How to Use a Broker: A Step-by-Step Guide to Investing Terms Explained for Dummies

Limit order? RTH? Position?

What do all these terms mean?

If you’ve just started using a brokerage platform, you might be overwhelmed by the sheer number of foreign terms. I know I was when I first started!

And just like any investing noob, there’s always the possibility that you could lose $100 just from misclicking.

Luckily, you can level up your investing knowledge with Seedly as we take you through all the common terms that you’ll encounter during your first foray into investing!

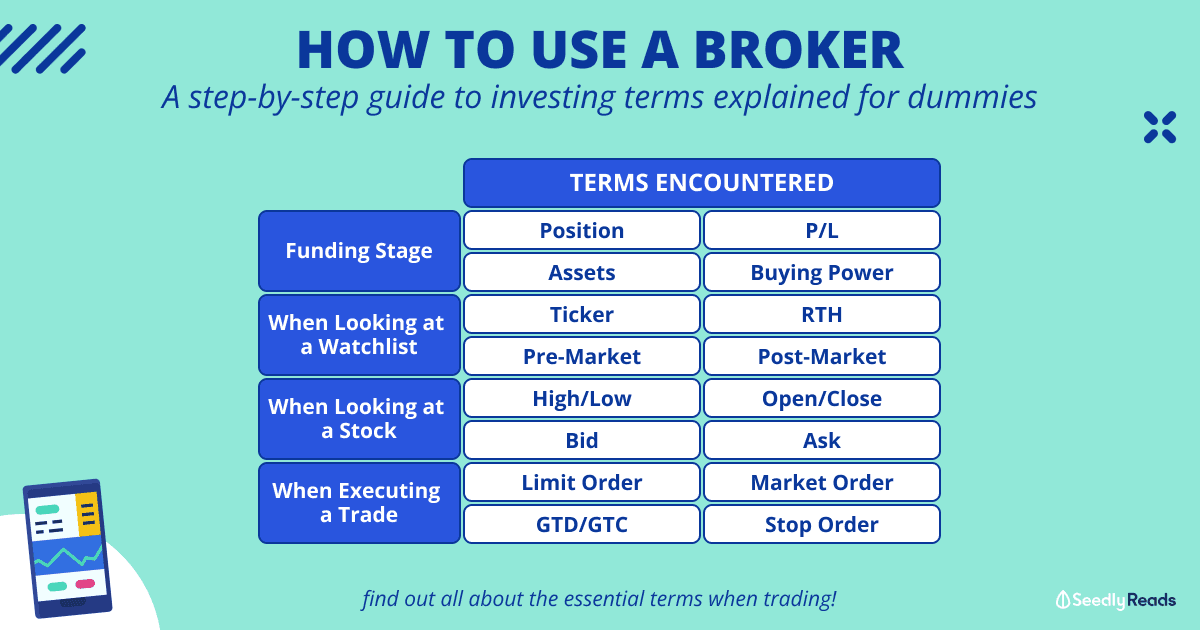

TL;DR: How to Use a Broker — A Step-by-Step Guide to Investing Terms

In this guide, we’ll do a walkthrough of all the essential terms you’ll come across when using a broker, from the time you register to the point of buying your first stock.

Jump to:

- Investing terms encountered during registration and funding

- Investing terms encountered on the watchlist

- Investing terms encountered when looking at a specific stock

- Investing terms encountered when executing a trade

- Investing terms encountered after executing a trade

| Term | Description |

|---|---|

| Assets | An asset is an economic resource that can be owned and provides you with a future benefit |

| Bid/Ask | The bid refers to the price that people are willing to pay for the stock while the ask refers to the price that people are willing to sell it |

| Buying Power | The amount of cash available that you can use to purchase an asset |

| Close (a position) | Sell all the stocks you own in that current position |

| Fill outside RTH | A characteristic whereby your limit order will be filled during pre-market or post-market hours |

| Good till Cancelled (GTC) | A characteristic whereby your limit order will be filled if the stock price reaches your specified price unless you decide to cancel the order |

| Good till Date (GTD) | A characteristic whereby your limit order will be filled if the stock price reaches your specified price within the date indicated (typically for the current day unless otherwise specified) |

| High/Low | Highest and lowest prices of the stock within the day |

| Limit Order | An instruction to the broker to buy or sell an asset at a specific price or better |

| Market Order | Execute your trade at the current market price |

| Open/Close | Prices of the stock the moment the stock market opens for trading during RTH and the price of the stock the moment the market closes |

| P/L | Profit/Loss - how much you earn or lose if you sold all your assets |

| Position | Amount of assets that you currently own |

| Pre-Market/Post-Market | Pre-market trading refers to buying or selling stocks before the stock market opens whereas post-market trading refers to the buying or selling of stocks after the stock market has closed |

| Regular Trading Hours (RTH) | The time period when the local stock market operates |

| Stop Order | An order to buy or sell a stock at the market price once the stock is trading at or through a specified price |

| Ticker | Unique combination of letters and numbers that represent a specific stock |

Read more

- How to Invest: A Singaporean’s Guide To Investing for Beginners

- The Ultimate Beginner’s Guide to Picking Your First Stock

- How to 6X an Investment Portfolio: Lessons From How Temasek Invests

Investing Terms Encountered During Registration and Funding

After you’ve registered for a broker, you’ll likely be bombarded with a screen filled with graphs, numbers and unfamiliar terms. While some brokers do attempt to educate their users on what the terms mean, most brokerages (especially older ones) immediately throw you into the home page, leaving us noobs overwhelmed and confuzzled.

Before you can begin to trade, you’ll need to fund your account with monies. Depending on your broker, you can find your assets under the “profile”, “account”, “securities”, “funds” or “trade” tab.

Here, there are a number of terms that you’ll need to know.

Assets

First off, we have assets which basically refers to any stocks, bonds, currencies or commodities. By definition, an asset is an economic resource that can be owned and provides you with a future benefit.

Buying Power

Present in some brokers, buying power simply refers to the amount of cash available that you can use to purchase an asset.

P/L

On the asset page of your broker, you may also find indicators such as P/L. It stands for Profit/Loss or in layman’s terms, how much you earn or lose if you sold all your assets.

Do note that these profits/losses are only “on paper” or what is known as paper profit/loss. You’ll only realise your gains or losses when you sell your assets.

Position

In the investing world, a position refers to the amount of assets that you currently own.

Investing Terms Encountered On The Watchlist

Once you’ve funded your account, you can start trading. Here’s where things get a lot more complicated.

Ticker

Most of us are familiar with company names such as Apple, Tesla, DBS and Nvidia. However, when you search for these companies on your broker, you’ll likely see them as a stock symbol or ticker.

For example, Apple is represented with the ticker AAPL, Tesla with TSLA and DBS with D05. These tickers are important as it is a unique combination of letters and numbers that represent a specific stock.

If you were to search for DBS for example, you would find different listings such as DBSDF and D05. However, if we want to invest in DBS locally, you’ll need to look for SGX: D05 on the Singapore Exchange.

Regular Trading Hours (RTH)

Regular trading hours or RTH refers to the time period when the local stock market operates. Investors should take note of the RTH of the markets that they are trading in as this will determine when your position can be filled (when you can buy and secure your stock).

For those intending to trade in the U.S. market, the RTH will be 9.30pm – 4am Singapore time.

When you trade during RTH, your orders will be filled much quicker when compared to trading outside of RTH.

Pre-Market/Post-Market

When you trade during a time outside RTH, you’ll either be trading during pre or post-market. As the name suggests, pre-market trading refers to buying or selling stocks before the stock market opens whereas post-market trading refers to the buying or selling of stocks after the stock market has closed.

During these periods, investors can still trade stocks which will cause the price to move up or down. However, your orders will be filled at a slower pace when compared to trading during RTH.

Investing Terms Encountered When Looking At a Specific Stock (Quote)

High/Low

One of the first few things that you might notice is the High/Low indicators. Simply put, these are the highest and lowest prices of the stock within the day.

Open/Close

You may also see the open/close indicator. These are the prices of the stock the moment the stock market opens for trading during RTH and the price of the stock the moment the market closes. These indicators are important to know as well as the prices reflected in a bigger font are usually the live prices or close prices once RTH is over. Thus, if you are trading outside RTH, make sure that you are looking at the pre or post-market prices.

Bid/Ask

The bid refers to the price that people are willing to pay for the stock while the ask refers to the price that people are willing to sell it.

Investing Terms Encountered When Executing a Trade

This is where things can get quite scary for beginners as clicking on the wrong things might get you in trouble. While there are safeguards such as a confirmation screen, it is good to know the following terms before you execute the trade.

When executing a trade, one of the most important things you should be aware of is the type of order you are inputting. Here are a few common order types and what they mean.

Limit Order

A limit order is an instruction to the broker to buy or sell an asset at a specific price or better. For example, if I want to buy Tesla at US$850 even though it is currently above US$870, I can set a limit order of US$850 and the broker will only execute my trade if the price drops to $850 or lower. When doing a limit order, there is also a timeframe for which the broker will execute my trade.

You may see terms such as GTD, GTC and Fill outside RTH.

Good till Date (GTD)

By selecting GTD, it means that your limit order will be filled if the stock price reaches your specified price within the date indicated (typically for the current day unless otherwise specified).

Good till Cancelled (GTC)

Similarly, when you select GTC, your limit order will be filled if the stock price reaches your specified price unless you decide to cancel the order.

Fill outside RTH

Some brokers may also include this option where the broker will execute your trade during pre-market or post-market hours.

Market Order

For those of us who are okay with the current live prices, you can select market order which will execute your trade at the current market price.

Stop Order

A stop order is an order to buy or sell a stock at the market price once the stock is trading at or through a specified price.

Sell Stops (Stop Loss)

Stop orders are a great tool when it comes to protecting your money. For example, if you are unable to tolerate a 10% decrease in your assets, you can set a stop loss order which will automatically sell your stocks should the price drop below 10% of the price you bought in.

Buy Stops

On the other hand, you can also set a buy-stop order should prices continue to rise. Let’s say that Tesla (current price: US$870) might drop to US$850 and I want to buy at that price. However, it looks like it is still rising in the meantime. In this case, I can set a buy stop order at US$880 just in case it goes up while giving it a chance that it may drop to US$850.

We won’t go into too much detail about the order types since most beginners would be using the above-mentioned order types.

Investing Terms Encountered After Executing a Trade

Once your trade is executed, you can view the stocks that you own in the “portfolio”, “positions” or “trade” tab of your broker. You can also track your order history which shows you the status of your past orders.

Most terms here are rather self-explanatory, such as buy/sell. But there is one term that you should take note of.

Close

If you select “close” after clicking a position in your portfolio, this will sell ALL the stocks you own in that current position. For example, if I have 10 Tesla shares and click on the “close” position, it will direct me to sell all 10 of my Tesla shares.

Afterthoughts

Now that you’re familiar with the terms, you’re ready to execute a trade without any mistakes. But of course, make sure that you are ready to invest in the first place!

Related Articles

Advertisement