Planning To Donate & Support A Good Cause? Here Are Some Charities Eligible For Tax Deductions!

16 Feb 2021 Update: 250% Tax Deduction to Remain

At the Budget 2021 Speech, Deputy Prime Minister Heng Swee Keat announced that the 250 per cent tax deduction campaign for qualifying donations made to Institutions of a Public Character (IPCs) will be extended for another two years until 31 December 2023.

At the risk of sounding old, does anyone remember bugging your parents to you some loose change, or even notes during Flag Day to ‘dong’ in the can?

Although most of us would not have fully understood the concept of donating then, but hey, at least we got stickers!

Now that most of us are older and earning our own money, we can actually take out money from our own pockets to help others in need.

Even though that’s not the main point of donating, the Singapore Government actually provides tax deductions for qualifying donations.

To encourage Singaporeans to give back to our community, the 250 per cent tax deduction for qualifying donations will be valid till 31 December 2023.

In other words, for every $1 donated to a registered charity before the year ends, $2.50 will be deducted from your taxable income for the next tax season.

Donations can come in the form of cash, gifts, shares and even artefacts!

But for this article, we are mainly focusing on cash donations. There are different types of donations available with differing levels of tax deductibility.

Here is all you need to know!

Information accurate as of 09 December 2021.

TL;DR – Donate To A Good Cause & Lower Your Assessable Income

For tax-paying individuals in Singapore, every $1 in cash you donate to an approved Institution of a Public Character (IPC) or Singapore Government to causes that benefit the local community will lower your assessable income by $2.50!

But which organisations are IPCs?

To find out, all you have to do is to look them up on the Charity Portal, and you’ll be able to check their IPC status!

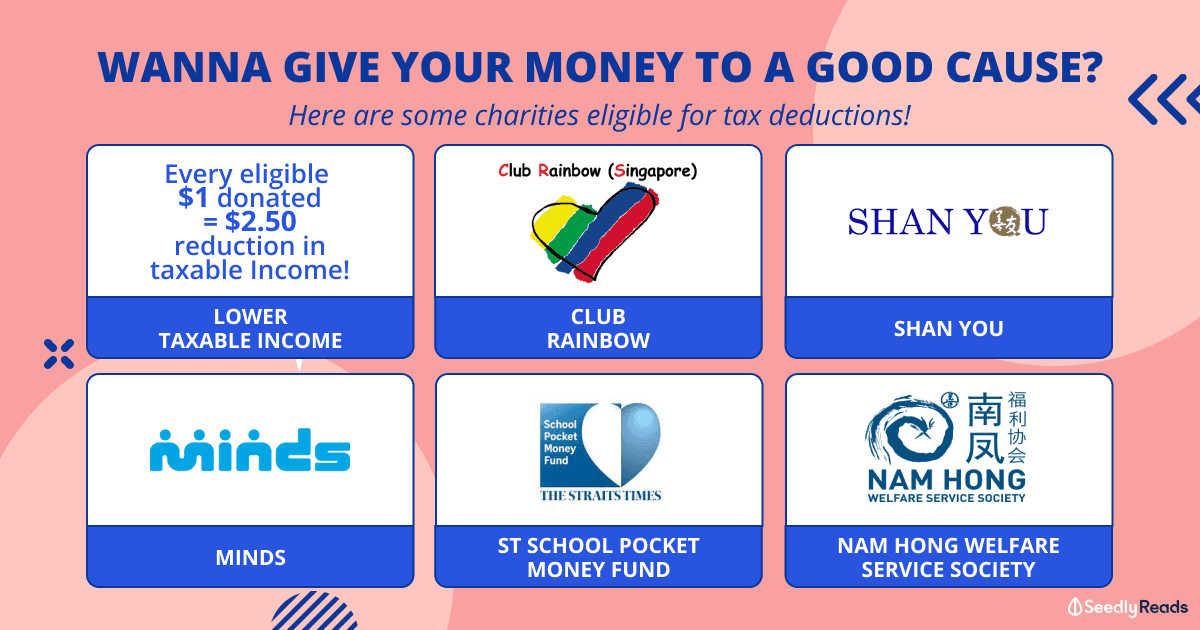

Here are some of the charities eligible for tax-deductible donations that our community members from Seedly have shared:

- Club Rainbow

- Hospice Care Association (HCA) Singapore

- Movement for the Intellectually Disabled of Singapore (MINDS)

- Nam Hong Welfare Service Society.

- Shan You

- Singapore Cancer Society

- The Straits Times School Pocket Money Fund

Tax Deductions on Cash Donations to Charity in Singapore

For every $1 donated, $2.50 will be deducted from your assessable income.

In other words, you will get to enjoy tax deductions of 2.5 times or 250 per cent of the qualifying donation amount next tax season.

Donations receipts are no longer required for tax deductions on your donations, but you should still take note of it to track your expenses.

When making your donations to the respective charities, you’ll be required to provide your personal information, such as your name and NRIC, for the purpose of tax deduction.

From 01 January 2011, all individuals and businesses must provide their identification number (e.g. NRIC/FIN/UEN) when making donations to the IPCs to be given tax deductions on the donations.

Qualifying donations will be automatically included in your tax assessment, so no need to remind yourself to declare your donations in your income tax return!

Remember, if you’re planning to donate and receive some tax deductions, don’t leave it till the last minute!

We all need some time to process information, and these charities are no exception; plan and donate in advance if you want your donation to qualify for tax deductions.

Again, donations shouldn’t be conditional, but be mindful of fundraising roadshows. Unfortunately, it’s not always that 100 per cent of your donations will go to the beneficiary charity organisation.

For your cash donations to be qualified for tax deductions, it has to be made to:

- An approved IPC or

- The Singapore Government for causes that benefit the local community (e.g. The Community Chest).

Note that only outright cash donations are fully tax-deductible if the donor does not receive any material benefit.

If the donor receives a benefit in return for the donation made, the tax deduction is granted only on the difference between the donation and the value of the benefit.

But as a concession, IRAS has mandated that:

donations made to IPCs on or after 1 May 2006 will be deemed as pure donations although there is the benefit given in return for the donation.

To qualify for the concessionary tax treatment, donations with benefits given in return will be treated as pure donations if the benefits are treated as having no commercial value.

That’s not all.

At the start of this year, IRAS reviewed and updated the concessionary tax treatment after consultation with IPCs.

From 19 March 2021, a benefit will be deemed as having no commercial value by IRAS if the benefit is given out in connection with a fundraising activity and fall within the list of benefits stated in paragraph 6.4 of IRAS’s latest e-Tax Guide:

| Types of Benefits | Whether Benefit is Considered to have a Commercial Value | Income Tax Treatment | GST Treatment |

|---|---|---|---|

| Charity gala dinner (including incidental benefits*) | No | Tax deduction on the full amount donated is allowed to the donor. | No GST needs to be accounted by the recipient of donation. |

| Charity show (including incidental benefits*) | No | Tax deduction on the full amount donated is allowed to the donor. | No GST needs to be accounted by the recipient of donation. |

| Golf tournament (including incidental benefits*) | No | Tax deduction on the full amount donated is allowed to the donor. | No GST needs to be accounted by the recipient of donation. |

| Not-intended-for resale^ complimentary tickets (e.g., Singapore Zoo, movies, seminars, performances, exhibitions) | No | Tax deduction on the full amount donated is allowed to the donor. | No GST needs to be accounted by the recipient of donation. |

| Souvenir or gift (e.g. plaques, commemorative books) | No, except where such souvenir or gift is sold commercially. The souvenir or gift will not be considered as sold commercially if it: (a) is specially made for a particular fund raising event and not available for sale in the market; (b) bears the logo of the recipient of the donation or; (c) carries the fundraising message. | Tax deduction on the full amount donated is allowed to the donor. Where the souvenirs or gifts are commercially available, tax deduction on the difference between the amount donated and the price of the souvenir or gift is allowed to the donor. | No GST needs to be accounted by the recipient of donation. Where the souvenirs or gifts are commercially available, GST is to be accounted by the recipient of donation on the price of the souvenir or gift. |

Source: IRAS

Incidental benefits refer to benefits that are:

- Given as part and parcel of a fundraising event; and

- Are not intended for resale.^

^Not-intended-for-resale refers to items that fulfil any of the following conditions:

- There is an indication on the item that it is “not-for-sale”

- The item is not in a form or packaging that is typically sold commercially.

IRAS clarified that:

Examples of incidental benefits include a goodie bag, refreshments, meals, lucky draw, carpark coupon, live entertainment, acknowledgements, etc. Where a lucky draw is held as part of a larger fundraising event specified in paragraph 6.4, the value of the top prize has to be at or below $2,000 in order to be eligible for the administrative concession.

Charities Suggested by Our Community

The list of foundations available for us to donate to is endless; it would be great to focus on the causes you believe in and wish to support.

We’ve compiled some of the tax-deductible charities that our community suggested if you need some inspiration!

Club Rainbow

- Name of Organisation: Club Rainbow (Singapore)

- UEN No.: S92SS0137H

- Charity Status: Registered with IPC

- Date of Charity Registration: 22 December 1992

- IPC Status: Live

- IPC Period: From 29 September 2020 to 28 September 2023

- Address: 538 Upper Cross Street, #05-263, Singapore 050538

- Website: http://www.clubrainbow.org

- Primary sector: Health

- Cause: Children with chronic illnesses.

Club Rainbow supports children with major chronic illnesses (even life-threatening ones) and their families by providing relevant services to give them a better quality of life and hope for a better future.

They conduct numerous events and programmes for their beneficiaries – to provide for psychosocial, financial, educational, informational, and social support.

How to Donate to Club Rainbow

You can make a donation via:

- Credit/Debit Cards

- Giro

- Cheque

- Internet Banking

- Giving.sg

- GIVE.asia.

Here’s the link to find out more!

Hospice Care Association (HCA) Singapore

- Name of Organisation: HCA Hospice Care

- UEN No.: S89SS0106G

- Charity Status: Registered with IPC

- Date of Charity Registration: 27 March 1991

- IPC Status: Live

- IPC Period: From 01 October 2019 To 30 September 2022

- Address: 705 Serangoon Road, #03-01, Kwong Wai Shiu Hospital, Singapore 328127

- Website: http://www.hca.org.sg

- Primary sector: Health

- Cause: Hospice care.

HCA is one of the many hospices in Singapore that provides comfort and support to patients with life-limiting illnesses regardless of age, religion, ethnicity, nationality and financial status.

HCA’s main service, home hospice care, is provided at no charge to about 3,700 patients every year.

How to Donate to Hospice Care Association (HCA) Singapore

You can make a donation via:

Here’s the link to find out more!

Movement for the Intellectually Disabled of Singapore (MINDS)

- Name of Organisation: Movement for the Intellectually Disabled of Singapore (MINDS)

- UEN No.: S62SS0075C

- Charity Status: Registered

- Date of Charity Registration: 16 April 1984

- IPC Status: Live

- IPC Period: From 01 October 2019 To 31 March 2022

- Address: 800 Margaret Drive, Singapore 149310

- Website: http://www.minds.org.sg

- Primary sector: Social and Welfare

- Cause: Persons with Intellectual Disability.

One of the oldest and largest organisations catering to the needs of persons with intellectual disability (PWIDs) in Singapore, MINDS aims to help provide equal opportunities to PWIDs to receive education to better integrate into society as contributing and responsible citizens.

How to Donate to Movement for the Intellectually Disabled of Singapore (MINDS)

You can make a donation via:

Here is the link to find out more!

Nam Hong Welfare Service Society

- Name of Organisation: Nam Hong Welfare Service Society

- UEN No.: T07SS0086D

- Charity Status: Registered with IPC

- Date of Charity Registration: 5 February 2009

- IPC Status: Live

- IPC Period: 8 Jan 2020 to 7 Jan 2022

- Address: 11 Yishun Ring Road, #01-375, Singapore 760111

- Website: http://www.namhongwelfare.org.sg/

- Primary sector: Healthcare

- Cause: Elderly and the Disadvantaged.

Despite being a small organisation, Nam Hong Welfare Service Society provides an extensive array of services like:

- Free Traditional Chinese Medical treatment

- Caring-Heart service for the elderly

- Free funeral services for the destitute

- Distribution of ration/bursary for disadvantaged students

- Health forums and voluntary consultation etc.

How to Donate to The Nam Hong Welfare Service Society

Here is the link to find out more!

Shan You

- Name of Organisation: Shan You

- UEN No.: S95SS0103B

- Charity Status: Registered with IPC

Date of Charity Registration: 28 December 1995 - IPC Status: Live

- IPC Period: From 2 December 2021 to 01 December 2023

- Address: 5 Upper Boon Keng Road, #02-15, Singapore 380005

- Website: https://www.shanyou.org.sg

- Primary sector: Social and family development

- Cause: Mental health.

Here’s Shan You in their own words:

Shan You is a social service agency founded in 1995 to provide mental health and social care services to the community.

A registered charity with the status of Institutions of a Public Character (IPC), Shan You is also a full member of the National Council of Social Service (NCSS).

Through their services, which are available to all in the community, regardless of race, religion, and ability to pay, Shan You seeks to improve people’s mental and social well-being from all walks of life.

Today, Shan You operates two centres: Shan You Counselling Centre in Kallang and Shan You Wellness Community in Eunos.

How to Donate to Shan You

You can make a donation via:

- Credit/Debit Cards

- Cheque

- PayNow

- Giving.sg.

- GIVE.asia.

Here is the link to find out more!

Singapore Cancer Society (SCS)

- Name of Organisation: Singapore Cancer Society

- UEN No.: S65SS0033F

- Charity Status: Registered with IPC

Date of Charity Registration: 8 May 1984 - IPC Status: Live

- IPC Period: From 31 March 2020 To 30 March 2022

- Address: 48 Pandan Road, L4M, Singapore 609289

- Website: http://www.singaporecancersociety.org.sg

- Primary sector: Health

- Cause: Fighting cancer

The Singapore Cancer Society (SCS) has a bold but straightforward mission: to minimise cancer and maximise lives.

SCS is dedicated to minimising the impact of cancer through education, screening, patient services, financial assistance for cancer treatment, research and advocacy.

SCS is a community-based voluntary welfare organisation dependent on public donations to provide quality services to cancer patients and their families.

For starters, SCS has an extensive write up on their website on cancer, even debunking the common myths that we usually hear!

Here’s how to donate to them.

How to Donate to Singapore Cancer Society (SCS)

You can make a donation via:

Here’s the link to find out more!

The Straits Times School Pocket Money Fund

- Name of Organisation: The Straits Times School Pocket Money Fund

- UEN No.: T11CC0007D

- Charity Status: Registered with IPC

- Date of Charity Registration: 14 November 2011

- IPC Status: Live

- IPC Period: From 1 February 2020 To 31 March 2022

- Address: News Centre, 1000 Toa Payoh North, Singapore 318994

- Website: http://www.spmf.org.sg

- Primary sector: Education

- Cause: Students from less fortunate backgrounds.

As the name goes, The Straits Times School Pocket Money Fund provides pocket money to students through their school, and since its inception in 2000, The Fund has helped over 160,000 cases of students in providing them school pocket money.

Students can use this pocket money for school-related expenses like buying food during recess, paying for transport or school supplies.

How to Donate to The Straits Times School Pocket Money Fund

You can make a donation via:

Here is the link to find out more!

Organisations & Platforms That Help You Donate To A Cause You Believe In:

- Giving.sg

- GIVE.asia.

Giving.sg

Giving.sg shouldn’t come as a surprise to you anymore since it’s one of the donation methods mentioned above.

Launched by the National Volunteer & Philanthropy Centre (NVPC) in 2015, Giving.sg is backed by the Ministry of Culture, Community & Youth.

If you are familiar with how other crowdfunding sites works like GoFundMe, looking at Giving.sg would be a no-brainer as you can browse through the different campaigns and causes to donate to.

Pro-tip: Not every organisation raising funds at Giving.sg is an IPC.

Do remember to use their filters and check ‘Tax Deductible’ for campaigns that have tax deductions. Alternatively, you may search if an organisation is an IPC here.

As individual donors, you will not have to pay any fees to donate, but Giving.sg charges the charities a nominal total fee of 3%* of the donation amount, plus prevailing GST.

This fee will cover bank charges, maintenance costs, and help Giving.sg improve the site features and improve the user experience on its website.

But as part of Giving. sg’s continued effort to support charities, the organisation will not be charging charities any transaction fees from 1 April 2021 to 31 March 2022.

GIVE.asia

Apart from donations to registered charities, GIVE.asia provides the platform for individuals to contribute to personal fundraisers for those in need.

Pro-tip: Similarly, you look out for charities with this “TAX DEDUCTIBLE” label or search the organisation on the Charity Portal.

While the charities do not have to pay any platform or service fees, GIVE.asia charged a standard processing fee of just 1.5 per cent payable to the registered charities.

This is a charge incurred from the banks that GIVE.asia uses and is amongst the lowest in Asia for charity portals.

Donors can also choose to give a tip on top of their donation to maintain the GIVE.asia platform.

Advertisement