Back in the day, our grandparents used to store money in biscuit tins to keep their money safe.

Thankfully, we don’t have to deal with the inconvenience of using biscuit tins to store our money, as online banking is so prevalent today. But, this may not be the safest way to store your money.

A joint study by the non-profit organisation Global Anti-Scam Alliance (Gasa) and data service provider ScamAdviser estimated that about US$1.02 trillion (S$1.4 trillion) was lost to scams occurring between August 2022 and August 2023. The study, which surveyed 49,459 individuals across 43 countries, identified that people in Singapore were the biggest scam victims who experienced an average loss of US$4,031 (~S$5,383) per victim.

Jorij Abraham, the Managing Director of Gasa, emphasized that the most prevalent scams globally involve online shopping, identity theft, and investments. Most notably, phishing scams, a form of identity theft, emerged as the most common scam in Singapore in 2022, with 7,097 reported cases and victims collectively losing S$16.5 million, as indicated by figures from the Singapore Police Force (SPF). For these cases, the SPF noted that fraudsters would assume the identities of authorities or reputable organisations to deceive victims into divulging their credit card particulars and banking account details.

What is a Money Lock Account/Feature?

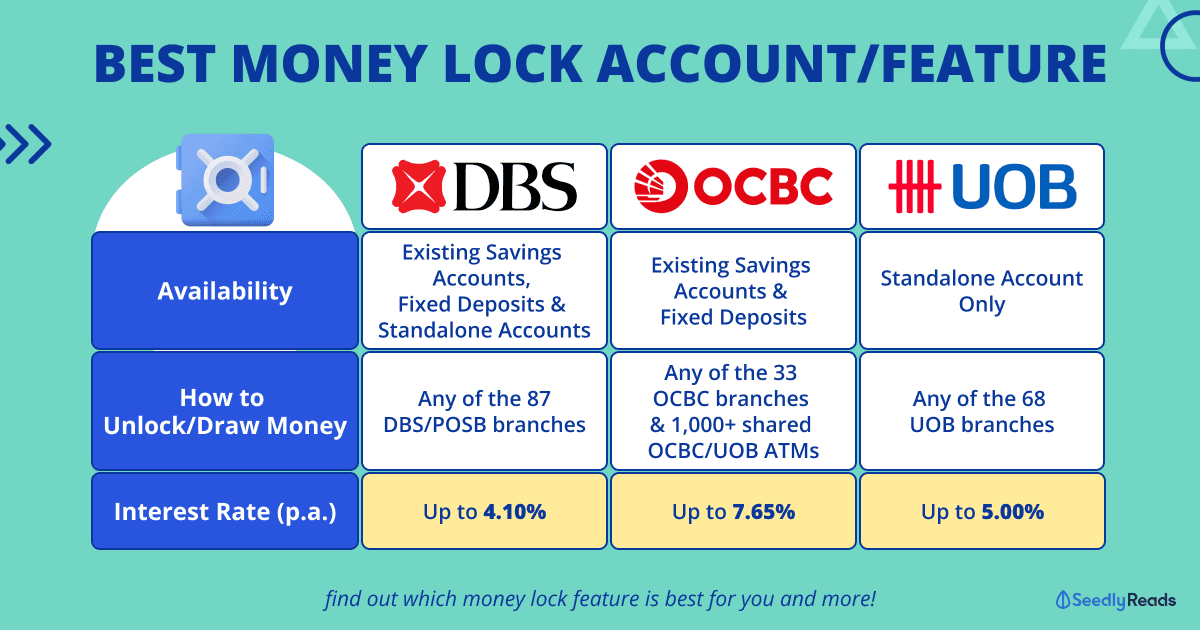

In a bid to protect Singaporeans against these scams, the big three local banks, DBS, OCBC and UOB, have announced new money-locking features where your funds can only be unlocked after you have visited the bank branches in person to verify your identity.

If you are looking to keep your money safe from scams, we’ve done a comparison to help you find which one is best for you!

TL;DR: Best Money Locking Account/Feature (2024) — DBS vs OCBC vs UOB

| DBS digiVault | OCBC Money Lock | UOB LockAway Account | |

|---|---|---|---|

| Availability | Existing savings accounts, Fixed deposits & Standalone account | Existing savings accounts & Fixed deposits | Standalone account |

| How to Unlock/Draw Money | Any of the 87 DBS/POSB branches | Any of the 33 OCBC branches & 1,000+ shared OCBC/UOB ATMs Overseas: Submit a request via the Secured Mailbox in the OCBC Digital app or Internet Banking. | Any of the 68 UOB branches |

| Interest Rate (p.a.) | DBS Multiplier: Up to 4.10% DBS Fixed Deposit: 3.20% (Mar 2024, min. $1,000) DBS digiVault Standalone Account: 0.05% (MyAccount) | OCBC 360: Up to 7.65% OCBC Fixed Deposit: 3.00% (Mar 2024, min. $30,000) | UOB Lockaway Account: Up to 5.00% |

Click to Teleport:

DBS digiVault

First up, we have the DBS digiVault. With the latest changes, there are now three ways you can lock your money:

- Lock savings in your existing DBS savings accounts (and continue to enjoy the interest rates offered across DBS’ various savings propositions)

- Lock savings in Fixed Deposits

- Set up a separate digiVault account for locking (a My Account with a paltry 0.05% p.a. interest rate)

When your money is locked, you will not be able to do any online transactions like digital payments and outbound transfers.

To access funds in digiVault, clients must personally visit any of the 87 DBS/POSB branches in Singapore to make a request and verify their identity before initiating any fund transfers from the account.

Do note that unlocking may take up to two working days.

For savings accounts and fixed deposit digiVaults, you can lock your money via digibot. Otherwise, existing DBS/POSB account holders can apply for a digiVault account through their digibank app in the “Apply” section under the “more” tab. Upon approval, customers will receive a push notification in digibank, signalling that their digiVault is ready for use. After approval is granted, you can deposit funds into the account digitally or otherwise.

FYI: The funds in the separate digiVault account are covered for up to $75,000 by the Singapore Deposit Insurance Corporation (SDIC) per bank per person, which means that all your DBS bank accounts share this cap. The account also has no minimum deposit requirement, maximum deposit, or fall-below fees.

OCBC Money Lock

OCBC customers can use OCBC Money Lock to secure their funds in their current OCBC bank accounts, providing robust protection against unauthorised transfers, malware, and phishing scams.

FYI: OCBC bank account funds are covered up to $75,000 by the Singapore Deposit Insurance Corporation (SDIC) per bank per person, meaning all your OCBC bank accounts share this cap.

Funds that are locked cannot be digitally transferred or utilised for the following purposes:

- Local and international transfers, including transfers between a customer’s own accounts.

- Initiating or modifying payment arrangements such as GIRO, standing instructions, or future-dated transfers.

- Settling bills or credit card payments.

- Placing fixed deposits or making investments.

- Purchasing or paying for insurance.

- Repaying loans or taxes.

- Withdrawing cash from ATMs or making transfers.

Customers can continue to conduct transactions as usual with the remaining balances in their accounts that have not been locked. In cases where these remaining balances are insufficient, customers must unlock their funds before proceeding with transactions.

Customers are not required to open a new bank account to utilise OCBC Money Lock; this feature is accessible to both new and existing OCBC current and savings accounts.

The funds locked in the selected account are combined with the unlocked funds to calculate the interest to be accrued. This ensures that you do not miss out on bonus interest earned through regular banking activities, as seen with popular accounts like the OCBC 360 Account!

Locking funds is accessible through the OCBC Digital app or Internet Banking. Customers choose a deposit account, specify the amount they want to lock (in multiples of S$10, with S$10 being the minimum and the available balance as the maximum), and complete the process.

Unlocking funds cannot be performed using the OCBC Digital app or Internet Banking. In Singapore, customers can only unlock funds at OCBC ATMs or branches. Authentication at an OCBC ATM involves using a physical ATM, debit or credit card, and the associated PIN.

Customers residing overseas seeking to unlock funds can submit a request through the Secured Mailbox in the OCBC Digital app or Internet Banking. A customer service executive will contact the customer within four working days.

UOB LockAway Account

Next up, we have the UOB LockAway Account, a standalone savings account that safeguards your funds against unauthorised online access and hasty financial decisions.

The UOB LockAway Account restricts the availability of deposited funds for online transactions, such as digital payments and outbound transfers. Customers can only access their locked-up funds by visiting any of the bank’s 63 branches in Singapore and undergoing identity verification by presenting their ID cards or passports.

However, you can still view your account or top it up anytime via the UOB TMRW app or on the UOB Personal Internet Banking website.

FYI: The funds in the account are covered for up to $75,000 by the Singapore Deposit Insurance Corporation (SDIC) per bank per person, which means that all your UOB bank accounts share this cap. The account also has no minimum deposit requirement, maximum deposit, or fall-below fees.

Furthermore, it does not come with a chequebook, and existing cards cannot be linked to it. Access to funds is limited to in-person transactions at the bank’s branches.

UOB LockAway Account Interest Rate

| Account Balance | Interest RateLimited time! (p.a.) From 30 Nov 2023 to 31 Mar 2024 | Interest Rate (p.a.) 1 Apr 2024 onwards |

|---|---|---|

| First S$20k | 1.00% | 0.05% |

| Next S$40k | 2.50% | 1.50% |

| Next S$40k | 3.00% | 3.00% |

| Next S$25k | 5.00% | 5.00% |

| Above S$125k | 0.05% | 0.05% |

Which Money Lock Account/Feature is the Best?

Money Lock for Savings Accounts

After comparing interest rates, OCBC’s Money Lock would be the best as you can easily earn a higher interest than the DBS digiVault:

Money Lock for Fixed Deposits

As for fixed deposits, this will vary from month to month. For this month, DBS has the best interest:

Money Lock for Standalone Accounts

For those of us who want a separate account for money locking, UOB has a better account with higher interest rates than the DBS digiVault.

Advertisement