HDB HFE Application Guide (Step-by-step): Updated For Feb 2024 BTO

Looking to buy an HDB flat?

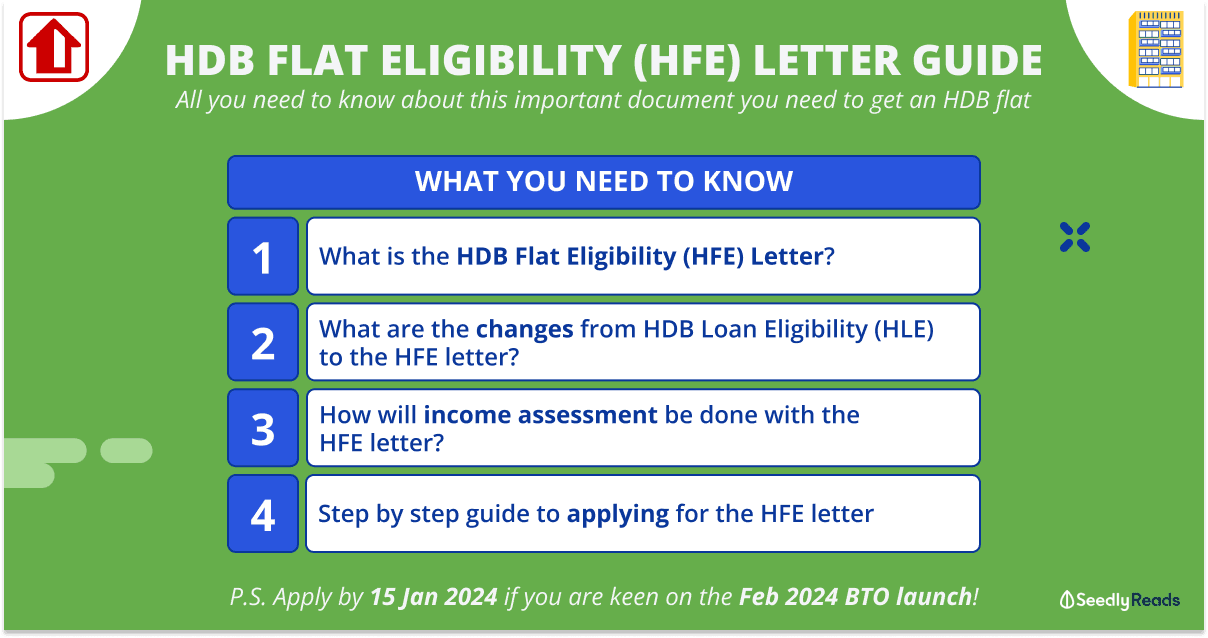

From 9 May 2023, HDB flat buyers will need to obtain an HDB Flat Eligibility (HFE) Letter, which has replaced the old HDB Loan Eligibility (HLE) letter.

xHere’s what the HDB HFE Letter is all about and how to get one!

TL;DR: HDB HFE Letter Application Guide — Here’s How to Get the HDB Flat Eligibility (HFE) Letter

Jump to:

- What Is an HDB Flat Eligibility (HFE) Letter?

- What Are The Changes From HLE to HFE?

- When Do You Need the HDB Flat Eligibility (HFE) Letter?

- How to Apply for the HDB Flat Eligibility (HFE) Letter + HFE Letter Validity

- How Will Housing Grants and Subsidies Be Assessed Compared to HLE?

What Is an HDB Flat Eligibility (HFE) Letter?

The HDB Flat Eligibility (HFE) Letter will inform you of your eligibility to:

- Buy a new and/or resale flat

- Receive CPF housing grants, including the grant amount

- Get an HDB housing loan, including the loan amount

If you are a second-timer, it will also provide information on the resale levy/ premium that you will have to pay if you purchase another subsidised flat from HDB.

Previously, you would have to be assessed by HDB for the eligibility of a flat purchase, CPF housing grants, and HDB housing loans at different stages of your home-buying journey.

But with the new HFE application process, these are all streamlined into one application! HDB will retrieve personal particulars from Myinfo for eligibility assessment.

From 9 May 2023, flat buyers must have a valid HFE letter when they:

- Apply for a flat from HDB during a sales launch or open booking of flats or

- Obtain an Option to Purchase (OTP) from a flat seller, as well as when they submit a resale application to HDB.

HLE to HFE Changes: How Will HDB Income Assessment Be Done Compared to HLE?

Aside from streamlining the process into a single application, there is a standardisation of the income assessment period to 12 months (where income months are available), instead of the most recent three or six months.

These are the new income assessment guidelines for HFE:

| Period of income assessment | 12 months |

| End of assessment period | Two months preceding the month of HFE letter application*^ |

| Income components considered | All components from employment or trade, except bonuses. |

*For example, if a person applies for an HFE letter in May 2023, the assessment period will be from April 2022 to March 2023.

^An individual must work at the point of the HFE letter application for his income to be considered for an HDB housing loan and the Enhanced CPF Housing Grant.

When Do You Need the HDB Flat Eligibility (HFE) Letter?

For new HDB flats, you must obtain an HFE letter before the Build-to-Order (BTO), Sales of Balance Flat (SBF) sales launch, or open booking.

An HFE letter application typically takes about one month to process after all the necessary paperwork has been submitted. However, processing could take longer during busy periods, like a BTO sales launch for example.

HDB BTO Feb 2024 HFE HDB Letter

If you are looking to get a flat in the February 2024 BTO launch:

HDB recommends that you apply for an HFE letter and submit all the required documents by Monday, 15 January 2024:

For resale flats, you must get the HFE letter before getting an Option to Purchase (OTP) from the seller and before submitting the resale application. So apply for the HFE letter and submit all the required documents at least one month before getting an OTP.

Transitionary Arrangement for New Flats

If you’ve applied for a BTO, SBF, or open booking flat before 9 May 2023, you will not need an HFE letter. Instead, HDB will invite you to apply for an HDB Loan Eligibility (HLE) letter ahead of your appointment to book a flat.

For the May 2023 HDB BTO sales exercise onwards, you must obtain a preliminary HFE assessment before applying for a flat. After completing the preliminary assessment, you must apply for the HFE letter within 30 days and submit supporting documents to HDB before booking a flat.

For future sales exercises (i.e. August 2023 sales exercise onwards), you will need a valid HFE letter to apply for a flat:

Transitionary Arrangement for Resale Flats

If you have a valid Intent to Buy (ITB) and a valid HDB Loan Eligibility (HLE) letter for an HDB housing loan, you may proceed to obtain an OTP from the flat seller and submit your resale application without an HFE letter as follows:

How to Apply for the HFE Letter — A HFE Letter Application Guide

There are two steps to applying for the HFE letter, in which both steps must be completed within 30 days of each other.

Step 1: Complete the Preliminary HFE check

Login to the HDB flat portal with your Singpass. The portal will then extract your personal particulars from Myinfo. While it’s nice to have fewer things to fill in, you will still have to do the following:

- Provide the particulars of all flat applicants and occupiers

- Declare any interest in local and/or overseas private property

- Indicate your intention to take up a housing loan

Based on your information, you will receive an instant preliminary assessment of your household’s eligibility for flat purchase, CPF housing grants and HDB housing loan.

Step 2: Apply for an HFE letter

Once you have completed the preliminary HFE check, all applicants and occupiers must fill out the HFE application. You must be logged into the HDB flat portal with your Singpass.

During the application process, you will be presented with a selection of housing loan packages from HDB and participating financial institutions (FIs).

You will have to:

- Confirm your eligibility for an HDB housing loan or

- Apply for an In-Principle Approval (IPA) for a housing loan from FIs.

If you’re unsure which to pick, check out our article on HDB vs bank loans.

You will also need to :

- Upload supporting documents

- Provide the required information before the due date

- Confirm your HFE application details

HDB will then notify you via SMS to view your HFE letter details on the HDB Flat Portal within 21 working days*.

HFE Letter Validity

In a press release on Saturday (4 November 2023), HDB announced that it will extend the validity of all existing and new HFE letters from six months to nine months.

This extension would take effect from Tuesday, 7 November 2023.

As such, the HFE letter will be valid for nine months.

*The processing time is expected to be longer during peak periods, such as in the months nearing a sales launch, and you could receive a confirmed outcome beyond 21 working days. Do apply for an HFE letter early.

Here’s how your HFE letter will look like:

How Will Housing Grants and Subsidies Be Assessed Compared to HLE?

As of 9 May 2023, the housing grants and subsidy criteria remain unchanged after replacing HLE with HFE. You may refer to our guide to HDB grants for more information:

Related Articles

Advertisement