Best Savings Accounts for Kids 2022: Best Places to Grow Your Child's Money

●

One of the most important things about parenting is to instill good values and habits in your children.

And what better way to teach your kids about personal finance than opening a savings account for them to get hands-on experience?

So here are the best savings accounts for kids to park your child’s money.

TL:DR: Best Savings Accounts for Kids 2021: Best Places to Grow Your Child’s Money

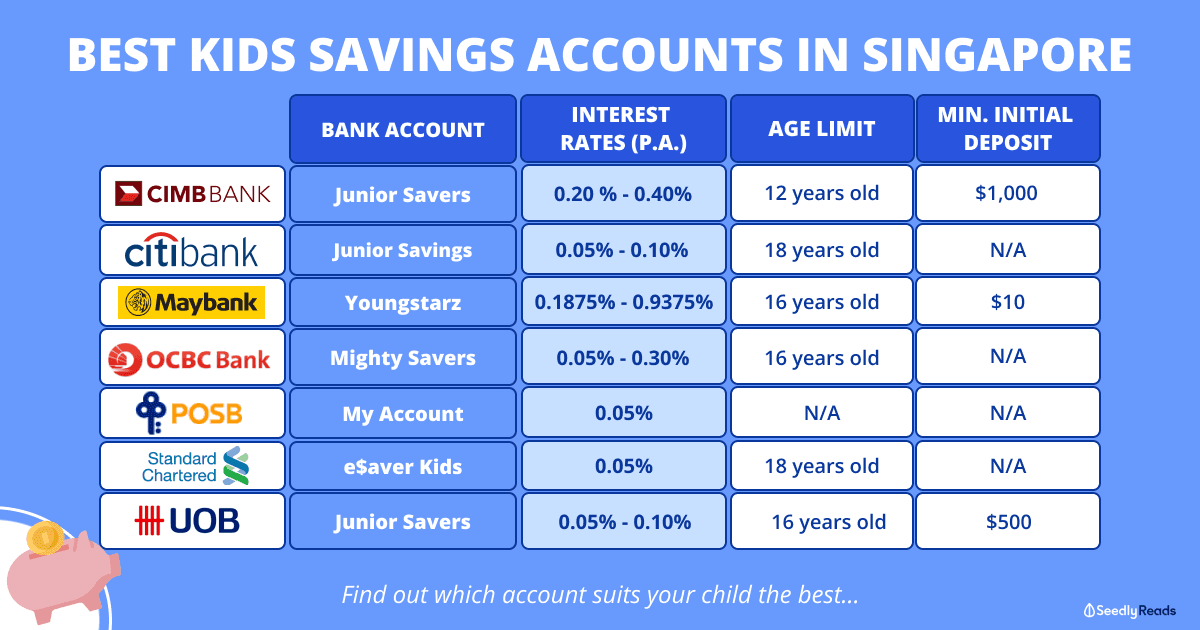

| Bank Accounts | Interest (p.a.) | Age Limit | Benefits |

|---|---|---|---|

| CIMB Junior Savers Account | 0.20 % to 0.40% | 12 years old | - |

| Citibank Junior Savings Account | 0.05% to 0.10% | 18 years old | - |

| Maybank Youngstarz Account | 0.1875% to 0.9375% | 16 years old | - Hand, Foot & Mouth Disease Hospitalisation and Outpatient Insurance - Worldwide Personal Accident Insurance coverage for parent and child - Maybank Family Plus which allows up to 3 times of interest rates |

| OCBC Mighty Savers Account | 0.05% to 0.30% | 16 years old | - Children can enjoy Mighty Savers® Fast Track at any “Sunday at OCBC” branch - Free coin deposit |

| POSB My Account | 0.05% | N/A | - Open a My Account with your child online and get rewarded with two NERF Action Xperience Tickets (worth S$98). Valid till 30 June 2022. - Can be used with POSB Smart Buddy |

| Standard Chartered e$aver Kids Account | 0.05% | 18 years old | - |

| UOB Junior Savers Account | 0.05% - 0.10% | 16 years old | Free insurance coverage of up to 100% of the deposit balance |

Best overall savings account for kids: Maybank Youngstarz Account

Best base interest rate savings account for kids: CIMB Junior Savers Account

Best benefits (insurance coverage) savings account for kids: Maybank Youngstarz Account, UOB Junior Savers Account

Kids Savings Account vs Child Development Account (CDA)

You might be familiar with the Child Development Account (CDA), which is a special savings account which provides government matching to savings, grants and cash gifts which can be spent on approved uses.

It can be opened at POSB/DBS, OCBC or UOB.

The CDA can be used to offset baby expenses including, but are not limited to:

- Child Care Centres

- Kindergartens

- Special Education Schools

- Providers of Early Intervention Programmes

- Providers of Assistive Technological Devices

- Medical-related Expenses (eg. Approved Vaccinations at Polyclinics)

- MediShield or Medisave-approved Private Integrated Plans

Here are two main differences between a kid’s savings account and CDA:

1) You Cannot Withdraw From CDA

As mentioned above, CDA is primarily used for baby expenses including education and medical expenses.

As they are to be spent on these approved uses, these funds cannot be withdrawn from the account.

On the other hand, placing your child’s money in a savings account allows your child to have funds that are liquid for other expenses.

2) CDA Closure at 13 Years Old

When your child turns 13 years old, the CDA will be closed and any leftover amount from the CDA will be transferred to the Post-Secondary Education Account (PSEA).

As for kids savings accounts, they can be converted conveniently into regular savings accounts when they reach certain age limits.

Which means that if you’re looking for a savings account for your child to have beyond 13 years old, it would be better to have one separate account with one of these banks.

Why You Should Open a Savings Account for Your Child

We know that habits are best built when they are started young.

As parents, we would definitely want to give your children a head start with financial literacy and pick up personal finance habits.

Having their own savings account could not only teach your child the concept of money, but also encourages him/her to pick up healthy saving habits.

CIMB Junior Savers Account

The CIMB Junior Savers Account offers the best base interest rates for your kid at 0.20% p.a. with the only caveat being that you have to maintain the initial deposit of S$1,000 to enjoy interest.

However, this attractive base interest rate is only offered until your child reaches the age of 12.

Interest Rates:

| Interest Rates (p.a.) | |

|---|---|

| First S$200,000 | 0.20% |

| Next S$800,000 | 0.40% |

| Above S$1,000,000 | 0.20% |

Minimum initial deposit: $1,000 (min. amount to earn interest as well)

Fall-below fee: N/A

Age limit: 12 years old

Citibank Junior Savings Account

Citibank’s Junior Savings Account gives parents the option to allow teenagers above 15 years old to access funds via ATMs and online banking.

This serves as a good start to let your teen get familiarised with online banking and keeping track of their transactions.

Interest Rates:

| Interest Rates (p.a.) | |

|---|---|

| First S$30,000 | 0.05% |

| Above S$30,000 | 0.10% |

Minimum initial deposit: N/A

Fall-below fee: N/A ($15 if the parent is also a Citibank account holder and total account balance is below $15,000)

Age limit: 18 years old

Maybank Youngstarz Account

The Maybank Youngstarz Account offers some of the best benefits on top of an attractive base interest rate of 0.1875% p.a. on the first S$3,000.

If you’re a parent who is well-integrated with Maybank’s products, your child can earn even more interest, which goes up to an effective rate of 0.9% p.a. on the first S$30,000.

Interest Rates:

| Interest Rates (p.a.) | 2X Interest Rates (p.a.) | 3X Interest Rates (p.a.) | |

|---|---|---|---|

| First S$3,000 | 0.1875% | 0.3750% | 0.5625% |

| Next S$27,000 | 0.3125% | 0.6250% | 0.9375% |

| Effective interest rate on S$30,000 | 0.3000% | 0.6000% | 0.9000% |

Minimum initial deposit: $10

Fall-below fee: N/A

Age limit: Below 16 years old

Benefits:

- Hand, Foot & Mouth Disease Hospitalisation and Outpatient Insurance if the account maintains a minimum deposit of $5,000. Payout is based on a daily hospitalisation cash benefit of S$100, up to a maximum of 25 days per year)

- Worldwide Personal Accident Insurance coverage for parent and child. Eligibility is based on maintaining a minimum deposit of S$5,000 in the Youngstarz Savings Account, with lump sum payout 8 times of account balance at the time of accident or S$400,000, whichever is the lower.

There is also Maybank Family Plus which allows up to 3 times of interest rates if different requirements are met.

This includes:

| Earn 3X interest for child | Earn 2X interest for child |

|---|---|

| Requirements | |

| Maintain an average daily balance of at least $2,000 in iSAVvy Savings Account | Maintain an average daily balance of at least $2,000 in your iSAVvy Savings Account |

| Transfer at least S$200 to child's Youngstarz Savings Account during the month | Transfer at least $200 to child's Youngstarz Savings Account during the month |

| Spend at least $800 on Maybank Family & Friends Card during the month | |

Do note that the parent has to be an iSAVvy Savings account holder, and own the Maybank Family & Friends card for additional interest.

OCBC Mighty Savers Account

For those who already have a CDA with OCBC bank, the OCBC Mighty Savers Account lets your child earn up to 0.30% p.a.

As a bonus, your kids can also make coin deposits at selected ATMs for free so they can transfer their piggy bank savings to their accounts.

Interest Rates:

The OCBC Mighty Savers Account offers up to 0.30% p.a., depending on the criteria.

| Interest Rates (p.a.) | |

|---|---|

| Base Interest | 0.05% |

| Bonus interest: Deposit at least $50 and do not make any withdrawals within the month | 0.05% |

| CDA Advantage Bonus Interest: OCBC CDA holders | 0.20% |

| Total | 0.30% |

Minimum initial deposit: N/A

Fall-below fee: N/A

Age limit: Below 16 years old

Benefits:

- Children can enjoy Mighty Savers® Fast Track at any “Sunday at OCBC” branch

- Free coin deposits

POSB My Account

Right off the bat, the POSB My Account doesn’t look too great with only a base interest rate of 0.05% p.a., a far cry from what some other banks are offering.

However, POSB stands out from the crowd with the POSB Smart Buddy, an in-school savings and payments wearable that allows the child to tap to pay in school and at selected merchants.

The POSB Smart Buddy lets parents to do auto-transfer of savings to the account and monitor expenses while helping your child develop budgeting and savings habits.

Moreover, upon reaching 18 years old, your child can easily convert their My Account into a Multiplier Account to earn interest of up to 3.8% p.a.

Interest Rates:

| Interest Rates (p.a.) | |

|---|---|

| First $10,000 | 0.050% |

| Next $90,000 | 0.050% |

| Next $250,000 | 0.050% |

| Next $650,000 | 0.050% |

| Remaining balance above $1,000,000 | 0.050% |

Minimum initial deposit: N/A

Fall-below fee: N/A ($2 account fee is waived till 16 years old)

Age limit: N/A

Benefits:

- S$1 gift deposit

- Can be used with POSB Smart Buddy

- Complimentary POPULAR 1-year student membership

- No coin deposit fees

- Open a My Account with your child online and get rewarded with two NERF Action Xperience Tickets (worth S$98). Valid till 30 June 2022.

Standard Chartered e$aver Kids Account

The Standard Chartered e$aver Kids Account lets your child hold onto it till the are 18 years of age.

But aside from a longer account lifespan, this account doesn’t offer much aside from no minimum initial deposit, no fall-below fees and a paltry base interest rate of 0.05% p.a.

You’ll also need a minimum monthly deposit of $50 (via GIRO or Standing Instruction Form) to maintain the account.

Interest Rates:

| Interest Rate (p.a.) |

|---|

| 0.05% |

Minimum initial deposit: N/A

Fall-below fee: N/A

Age limit: Below 18 years old

UOB Junior Savers Account

The UOB Junior Savers Account is another account that offers great benefits in the form of free insurance coverage, depending on the deposit balance.

Interest Rates:

| Interest Rates (p.a.) | |

|---|---|

| First S$15,000 | 0.05% |

| Next S$85,000 | 0.05% |

| Next S$250,000 | 0.05% |

| Above S$350,000 | 0.10% |

Minimum initial deposit: $500

Fall-below fee: $2 if balance is below $500

Age limit: Below 16 years old

Benefits:

- Free insurance coverage with an average daily balance of $3,000 a month (over past 6 months or since account is open, whichever period is shorter)

| Deposits Balance Tiers (based on average daily balance)** | Coverage Amount |

|---|---|

| S$3,000 – S$9,999.99 | 50% |

| S$10,000 – S$49,999.99 | 70% |

| S$50,000 & above | 100% |

Note: Insurance covers the insured till age 65 or upon the child reaching 17 years old, whichever comes first

Other Considerations When Choosing the Best Savings Account for Your Child

Besides looking at the interest rates, here are some other considerations to think about when you’re choosing your child’s savings account.

- Which bank account is linked to your child’s CDA (some banks offer additional benefits for this)

- Which savings account you commonly use (application process would be easier for existing customers, additional benefits for stacked accounts)

- Age limit and account service fees

Still deciding which is the best savings account for your kid? Why not check out what the other parents might be doing at Seedly!

Related Articles

-

- Which Child Development Account (CDA) Should You Open for Your Child in 2022?

- Best Saving Account in Singapore (2022): Which Bank Is Best for Monthly Interest?

- Best Fuss-Free Savings Accounts With No Conditions in Singapore 2022

- Cheat Sheet: Best Savings Accounts in Singapore For Working Adults? – Highest Interest Rates

- Ultimate Cash Management Accounts Comparison

- This Month’s Singapore Savings Bonds (SSB): Interest Rates & How To Buy

- Best Saving Accounts For Students

- Still Holding Onto Your First Savings Account? Here’s Why You Should Change It

- Cheat Sheet: Best Savings Accounts With No Conditions

- Working Adults: Which Savings, Expenses And Investment Accounts Should I Start With?

Advertisement