If you were to have $1 million dollars to your name right now, would you YOLO it all into risky growth stocks? Or would you put it all into your savings account?

What if that number was changed to $10,000? Would your answer be any different?

What we do with our money largely depends on how much we have, as well as our age and the stage of life that we are in.

And while there are guidelines such as the 50/30/20 rule to help us set aside money to save and invest, it has its limitations; it does not take into account all the various circumstances that an individual could be in.

Or as how one of our Seedly community members, Zhirong, puts it:

“A lot of advice is piecemeal rather than a journey”.

He can’t be more right!

TL;DR – How Much Investment Risk Should You Take as You Grow Older?

Disclaimer: the numbers and figures here are based on assumptions and estimations. Feel free to adjust them accordingly to better reflect your situation. The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any investment products.

Investing Through Life Stages For Singaporeans

As a general guideline, a person’s life stage is a good factor to determine your investment risk appetite.

In turn, your risk appetite affects your asset allocation strategy when constructing your investment portfolio.

We have written a piece breaking down a Singaporean’s life stages by age to provide a general guideline on how much risk to take when investing.

| Age Range | Goals | Return Expectations | Risk Appetite | Liquidity |

|---|---|---|---|---|

| 20-30 Years Old | Education, Marriage, Holiday | High | High | Low |

| 30-40 Years Old | Children, Education, Insurance | Moderately High | Moderately High | Moderately Low |

| 40-50 Years Old | Children's Marriage, Retirement | Balanced | Balanced | Balanced |

| 50-60 Years Old | Retirement | Moderately Low | Moderately Low | Moderately High |

| More than 60 Years Old | Holidays, Estate Planning | Low | Low | High |

From there, a recommended rule of thumb to stick to will be:

(110 – Your Age) = % of your investment portfolio that should be in Equity/Stocks

The remaining part of your investment portfolio should be allocated to fixed-income instruments like bonds.

Read more

- The Ultimate Guide to SSB (Singapore Savings Bond)

- The Ultimate Guide to SGS (Singapore Government Securities) Bonds

Investment Strategy And Portfolio Asset Allocation At Various Life Stages

Here are our recommended investment strategies based on your life stage.

Age Range Situation/ Life Stage Investor Profile Investment Strategy Asset Allocation Percentage Example

20 - 30 Fresh graduate or those who have worked for a few years Willing to assume a relatively higher level of risk to achieve long-term capital growth High growth

(Aggressive)25% fixed income

75%

equity/stocks

31 - 40 Planning to get married or buy a new home Willing to assume an above average level of risk to achieve higher returns Growth 35% fixed income

65% equity/stocks

41 - 50 Planning to have children Willing to assume a medium level of risk to achieve stable returns Balanced 45% fixed income

55% equity/stocks

51 - 60 Children grown up and working Willing to assume a relatively low level of risk to achieve stable capital appreciation Conservative 70% fixed income

30% equity/stocks

61 and above Approaching retirement Willing to assume the lowest level of risk with primary focus on capital preservation. Defensive 80% fixed income

20% equity/stocks

Source: Allianz Global Investors

Source: Allianz Global Investors

Although these guidelines mentioned are good for most people, they do not take into account one important factor that can immediately change one’s risk appetite:

The amount of savings you have.

Your Amount Of Savings Determines Your Life Stage When Investing

Think of it this way, achieving common life goals like buying a house, raising children or retiring comfortably relies on our savings.

- We try to clear our loans as fast as possible so that we can start saving.

- The occupation and salary an individual is getting affect how much he/she can save every month.

So what if someone were to be at a certain life stage, but the amount of his/her savings has yet to catch up?

Age And The Amount Of Savings Are Not Correlated

One could be 40 but have almost zero savings due to high expenditures or low income. On the other hand, a 20-year-old genius entrepreneur could already have $1 million in his bank from selling a startup.

That said, the common assumption will be that younger Singaporeans will have lower savings compared to older Singaporeans.

We all know that there will always be outliers.

The Amount Of Savings Matters!

When it comes to risk appetite, the amount of savings affects the amount of risk you can take.

Having $100,000 worth of savings at the age of 20 compared to someone at age 50 will affect the person’s risk appetite more than their age.

It Is All About The Savings Amount

Your life stage affects the liquidity required, but reaching your savings targets earlier can help you with your investment strategy.

The general 50/30/20 budgeting guideline is not as useful when you are more advanced in your personal finance journey.

Here are the assumptions we made with this illustration:

- We are assuming you are looking to retire at age 62 in Singapore, you will need $300,960 in savings. We set it as $400,000 in savings to keep things simple.

- We are assuming your goal is to reach your retirement amount as soon as possible barring any catastrophic events.

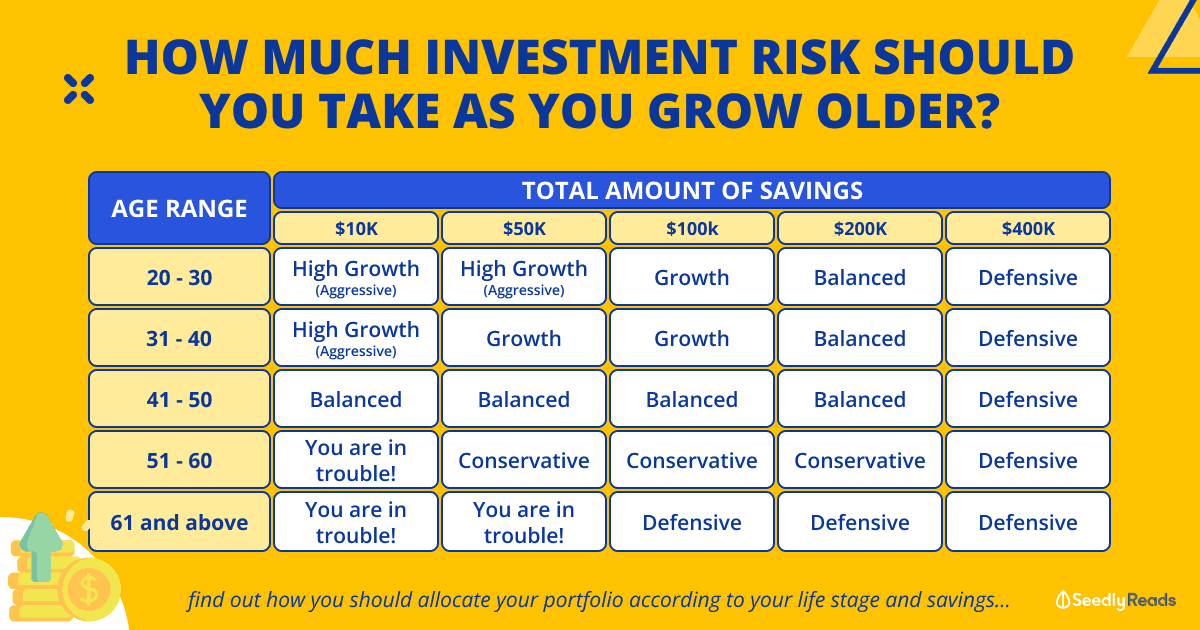

| Age Range | $10,000 in savings | $50,000 in savings | $100,000 in savings | $200,000 in savings | $400,000 in savings |

|---|---|---|---|---|---|

| 20 - 30 | High growth (Aggressive) | High growth (Aggressive) | Growth | Balanced | Defensive |

| 31 - 40 | High growth (Aggressive) | Growth | Growth | Balanced | Defensive |

| 41 - 50 | Balanced | Balanced | Balanced | Balanced | Defensive |

| 51 - 60 | Jialat... | Conservative | Conservative | Conservative | Defensive |

| 61 and above | Jialat... | Defensive | Defensive | Defensive | |

Let’s break it down:

Age 20 to 30

Possible financial goals:

- Marriage and weddings (~$7k to $60k)

- Applying for BTO (Downpayment: ~$30k to $50k for a 3- or 4-room flat)

During this period, most Singaporeans are faced with building their savings to “BTO” with their partner or saving up money if they are single. As you are still young, you can afford to take a much higher risk with your savings as you still can earn back money given a longer time horizon.

Age 31 to 40

Possible financial goals:

- Applying for BTO/mortgage payments

- Starting a family

- Raising kids (~$300k in total)

- Planning for retirement

As we enter our 30s, many of us would be married or even raising a child. This means that we have to dial back on our risk appetite as we need financial stability for our family. At this life stage, planning for retirement and building up our assets are also becoming more important.

Age 41 to 50

Possible financial goals:

- Raising kids

- Paying for children’s education (~$70,000)

- Saving for retirement

In our 40s, many parents would need to begin saving for their children’s education while saving up for retirement.

Age 50 and above

Possible financial goals:

- Paying for children’s education

- Retirement (~$400k)

As we approach retirement, whatever savings that you have left become more important as your earning power will probably diminish. Any unnecessary risk should be avoided.

Asset Allocation

As such, here’s a reminder about how to determine your asset allocation strategy and construct your investment portfolio.

| Investment Strategy | Portfolio Mix |

|---|---|

| High growth (Aggressive) | 25% fixed income 75% equity/stocks |

| Growth | 35% fixed income 65% equity/stocks |

| Balanced | 45% fixed income 55% equity/stocks |

| Conservative | 70% fixed income 30% equity/stocks |

| Defensive | 80% fixed income 20% equity/stocks |

Want More In-Depth Analysis And Discussions?

Check out the Seedly community and participate in the lively discussion surrounding investing:

Advertisement