In the landscape of credit cards available to Singaporeans, the CIMB World Mastercard stands out as a beacon for those who seek both luxury and value in their spending.

This card is tailored to benefit frequent travellers and avid shoppers. It offers a compelling blend of rewards without the burden of an annual fee.

This review dives deep into why the CIMB World Mastercard might just be necessary to optimise your spending habits effectively.

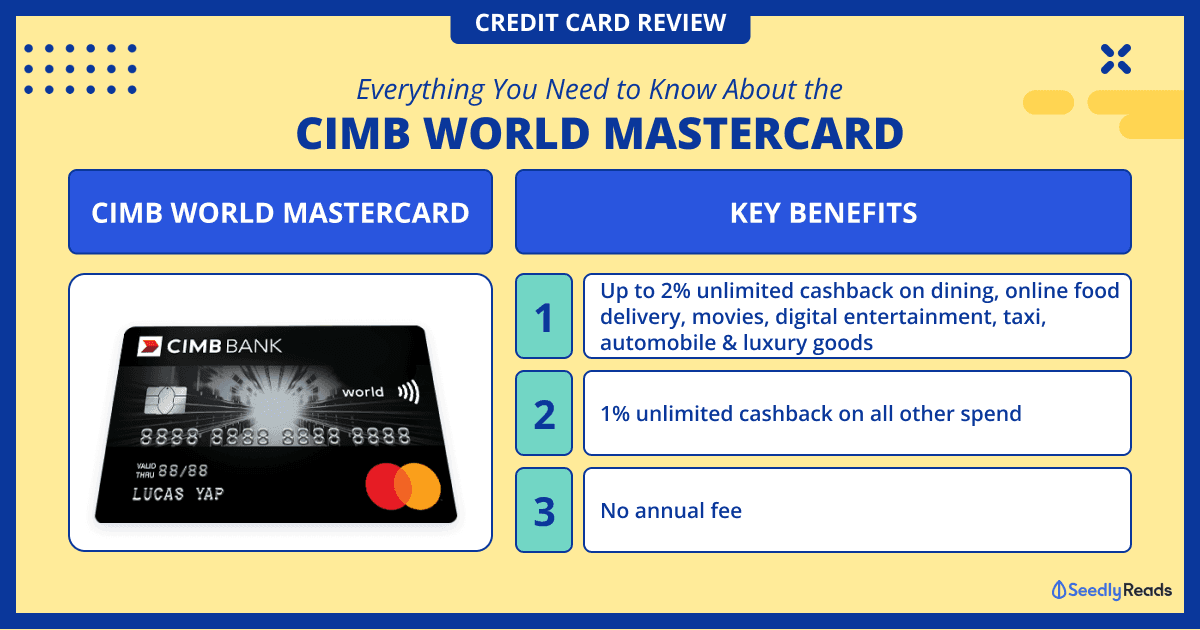

TL;DR CIMB World Mastercard Review 2024

The CIMB World Mastercard is perfect for Singaporeans with a zest for travel and a penchant for dining. It maximizes your expenditures by offering up to 2% unlimited cashback on specific categories like dining, online food delivery, movies, digital entertainment, taxi rides, ride-hailing, automobile, and luxury goods when a minimum of $1,000 is spent in the same statement month. Coupled with comprehensive travel insurance and zero annual fees, this card enhances your spending and enriches your lifestyle.

Key Features and Benefits of the CIMB World Mastercard

- Annual Fee: $0, making it cost-effective for long-term use.

- Cashback Rewards: Up to 2%

- Travel Insurance: Coverage includes personal accidents and travel inconveniences, providing a safety net during your travels.

- Income Requirement: $30,000 for Singapore citizens and PRs, $45,000 for foreigners

- Late Payment Fee: $100

- Interest Rate: The annual rate is 27.80%, the standard among most credit cards in Singapore.

The CIMB World Mastercard offers up to 2% unlimited cashback on specific categories like dining, online food delivery, movies, digital entertainment, taxi rides, ride-hailing, automobile, and luxury goods when a minimum of $1,000 is spent in the same statement month. If the spend is below $1,000, the cashback rate is 1%. For all other spends, a 1% cashback applies if a minimum of $500 is spent in the statement month:

The card also has no annual fees, and it can be used for both the primary and up to four supplementary cards, which can be quite advantageous for families.

Cardholders enjoy complimentary travel insurance and can access over 1,300 airport lounges worldwide at a preferential rate through the Mastercard Airport Experiences by LoungeKey.

The card offers exclusive deals and discounts across a wide range of dining, retail, and lifestyle outlets in Singapore, Malaysia, and Indonesia (CIMB). It also supports SimplyGo transactions and allows cardholders to use their card as a transit pass on buses and trains in Singapore (CIMB).

Detailed Perks Analysis

The CIMB World Mastercard does not just stop at basic features. It extends its benefits to ensure every aspect of your spending is rewarding. For instance, the card offers unlimited cashback with no minimum spend and no cap on the cashback earned, making it highly attractive for high spenders. Additionally, the card includes perks such as discounted green fees at 100 golf courses worldwide, enhancing its appeal to golf enthusiasts.

Furthermore, the card’s acceptance of contactless payments via Visa payWave, Apple Pay, Samsung Pay, and Google Pay makes it a convenient option in an increasingly digital world. This feature is particularly beneficial in Singapore, where digital transactions are becoming the norm.

Comparison With Competitors

When placed alongside competitors like the DBS Altitude Card or the UOB PRVI Miles Card, the CIMB World Mastercard offers distinct advantages. While the other cards may provide specific travel points or mile accumulations that could benefit frequent flyers, the CIMB World Mastercard’s zero annual fee and straightforward cashback system provide immediate, tangible benefits that can be appreciated by a broader audience.

Conclusion

The CIMB World Mastercard is an excellent choice for Singaporeans who prioritize simplicity and effectiveness in their credit card usage. Its combination of zero annual fees, comprehensive insurance coverage, and competitive cashback rates make it a standout option in the crowded credit card market.

Consider your spending patterns if you’re contemplating when to apply for the CIMB World Mastercard. If you frequent dining out, travel overseas regularly, and prefer cashback to points or miles, this card is tailored for you. Apply today and begin enjoying the many benefits of the CIMB World Mastercard. Sign up now and elevate your financial management with smart, rewarding spending.

Read More

Advertisement