers: 2.90% | 3, 6, 12, 18 months | $20,000 | Further notice |

| CIMB Fixed Deposit Rates | Preferred Banking: 2.80% Personal Banking: 2.75% | 3, 6 months | $10,000 | Further notice |

| Hong Leong Finance Fixed Deposit Rates | 2.75% | 7, 8 months | $20,000 | Further notice |

| Sing Investments & Finance Limited (SIF) Fixed Deposit Rates | 2.70% | 3, 12 months | $10,000 (Fresh funds) | Further notice |

| OCBC Fixed Deposit Rates | 2.60% (Online) | 6 months | $30,000 (Fresh funds) | Further notice |

| Standard Chartered Fixed Deposit Rates | Priority Private Banking: 2.75% Priority Banking: 2.65% Promotional Rate: 2.55% | 6 months | $25,000 (Fresh funds) | 31 Dec 2024 |

| HSBC Fixed Deposit Rates | 2.45% | 3 months | $30,000 (Fresh funds) | 31 Dec 2024 |

| UOB Fixed Deposit Rates | 2.50% | 6 months | $10,000 (Fresh funds) | 31 Dec 2024 |

| Citi Fixed Deposit Rates | Existing/New Customer: 2.40% | 3 months | $50,000 (Fresh funds) | 31 Dec 2024 |

*For every $1,000 deposited into Maybank Current or Savings Accounts (min. $2,000), you can deposit $10,000 into the Deposit Bundle Promotion ($20,000).

Jump To:

- What is a Fixed Deposit Account?

- How Do Fixed Deposit Compare to Singapore Savings Bonds?

- How Do Fixed Deposit Rates Compare to Treasury Bills?

- How Do Fixed Deposit Rates Compare to The Best Savings Accounts in Singapore?

- How Do Fixed Deposit Rates Compare to Guaranteed Cash Management Portfolios?

- Bank of China Fixed Deposit Rates

- CIMB Fixed Deposit Rates

- Citi Fixed Deposit Rates

- DBS/POSB Fixed Deposit Rates

- Hong Leong Fixed Deposit Rates

- HSBC Fixed Deposit Rates

- ICBC Fixed Deposit Rates

- Maybank Fixed Deposit Rates

- OCBC Fixed Deposit Rates

- RHB Fixed Deposit Rates

- SIF Fixed Deposit Rates

- Standard Chartered Fixed Deposit Rates

- UOB Fixed Deposit Rates

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their due diligence and consider their financial goals before investing in any investment product. Information is accurate as of 4 Dec 2024.

What is a Fixed Deposit Account?

Fixed deposits, also known as time deposit accounts, guarantee an interest rate on money deposited over a specified period.

Advantages of Fixed Deposit

Fixed deposits are popular among some Singaporeans due to a few reasons:

- Virtually risk-free: Up to $100,000 of the amount is insured by Singapore Deposit Insurance Corporation (SDIC)

- Guaranteed returns: By locking up an amount of money, it helps a particular group of people save better

- Tax-free interest: The interest you earn from your fixed deposit sum is exempted from tax in Singapore

- High liquidity: Despite what many seem to think, you may withdraw your money from fixed deposits at any time but incur early withdrawal fees.

Disadvantages of Fixed Deposit

For the additional interest rate, parking your money into a fixed deposit has its cons, too:

- Less flexibility: You’ll give up the liquidity of your savings for a fixed amount of time to get the interest

- Early withdrawal fees: Withdrawing your money before the deposit reaches its maturity date will mean receiving less interest

- Minimum deposit amount required: Fixed deposit usually requires a minimum of between $1,000 and $5,000.

How Do Fixed Deposit Rates Compare to Other Investment Options?

Fixed Deposit vs. Singapore Savings Bonds (SSB)

When comparing Fixed Deposits to Singapore Savings Bonds, the key difference lies in the issuer.

Banks offer Fixed Deposits, where you deposit a sum for a fixed period at a fixed interest rate. On the other hand, Singapore Savings Bonds (SSBs) are issued by the Singapore government and offer a flexible, potentially higher-return investment option.

While fixed deposits provide a guaranteed return, Singapore Savings Bonds offer a step-up interest rate that may increase over time, making them attractive for long-term investors seeking security and growth potential.

Your choice between the two will depend on your investment goals, risk tolerance, and time horizon.

Fixed Deposit vs. Saving Accounts

When it comes to savings accounts, you have to jump through some hoops to set up your account, credit your salary, etc., but for some accounts, it may be worth it.

Fixed Deposit vs. Treasury Bills (T-Bills)

If you’re thinking about other low-risk investment options with the flexibility of withdrawal in the short term. But note that for SSBs and T-bills, you might not get the full amount you want to be allocated.

Apart from those mentioned above, there are these low-risk alternatives you can consider such as insurance savings plans and cash management accounts.

Fixed Deposit vs. Foreign Currency Fixed Deposit

Foreign Currency Fixed Deposits such as the USD Fixed Deposit work similarly but involve depositing funds in a foreign currency and it is subjected to exchange rate fluctuations.

While Fixed Deposits offer stability in the local currency, Foreign Currency Fixed Deposits expose you to potential gains or losses due to currency exchange rate movements.

Fixed Deposit vs. Guaranteed Cash Management Portfolios

Guaranteed cash management portfolios, such as Syfe Cash+ Guaranteed and StashAway Simple Guaranteed, are investment products that invest your funds in fixed deposits at partner banks.

When you invest in them, you will be locking up your cash for a fixed period and enjoying a guaranteed fixed rate of return.

But wait, how is this different from directly investing in a fixed deposit? Here’s a table to explain the key differences:

| Investment Product | "Guaranteed" Cash Management Portfolio | Fixed Deposits |

|---|---|---|

| Tenure/Term | 3 - 6 months | Up to 24 months |

| Liquidity | None (withdrawal only at end of term) | High (but with fees) |

| Minimum Investment Amount | None or as low as $1 | Typically $5,000 and above depending on bank |

| Insurance | No SDIC coverage on an individual level. Up to $75k SDIC coverage applies to the bank account(s) used by the company. | Insured by SDIC up to $75k on an individual basis |

One key difference I would like to highlight is that there is absolutely ZERO liquidity when investing in these guaranteed cash management portfolios.

This means you can neither withdraw nor top up your invested funds until the term ends. So ensure you don’t need that money for the specified period.

| Syfe Cash+ Guaranteed | StashAway Simple Guaranteed | |

|---|---|---|

| Returns (p.a.) (lock-in period) | 3 months: 3.75% 6 months: 3.75% 12 months: 3.50% | 1 month: 3.50% 3 months: 3.75% 6 months: 3.60% 12 months: 3.50% |

| Minimum Investment Amount | None | $1 |

| Funding | Cash | Cash/SRS |

| Fees | None | |

| Liquidity | None (Withdrawal only at end of term) | |

| Insurance | No SDIC coverage on an individual level. Up to $100,000 SDIC coverage applies to the bank account(s) used by the company. |

|

| Underlying Investments | Fixed deposits with a bank | |

Regardless of your option and how promising a certain investment may sound…

Always, ALWAYS, do your own due diligence when you’re investing.

How to Choose the Right Fixed Deposit?

- Minimum Amount: There is always a minimum deposit you have to make, so ensure you have set aside emergency funds first before putting them into fixed deposits

- Promotional Interests: More often than not, there is a promotion every month, and you can look forward to higher interest rates and sometimes cash rewards or cashback

- Tenures: Choosing the right tenure for your fixed deposit is crucial. Remember, longer doesn’t always mean better. With fixed deposit options ranging from months to years, selecting a tenure that aligns with your financial goals and liquidity requirements is important.

Read more:

- When Should You Choose Fixed Deposits over Singapore Savings Bonds (SSB)?

- Investment Products Backed By The Singapore Government: SSB vs SGS Bond vs Treasury Bills

What are The Best Fixed Deposit Rates Offered in Singapore?

With that in mind, here are the best fixed deposit rates in Singapore.

Bank of China Fixed Deposit Rate (Dec 2024)

| Tenure | Amount (SGD) | Over the Counter Placement Interest Rates (% p.a.) | Via Mobile Banking Placement* Interest Rates (% p.a.) | Promotional Validity |

|---|---|---|---|---|

| 1 month | $10,000 and above (Over the Counter) $500 and above (Via Mobile Banking*) | 2.60 | 2.70 | Till further notice |

| 2 months | 2.70 | 2.80 | ||

| 3 months | 2.90 | 3.00 | ||

| 4 months | 2.80 | 2.90 | ||

| 5 months | 2.70 | 2.80 | ||

| 6 months | 2.65 | 2.75 | ||

| 9 months | 2.45 | 2.55 | ||

| 12 months | 2.50 | 2.60 | ||

| 18 months | 2.10 | 2.20 | ||

| 24 months | 1.90 | 2.00 |

*This promotional rate is only applicable to personal banking customers with placement via BOC Mobile Banking.

Bank of China Fixed Deposit Terms & Conditions:

- The rates are indicative and applicable to personal customers only

- Rates used at the point of transaction may differ.

CIMB Fixed Deposit Rates (Dec 2024)

| Tenure | Personal Banking Online Promo Rate (% p.a.) - $10,000 & Above | Preferred Banking Online Promo Rate (% p.a.) - $10,000 & Above | Promotion Validity |

|---|---|---|---|

| 3 months | 2.75 | 2.80 | Further notice |

| 6 months | 2.75 | 2.80 | |

| 9 months | 2.55 | 2.60 | |

| 12 months | 2.55 | 2.60 |

CIMB Fixed Deposit Terms & Conditions

Citi Fixed Deposit Rates (Dec 2024)

| Type | Deposit Amount (Fresh Funds) | Tenor | Interest Rate (% p.a.) | Promotion Validity |

|---|---|---|---|---|

| New-To-Bank and existing with Citi Priority, Citibanking or Citi Plus relationship | $50,000 to $3,000,000 | 3 months | 2.40 | 31 Dec 2024 |

| 6 months | 2.40 | |||

| New-To-Bank and existing clients with Citigold* | $10,000 to $250,000 | 3 months | 2.90 | |

| $250,000 to $3,000,000 | 3.00 | |||

| $10,000 to $250,000 | 6 months | 2.80 | ||

| $250,000 to $3,000,000 | 2.90 | |||

| New-To-Bank and existing clients with Citigold Private Client* | $10,000 to $250,000 | 3 months | 3.00 | |

| $250,000 to $3,000,000 | 3.10 | |||

| $10,000 to $250,000 | 6 months | 2.90 | ||

| $250,000 to $3,000,000 | 3.00 |

Citi Fixed Deposit Terms & Conditions

- Citi also offers time deposits with a minimum deposit of $50,000 and tenures ranging from one week to 48 months.

- To qualify for Citigold and Citigold Private, you will need to meet the following AUM: Citigold (AUM of ≥ S$250,000), Citigold Private Client (AUM of ≥ S$1,500,000)

DBS/POSB Fixed Deposit Rates (Dec 2024)

Next up, we have Singapore’s biggest bank.

| Tenure | Interest Rate (% p.a.) $1,000 - $19,999 | Interest Rate (% p.a.) $20,000 - $999,999 |

|---|---|---|

| 1 month | 0.30% | 0.05% |

| 2 months | 0.50% | |

| 3 months | 1.00% | |

| 4 months | 1.85% | |

| 5 months | 2.35% | |

| 6 months | 2.90% | |

| 7 months | 2.95% | |

| 8 months | 3.00% | |

| 9 months | 3.10% | |

| 10 months | 3.15% | |

| 11 months | 3.15% | |

| 12 months | 3.20% | |

| 18 months | 3.20% | |

| 24 months | 3.20% | |

| 36 months | 3.20% | |

| 48 months | 3.20% | |

| 60 months | 3.20% |

Note that DBS only accepts new placements for tenures 12 months and below. Interest rates for tenures of 18 months and above are applicable only to the rollover of existing placements at the same tenure.

DBS Fixed Deposit Terms & Conditions

- Interest rates are indicative. Rates apply to individual accounts only

- Rates quoted are in % p.a. and are subject to change without prior notice

- From 21 May 20, interest rates for new placements and renewals in an SGD FD Account will be computed based on the total SGD FD balances instead of each placement and/or renewal.

Hong Leong Fixed Deposit Rates (Dec 2024)

| Deposit Amount (SGD) | $20,000 to ≤ $49,999 | $50,000 and above | Promotion Validity |

|---|---|---|---|

| 7-month | 2.70% | 2.75% | |

| 8-month | 2.70% | 2.75% | |

| 10-month | 2.60% | 2.60% | |

| 11-month | 2.60% | 2.60% |

Terms & Conditions:

- The Fixed Deposit Promotion is applicable for individual accounts only and applicable to both new placement and renewal

- Upon maturity, this Fixed Deposit will be auto-renewed at the prevailing Board/Special Rate whichever is applicable

- For premature withdrawal, a $50 fee applies, and 0.10% p.a. interest is payable for the completed quarter(s)

- Promotional interest rates are subject to change without prior notice. Other terms & conditions apply

Hong Leong Fixed Deposit Terms & Conditions

- For sums of $1 million and higher, please enquire at our branches for rates

- For Non-Individual Accounts, please enquire at our branches for rates

- Rates are only indicative and subject to change at any time without prior notice

- Overdue Fixed Deposit (3 to 36 months) will be paid on the then prevailing Board Rate for the completed quarter(s) or cycle(s)

- Short-Term Monthly Deposits (1 & 2 months)—Overdue Fixed Deposits will be paid at the then-prevailing Board Rate for each successive cycle (original tenure).

HSBC Fixed Deposit Rates (Dec 2024)

| Tenure | Total Relationship Balance | Promotional SGD Time Deposit (Minimum deposit of $30,000 in fresh funds) | Promotion Validity |

|---|---|---|---|

| 3-month | Below $200,000 | 2.45% p.a. | 31 Dec 2024 |

| 3-month | $200,000 and above | 2.65% p.a. | |

| 6-month | Below $200,000 | 2.35% p.a. | |

| 6-month | $200,000 and above | 2.60% p.a. | |

| 12-month | Below $200,000 | 2.15% p.a. | |

| 12-month | $200,000 and above | 2.45% p.a. |

The minimum fresh fund placement amount for the HSBC SGD Time Deposit Promotion is $30,000.

For placement amounts greater than $1,200,000, please contact either HSBC or your Relationship Manager.

HSBC Fixed Deposit Terms & Conditions

- Rates are subject to change without notice

- The Premier-exclusive rates set out in the table above shall apply only to account(s) which are subject to the terms and conditions governing the use of the HSBC Premier Account Package.

ICBC Fixed Deposit Rates (Dec 2024)

| Tenure | Over the Counter Promotion Rates (Min. $20,000 & Above) | Via E-Banking Promotion Rates (Min. $500 & Above) | Valid Till |

|---|---|---|---|

| 1 month | 2.40% | 2.45% | Further notice |

| 3 months | 2.85% | 3.00% | |

| 6 months | 2.40% | 2.45% | |

| 9 months | 2.35% | 2.40% | |

| 12 months | 2.25% | 2.30% |

Terms & Conditions:

- Rates are subject to change without prior notice, and promotion is valid until further notice

- There is no penalty for pre-matured withdrawal of fixed deposit; you will get paid based on the prevailing current account interest rate

- “Fresh Funds” refers to funds that do not originate from any existing accounts you have with ICBC. For example, any transfer of funds between ICBC account(s) would not be considered fresh funds.

- The minimum deposit amount over the counter is $20,000, and the minimum deposit amount via E-banking is $500

Also, the following applies to the maturity of the FD with auto-renewal instructions provided via electronic banking (ICBC Internet Banking or Mobile Banking) (“E-banking”):

For FD placed before 28th April 2020

1. Tenure of 1 month, 3 months, 6 months, or 9 months:

FD will enjoy the prevailing Over-the-Counter Promotion Rate upon maturity of FD. For example, if you place 3 months FD on 5th February 2020, the prevailing Over-the-Counter Promotion Rate will automatically apply on renewal.

2. Tenure of 12 months:

FD will enjoy the prevailing E-banking Promotion Rate upon maturity of FD.

ICBC Fixed Deposit Terms & Conditions

- Minimum deposit of $500

- No penalty for pre-matured withdrawal of a fixed deposit, you will get paid based on the prevailing current account interest rate

- ‘Fresh Funds” refers to funds that do not originate from any existing accounts you have with us. For example, any transfer of funds between ICBC account(s) would not be considered fresh funds.

Maybank Fixed Deposit Rates (Dec 2024)

| Minimum Placement Amount | Tenure | Interest Rate (p.a.) | Valid Till | |

|---|---|---|---|---|

| Deposit Bundle Promotion (Placement in Branch) Available to Individual, SME and Commercial Banking customers | $20,000 and above | 6 months | 3.15%* | Further notice |

| 9 months | 2.90% | |||

| 12 months | 2.80% | |||

| iSAVvy Time Deposit Promotion (Online Placement) Available to Individual Banking customers | $20,000 and above | 6 months | 2.80% | |

| 9 months | 2.55% | |||

| 12 months | 2.50% |

Terms and Conditions:

- *Deposit Bundle Promotion (Placement in Branch)

- For every $1,000 deposited into Maybank Current or Savings Accounts (min. $2,000), you can deposit $10,000 into the Deposit Bundle Promotion ($20,000)

- Available to Individual, SME, and Commercial Banking customers

- Minimum placement: $20,000

- iSAVvy Time Deposit promotion:

- Available to Individual Banking customers

- Minimum placement: $25,000

Maybank Fixed Deposit Terms & Conditions

- Minimum age 16 years old

- To qualify for promotional interest/profit rates, the placement of Singapore Dollar Time Deposit/Term

Deposit-i (“Time Deposit”) has to meet a minimum amount of $10,000 - Promotion is valid until further notice, and rates are subject to change without prior notice.

OCBC Fixed Deposit Rates (Dec 2024)

| Type | Minimum Deposit (SGD) | Tenure | Interest Rate (p.a.) |

|---|---|---|---|

| SGD Time Deposit Rate | $30,000 (Branch) | 6 months | 2.30% |

| 12 months | 2.20% | ||

| $30,000 (Online) | 6 months | 2.60% | |

| 12 months | 2.50% |

*Fresh funds refer to funds not transferred or withdrawn from existing OCBC Bank deposit accounts and re-deposited and do not include funds in the form of OCBC Bank cheque/cashier’s order/demand drafts

Promotion Terms & Conditions

- The minimum placement amount for the above SGD promotion is $30,000.

- This promotion is not available for placements via Supplementary Retirement Scheme (SRS) funds

- The maximum placement amount for all the above Time Deposit promotions is $999,999 or equivalent. For deposits above $1 million

RHB Fixed Deposit Rates (Dec 2024)

| Deposit Amount | Tenure | Personal Customers Interest Rate (p.a.) | Premier Customers / Online Promo Rates (p.a.) | Valid Till |

|---|---|---|---|---|

| $20,000 and above | 3 months | 2.90% | 3.00% | Further notice |

| 6 months | 2.90% | 3.00% | ||

| 12 months | 2.90% | 3.00% | ||

| 18 months | 2.90% | 3.00% |

Promotional rates are subject to change without prior notice. Terms and conditions apply. To enjoy the promotional rate, you will need a deposit amount of at least $20,000.

SIF Fixed Deposit Rates (Dec 2024)

Next up, we have Sing Investments & Finance Limited (SIF): a lender and financier that was incorporated in Singapore on 13 November 1964 and was listed on the Singapore Stock Exchange since July 1983.

FYI: SIF has an Exempt Capital Markets Services Entity that has a license to deal in capital markets products (securities), product financing, and provision of custodial services from the Monetary Authority of Singapore (MAS).

Here are its Fixed Deposit promotions:

Daily Special Fixed Deposit Rates (Online Placement) 3 months 6 months 12 months

$1,000 2.65% 2.55% 2.50%

$10,000 2.70% 2.60% 2.70%

Daily Special Fixed Deposit Rates (Over the counter) 3 months 6 months 12 months

$10,000 2.70% 2.60% 2.70%

*Applicable to personal accounts & fresh funds only. Note that rates are subject to change without prior notice. Terms and conditions apply.

Standard Chartered Fixed Deposit Rates (Dec 2024)

| Deposit Amount (SGD) | Tenure | Promotional Interest Rate (p.a.) | Priority Banking Preferential Interest Rate (p.a.) | Priority Private Banking Preferential Interest Rate (p.a.) | Promotion Validity |

|---|---|---|---|---|---|

| $25,000 and above | 6 months | 2.55% | 2.65% | 2.75% | 31 Dec 2024 |

Note:

- *For Standard Chartered’s Fresh Funds promotions, you need to place a minimum of $25,000 in fresh funds

- Fresh funds refer to funds not originating from any existing account with Standard Chartered Bank (Singapore) Limited (the “Bank”) and funds that are not withdrawn and re-deposited within the last 30 days of opening your Time Deposit

- The promotional interest rates are only applicable if the Time Deposit is held until the maturity of the tenure.

UOB Fixed Deposit Rates (Dec 2024)

| Minimum Deposit Amount (Fresh Funds) | Tenure | Interest Rate (p.a.) | Promotion Validity |

|---|---|---|---|

| $10,000 and above | 6 months | 2.50% | 31 Dec 2024 |

| $10,000 and above | 10 months | 2.30% |

Those with a fixed deposit account with UOB must commit to at least a 6-month tenure and deposit at least $10,000 in fresh funds to enjoy the promotional interest rate.

UOB Fixed Deposit Terms & Conditions

- You must be at least 15 years old

- Minimum placement of $5,000 for tenures of one month and above

- Minimum placement of $250,000 for tenures of between seven days and 14 days

- Minimum placement of $1,000,000 for tenures of fewer than seven days.

Don’t be shy to ask our friendly Seedly Community for their opinions when in doubt, or hop over to our product review page to read personal experiences!

Related Articles:

- I’m Scared Of Investing But Here’s How I Got Started: A Noob-Friendly Beginner’s Guide To Investing

- Best Saving Account Singapore: Which Bank Is Best for Monthly Interest?

- The Ultimate Guide to Cash Management Accounts in Singapore

- How to Invest: A Singaporean’s Guide To Investing for Beginners

- How To Open an SGX CDP Account & Brokerage Account to Start Trading Singapore Listed Investments

- Budget 2023 Singapore Summary

- Best Travel Insurance in Singapore

- Best Credit Card in Singapore

Advertisement