Can’t afford to wait for another four to five years for a Housing and Development Board (HDB) Build to Order (BTO) flat or pay for an HDB Resale flat?

Consider applying for an HDB Sale of Balance (SBF) flat from the Housing and Development Board (HDB).

If you’re lucky, you might even pick up a flat in an HDB BTO estate, which you really wanted but couldn’t get before!

Interested?

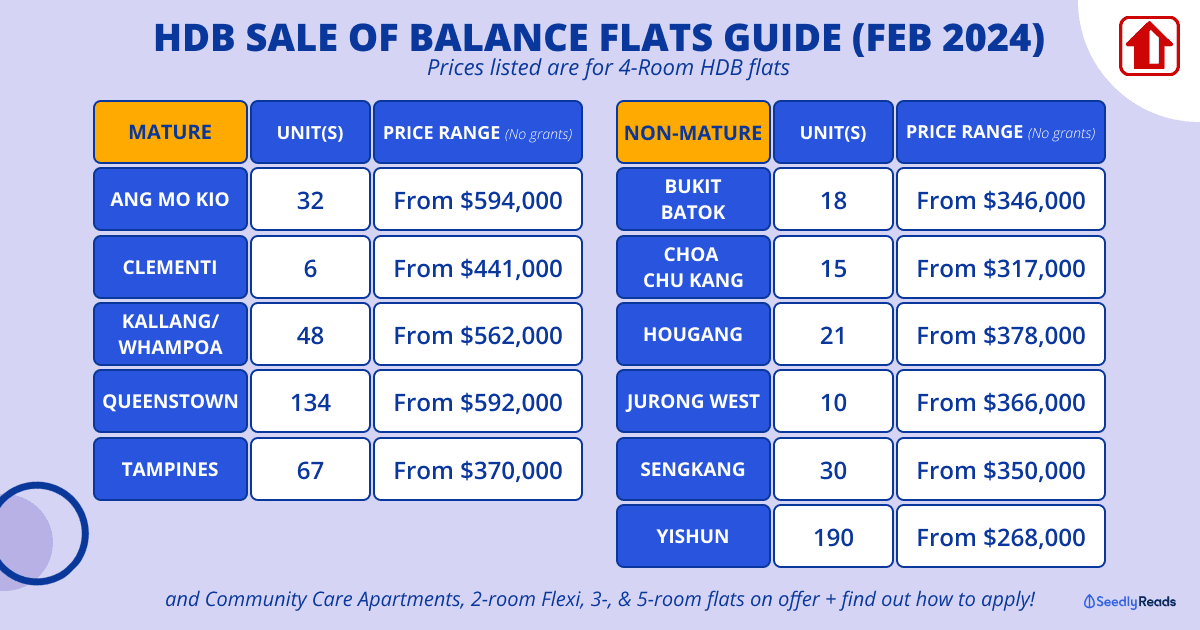

HDB has released a preview of the upcoming February 2024 SBF exercise.

Let’s have a look at what’s available, shall we?

TL;DR: HDB Sale of Balance Flat Feb 2024 Guide

Apply online for your preferred town and flat application category (as listed in the price table) by 28 February 2024, Wednesday, 11:59pm.

Apply online for your preferred town and flat application category (as listed in the price table) by 28 February 2024, Wednesday, 11:59pm.

Jump to:

- HDB SBF February 2024 Flats

- What is a Sale of Balance Flat?

- How to apply for an HDB Sale of Balance Flat?

- FAQs

HDB SBF Flats 2024 Feb: SBF Non-Mature & SBF Mature Flats

According to HDB, there will be about 1,588 2-room Flexi, 3-, 4-, 5-room, 3Gen, and Community Care Apartment (Seniors Only) in various towns/ estates on offer in the upcoming February 2024 SBF launch:

| Town/ Estate | Flat Application Category | Flat Supply | Ethnic Quota | Selling Price (Excluding Grants) | Selling Price (Including Grants)* |

||

|---|---|---|---|---|---|---|---|

| Malay | Chinese | Indian/ Other Races | |||||

| Mature Towns/ Estates: | |||||||

| Ang Mo Kio | 2-room Flexi (short lease) | 20 | 20 | 12 | 16 | From $132,000 | From $52,000 |

| 2-room Flexi (99-year/ balance lease) | From $231,000 | From $151,000 | |||||

| 4-room | 32 | 32 | 22 | 32 | From $594,000 | From $549,000 | |

| 5-room | 19 | 19 | 14 | 18 | From $794,000 | From $764,000 | |

| Clementi | 2-room Flexi (short lease) | 7 | 7 | 7 | 7 | From $97,000 | From $17,000 |

| 2-room Flexi (99-year/ balance lease) | From $169,000 | From $89,000 | |||||

| 3-room | 11 | 11 | 11 | 10 | From $337,000 | From $277,000 | |

| 4-room | 6 | 6 | 6 | 5 | From $441,000 | From $396,000 | |

| 5-room | 3 | 3 | 3 | 3 | From $644,000 | From $614,000 | |

| Kallang/Whampoa | 2-room Flexi (short lease) | 47 | 47 | 33 | 18 | From $134,000 | From $54,000 |

| 2-room Flexi (99-year/ balance lease) | From $234,000 | From $154,000 | |||||

| 3-room | 10 | 10 | 5 | 8 | From $402,000 | From $342,000 | |

| 4-room | 48 | 48 | 38 | 32 | From $562,000 | From $517,000 | |

| Queenstown | 3-room | 41 | 41 | 34 | 18 | From $444,000 | From $384,000 |

| 4-room | 134 | 134 | 74 | 116 | From $592,000 | From $547,000 | |

| Tampines | 2-room Flexi (short lease) | 27 | 20 | 27 | 25 | From $89,000 | From $9,000 |

| 2-room Flexi (99-year/ balance lease) | From $153,000 | From $73,000 | |||||

| 3-room | 7 | 5 | 7 | 6 | From $289,000 | From $229,000 | |

| 4-room | 67 | 59 | 67 | 67 | From $370,000 | From $325,000 | |

| 5-room | 52 | 51 | 52 | 50 | From $551,000 | From $521,000 | |

| Non-Mature Towns/ Estates: | |||||||

| Bukit Batok | Community Care Apartment (CCA) | 51 | 35 | 43 | 21 | From $62,000 | From $4,000 + |

| 2-room Flexi (short lease) | 20 | 17 | 20 | 20 | From $69,000 | From $4,000 + | |

| 2-room Flexi (99-year/ balance lease) | From $118,000 | From $38,000 | |||||

| 3-room (income ceiling $7,000) | 31 | 15 | 31 | 18 | From $249,000 | From $174,000 | |

| 4-room | 18 | 15 | 18 | 17 | From $346,000 | From $286,000 | |

| 5-room | 17 | 17 | 17 | 17 | From $481,000 | From $436,000 | |

| Choa Chu Kang | 2-room Flexi (short lease) | 9 | 9 | 9 | 9 | From $77,000 | From $4,000 + |

| 2-room Flexi (99-year/ balance lease) | From $133,000 | From $53,000 | |||||

| 3-room (income ceiling $7,000) | 6 | 6 | 6 | 6 | From $249,000 | From $174,000 | |

| 4-room | 15 | 15 | 15 | 15 | From $317,000 | From $257,000 | |

| 5-room | 11 | 9 | 11 | 11 | From $486,000 | From $441,000 | |

| Hougang | 2-room Flexi (short lease) | 20 | 20 | 20 | 19 | From $78,000 | From $4,000 + |

| 2-room Flexi (99-year/ balance lease) | From $135,000 | From $55,000 | |||||

| 4-room | 21 | 21 | 20 | 21 | From $378,000 | From $318,000 | |

| 5-room | 11 | 11 | 11 | 11 | From $531,000 | From $486,000 | |

| Jurong West | 2-room Flexi (short lease) | 25 | 25 | 25 | 25 | From $74,000 | From $4,000 + |

| 2-room Flexi (99-year/ balance lease) | From $128,000 | From $48,000 | |||||

| 3-room (income ceiling $7,000) | 5 | 5 | 5 | 5 | From $263,000 | From $188,000 | |

| 4-room | 10 | 10 | 10 | 10 | From $366,000 | From $306,000 | |

| 5-room | 6 | 6 | 6 | 6 | From $542,000 | From $497,000 | |

| Sengkang | 2-room Flexi (short lease) | 58 | 58 | 57 | 58 | From $68,000 | From $4,000 + |

| 2-room Flexi (99-year/ balance lease) | From $118,000 | From $38,000 | |||||

| 3-room (income ceiling $7,000) | 7 | 6 | 7 | 7 | From $237,000 | From $162,000 | |

| 4-room | 30 | 29 | 30 | 29 | From $350,000 | From $290,000 | |

| 5-room | 13 | 13 | 13 | 13 | From $480,000 | From $435,000 | |

| Yishun | 2-room Flexi (short lease) | 290 | 180 | 289 | 123 | From $51,000 | From $3,000 + |

| 2-room Flexi (99-year/ balance lease) | From $88,000 | From $8,000 | |||||

| 3-room (income ceiling $7,000) | 6 | 2 | 6 | 2 | From $215,000 | From $140,000 | |

| 4-room | 190 | 35 | 190 | 66 | From $268,000 | From $208,000 | |

| 5-room | 187 | 86 | 187 | 84 | From $382,000 | From $337,000 | |

| Total | 1,588 | 1,158 | 1,458 | 1,044 | |||

*For illustation purposes, the assumed Enhanced CPF Housing Grant (EHG) amounts are:

(i) CCA/ 2-room Flexi flat: $80,000

(ii) 3-room flat: $75,000 in non-mature towns and $60,000 in mature towns

(iii) 4-room flat: $60,000 in non-mature towns and $45,000 in mature towns

(iv) 5-room flat: $45,000 in non-mature towns and $30,000 in mature towns

The starting prices after grant amounts are illustrative, assuming that the household incomes of eligible first-time buyers of flats in the mature towns are higher. The actual grant amount received will depend on the buyers’ income and eligibility, and the lease coverage of the flat.

Note:

1. Selling prices are rounded up to the nearest thousand dollars. Actual selling price of individual flats will vary based on location and other attributes.

2. Starting prices of short lease 2-room Flexi flats are based on 40-year lease. Buyers can refer to prices of individual flats on short lease in the project pages.

3. Starting prices of CCA are based on 30-year lease. Buyers can refer to prices of individual CCA in the project page.

4. + Buyers need to pay 5% of the published price using their CPF and/or cash savings when their EHG exceeds 95% of the published price.

What Is an SBF? (BTO, SERS and Repurchased HDB Flats)

A Sale of Balance Flat is an HDB flat that is sold under the HDB Sale of Balance Flat exercise.

Sale of Balance flats are usually pooled from:

- Unsold flats from past BTO sale launches

- Leftover replacement flats from Selective En-bloc Redevelopment Scheme (SERS) projects, OR

- Flats repurchased by HDB.

This means these flats are either under construction or have already been completed, so you can expect to move into your new home much quicker!

To make things a little clearer,

Here’s a look at the advantages and disadvantages of applying for a Sale of Balance flat when compared against an HDB BTO flat and an HDB Resale flat:

| Build to Order (BTO) vs Sale of Balance (SBF) vs Resale Flats | HDB BTO Flat | Sale of Balance Flat | HDB Resale Flats |

|---|---|---|---|

| Initial Flat Cost | $ | $$ | $$$ |

| Grants Available | Up to $80,000 | Up to $80,000 | Up to $190,000 |

| Renovation Costs | $ | $ | $$ - $$$ Note: generally higher but depends on age and condition of flat |

| Wait Time | 4 to 5 years | Shorter than BTO because some flats might already be under construction or are ready to move into | As little as 8 weeks |

| Location | Limited to where HDB BTO projects are launched | Limited to wherever Sale of Balance flats are available but locations are usually more than BTO exercises which usually only launch in 3 to 4 areas | Can choose flats from all over Singapore |

| Choice of Flat | Can choose preferred location and flat size (also largely depends on your ballot number) | Lesser choice as compared to BTO because you can only pick from whatever is left | Depends on your preference and what is available on the market |

| Ethnic Quota Restrictions | Generally available for all races | More restricted than BTOs due to quota being almost filled | More restricted than BTOs due to quota being almost filled |

| Potential Growth in Value | Full 99-year lease leaves room for price growth | If it is close to a 99-year lease, leaves room for price growth | Generally less than BTO and SBF due to lesser remaining years of lease |

How to Apply for Sale of Balance Flat on the HDB Sales Portal

Applying for the Sale of a Balance flat is pretty similar to applying for an HDB BTO (Built-To-Order) flat.

1) HDB Sale of Balance Flats 2024 Eligibility Criteria Check

Generally, you’ll need to fulfil the following criteria:

| Application Schemes | You will need to qualify for any one of these current HDB eligibility schemes: 1. Public Scheme 2. Fiance/Fiancee Scheme 3. Orphans Scheme |

| Citizenship Status | 1. One applicant must possess Singaporean citizenship 2. Furthermore, another applicant must be either a Singaporean citizen or a Singapore permanent resident. |

| Age Requirement | Aged 21 years old and above |

| Monthly Household Income Cap | Your monthly household income does not exceed the income ceiling that you want to apply to

1. Family ($14,000) |

| Property Ownership Statis | 1. All applicants and occupants listed in the flat application must not own any other property, whether locally or overseas 2. Within the last 30 months, you should not have sold or disposed of any property 3. Starting from the date of the flat application until after the Minimum Occupation Period (MOP), you and all other applicants or occupants mentioned in the application are not allowed to invest in private residential property 4. You should not have previously purchased a new HDB/Design, Build and Sell Scheme (DBSS) flat or Executive Condominium (EC), nor have received a Central Provident Fund (CPF) Housing Grant 5. Alternatively, if you have previously purchased one of those properties and have received only one CPF Housing Grant, you still meet the requirements. |

Please note that the aforementioned requirements apply solely to individuals applying as part of a family nucleus or with their fiancé/fiancée/spouse.

In the case of first-time single applicants purchasing an HDB SBF flat, the following criteria must be met:

- The applicant must be a Singapore citizen

- If the applicant is unmarried or divorced, they must be at least 35 years old. If the applicant is widowed or an orphan, they must be 21 years old or above.

- The applicant must satisfy the Ethnic Integration Policy (EIP) and Singapore Permanent Resident (SPR) quota specific to the area where the flat is located. This criterion is more likely to impact the choice of a flat location.

- The monthly household income of the applicants should not exceed $7,000.

2) Apply for an HDB Flat Eligibility (HFE) Letter

As of 9 May 2023, you’ll need to produce the new HDB Flat Eligibility (HFE) Letter to apply for a flat from HDB during a sales launch or open booking of flats:

HDB has stated that the preliminary HFE check provides a quick overview of your household’s eligibility to buy a new and/or resale flat, receive CPF housing grants and take up an HDB housing loan. You need to have the particulars of all the applicants and occupiers ready to do the check. As the preliminary HFE check outcome is based on your declaration, you must provide accurate information.

You must also:

- Complete “Step 1: Preliminary HFE check” of the HFE letter application and obtain a preliminary HFE assessment before submitting a new flat application

- Within 30 calendar days of starting Step 1, complete “Step 2: Apply for an HFE letter” and submit the required information to HDB

- Obtain a valid HFE letter before booking the flat.

3) Apply for Your Sale of Balance Flat

For this year’s SBF exercise in February, apply online for your preferred town and flat application category (as listed in the price table) by 28 February 2024, Wednesday, 11:59pm.

FYI: you have one week to mull over your options and decide which project is best since the process is a ballot and NOT on a first-come, first-served basis.

If you’re looking for a specific location, check out the exact locations of available SBFs here.

You can also check on the latest number of applications received to get a sense of which Sale of Balance Flat project you should go for.

Naturally, you’ll have a higher chance of getting an SBF project which has fewer applicants.

You’ll also need to pay a non-refundable admin fee of $10 for your SBF application.

You will know the outcome of the ballot within six weeks after the application closed (i.e. July 2023).

Psst… just like if you’re applying for an HDB BTO flat.

Did you know that you can increase your ballot chances if you apply under certain HDB priority schemes?

4) Apply for a Mortgage Loan

So once you know that you’re going to book a flat, you’ll want to apply for an HDB housing loan or bank loan ASAP.

For first-timer couples who are:

- Full-time students

- National Servicemen

- Recently completed studies or National Service within 12 months prior to flat application.

You may defer the income assessment for CPF housing grants and HDB housing loans until just before key collection.

You’ll need to submit your income documents to HDB for assessment when you receive the notice of Probable Completion Date — which is about 3 months before your flat is complete.

If you’re booking a flat that is already completed (yep, some SBF projects are already done).

Your income for CPF housing grants and HDB housing loans will be assessed when you book your flat.

And if you’re taking a bank loan, you’ll need to get a valid Letter of Offer before signing the Agreement for Lease.

5) Registration and HDB Balance Flat Selection: Get Your Sale of Balance Flat Queue Number

If you’re successful, you’ll be invited to book a flat by HDB sometime in the future.

There are a couple of things that you’ll need to bring along during this appointment:

- Identity cards (if you’re in the SAF, SCDF or SPF, you’ll need to provide a certified true copy of your NRIC from your Personnel Department)

- Passport for non-citizens

- Doctor’s certification of pregnancy or birth certificates of your children (if you apply under the Parenthood Priority Scheme)

- Your birth certificate and your parent’s marriage certificate (if you’re buying the flat under the Multi-Generation Priority Scheme or Married Child Priority Scheme)

- Marriage certificate (if you’re married)

- Divorce certificate (if you’re divorced)

- Death certificate of your spouse (if your spouse is deceased)

- Student Pass or Letter from School or College or Institute of Learning for persons who are >18 years

- Income documents for assessment of income ceiling to buy or take CPF housing grant(s)

If you opt for an HDB loan, you must also submit a valid HFE letter.

When booking your flat, you’ll need to pay an option fee by NETS:

| Flat Type | Option Fee Payable |

|---|---|

| 2-room Flexi Flat | $500 |

| 3-room Flat | $1,000 |

| 4-/5-room/3Gen/Executive Flat | $2,000 |

6) Sign the Agreement of Lease

The next HDB Appointment is when you’ll sign the Agreement for Lease.

You’ll need to bring the original copy of the following:

- Identity cards

- Receipt of booking fee

- Bank passbook and photocopy of the page stating your name and bank account number

- Approval in Principle of loan letter from a bank or financial institution

- Power of Attorney (if unable to attend the appointment personally)

- Latest CPF statements.

You’ll also need to make a downpayment for your flat as follows:

[1] For flat applications received from 16 Dec 2021 to 29 Sep 2022, the LTV limit for HDB housing loan is at 85%, and the downpayment amount during collection of keys is 5% of purchase price.

[2] For flat applications received on or after 30 Sep 2022, the LTV limit for HDB housing loan is at 80%.

as well as any other legal fees and stamp duties (1% to 3% of your flat’s selling price).

If you intend to use your CPF to pay for your flat, you’ll need to set up the 2-Factor Authentication for your SingPass.

FYI: this registration takes up to 10 working days to be activated.

7) Move into Your New Sale of Balance Flat

You’ll need to pay the balance of your flat’s selling price via an HDB housing loan or bank loan.

If you booked a completed Sale of Balance flat and are taking an HDB housing loan, you’ll be invited to sign the Agreement of Lease and collect your keys to your flat at the same time.

To collect your keys, you’ll need the original copy of the following:

- Identity cards

- Certificate of Fire Insurance (different from Home Insurance)

- Power of Attorney (if unable to attend the appointment personally)

- Latest CPF statements

- Completed GIRO form (if you’re paying monthly loan instalments partially or fully by cash).

If you have booked a Sale of Balance flat that is still under construction, you will be invited to collect your keys when your flat is completed.

FYI: HDB will inform you when is the Probable Completion Date and the Estimated Possession Date

FAQs About Sale of Balance Flats

Also, we added this section for commonly asked questions about SBF, which I think will prove helpful.

How Do I Check My HDB Sale of Balance Flats Status?

You will be notified of the ballot results in up to two months’ time after applications close, depending on the sales launch, flat supply, etc. When the ballot results are available, you will receive an email notification to log in to the HDB Flat Portal to check the results.

For flat applications made before February 2024, you can check the application status via My HDBPage.

When Is the Next HDB Sale of Balance Flat Exercise?

According to a statement from HDB, the Sale of Balance Flats exercise will only be held once a year from 2024 in February.

Previously, these launches used to happen twice a year, in May and November, but the November 2023 launch was postponed to 2024.

How Long Is the Process / How Long Do I Have To Wait for Sales of Balance Flat?

If your application is approved, you will be selected through a computer-based lottery system to proceed to the next stage. The announcement of the HDB SBF results typically takes approximately two months.

Once you have successfully reserved your flat, you will be required to sign the Agreement for Lease within a period of nine months. Subsequently, you will receive the keys to your flat closer to its completion date.

In the case of flats that have already been constructed, you have the option to collect the keys and sign the Agreement for Lease within nine months from the date of reserving your flat.

Open Booking HDB: What is Open Booking for Flats?

If you missed the Sale of Balance Flat exercise and need a flat urgently, you can always try the Open Booking of Flat exercise, which happens all year round.

If you’ve missed out on a successful application for a particular BTO project and the Sale of Balance Flats (SBF) exercise, the Open Booking of Flats exercise is an HDB Flat buyer’s final opportunity to get a unit in that elusive BTO project.

After all, the third time’s the charm, right?

You apply for a particular BTO project.

Unfortunately, it was oversubscribed, and you didn’t get it.

A couple of months later, during the SBF exercise.

You realise that there are flats within the same BTO project you wanted, which are up for sale again. You won’t have the whole range to choose from, but you’ve got a pretty good pick.

You apply for the balance flats within the same BTO project.

But sadly… you didn’t get balloted. Or the ethnic quota is maxed out.

After the SBF, HDB rounds up all the remaining flats and pools them together with completed flats that were repossessed or sold back to HDB.

Finally, HDB sells them via the Open Booking of Flats.

Can I Apply For BTO and SBF At The Same Time?

Unfortunately, you can’t.

You can only apply for ONE HDB exercise at any time.

You cannot apply for both a Sale of Balance flat and a Built-to-Order flat at the same time.

Both are based on a ballot, too, so pick whichever one gives you a higher chance and go for it!

Does SBF Have Grants?

Yes!

Just like BTO applications, you may check your eligibility for the Enhanced CPF Housing Grant and Step-Up CPF Housing Grant Guide:

Can Singles Buy Sale of Balance Flats?

Yes, singles can buy an SBF flat.

However, like the BTO scheme, you can only apply for a 2-room Flexi flat in a non-mature estate. The flat allocation set aside for singles is only 5% under the Single Singapore Citizen and Joint Singles Schemes.

If you’re a first-timer getting a BTO flat as a single, you can get up to a $40,000 Enhanced CPF Housing Grant (EHG) [Singles]. But if you are buying with other first-timer single(s), up to two singles may each be eligible for an EHG (Singles) of up to $40,000, i.e., a total of $80,000.

Currently, Singles can only apply for a two-room flexi BTO flat in a non-mature estate. In the resale market, they are also not allowed to purchase a Prime flat.

But on 20 August 2023, Singapore’s Prime Minister Lee Hsien Loong announced at the National Day Rally that housing estates will no longer be classified into Mature and Non-mature estates by HDB.

Instead, from the second half of 2024, the governing body will adopt a new flat classification model – Standard, Plus, and Plus – to differentiate flats in Singapore:

With the change in the housing model from the second half of 2024, singles will be able to:

- Apply for any Standard, Plus and Prime two-room flexi BTO flats in any location

- Buy a 2-room Prime resale flat

- Buy a Standard or Plus resale flat of any size except a 3Gen flat.

Why Is Sale of Balance More Expensive Than BTO?

SBFs are generally more expensive than BTO flats because their prices have been adjusted to reflect market rates due to the shorter waiting time.

Related Articles

Advertisement