ETFs in Singapore (SGX): What Investors Should Know

Sudhan P

Sudhan P●

ETFs in Singapore (SGX)

Exchange-traded funds (ETFs) are open-ended investment funds that commonly track the performance of an underlying index.

Since they are traded on a stock exchange, they are aptly named as such.

The most common ETF in Singapore mimics the performance of the Straits Times Index (STI).

On top of the STI-tracking ETFs, there are other types of ETFs listed in Singapore.

Here, let’s explore the many types of ETFs listed on the Singapore stock market that are designed to track the different indices or asset classes.

(You can now bookmark this article using the Seedly Bookmark feature so that you can refer to it whenever you need it!)

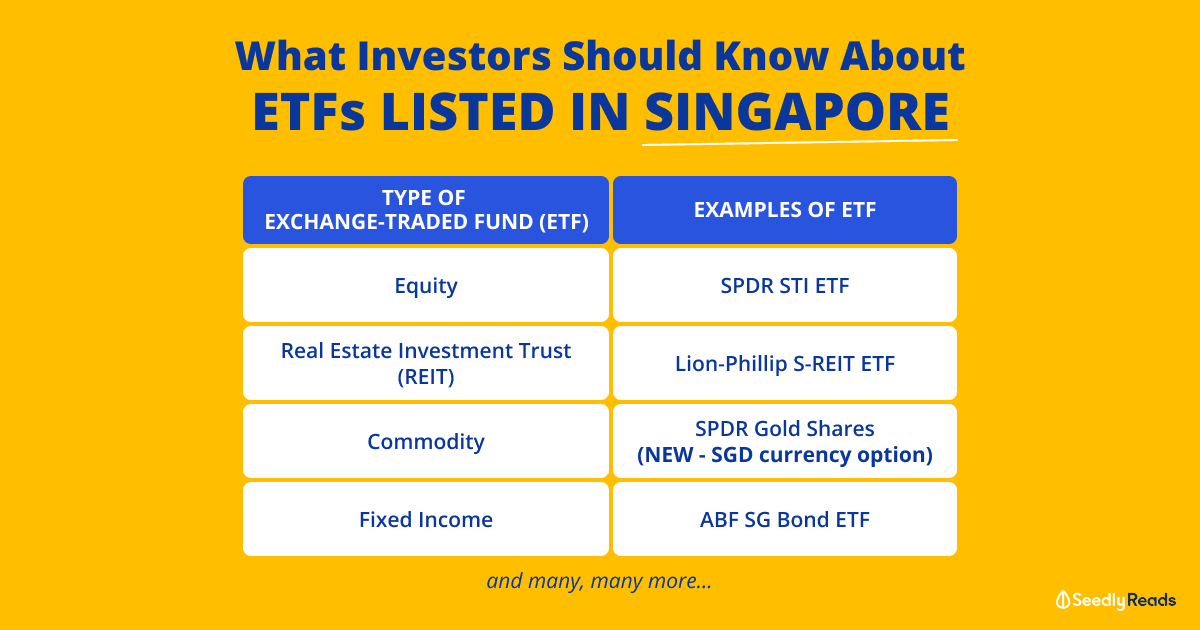

TL;DR: Different Types of ETFs in Singapore

- There are four main types of ETF in Singapore;

- They are those tracking equity indices, REIT indices, commodity or a commodity index, and fixed income indices;

- There are two equity ETFs tracking Singapore’s Straits Times Index — the SPDR STI ETF and Nikko AM STI ETF; and

- For those who are interested to invest in gold, there’s the SPDR Gold Shares.

Equity Index

An equities ETF aims to track the movements of a stock index.

The SPDR STI ETF (SGX: ES3) tracks the fundamentals of the Straits Times Index.

The Straits Times Index consists of the 30 largest and most liquid companies listed in Singapore (also known as blue-chip stocks).

Other than the SPDR STI ETF, there is also the Nikko AM STI ETF (SGX: G3B), which also seeks to replicate the fundamentals of the Straits Times Index.

For a primer on STI ETFs, you can jump in here.

Here’s an article discussing the differences between the two ETFs tracking the Straits Times Index.

Equity ETFs can be further broken down by country or region.

If investors wish to get exposure to the Chinese stock market, they can choose to invest in the United SSE50 China ETF (SGX: JK8), which tracks the SSE 50 index.

The SSE 50 is a 50-stock index of the Shanghai Stock Exchange.

For those who like dividends and want to invest in the Asia-Pacific region, there’s the Principal S&P Ethical Asia Pacific Dividend ETF (SGX: QR9) (SGX: P5P).

The ETF tracks the S&P Ethical Pan Asia Select Dividend Opportunities Index.

REIT Index

A REIT ETF tracks the fundamentals of a real estate investment trust (REIT) index.

In Singapore, there are three REIT ETFs, and they are:

- NikkoAM-StraitsTrading Asia Ex Japan REIT ETF (SGX: CFA) (SGX: COI);

- Phillip SGX APAC Dividend Leaders REIT ETF (SGX: BYJ) (SGX: BYI); and

- Lion-Phillip S-REIT ETF (SGX: CLR).

Among Singapore’s three REIT ETFs, the Lion-Phillip S-REIT ETF is the newest to be listed in October 2017.

Here’s a complete guide on REIT ETFs for those who want a deeper dive.

Commodity or Commodity Index

A commodity ETF gives investors exposure to a single type of commodity or a basket of commodities.

In Singapore, there’s only one such commodity ETF – the SPDR Gold Shares (SGX: O87), which is backed by physical gold and tracks the spot gold price.

Come 30 June 2021, the SPDR Gold Shares ETF — currently traded in US dollars — will start trading in a secondary currency of the Singapore dollar as well.

This gives Singaporeans the option to purchase the gold ETF in our local currency. The ticker symbol would be “GSD”.

Singaporeans who wish to have exposure to other varieties of commodity ETFs can check out those listed on the US stock market.

Fixed Income Index

Investors who wish to add stability to their portfolio or would like to receive passive income can consider buying some bond ETFs.

The oldest bond ETF in Singapore is the ABF SG Bond ETF (SGX: A35), which was listed in 2005.

The ETF tracks the iBoxx ABF Singapore Bond Index, which contains high-quality bonds issued by the Singapore government and government-linked bodies such as the Housing & Development Board (HDB) and the Land Transport Authority (LTA).

Another fixed income ETF that investors can consider is the Nikko AM SGD Investment Grade Corporate Bond ETF (SGX: MBH).

It gives investors exposure to a diversified portfolio of quasi-sovereign, Singapore and foreign corporate bonds.

The ETF aims to replicate the performance of the iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index.

The latest Singapore fixed-income ETF that was launched in early October 2020 is Phillip SGD Money Market ETF (SGX: MMS)(SGX: MMT), the first of its kind in this part of the region.

It invests in short-term, high-quality money market securities and deposits of established financial institutions to generate returns that are comparable to Singapore-dollar savings deposits.

Another recently-launched ETF is the ICBC CSOP FTSE Chinese Government Bond Index ETF (SGX: CYC)(SGX: CYB).

It is the world’s largest Chinese pure government bond ETF and the China government bonds under the ETF are A1-rated.

List of Selected ETFs in Singapore

| ETF | SGX Stock Code | Underlying Index | Board Lot Size | Trading Currency |

|---|---|---|---|---|

| REITs | ||||

| Lion-Phillip S-REIT ETF | CLR | Morningstar Singapore REIT Yield Focus Index | 100 | SGD |

| NikkoAM-StraitsTrading Asia ex Japan REIT ETF | CFA/COI | FTSE EPRA/NAREIT Asia ex Japan Net Total Return REIT Index | 10 | SGD/USD |

| Phillip SGX APAC Dividend Leaders REIT ETF | BYJ/BYI | SGX APAC ex Japan Dividend Leaders REIT Index | 100 | SGD/USD |

| Fixed Income | ||||

| ABF Singapore Bond Index ETF | A35 | iBoxx ABF Singapore Bond Index | 10 | SGD |

| Nikko AM SGD Investment Grade Corporate Bond ETF | MBH | iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index | 10 | SGD |

| Phillip SGD Money Market ETF | MMS/MMT | FTSE SGD 3-month SOR Index | 5 | SGD/USD |

| ICBC CSOP FTSE Chinese Government Bond Index ETF | CYC/CYB | FTSE Chinese Government Bond Index | 10 | SGD/USD |

| iShares Barclays Capital USD Asia High Yield Bond Index ETF | QL3/O9P | Bloomberg Barclays Asia USD High Yield Diversified Credit Index | 100 | SGD/USD |

| iShares J.P. Morgan USD Asia Credit Bond Index ETF | QL2/N6M | J.P. Morgan Asia Credit Index - Core | 100 | SGD/USD |

| Xtrackers II Singapore Government Bond UCITS ETF | KV4 | Citi Singapore Government Bond Index | 5 | SGD |

| Commodities | ||||

| Precious Metal | ||||

| SPDR Gold Shares | O87 | Spot Gold Price | 5 | USD |

| GSD (from 30 June 2021) | SGD (from 30 June 2021) |

|||

| Single Market Equities | ||||

| Singapore | ||||

| SPDR Straits Times Index ETF | ES3 | Straits Times Index | 10 | SGD |

| Nikko AM Singapore STI ETF | G3B | Straits Times Index | 10 | SGD |

| Phillip SING Income ETF | OVQ | Morningstar Singapore Yield Focus Index | 100 | SGD |

| Xtrackers MSCI Singapore UCITS ETF | O9A | MSCI Singapore Investable Market Total Return Net Index | 10 | USD |

| China | ||||

| United SSE50 China ETF | JK8 | SSE 50 Index | 100 | SGD |

| Xtrackers FTSE China 50 UCITS ETF | HD8 | FTSE China 50 index | 10 | USD |

| USA | ||||

| SPDRs S&P 500 Index ETF | S27 | S&P 500 Index | 10 | USD |

| SPDR Dow Jones Industrial Average ETF | D07 | Dow Jones Industrial Average Index | 10 | USD |

| Australia | ||||

| Xtrackers S&P ASX 200 UCITS ETF | LF1 | S&P/ASX 200 Index | 10 | USD |

SGX’s ETF Screener

For investors who wish to see the full list of ETFs in Singapore or create a portfolio with ETFs, they can explore an ETF screener provided by the Singapore Exchange (SGX).

On top of showing the full list of ETFs, the SGX ETF screener provides filters to sieve out ETFs listed in Singapore by asset class, geography, benchmark, and so on.

So, if you are looking for a cool tool to choose ETFs, SGX’s is a great start!

Have Burning Questions Surrounding The Stock Market?

Why not check out our community at Seedly and participate in the lively discussion regarding ETFs and more!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock. The writer owns units in SPDR STI ETF.

Advertisement