CPF Contribution Cap (2023) Guide: What Singaporeans and Permanent Residents Need to Know

●

When the Central Provident Fund (CPF) was introduced on 1 July 1955, it was touted as a straightforward contributions system with the sole purpose of serving the retirement needs of workers.

But today, we can use our CPF for healthcare, use CPF for housing and even invest our CPF funds. With so many use cases for CPF, things are bound to get slightly complex.

But on balance, I understand that this complexity is a necessary evil because of the flexibility and security it provides Singaporeans.

I am still learning about CPF. One of the things that I learned recently is that there are actually limits to the amount of CPF you can receive and contribute in a year.

For employees, this is vital as we need to know how much CPF we are entitled to and how much CPF we can deposit each year.

For employers, you will need to know this information to ensure that you are not paying more CPF than required.

TL;DR: CPF Contribution Cap (2023) Guide

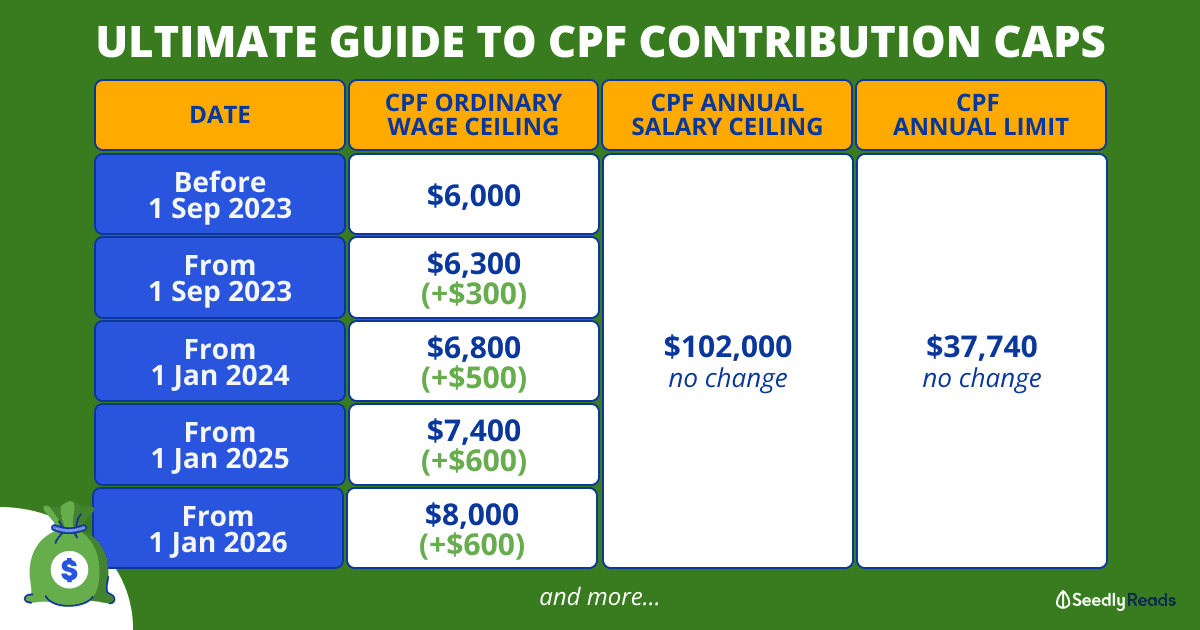

These are the three CPF limits that every Singaporean and Singaporean Permanent Resident (SPR) employee, as well as employers, need to know:

- Ordinary Wage (OW) Ceiling: OW exclusively refers to the wages employees receive in return for their monthly employment.

From 1 Sep 2023, the OW ceiling will be increased from $6,000 to $6,300 and gradually to $8,000 in 2026. - Additional Wage (AW) Ceiling: Compensation given to employees at intervals of more than a month. The AW ceiling is currently at $102,000 – total OW subject to CPF for the year.

- CPF Annual Limit: Maximum amount of mandatory and voluntary contributions CPF members can make to their three CPF accounts [Ordinary Account (OA) and Special Account (SA) and Medisave Account (MA)] in a calendar year. The CPF Annual limit is currently at $37,740.

These caps are applicable on a monthly basis for the OW ceiling and a yearly basis for the AW ceiling and CPF Annual Limit.

Click to Teleport

- What is CPF Contribution?

- What is the CPF Ordinary Wage Ceiling?

- CPF Monthly Salary Ceiling Increase: What Has Changed, Who Does This Affect, and What Should I Take Note of

- How Will the CPF OW Ceiling Increase Affect Your Take Home Pay and CPF Savings?

- What is the CPF Additional Wage Ceiling?

- What is the CPF Annual Limit?

- Is That All the CPF I Can Add to My CPF Account in a Year?

- Got Questions About CPF?

What is CPF Contribution?

Before we start, it is important that you have a basic knowledge of CPF.

CPF, short for Central Provident Fund, is a comprehensive social security system that helps Singaporeans and Permanent Residents (PRs) set aside savings for our healthcare, retirement and housing. The funds inside can also be invested via the CPF Investment Scheme.

In other words, CPF is a mandated employment-based savings scheme that enlists employers and employees to make CPF contributions to the employee’s CPF.

However, according to CPF, there is a cap on the amount employers and employees can contribute.

To illustrate this, we will use Calmond, who was born in the year of the Monkey, as an example:

Calmond’s Profile

For the purposes of this article, Calmond is a hardworking Singaporean worker who is drawing a monthly salary of $7,000.

This year is also a good year for Calmond as he received $10,000 in annual bonuses.

Calmond is also a young almond below 55 years old in human years.

What is the CPF Ordinary Wage Ceiling?

OW exclusively refers to the wages employees receive in return for their monthly employment.

For example, the monthly salary that Calmond receives is categorised by CPF as Ordinary Wages (OW).

Employers must pay their CPF on their employee’s OW before the due date to pay CPF contributions for that month.

But, there is a cap on the CPF contributions payable each month. This is what is known as the Ordinary Wage (OW) Ceiling.

From tomorrow, 1 September 2023, the monthly OW Ceiling will be increased to $6,300 monthly.

Also, the OW ceiling will go up from $6,000 to $8,000 monthly by the year 2026 for all employees. This increase will take place in four phases, as shown in the table below:

| Date | CPF Ordinary Wage Ceiling | CPF Annual Salary Ceiling |

|---|---|---|

| Current | $6,000 | $102,000 (no change) |

| From 1 September 2023 | $6,300 (+$300) | |

| From 1 January 2024 | $6,800 (+$500) | |

| From 1 January 2025 | $7,400 (+$600) | |

| From 1 January 2026 | $8,000 (+$600) |

CPF Monthly Salary Ceiling Increase: What Has Changed, Who Does This Affect, and What Should I Take Note of

If you are a Singaporean and Singaporean Permanent Resident (SPR) earning more than $6,000 a month, you will be affected by the 1 September 2023 CPF OW ceiling increase.

But, do note that CPF contributions are segmented into employee and employer contributions as follows:

As a result, employers of Singaporeans and SPRs will have to give eligible employees more money due to the monthly CPF OW ceiling increase even though their employees salaries did not change.

How Will the CPF OW Ceiling Increase Affect Your Take Home Pay and CPF Savings?

If you earn more than $6,000 per month, your monthly take-home pay will be reduced due to the higher CPF OW ceiling.

This decrease in take-home pay results from the higher CPF contributions you must make each month.

For instance, if your monthly salary is $7,000, your employee contribution of 20 per cent will be $1,200, limited by the $6,000 salary threshold.

When the monthly CPF salary cap rises to $6,300 from 1 September 2023, your 20% employee contribution will go up to $1,260.

As a result of this change, your monthly employee CPF contribution will increase by $60. Consequently, your take-home pay will also decrease by $60.

In 2026, when the CPF OW ceiling is further increased to $8,000, 20 per cent of this new limit will amount to $1,600.

This means that, compared to the current situation, your CPF employee contribution will rise by $400 per month. Consequently, if your salary remains unchanged during this period, your take-home pay will be reduced by $400 per month.

In addition, you will receive $340 more in employer CPF contributions every month.

This means that there will now be an additional $740 going into their CPF every month, or $8,880 every year.

So, what does this mean for Calmond?

Since Calmond earns a monthly salary of $7,000 a month.

$6,300 out of $7,000 is liable for CPF contributions from 1 September 2023 onward.

And the remaining $700 is not liable for CPF contributions.

What is the CPF Additional Wage Ceiling?

In addition, we have Additional Wages (AW), which is defined by CPF as the compensation given to employees made at intervals of more than a month.

Examples include bonuses, commissions, allowances, leave pay and other forms of compensation given at intervals of more than a month.

Calmond’s annual bonus of $10,000 falls under this category of AW.

The AW Ceiling for 2016 onwards is $102,000 — this amount represents the Total Ordinary Wages subject to CPF for the year.

Since Calmond earns more than $6,300 a month, his OW for the year amounts to $75,600 ($6,300 x 12).

As such, the amount of AW Ceiling that applies to Calmond is calculated using this formula:

$102,000 – $75,600 = $26,400.

This means that Calmond’s entire bonus of $10,000 is liable for CPF contributions as it falls below the CPF contribution cap of $26,400.

If you are an employer or employee wanting to know your specific AW ceiling, check out this AW ceiling Calculator from CPF!

What is the CPF Annual Limit?

Last but not least, we have the CPF Annual Limit.

This is the maximum amount of mandatory and voluntary contributions that can be contributed to a CPF member’s three accounts in a year.

The current CPF Annual limit is $37,740.

This $37,740 limit is the total limit and includes the mandatory amount you contributed through your salary (20%) and the contribution by your employer (17%).

We will be using Pistachio, who was born in the year of the Tiger, as an example:

Pistachio is younger than 55, but unlike Calmond, Pistachio did not receive a bonus this year and only received his monthly salary of $7,000 a month.

Given that Pistachio is still below 55, he would have accumulated $27,972 in his three CPF accounts within a year based on her monthly wage of $7,000, excluding bonuses.

This is so, as CPF only looks at the OW of $6,300 a month.

As such, Pistachio’s total CPF Contribution in a year is:

[($6,300 x 20%) + ($6,300 x 17%] x 12 months = $27,972.

This will mean that Pistachio can only contribute a maximum of $37,740 – $27,972 = $9,768 more to his three CPF accounts this year.

Do note that CPF Special Account (SA) top-ups under the Retirement Sum Top-up Scheme (RTSU) are not included in the CPF annual limit.

Is That All the CPF I Can Add to My CPF Account in a Year?

However, if you would like to top-up more than the CPF Annual Limit contributions, there is an option or two for you.

Under the Retirement Sum Topping-Up Scheme (RSTU), you can do a voluntary top-up of CPF with cash.

Do note that voluntary contributions and retirement sum top-ups are irreversible. Meaning there is no turning back once you’ve done it.

Retirement Sum Topping-Up Scheme Limits

| Age | Account | Top-Up Limit | Retirement Sums 2024 |

|---|---|---|---|

| Below 55 years old | Special Account | Up to current Full Retirement Sum - Including nett SA savings under CPF Investment Scheme | Full Retirement Sum is currently $205,800 |

| 55 years old and above | Retirement Account | Up to current Enhanced Retirement Sum | Enhanced Retirement Sum is currently $308,700 |

Got Any Questions About CPF?

Hop on over to our Seedly Community CPF group and join in the discussion. Who knows? Someone from the CPF Board might just answer your question:

Read More

Advertisement