Buying an HDB Resale Flat in 2024: How Much Do You Need To Be Earning and How Much Cash Is Required?

●

So…

You looked at the latest Feburary 2024 Housing and Development Board (HDB) Build-to-Order (BTO) launch and scoffed at the long wait times of ~3.08 to 4.25 years.

Or maybe you’ve applied countless times for a BTO flat or tried your luck with the sale of balance (SBF) exercises or open booking of flats scheme but still ended up with nothing.

That’s tough.

But there’s an alternative.

You could always get an HDB resale flat.

Granted, the HDB Resale Price Index (RPI) has been going up for 16 consecutive quarters since the second quarter of 2020, when Singapore exited the circuit breaker, increasing nearly 40% from 131.5 in Q2 2020 to 183.7 in Q1 2024.

FYI: HDB Resale Price Index tracks the overall price movement of the public residential market

Despite that, resale flats remain relatively affordable, with housing grants boosted in February last year.

Before we get ahead of ourselves, let’s do a little math to find out what type of HDB flat you can really afford.

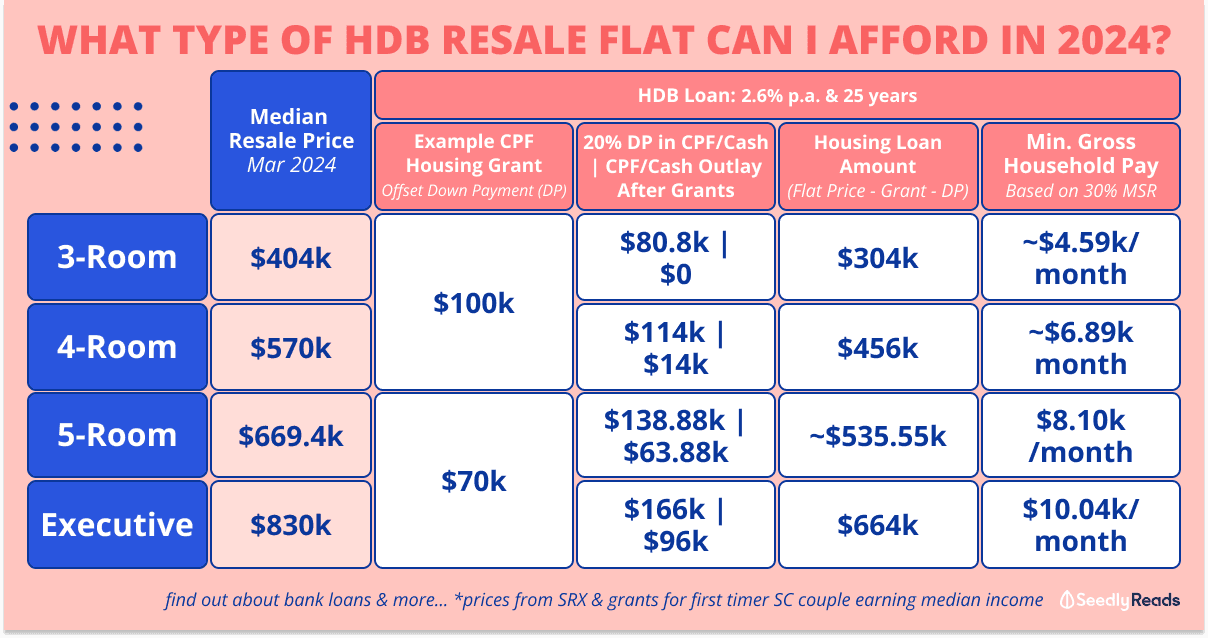

TL;DR: Buying a Resale Hdb Flat in 2024 — How Much Should Be Earning, Downpayment for Resale Flat and More

HDB Loan

| Type of HDB Flat | Median Resale Price (March 2024) | Example Grant Amount (Used to Offset Downpayment) | Downpayment 20% in CPF/Cash | CPF/Cash Outlay After Grants | Housing Loan Amount (Flat Price - Grant - Downpayment) | Estimated Monthly Repayment HDB Loan (2.6% p.a.) | Min. Gross Monthly Household Income (30% MSR) |

|---|---|---|---|---|---|---|

| 3-Room | $404,000 | $100,000 | $80,800 | $0 | $304,000 | $1,379 | ~$4,597 |

| 4-Room | $570,000 | $114,000 | $14,000 | $456,000 | $2,069 | ~$6,897 | |

| 5-Room | $669,444 | $70,000 | $138,888 | $63,888 | $535,555 | $2,430 | $8,100 |

| Executive | $830,000 | $166,000 | $96,000 | $664,000 | $3,012 | $10,040 |

Bank Loan

Type of HDB Flat Median Resale Price (March 2024) Example Grant Amount (Used to Offset CPF Portion of Downpayment) Min. Downpayment Cash Portion (5%) Downpayment CPF Portion (20%)

CPF | CPF Outlay After GrantsHousing Loan Amount (Flat Price - Grant - Cash + CPF Downpayment) Estimated Monthly Instalment

3.0% p.a.Min. Gross Monthly Household Income

30% MSR

3-Room $404,000 $100,000 $20,200 $80,800 | $0 $283,800 $1,346 ~$4.487

4-Room $570,000 $28,500 $114,000 | $14,000 $427,500 $2,027 ~$6,757

5-Room $669,444 $70,000 ~$33,472 $138,888 | $63,888 $497,084 $2,357 $7,857

Executive $830,000 $41,500 $166,000 | $96,000 $622,500 $2,952 $9,840

Click to Teleport

- HDB Resale Flat Grants

- Transacted HDB Prices March 2024

- HDB Resale Flat (HDB Loan) Monthly Income Guide

- HDB Resale Flat (Bank Loan) Monthly Income Guide

HDB Resale Flat Grants and Using CPF for Payments

Before we discuss how much you need to earn, let’s consider how much in Central Provident Fund (CPF) housing grants you can get if you buy a resale flat from the open market.

FYI: According to HDB, homebuyers can use these housing grants to offset the purchase price of their flats and reduce the down payment or the amount of mortgage loan required. The housing grants will be fully credited into their CPF Ordinary Account(s) [OA], and no cash will be disbursed.

The maximum CPF housing grant you can get is $190,000 for a first-time couple. But, the amount you can get is dependent using grants someone can get depends on factors like:

- their marital status

- their monthly household income

- whether they are applying for a flat for the first time or the second time

- living near their parents or children.

- And more.

For example, eligible first-timer families may apply for the following:

- Family Grant: Maximum $80,000 (up from $50,000) in grants (in increments of $5,000) and a monthly household income ceiling of $14,000 ($21,000 if applying with extended family)

- Enhanced CPF Housing Grant: Maximum $80,000 + monthly household income ceiling of $9,000

- Proximity Grant: Maximum $30,000 for those buying a resale to live with their parents/child or within 4km of parents/child.

Also, Here’s a neat little infographic from 99.co breaking it down further:

For a full breakdown of the amount of CPF housing grants, you can check out our comprehensive HDB CPF Housing Grants guide:

Price of HDB in Singapore: Transacted HDB Resale Prices March 2024

To illustrate this, we will be using the latest March 2024 median resale prices by town and flat type for resale cases registered from 99-SRX:

We will distil it down to the overall median resale prices as a rough guide.

We recommend using the calculators provided to estimate affordability for HDB flats.

HDB Resale Portal: What Happens if You Don’t Have Enough

If you are in the market for an HDB resale flat, you can use the HDB resale price index portal to find a fair price for a flat in the estate where you want to live.

HDB Resale Flat (HDB Loans) Monthly Income Guide: Down Payment for HDB and HDB Financing Explained

The estimates will be based on the following assumptions:

- You will apply for an HDB loan and can meet the criteria to borrow a maximum of 80% of the purchase price. This means that you will only need to pay a 20% down payment, which can be offset by the grants

- You will take on the maximum HDB loan tenure of 25 years with the prevailing interest rate of 2.6% per annum (p.a.), which is 0.1% above the CPF Ordinary Account (OA) interest rate

- The loan tenure is a maximum of 25 years, with a current interest rate of 2.6%

- This is your only mortgage

- When you take up an HDB home loan, there is a cap on the monthly instalment amount you can take up (i.e. 30% mortgage servicing ratio (MSR). Your monthly home loan instalment cannot exceed 30% of your household’s gross monthly income (income before deduction of employee CPF contributions)

- We used PropertyGuru’s Mortgage Repayment Calculator to estimate the monthly mortgage payments you need to make. This figure is then used to derive the minimum monthly income required to buy a resale flat

- For HDB CPF housing grants, although the amount of grants you can receive varies from couple to couple, we are using an example based on our assumptions for an average couple in Singapore for this calculation. Our average couple is a married couple who are both:

- 30 years old

- Singaporean Citizens

- First-time buyers

- Earn Singapore’s gross median income of $4,550 a month (excluding CPF): Average household income = $9,100

- Buying an HDB resale flat within 4km of their parents.

CPF Housing Grants for a 4-Room Resale Flat or Smaller (From 14 Feb 2023)

- Enhanced CPF Housing Grant (More than $9,000 Average Monthly Household Income): $0

- Family Grant: $80,000

- Proximity Grant: $20,000.

This means in total, the couple will receive $100,000 in grants.

CPF Housing Grants for a 5-Room Resale Flat or Smaller (From 14 Feb 2023)

- Enhanced CPF Housing Grant (More than $9,000 Average Monthly Household Income): $0

- Family Grant: $50,000

- Proximity Grant: $20,000.

This means in total, the couple will receive $70,000 in grants.

So with the HDB loan, here is how much your entire household should minimally be earning for the past 12 months:

| Type of HDB Flat | Median Resale Price (March 2024) | Example Grant Amount (Used to Offset Downpayment) | Downpayment 20% in CPF/Cash | CPF/Cash Outlay After Grants | Housing Loan Amount (Flat Price - Grant - Downpayment) | Estimated Monthly Repayment HDB Loan (2.6% p.a.) | Min. Gross Monthly Household Income (30% MSR) |

|---|---|---|---|---|---|---|

| 3-Room | $404,000 | $100,000 | $80,800 | $0 | $304,000 | $1,379 | ~$4,597 |

| 4-Room | $570,000 | $114,000 | $14,000 | $456,000 | $2,069 | ~$6,897 | |

| 5-Room | $669,444 | $70,000 | $138,888 | $63,888 | $535,555 | $2,430 | $8,100 |

| Executive | $830,000 | $166,000 | $96,000 | $664,000 | $3,012 | $10,040 |

FYI: For home loans and grants, HDB assesses your household’s income over 12 months, with the assessment period ending two months before the month of the HFE letter application. For example, if your HDB Flat Eligibility (HFE) letter application is submitted in April 2024, the assessment period will be from March 2023 to February 2024.

HDB Resale Flat (Bank Loans) Monthly Income Guide: Is HDB Downpayment 10% or 15%?

The estimates will be based on the following assumptions:

- You’re taking a bank loan for your HDB flat and can meet the criteria to borrow a maximum of 75% of the purchase price. This means that you will have to pay a 25% downpayment, of which 5% has to be paid with cash while the remaining 20% can be paid with CPF which can be offset bu the grants (It is important to note that the days of HDB flat down payments being 10% or 15% are behind us)

- You will be taking on a loan tenure of 25 years with the prevailing interest rate of 3.0% p.a. based on the cheapest 2-year DBS fixed loan package (via PropertyGuru as of 28 April 2024):

-

- This is your only mortgage

- When you take up an HDB bank home loan, there is a cap on the monthly instalment amount you can take up (i.e. 30% MSR). Your monthly home loan instalment cannot exceed 30% of your household’s gross monthly income

- We used PropertyGuru’s Mortgage Repayment Calculator to estimate the monthly mortgage payments you need to make. This figure is then used to derive the minimum monthly income required to buy a resale flat

- We will use the same assumptions for the HDB loan.

Type of HDB Flat Median Resale Price (March 2024) Example Grant Amount (Used to Offset CPF Portion of Downpayment) Min. Downpayment Cash Portion (5%) Downpayment CPF Portion (20%)

CPF | CPF Outlay After GrantsHousing Loan Amount (Flat Price - Grant - Cash + CPF Downpayment) Estimated Monthly Instalment

3.0% p.a.Min. Gross Monthly Household Income

30% MSR

3-Room $404,000 $100,000 $20,200 $80,800 | $0 $283,800 $1,346 ~$4.487

4-Room $570,000 $28,500 $114,000 | $14,000 $427,500 $2,027 ~$6,757

5-Room $669,444 $70,000 ~$33,472 $138,888 | $63,888 $497,084 $2,357 $7,857

Executive $830,000 $41,500 $166,000 | $96,000 $622,500 $2,952 $9,840

Read More

Advertisement