The Singapore Budget 2024 has just been announced! Here’s all you, the average Singaporean, need to know in 3 minutes!

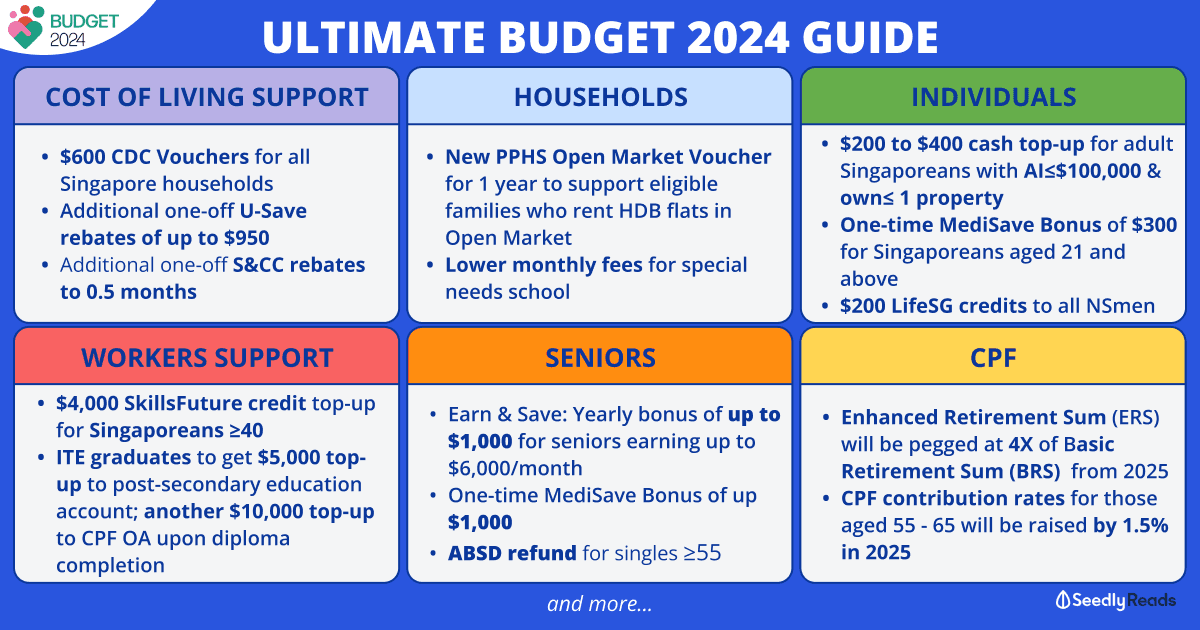

TL;DR: Singapore Budget 2024 Key Highlights

In This Article

- For Individuals

- Cost-of-Living Special Payment

- Personal Income Tax Rebates

- Medisave Bonus

- LifeSG Credits Top-Up

- For Households

- Additional CDC Vouchers and Utility Rebates

- Support for Lower-Income Families

- Housing support for those with urgent housing needs

- Lower Preschool and Special Needs School Fees

- For Seniors

- Central Provident Fund (CPF) Changes

- Majulah Package

- Additional Buyer Stamp Duty Changes For Seniors Looking to Right Size

- $3.5 billion support under Age Well SG

- For Workers

- SkillsFuture Level-Up Programme

- Subsidised Courses and Training Allowance

- Financial Support Scheme For Retrenched Workers

- More Support for ITE Students via the ITE Progression Award

- Uplifting Lower-Wage Workers

Budget 2024 For Individuals

Cost-of-Living Special Payment

There will be a Cost-of-Living Special Payment of between $200 and $400 in cash for adult Singaporeans with an Assessable Income of up to $100,000 and who own no more than one property.

Personal Income Tax Rebates

For Assessment Year 2024, there will be a personal income tax rebate of 50 per cent, capped at $200.

With effect from Assessment Year 2025, there will be an increase in annual income threshold of spouse/siblings for tax relief from cash top-ups from $4,000 to $8,000.

The income threshold to qualify for tax relief for cash top-ups made to spouse/siblings will be increased from $4,000 to $8,000 in Year of Assessment (YA) 2025 for top-ups made from 1 January 2024

In other words, the annual income of a dependant or caregiver cannot exceed $8,000 or less in the preceding year if a tax-resident individual wishes to claim spouse relief, parent relief, qualifying child relief, working mother’s child relief, relief for topping up the Central Provident Fund (CPF) account of a spouse or siblings, or grandparent caregiver relief.

Medisave Bonus

All adult Singaporeans aged 21 to 50 will receive a one-time Medisave bonus of up to $300.

LifeSG Credits Top-Up

All past and present national servicemen will get $200 in LifeSG credits.

Budget 2024 For Households

Additional CDC Vouchers and Utility Rebates

In response to rising living costs, the government has announced an additional $600 in CDC Vouchers for all Singaporean households, with $300 disbursed at the end of June 2024 and $300 in January 2025.

For households living in HDB flats, there will be an additional one-off U-Save rebate for eligible HDB households. They can expect to receive two-and-a-half times the amount of regular U-Save rebates or up to $950 in FY2024.

Moreover, eligible households will receive an additional one-off Service and Conservancy Charges (S&CC) rebate. Together with the regular S&CC rebates, this will amount to four months of rebates.

Support for Lower-Income Families

Housing support for those with urgent housing needs

Lower Preschool and Special Needs School Fees

Before childcare subsidies, fees will be capped at $650 for anchor operators and $680 for partner operators.

There will be further reductions in 2026, with details to be announced.

As for families of persons with special needs or disabilities, the maximum monthly fee at special education schools will be reduced to $90, from $150.

Budget 2024 For Seniors

Central Provident Fund (CPF) Changes

In a surprising move, CPF members aged at least 55 will no longer have a Special Account (SA) from 2025. This means that CPF shielding will no longer be viable. The CPF SA funds will be channelled to the Retirement Account (RA) to fulfil the Full Retirement Sum (FRS). Any remaining funds in the CPF SA will be moved to the CPF Ordinary Account (OA).

From 2025,

- individuals aged 55 to 65 will see an additional 1.5% increase in their CPF contribution rates

- the CPF Enhanced Retirement Sum (ERS) will be raised to quadruple the Basic Retirement Sum (BRS), setting the ERS at $426,000.

Majulah Package

An Earn and Save Bonus will be available for eligible seniors earning up to $6,000 a month. They will get a yearly bonus of up to $1,000 for as long as they work, with more going to those who earn less.

There will also be a Retirement Savings Bonus for eligible seniors with retirement savings below the Basic Retirement Sum. They will get a one-time bonus of between $1,000 and $1,500.

Both bonuses will be for seniors who live in a property with an annual value of $25,000 or less and own no more than one property.

Lastly, there will be a one-time MediSave Bonus: Eligible seniors will get either $750 or $1,500.

Additional Buyer Stamp Duty Changes For Seniors Looking to Right Size

Single Singaporeans aged 55 and above can now enjoy an ABSD refund on their replacement private property under a concession. These seniors can claim a refund of ABSD paid on their replacement private property if they sell their first property within six months after buying a lower-value replacement private property.

$3.5 billion support under Age Well SG

The government will set aside $3.5 billion under Age Well SG to support active ageing. There will be more Active Ageing Centres, a wider range of programmes, more assisted living options such as Community Care Apartments, more senior-friendly amenities in neighbourhoods, more sheltered linkways, pedestrian-friendly roads, and bus stops with senior-friendly features.

Budget 2024 For Workers

SkillsFuture Level-Up Programme

There will be a new SkillsFuture level-up programme. All Singaporeans aged 40 and above will get an additional $4,000 from May 2024.

Subsidised Courses and Training Allowance

There will be subsidies for all Singaporeans aged 40 and above to pursue another subsidised full-time diploma at polytechnics, ITE, and Arts Institutions from Academic Year 2025.

Additionally, there will be a training allowance for Singaporeans aged 40 and above who enrol in select full-time courses. It will equal 50 per cent of your average income over the latest 12-month period, capped at S$3,000 per month. Everyone can receive up to 24 months of such training allowance throughout their lifetime.

Financial Support Scheme For Retrenched Workers

The government will introduce a temporary financial support scheme for those involuntarily unemployed while they undergo training or look for jobs that are a better fit. More details will be released soon.

More Support for ITE Students via the ITE Progression Award

There will be a $5,000 top-up to the post-secondary education accounts for Singaporean ITE graduates aged 30 and below.

Upon diploma completion, there will be a $10,000 top-up to their Ordinary Account.

Uplifting Lower-Wage Workers

Related Articles:

- Budget 2022: Middle Income Concerns and Other Issues Addressed

- More Baby Bonus & Paternity Leaves: Did Budget 2023 Address Young Parents’ Concerns?

- Government Payout: How Much Do I Get From the Government (GSTV & AP) in 2023 and Beyond?

- Benefits For New Parents (2023 & Beyond): Baby Bonus, CDA Grants, 4 Weeks Paternity Leave & More

Advertisement