Banking on Diversification: Why You Should Have Multiple Bank Accounts

Bank accounts are the bedrock of our financial lives.

It is where we keep most of our life savings, make transactions and track our money. Most of us assume that just having one bank account would suffice.

As someone who prefers simplicity, I would rather have just one account too. However, as I grew more financially mature, I realised that even with bank accounts, diversification is also important for our financial health.

So, here’s why you should have more than one bank account!

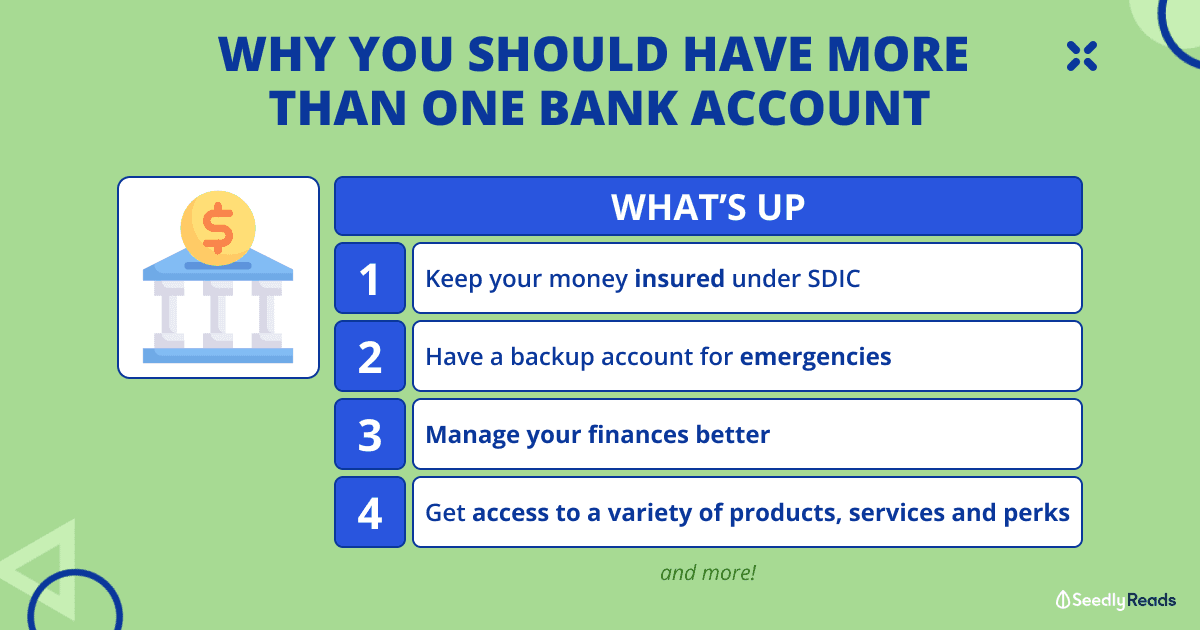

TL;DR: Why You Should Have More Than One Bank Account

Jump to:

- Keep Your Money Insured Under SDIC

- Ensure Seamless Transactions and Payments

- Manage Your Finances Better

- Get Access to a Variety of Financial Products, Services, and Perks

- Things to Look Out For When Choosing Bank Accounts

- How Many Bank Accounts Should I Have?

1. Keep Your Money Insured Under SDIC

As mentioned previously, bank accounts are the bedrock of our financial lives.

But what happens when this financial bedrock isn’t as reliable as it should be?

Overseas, we’ve seen how reputable banks such as Silicon Valley Bank and Credit Suisse crumble this year, leading many of us to think: “How safe is my money with banks?”.

In the US, depositors with the failed Silicon Valley Bank got back their money up to $250,000 thanks to the Federal Deposit Insurance Corp (FDIC).

Fortunately, we have our own Singapore Deposit Insurance Corporation (SDIC) which insures our deposits of up to $75,000 per bank per person.

In other words, if you have savings of more than $75,000, it is a good idea to save the excess with another bank. While Singapore banks are considered pretty safe, it’s definitely wise to be safe rather than sorry with your life savings!

2. Ensure Seamless Transactions and Payments

Ever faced an embarrassing moment when you were about to make an e-payment at the cashier but realised that the service was simply not working?

That was me, and probably many other users of DBS PayLah! on 29 March 2023. I remember telling myself how annoying it was and wondered what if I had to make an emergency transaction such as paying bills.

Fast forward to 5 May 2023, I had to pay a credit card bill…and guess what? DBS was down again! Luckily for me, I had a secondary bank account set up with enough money to pay.

I can only imagine how frustrating it could be for someone who had to make an emergency transaction but only had one bank account.

Although DBS is the largest bank in Singapore, it doesn’t mean that there are no risks of outages. Thus, it’s a good idea to have a backup account with another bank for such cases.

3. Manage Your Finances Better

Having multiple bank accounts can not only help you reduce risks through diversification, but also help you keep track of your finances better.

If you’ve read about the 50-30-20 rule, you’ll know that it is important to separate your money for different goals such as expenses, savings and wealth.

Having multiple accounts is a great way to keep your money separate, especially for savings such as your emergency funds. or for specific financial goals like buying a house or a car.

4. Get Access to a Variety of Financial Products, Services, and Perks

While most banks typically give you a higher interest rate for a higher deposit amount, there are cases when you could get more interest with multiple accounts. Moreover, having multiple bank accounts opens you up to a variety of services and perks throughout Singapore.

In my case for example, I’m not getting a lot of interest from a DBS multiplier account as I don’t hit most of their criteria. Putting all my money there would mean that I’m losing out on interest compared to having multiple accounts.

As such, since DBS has the largest network of ATMs and plenty of services such as PayLah! which I often find myself using, I am now using DBS as my transactions account while keeping a Standard Chartered Jumpstart account and GXS Bank account to park my savings for higher interest. The best part is that I don’t even have to hit any criteria for these saving accounts.

Moreover, having a relationship with multiple banks let’s me have access to better fixed deposits, personal loans, and other products should I need them in the future.

Things to Look Out For When Choosing Bank Accounts

Of course, having multiple bank accounts may also have its downsides. When choosing bank accounts, make sure to take note of any minimum balances and fall-below fees.

You’ll also want to choose an account that can give you the best interest rates for your money and whether that bank has any useful credit cards to earn more interest.

Lastly, I’ll look out for an easy to use banking app, integrations with finance apps such as Google Pay, and if you’re a cash-reliant person, the abundance of ATMs in Singapore.

How Many Bank Accounts Should I Have?

If you asked me, I would say at least three. One for transactions, one for savings and the last for wealth. Having these three helps you make a proper distinction between the purpose of your monies and forces you to save or invest better.

For those who have savings on more than $75,000 in one bank, that’s a strong signal that you should open an account with another bank to keep your monies insured.

Related Articles

Advertisement