CPF Moves To Make Before 2024 Ends: Enjoy Tax Relief & Grow Your Retirement Savings

●

In the blink of an eye, 2024 is already ending in about two weeks!

Congratulations to all of us for making it through this crazy year.

Since the end of the year is approaching, I began a yearly review of my financial growth to keep track of my progress and identify areas for improvement.

As I didn’t actively keep track of my Central Provident Fund (CPF) accounts, it was heartening to see how it has grown over time.

If you want to get your finances sorted before the year ends, here are some CPF things you can look at!

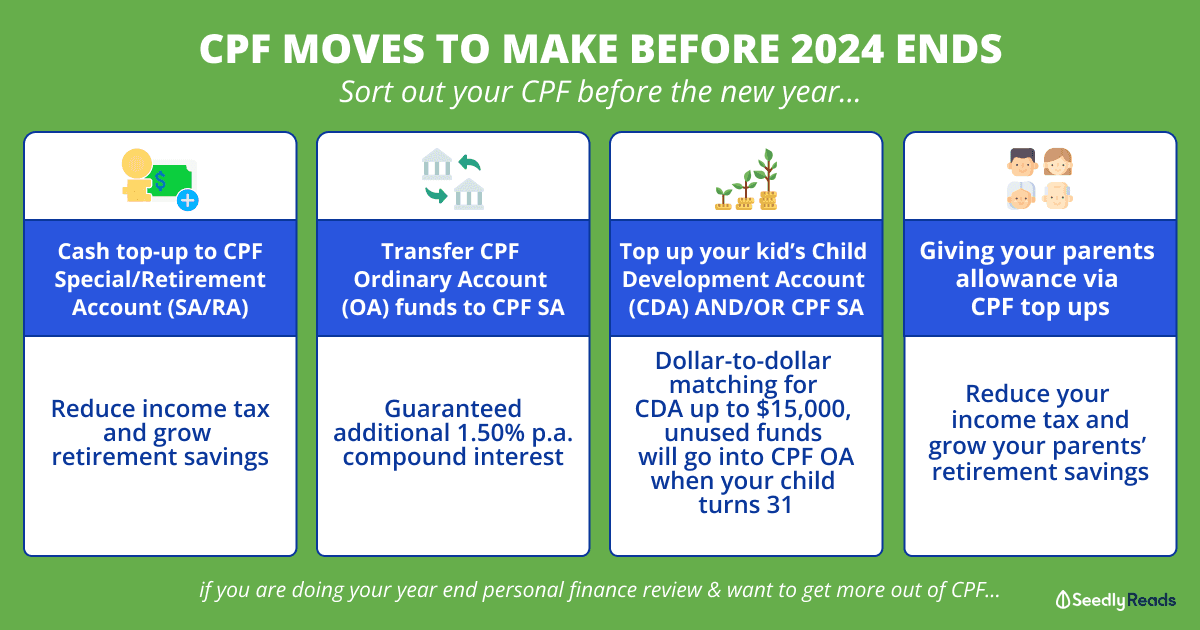

TL;DR: What Can CPF be Used For? CPF Moves to Make Before the Year Ends

| Things To Do | What You Can Get |

|---|---|

| Cash Top-up to CPF Special Account or Retirement Account | Reduce income tax and grow retirement savings |

| Transfer CPF From OA to SA | Guaranteed additional 1.5% compound interest |

| Top up Your Child's CDA & SA | Dollar-to-dollar matching for CDA, unused funds will go into PSEA at 13 and the CPF OA when child turns 31 years old |

| Giving Your Parents Allowance via CPF | Reduce income tax and grow parents' retirement savings |

| Top up SRS Account | Reduce income tax and grow retirement savings |

Click to Teleport

- Cash Top-up to CPF Special Account (SA) or Retirement Account (RA)

- Transfer CPF From OA to SA

- Top-up Your Child’s Child Development Account (CDA) & CPF SA

- Giving Your Parents Allowance via CPF

- Somewhat Related Bonus: Top up Your SRS Account

1. Cash Top-up to CPF Special Account (SA) or Retirement Account (RA)

This is one that I practise yearly – doing cash top-ups to my CPF Special Account (SA):

While this might not be common among my peers, I believe in taking the money I can currently spare and channelling it into my CPF account as part of my retirement fund.

There are different ways you can top up your CPF to grow your CPF savings:

- Voluntary cash contribution to all three accounts (Ordinary, MediSave, and Special Accounts)*

- Voluntary cash contribution to MediSave Account (MA) only

- Transfer of savings to SA or Retirement Account (RA)

- If you are below age 55, you can transfer your OA savings to your SA to earn higher interest

- If you are aged 55 and above, you can set aside more savings for your needs in retirement by transferring your SA or OA savings to your RA

- Cash top-up to SA or RA.

*Do note that according to CPF, ‘the maximum amount you can voluntarily top up is the difference between the CPF Annual Limit of $37,740 and the mandatory CPF contributions made for the calendar year.’

I personally opted for the cash top-up to my CPF SA, but you can top up your CPF RA as well.

Besides being able to reap the benefits of the 4 per cent interest that compounds annually, I can also reduce my taxable income within the respective retirement sums with this top-up:

| Age | Account | Top-Up Limit | Retirement Sums 2024 |

|---|---|---|---|

| Below 55 years old | Special Account | Up to current Full Retirement Sum - Including nett SA savings under CPF Investment Scheme | Full Retirement Sum is currently $205,800 |

| 55 years old and above | Retirement Account | Up to current Enhanced Retirement Sum | Enhanced Retirement Sum is currently $308,700 |

Note that there is an annual income tax relief cap of $8,000 for personal cash top-ups and another $8,000 for cash top-ups to loved ones’ accounts. Do note that:

- If you make cash top-ups to your loved ones, please note that tax relief does not apply to your recipients.

- Your loved ones include parents, parents-in-law, grandparents, grandparents-in-law, spouse and siblings.

- If you are making cash top-ups to a spouse or sibling, you will only be eligible for tax relief if the recipient’s income in the previous year does not exceed $4,000 or if the recipient is handicapped. In this instance, income would include income from bank interest, dividend and pension, investment income/rental income/directorship income. An example of a handicapped person is someone with visual impairment, loss of hearing, loss of limb and dementia.

These caps fall under the annual Personal Income Tax relief cap of $80,000. But, according to the Inland Revenue Authority of Singapore (IRAS), this tax relief cap does not apply to tax deductions for donations.

Also, if you’re wondering about the magic of compounding, here’s a sneak peek:

If you were to top up $8,000 and leave it for 30 years, this $8,000 will eventually become $26,553.

That being said, this process is irreversible, and the cash that you top up can only be retrieved as CPF LIFE’s monthly payouts when we turn 65. So, only put in money that you’re comfortable keeping aside until you are old and grey.

You should also read our guide to topping up CPF before you make this decision:

Latest CPF Rules Changes

Note that this CPF cash top-up limit for tax deductions has changed in 2022. Here are the details of the CPF rule changes:

From 1 Jan 2022, givers will have an increased annual tax relief cap of $8,000 for cash top-ups to their own CPF accounts and another $8,000 for cash top-ups to their loved ones’ accounts.

This cap is shared between the Retirement Sum Topping-up (RSTU) scheme and voluntary contributions to MediSave Account (MA) for employees.

In addition, with the new changes, tax relief for voluntary contributions to the MA will be provided to the giver instead of the recipient.

Changes in Top-up Limit Rules for MediSave Account

The top-up limit currently depends on two figures – the Basic Healthcare Sum and the CPF Annual Limit.

Moving forward, to simplify matters, the top-up limit for employees will only depend on the Basic Healthcare Sum (BHS).

Here is an example of how this works:

Sarah currently has $50,000 in her MediSave account.

The BHS in 2024 is $71,500.

With this new rule, she will instantly know that she can contribute up to $21,500 ($71,500 – $50,000), which is the difference between her current MediSave balance and 2024’s BHS.

Starting from January 1, 2022, there will be no Contribution Limit imposed on voluntary contributions made for CPF MediSave top-ups. Instead, CPF members are now allowed to make voluntary contributions up to the Basic Healthcare Sum, which is $71,500 as of 2024. Furthermore, there is a shared tax relief cap of $8,000 for both MediSave and Retirement Sum Topping Up Scheme top-ups, along with an additional $8,000 tax relief specifically for top-ups made to loved ones.

2. Transfer CPF From OA to SA

This strategy can be adopted if you’d like to look for alternatives to grow your retirement savings.

It is also a risk-free approach if you’d like to grow your retirement nest egg at a slightly faster pace.

While there is no tax deduction for this transfer, this simple transfer guarantees an additional 1.50% at the upcoming rates, which would compound significantly over time.

Here’s how much difference it could make over 30 years, assuming a transfer of $30,000:

| Age | Ordinary Account (2.5%) | Special Account (4.00%) |

|---|---|---|

| 25 | $30,000 | $30,000 |

| 30 | $33,942.25 | $36,499.59 |

| 40 | $43,448.94 | $54,028.31 |

| 50 | $55,618.32 | $79,975.09 |

| 55 | $62,927.03 | $97,301.93 |

This method is also very convenient as individuals do not have to decide what investment product to invest in to grow their savings.

However, this transfer would mean losing the flexibility to spend these funds on investments, education, or approved insurance if kept in the OA.

And if you still have a hefty mortgage you have not paid off, you might want to think carefully about this decision as the transfer is irreversible.

3. Top-up Your Child’s Child Development Account (CDA) & CPF SA

If you’re a parent, you must not miss some of the CPF hacks to give your child a financial headstart.

If you’re wondering what’s the relation between the Child Development Account (CDA) and CPF, this is because any unspent balance in your child’s CDA will be transferred to their Post-Secondary School Account (PSEA) when they turn 13 years old.

And if it remains unspent, it will then be automatically transferred to their CPF Ordinary Account in the middle of the year when they turn 31!

What’s excellent about topping up the CDA account is that the Government will also match the amount you saved in your child’s CDA, dollar-for-dollar.

Here is a quick view of how much will be matched:

| Child Order | Child Develop Account (for approved uses, such as healthcare and preschool fees) | Total CDA Benefits | |

|---|---|---|---|

| CDA First Step (No initial deposit required) | Govt's Dollar-for-Dollar Matching | ||

| 1st child | $5,000 (+$2,000) | Up to $4,000 (+$1,000) | Up to $6,000 |

| 2nd child | $5,000 (+$2,000) | Up to $7,000 (+$1,000) | Up to $9,000 |

| 3rd | $5,000 (+$2,000) | Up to $9,000 | Up to $14,000 |

| 4th child | $5,000 (+$2,000) | Up to $9,000 | Up to $14,000 |

| 5th child onwards | $5,000 (+$2,000) | Up to $15,000 | Up to $20,000 |

As well as other benefits you can get for your children in Singapore:

If you would like to take things a step further and plan for your child’s retirement nest egg using CPF, you can contribute up to the prevailing Full Retirement Sum (FRS) for your child…

You can top up to your, your children or your loved one’s:

- CPF SA only under the Retirement Sum Topping Up Scheme (RSTU) [non-tax deductible].

- CPF MA only (non-tax deductible).

- Three CPF Accounts (non-tax deductible).

If you have the big, hairy, audacious goal of helping your child become a millionaire once they turn 55 years old safely. 🤯

Here’s how much you need to top up to their CPF SA via the Retirement Sum Topping Up Scheme (RTSU) when they are age 0 with the magic of compound interest:

| Your Child's CPF Special Account | |

|---|---|

| Initial Lump Sum Top-Up | $110,866.27 |

| Balance after 25 years | $301,287.79 |

| Balance after 55 years | $1,000,000.07 |

Your child could be a millionaire once they turn 55 years old. 🤯

Note: The amount that your child can receive is the current FRS less net Special Account (SA) balance and net amounts withdrawn from SA for investments that are still active.

4. Giving Your Parents Allowance via CPF

This is something that I’ve heard my friends doing, especially those with parents who are not in urgent need of additional cash for their current lifestyle.

A way to ensure that your parents are well-prepared for retirement would be to top up their CPF accounts.

Through the CPF Retirement Sum Topping-Up Scheme (RSTU), you can top-up your loved ones’ Special Account up to the current Full Retirement Sum for recipients aged 55 and below.

Similar to the top-up to your own SA, you will get to enjoy tax relief of up to $8,000 per year as well.

But do note that:

- If you make cash top-ups to your loved ones, please note that tax relief does not apply to your recipients.

- Your loved ones include parents, parents-in-law, grandparents, grandparents-in-law, spouse and siblings.

- If you are making cash top-ups to a spouse or sibling, you will only be eligible for tax relief if the recipient’s income in the previous year does not exceed $4,000 or if the recipient is handicapped.

Since your parents are not your spouse or siblings, this rule does not apply to them.

This means that if you were to perform top-ups to both your own SA and your parents’ RA, you could get tax relief of up to $16,000 ($8,000 for self, $8,000 for family members).

There is also another additional option for such top-ups from 1 Jan 2021 through the CPF Matched Retirement Savings Scheme (MRSS) — where top-ups can be done for CPF accounts that have yet to meet the Basic Retirement Sum.

The Government will match every dollar of cash top-ups made to eligible members up to an annual cap of $600.

You can read more about it here:

Bonus: Review Your CPF Nominee

The end of the year is a great time to take a moment to reflect on your financial situation and set yourself up for the year ahead.

As part of your financial planning, it’s a good idea to review your CPF nomination and make sure your savings are distributed the way you want. If you’ve already made a nomination, your nominee(s) can claim your CPF savings quickly and easily, with no administration fees taken out.

Somewhat Related Bonus: Top up Your SRS Account

While the Supplementary Retirement Scheme (SRS) is not directly related to the CPF, it is a voluntary scheme introduced by the Government that complements the CPF.

While the CPF is an involuntary savings scheme that would provide us with our basic retirement income, the SRS is in place to help you put aside more funds for retirement.

Besides putting aside money for retirement, you get to enjoy tax relief and pay lesser income tax as well.

You must contribute to your SRS account by 31 December every year to qualify for tax relief.

Besides that, you can also consider investing your SRS funds to grow your money further.

Here’s a quick list of government-approved SRS investment options:

- Bonds

- ETFs

- Fixed Deposits

- Life Cover (including total and permanent disability benefits)

- Real Estate Investment Trusts (REITs)

- Robo-Advisors

- Shares

- Singapore Savings Bonds

- Singa Bonds

- Single-Premium Insurance Products (recurrent single premium products, both annuity and non-annuity plans)

- Unit Trusts or Mutual Funds.

Note that there is a yearly contribution cap of $15,300 for Singaporeans and PRs and $35,700 for foreigners.

If you still do not have an SRS account, you can consider opening your SRS account and top up $1 to “lock in” your retirement age at 63:

Things You Can Do With CPF Before the Year Ends

Many of these CPF moves would require the ‘locking up’ of your money to enjoy the delayed fruits of labour.

This is the epitome of delayed gratification since most of the results can only be seen years later.

As these actions are irreversible, they would work well for funds that you know you would not be touching for the next 30 years or so.

But given the magic of compounding, these CPF moves are definitely worth considering if you are looking to grow your retirement nest egg.

Read More

Advertisement