Want To Ace Your Personal Finance Game? These Instagram Accounts Are Here To Help!

Taking control of your finances doesn’t have to feel overwhelming. Whether you’re trying to budget smarter, start investing, or make sense of policies like CPF, Singapore’s growing community of finfluencers (financial influencers) has got you covered.

In this guide, we’ll dive into the best finfluencers Singapore has to offer in 2024. From personal finance and investing to global business trends and local policies, these Instagram accounts and platforms will help you take charge of your financial journey.

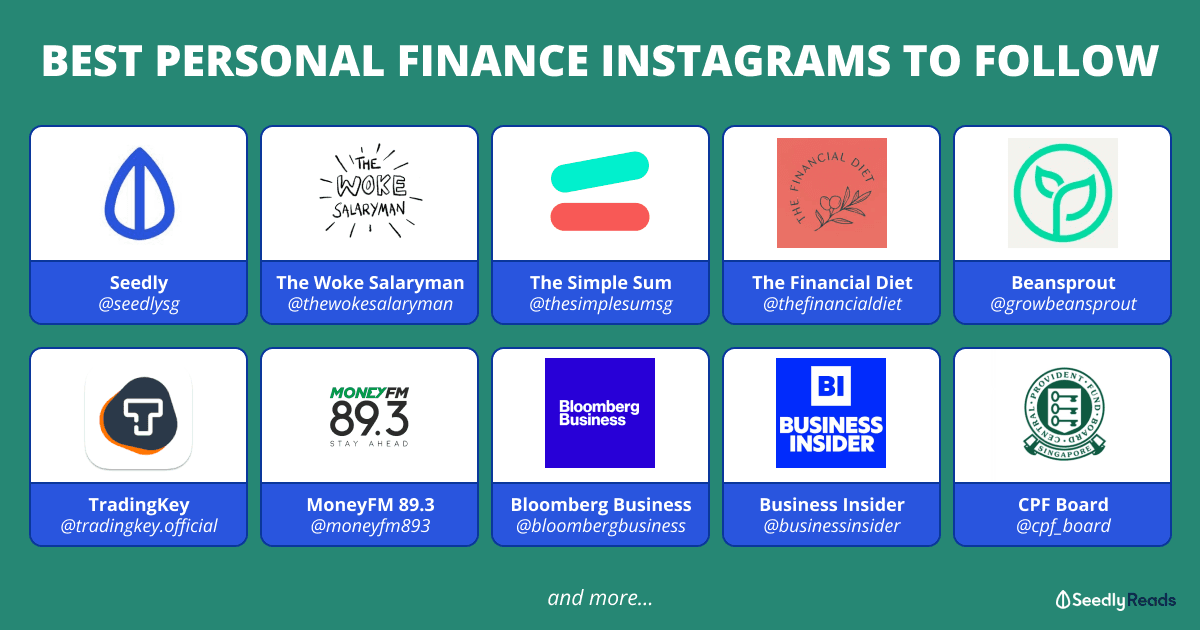

TL;DR: 10 Instagram Accounts That Help You Get Better At Your Money

- Category: Personal Finance Gurus:

- Seedly (@seedlysg)

- The Woke Salaryman (@thewokesalaryman)

- The Simple Sum (@thesimplesum)

- The Financial Diet (@thefinancialdiet)

- Category: Investing Gurus:

- Beansprout (@growbeansprout)

- TradingKey (@tradingkeys)

- Category: Business, Financial News, and Economy:

- MoneyFM 89.3 (@moneyfm893)

- Bloomberg (@bloombergbusiness)

- Business Insider Graphics (@businessinsider)

- Category: Government & Policy Resources:

- CPF Board (@cpf_board)

Category: Personal Finance Gurus

Seedly (@seedlysg)

If you haven’t been on our Instagram, you should!

Seedly is one of Singapore’s most trusted platforms for personal finance advice. Our Instagram posts simplify everything from comparing savings accounts to optimising your CPF. What sets us apart is our community-driven approach, where users share experiences and insights, creating a rich ecosystem of real-world advice.

Whether it’s localised lifestyle hacks or personal finance tips, the whole Instagram takes a swipe at making content in a “Singaporean” manner.

The Woke Salaryman (@thewokesalaryman)

Known for their clever comics, The Woke Salaryman has transformed how Singaporeans view personal finance. Their posts focus on building financial independence, understanding CPF, and budgeting effectively. What makes them relatable is their honest, no-sugar-coating approach to money matters.

Their comics often highlight real-life scenarios, showing the consequences of poor financial habits and the benefits of smart money management. Following them feels like having a candid conversation with a financially savvy friend.

The Simple Sum (@thesimplesum)

The Simple Sum takes a friendly and approachable tone to personal finance. Their Instagram is full of bite-sized tips on setting up emergency funds, managing debt, and saving for future goals.

Their content is great for beginners who feel intimidated by jargon-heavy finance advice. They explain concepts clearly, ensuring that even the least financially savvy can take actionable steps toward a more secure future.

The Financial Diet (@thefinancialdiet)

Though based abroad, The Financial Diet shares globally relevant advice on balancing finances with lifestyle choices. Their posts cover everything from budgeting to avoiding impulse purchases and planning for long-term financial goals.

They’re perfect for anyone who wants to save smartly without sacrificing their quality of life.

Category: Investing Gurus

Once you’ve nailed the basics, it’s time to grow your wealth. These accounts specialise in making investing less intimidating and more accessible.

Beansprout (@growbeansprout)

Beansprout is a top resource for Singaporeans looking to start investing. Their Instagram breaks down investment concepts like REITs, ETFs, and CPF investments into easy-to-understand posts.

What makes Beansprout special is their focus on actionable advice tailored to the Singapore market. Their content often tackles questions like, “How do I start investing with $100?” or “What are the benefits of dividend stocks?” By following them, you’ll feel confident taking your first steps into the world of investing.

TradingKey (@tradingkey.official)

If you’re interested in trading, TradingKey is the perfect guide. Their Instagram shares insights into trading strategies, market trends, and cryptocurrency tips. But the real treasure lies on their website, tradingkey.com, which offers in-depth tutorials, market analyses, and tools for traders of all levels.

What sets TradingKey apart is their ability to cater to both beginners and seasoned traders. They provide step-by-step guidance on technical analysis while also offering advanced strategies for experienced traders. If trading has always felt too complex, TradingKey makes it approachable and achievable.

Category: Business, Financial News, and Economy

Understanding the bigger picture can help you make smarter financial decisions. These accounts focus on market trends, economic policies, and global finance.

MoneyFM 89.3 (@moneyfm893)

As Singapore’s leading business and finance radio station, MoneyFM 89.3 provides quick updates on market trends, economic developments, and government policies. Their Instagram posts are concise and easy to follow, making it perfect for staying informed without getting overwhelmed.

Bloomberg (@bloombergbusiness)

Bloomberg is a trusted source for global financial news. Their Instagram shares market insights, industry updates, and economic trends in a way that’s accessible to everyone, from seasoned investors to casual followers.

Business Insider Graphics (@businessinsider)

Business Insider Graphics is ideal for visual learners. Their infographics turn complex data into easily digestible insights, covering topics like inflation, interest rates, and consumer behaviour. Their content is great for understanding the broader economic landscape without diving into lengthy reports.

Category: Government & Policy Resources

Policies like CPF play a significant role in long-term financial planning. These accounts help you navigate Singapore’s financial systems with ease.

CPF Board (@cpf_board)

The CPF Board’s Instagram is essential for anyone who wants to make the most of their CPF contributions. Their posts cover everything from retirement planning to housing and healthcare schemes, breaking down complex policies into simple, actionable tips.

If you’ve ever felt confused about your CPF statement or unsure about using CPF for housing, their content will give you the clarity you need.

Can You Trust Finfluencers With Your Financial Decisions?

But with so much advice online, it’s natural to wonder if finfluencers are trustworthy. The Monetary Authority of Singapore (MAS) has taken steps to regulate this space, requiring finfluencers offering financial advice to be licensed under the Financial Advisers Act (FAA).

This ensures that anyone providing specific investment recommendations meets regulatory standards. However, many finfluencers, like us and The Woke Salaryman, focus on financial education rather than direct advice. Their aim is to empower you with knowledge so you can make informed decisions.

The best approach is to use finfluencers as a starting point and validate their advice with trusted resources like CPF Board or Seedly’s blog. And remember to tailor every financial decision to your unique goals and situation.

How Anyone Can Build Wealth Through Investing

Feeling inspired? Start small and keep it simple. Open a savings account, track your spending, and set aside a portion of your income each month for investments. Explore low-risk options like ETFs or REITs to begin growing your money steadily with our beginner investing guide:

Accounts like Seedly, Beansprout, and TradingKey’s are excellent companions on your financial journey, offering practical advice and the motivation to stay consistent. Remember, building wealth is about taking small, steady steps—it’s a marathon, not a sprint.

FAQ:

What is the Meaning of Finfluencer?

A “finfluencer” is a financial influencer who shares money-related advice and insights through social media platforms like Instagram and YouTube.

Who is the Biggest Financial Influencer in Singapore?

While “biggest” is subjective, The Woke Salaryman and is amongst the most followed and impactful financial influencers in Singapore.

By following these top finfluencers Singapore, you’ll gain the tools, knowledge, and inspiration to take charge of your finances in 2024. From managing your personal budget to diving into the world of investing, these accounts will guide you every step of the way. Start following them today and make this the year you achieve your financial goals!

Advertisement