URA Private Property Singapore Prices (Q2 2022) & Guide to Private Property in Singapore

●

According to the latest data from SingStat, 78.3 per cent of all households in Singapore lived in Housing and Development Board (HDB) flats, i.e. public housing, in 2021.

A small percentage also live in uncommon housing types, such as non-HDB shophouses.

Whereas 16.5 per cent of households in Singapore stay in Condominiums and Other Apartments while 4.9 per cent stay in Landed Properties.

If you want to join the 21.4 per cent living in private properties in Singapore.

Here’s what you need to consider!

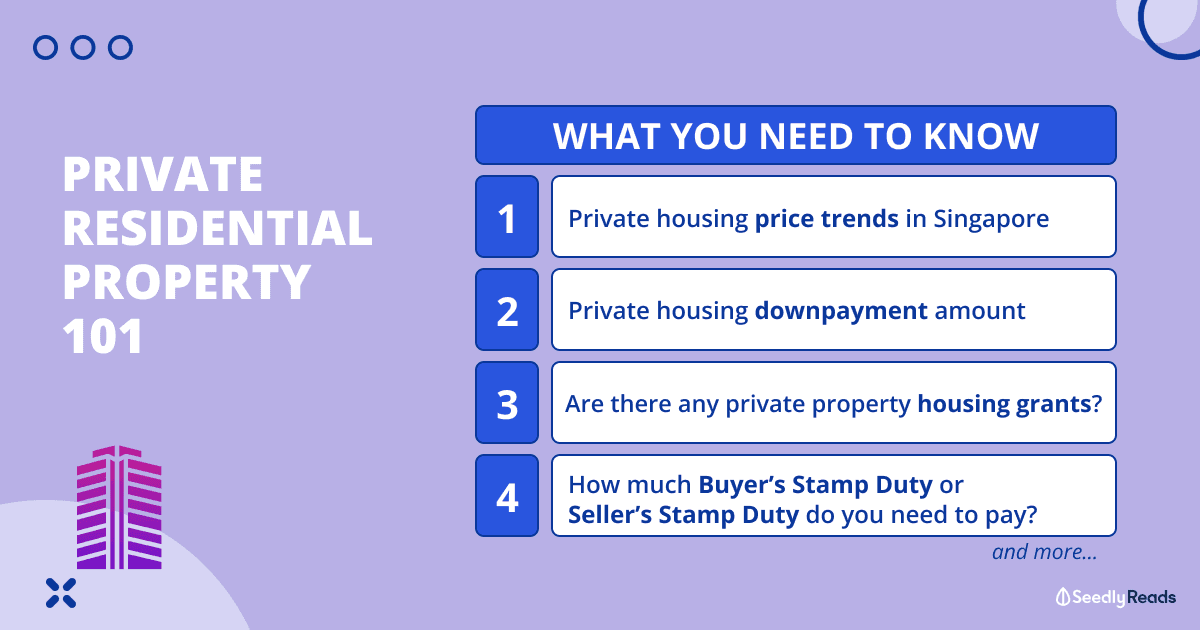

TL;DR: Buying Private Property in Singapore — Here’s What You Need to Know

Note that private property in this article refers to Condominiums and Other Apartments, Landed Properties, and Executive Condominiums (ECs), which become fully privatised from year 11.

Latest Private Property Prices in Singapore: Q2 2022 Private Residential Property Price Index Figures

First, let’s look at how much private property in Singapore costs.

For that, we will have to look at the latest private property residential flash estimates from the Urban Redevelopment Authority (URA), compiled based on transaction prices given in contracts submitted for stamp duty payment and data on units sold by developers up till mid-June.

Note that the statistics will be updated on 22 July 2022 when URA releases its complete set of real estate statistics for Q2 2022. Past data have shown that the difference between the quarterly price changes indicated by the flash estimate and the actual price changes could be significant when the change is small. The public is advised to interpret the flash estimates with caution.

Overall, the private residential property price index increased by 5.6 points from 174.8 points in Q1 2022 to 180.4 points in Q2 2022.

This represents an increase of 3.2%, compared to the 0.7% increase in the previous quarter:

In addition, the current baseline reference period used for the index is the first quarter of 2009 — this means Q1 2009 has a value of 100 points.

The Private Residential Property Price Index for Q2 2022 has a value of 180.4 points.

In other words, private property prices have gone up by a little over 80% compared to Q1 2009!

Core Central Region (CCR) Private Property Prices (Non-Landed)

Prices of non-landed private residential properties in the Core Central Region (CCR) increased by 1.6%, compared to the 0.1% decrease in the previous quarter.

Rest of Central Region (RCR) Private Property Prices (Non-Landed)

Prices in the Rest of Central Region (RCR) increased by 6.0%, compared to the 2.7% decrease in the previous quarter.

Outside Central Region (OCR) Private Property Prices (Non-Landed)

Prices in Outside Central Region (OCR) increased by 1.7%, compared to the 2.2% increase in the previous quarter.

URA Private Property Transactions Tool

If you would like more granular data on private residential property transactions in Singapore, you can always check out URA’s Private Residential Property Transactions tool!

Now that you have an idea of private property prices in Singapore, let’s look at the other essential considerations of owning private property here.

Private Property Downpayment

So here’s the deal when it comes to downpayment for private properties.

If you are looking to buy private residential property (e.g. Executive Condominium EC, Condominium, landed property etc.), you can only take up a bank loan:

Also, the bank will only loan you up to 75% of the purchase price of the private property you want to want to buy.

This means that you will have to pay a downpayment of 25% of the purchase price, of which at least 5% must be paid in cash.

Private Property Grants

For obvious reasons, you won’t be able to receive any Government housing grants for your private property purchase.

The exception is ECs which become private property after year 11.

If you are buying an EC from a property developer, you might be eligible for the Central Provident Fund (CPF) Housing Grant (Family Grant or Half-Housing Grant):

| Average Gross Monthly Household Income of All Persons in Application, i.e. Applicants and Occupiers | Family Grant | Half-Housing Grant If You Are a First-Timer (FT) SC and Your Co-applicant is a Second-Timer (ST) Who Has Previously Taken 1 Housing Subsidy, i.e. FT/ ST Couple |

|

|---|---|---|---|

| Singapore Citizen (SC/ SC) Household | SC/ Singapore Permanent Resident (SC/ SPR) Household | ||

| $10,000 or lower | $30,000 | $20,000 | $15,000 |

| $10,001 to $11,000 | $20,000 | $10,000 | $10,000 |

| $11,001 to $12,000 | $10,000 | Nil | $5,000 |

| $12,001 to $14,000 | Nil | Nil | Nil |

| Source: HDB | |||

Note that you and any co-applicants must be eligible for the grant at the point of booking the EC unit.

Private Property Stamp Duty

Regardless of if you are buying an HDB flat or Private Housing, you will have to pay Buyer’s Stamp Duty (BSD) or Additional Buyer’s Stamp Duty)

Private Property Buyer’s Stamp Duty (BSD)

Regardless of if you are buying an HDB flat or Private Housing, you will have to pay Buyer’s Stamp Duty (BSD) or Additional Buyer’s Stamp Duty (BSD)

Check out our complete BSD and ABSD guide to find out how much you will need to pay:

Private Property Seller’s Stamp Duty (SSD)

Well, the good thing about private property is that, unlike HDB flats, there is no minimum occupation period (MOP) you need to fulfil before you can sell the flat. For example, the new flats under the Prime Location Public Housing (PLH) Model scheme have a MOP of 10 years!

However, you will have to take note of Seller’s Stamp Duty (SSD).

For context, SSD rates are based on the period that the property was owned by the seller.

The SSD payable is calculated by taking the applicable SSD rate multiplied by the property’s sale price or its market value, whichever is higher and is payable within 14 days from the signed/executed document.

SSD is levied should you sell your private property within the first three years at the following rate:

- First year: 12%

- First – Second year: 8%

- Second – Third year: 4%

- More than three years: 0%.

Note that SSD payable will be rounded down to the nearest dollar.

HDB Ownership Rules: Can Private Property Owner Buy HDB Flat?

Short answer, NO.

According to a written reply by the Ministry of National Development (MND) on HDB ownership, pre-requisites for HDB flat owners acquiring private properties and private property owners acquiring HDB flats published on 4 October 2021:

HDB flats are meant for owner-occupation. To reinforce this principle, HDB flat owners are not allowed to concurrently own any private property during the Minimum Occupation Period (MOP) of five years for their flat.

The same principle extends to private property owners who wish to buy a non-subsidised HDB (resale) flat. They will have to dispose of their private property within six months from the date of the flat purchase to meet the MOP conditions.

In other words, you will have to sell your private property if you want to buy an HDB resale flat.

Private Property Leasehold Types:

For private residential property in Singapore, you are looking at either Freehold or Leasehold properties.

Freehold properties can be held almost indefinitely by the buyer.

Whereas leasehold properties will have to be returned to the Government after the lease ends, most leasehold private properties have leases of 99 or 999 years.

One common misconception about freehold properties is that once they are acquired by the buyer, the property will remain in the buyer’s family forever.

However, this is not the case.

According to the Singapore Land Authority (SLA):

Private land may at times be acquired for public purposes such as economic and infrastructure developments and public programmes. Land acquisition in Singapore is governed by the Land Acquisition Act, and SLA is responsible for its administration.Given that Singapore is so densely built-up, acquisition of land for public purposes is unavoidable. At SLA, we work very closely with other public agencies to keep acquisition to a minimum. Landowners whose lands are acquired are paid market value compensation under the Land Acquisition Act. We are committed to walk the journey with the affected landowners and to support them throughout the acquisition process.

An example of this would be the four-storey Thomson Road building (via CNA) acquired by the Government for constructing the North-South Corridor.

Is It Worth Buying Property in Singapore?

Head on over and start a discussion on the Seedly Property Group and start a discussion!

Related Articles:

Advertisement