Sick and tired of making sure you hit a minimum spend on your credit card just to earn bonus interest in your linked bank account? Or are you a minimalist who prefers a simple savings account without extra terms and conditions to hit that “up to” interest rate that banks love to blast in their marketing?

Whether you’re a fresh graduate looking for a simple, no-frills savings account or a working adult looking for an alternative account/don’t want to deal with all the requirements for higher interest, we’ve got you covered!

Here are the best savings accounts with little to no hoops, so you can park your savings there, do nothing and earn interest!

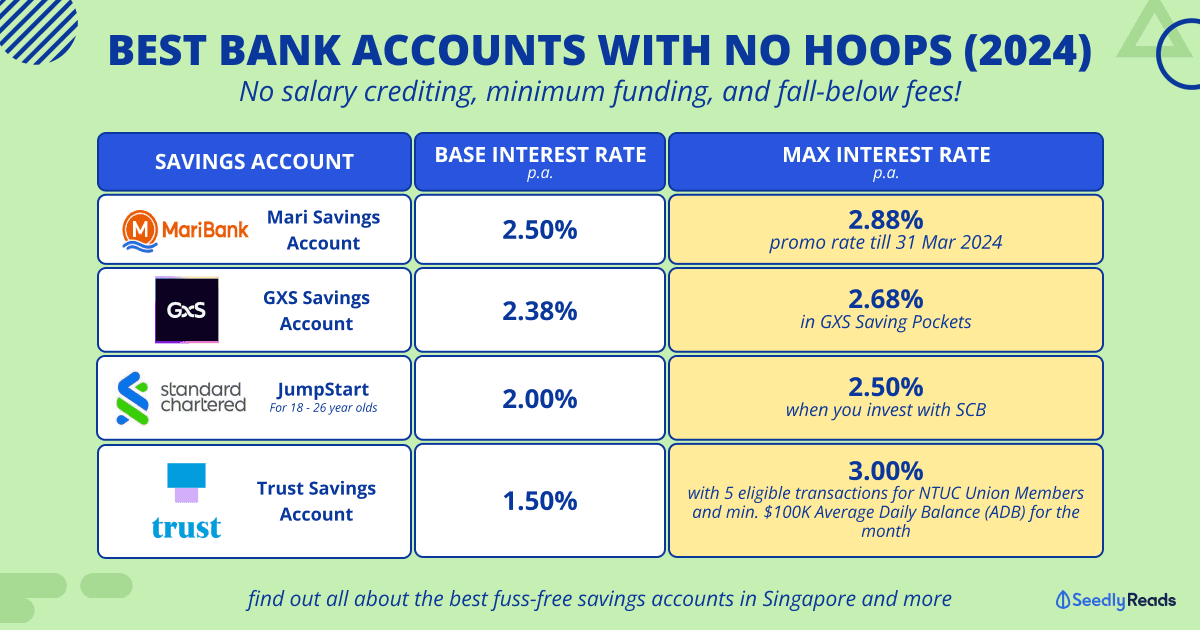

TL;DR: Best Savings Accounts With Little to No Hoops

In This Article:

- Best Savings Accounts With Little to No Hoops

- How to Pick the Best Savings Account for Your Needs

Best Savings Accounts With Little to No Hoops

We’re sure you’ve seen advertisements by banks about their savings accounts where you can earn “up to 7.88%”, for example. But when you open the account, you realise that there are many requirements (hoops) you need to fulfil before you can even hit the advertised rate. That’s why in our ultimate guide to bank accounts, we decided to show the realistic interest rate based on the criteria that we set:

However, not everyone can fulfil such requirements. Those who do may also need a savings account separate from their primary bank account for emergency funds or simply to diversify their savings across banks. Moreover, if you are a minimalist or someone who prefers simplicity, these banks simply have far too many things to take note of.

But fret not! The featured accounts will have a simple way to earn maximum interest. In other words, there will be no hoops such as investing in a bank’s investment product, minimum spending on the bank’s credit card, salary crediting, minimum balance, etc. Plus, these bank accounts will also have no fall-below fees or any sort of account maintenance fee.

Lastly, these are bank accounts (not cash management accounts), meaning they are SDIC-insured!

We are talking about savings accounts where you can simply open them, park some money, and not worry while getting the advertised interest rate, or at least close to it!

Do note that we are only considering savings of up to $75,000 as that is the amount currently insured by SDIC!

| Savings Account | Base Interest Rate (p.a.) | Maximum Interest Rate (p.a.) |

|---|---|---|

| Mari Savings Account | 2.50% | 2.88% promotional rate till 31 Mar 2024 |

| GXS Savings Account | 2.38% | 2.68% (with saving pockets) |

| Standard Chartered JumpStart | 2.00% | 2.50% (Step up interest on deposit balances up to $50,000 when you invest) |

| Trust Savings Account | 1.50% | Up 3.00% (with 5 eligible purchases on the NTUC Link card on deposits up to $500k and min. $100K Average Daily Balance (ADB) for the month on deposit balance up to $500K) |

How to Pick the Best Savings Account for Your Needs

All the savings accounts featured are digital bank accounts except for the Standard Chartered JumpStart account. You may find more detailed information about digital banks and the Standard Chartered JumpStart account here.

Fresh Graduates

If you’re just fresh out of school, you will need a better bank account than your POSB Kids Savings Account or the DBS Multiplier if you have converted the account. For fresh graduates, you’ll likely earn 1.50% p.a. only with the DBS Multiplier if you transact with Paylah!

This is where Standard Chartered JumpStart comes into play. While it has the lowest base interest compared to digital banks, it is the only one that affords you ATMs, a debit card, and the ability to pay any credit cards you have or are going to get.

We would use Standard Chartered JumpStart as a primary transactions account. Next, you can open any of the three digital bank accounts to build up your savings and/or emergency funds.

If you are looking for the highest interest with no hoops, MariBank would be your best bet with 2.88% p.a., at least until 31 March 2024. Once MariBank reverts to its 2.50% p.a. base interest, GXS Bank would be your next go-to as you can park your money in the GXS Savings Pockets for 2.68% p.a.

In case you didn’t know, the savings pockets allow you to instantly transfer funds to the GXS Main account. For us users, savings pockets are purely a visual thing to help us separate our funds better when we do our budgeting.

Otherwise, the justification for using Trust Bank and GXS Bank lies in whether you often use Grab or shop at NTUC and its partners.

Working Adults

At least among the financially-savvy Seedly community, UOB One is very popular as you only need to credit your salary and hit a $500 min. spend on your credit cards to get 3.85% p.a. interest on your first $30,000.

You may ask, “Why should I bother with a simpler bank account with less interest?”

Well, if your UOB One account has over $100,000, any excess savings will not be earning the full interest, and it would be better for that excess savings to be in an alternative bank account such as the ones featured above.

For those who can’t hit or don’t want to bother with the requirements, these accounts are also a great saving alternative.

Bonus:

Okay, this account does not meet all my criteria as it has a fall-below fee of $2 if your minimum average daily balance falls below $1,000.

But if you are okay with the above, you might want to consider the Sing Investments & Finance (SIF) GoSavers Account.

The account is a premier savings account offered by Sing Investments & Finance Limited and is the company’s flagship product. This institution is not only licensed but also under the regulatory oversight of the Monetary Authority of Singapore (MAS), signifying its compliance with local financial standards.

Sing Investments & Finance Limited was established in Singapore on 13 November 1964 and was listed on the Singapore Stock Exchange (SGX) in 1983.

In addition to the GoSavers Account, the company provides a suite of financial solutions that encompass fixed deposits, various loan options for individuals (including home, HDB, and car loans), and financing services for corporate and SME clients (covering commercial property loans, machinery loans, and more).

Pioneering in the Singaporean finance industry, SIF introduced a set of mobile and business applications, offering a spectrum of E-services. These services facilitate straightforward personal account openings through MyInfo, FAST transfer capabilities, and the convenience of placing fixed deposits online.

The SIF GoSavers Account is designed as a straightforward savings account, rewarding savers with interest rates up to 3.50% p.a. It structures its interest tiers as follows:

| Account balance | Interest rate (p.a.)* |

| First $100,000 | 2.50% |

| Next $150,000 | 3.00% |

| Above $250,000 | 3.50% |

Account Details

- Minimum initial deposit: $0

- Minimum average daily balance: $1,000

- Monthly fall below fee: $2

- Bonus interest cap: N.A.

How to Earn Bonus Interest With the SIF GoSavers Account Based on the Above Criteria

This straightforward account lets us earn a decent 2.50% p.a. on our $10,000 deposit. The best part is that there are absolutely zero hoops to jump through! The only thing you have to note is the fall-below fee of $2 if your average daily balance falls below $1,000.

Related Articles

Advertisement