Best Women's Credit Card in Singapore 2022: UOB Lady's Card, DBS Woman's Card & More

Credit cards reward you with a comprehensive list of things.

Be it shopping, paying for a gym membership, or doing weekly grocery runs – you name it, they have it.

How do you choose which card you need and what best suits you?

Just to highlight that while these cards are labelled in the title as cards for women, men are welcome to apply for all except the UOB Lady’s card!

When getting a credit card, most people will look for the following perks:

- Rewards for online, offline, local and overseas shopping

- Special rates and discounts on groceries, fashion, healthcare and beauty products

- Complimentary drinks at participating pubs and bars

- Flexibility to convert large purchases into interest-free instalment payment plans

- Complimentary access to airport lounges before take-off

- More frequent shopping purchases and higher bills (online + offline)

- Discounts for vacation booking

- Indulging in spa/healthcare treatments

If you are completely new to credit cards, do read through the ultimate guide to credit cards before coming back to read this article as there are a few things that you need to take note of such as fees and the danger of credit card debt.

Without further ado, let’s go to the cards!

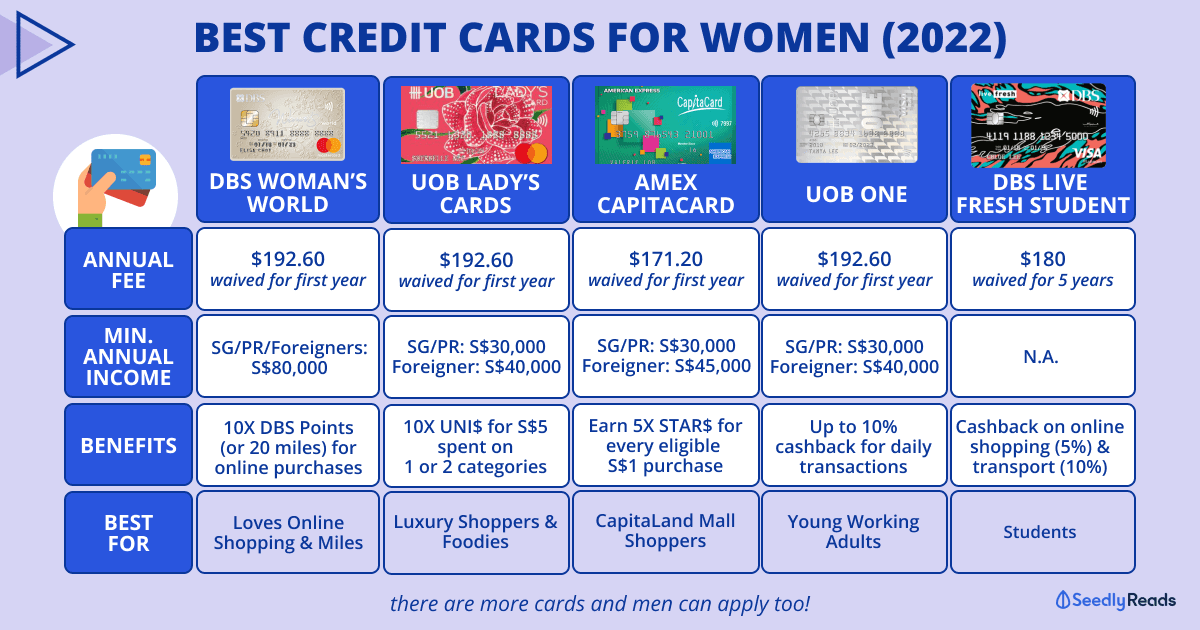

TL;DR Best Women’s Credit Cards Based on Your Lifestyle (2022)

| Suitable For | Credit Card | Benefits | Cap Cashback, Miles, Points Per Month | Pros | Cons | Min. Annual Income | Annual Fee | Promotions | Can Men Apply? |

|---|---|---|---|---|---|---|---|---|---|

| Loves Online Shopping & Miles | DBS Woman's World Card Card Apply Now | 10X DBS Points (or 20 miles) for every S$5 on online purchases 3X DBS Point (or 6 miles) on overseas purchases 1X DBS Point on other purchases 0% Interest Payment Plans over 6 months Any spend in excess of this cap earns 0.4 mpd. | Maximum spend cap of $2,000 for online purchases per calendar month | No Minimum Spend Earn miles faster e-Commerce Protection on online purchases Split big purchases and enjoy 0% Interest on My Preferred Payment Plann# | Points expire every year | Singaporean/PR/Foreigners: S$80,000 | $192.60 (waived for first year) | S$300 cashback when you apply online for your first DBS/POSB Credit Card | Yes |

| Citi Rewards Credit Card | 10X rewards (4 miles) on online and shopping purchases 10X rewards (4 miles) on rides with Grab, Gojek and more 10X rewards (4 miles) on online food delivery 10X rewards (4 miles) on online groceries | 10,000 points per statement month | No Minimum Spend Helps clock miles relatively quickly Can pair with Instarem's Amaze card to earn miles on almost all overseas transactions | You need to actively choose to pay via credit card transaction upon checkout, and not via Apply Pay, Google Pay or any other in-app mobile wallet to earn rewards points | Singaporean/PR: S$30,000 Foreigner: S$42,000 | $192.60 (waived for first year) | 40,000 Thank You Bonus Points (equivalent to 16,000 miles) when you spend S$800 in the first 2 months | Yes | |

| Luxury Shoppers & Foodies | UOB Lady's Card | 10X UNI$ for every S$5 spent on one category (including Beauty & Wellness, Fashion, Dining, Family, Travel, Transport & Entertainment) 1X UNI$ (or 2 miles) on other purchases | Bonus cap is S$1,000, i.e. 1,800 UNI$ | No Minimum Spend You have the flexibility to change your categories every quarter, to suit your ever-changing lifestyle and interests Female cancer coverage based on your savings with UOB Lady's Savings Account UOB LuxePay is a 0% interest-free instalment plan over 6 or 12 months e-Commerce Protection on online purchases Complimentary Travel insurance coverage of up to USD100,000 | UOB automatically deducts your miles or points accumulated for the annual fee, hence you should always check your rewards statement to ensure they do not do that | Singaporean/PR: S$30,000 Foreigner: S$40,000 | $192.60 (waived for first year) | Get S$250 Grab Vouchers and up to S$120 cash credit | No |

| High income earners ($10k per month) | UOB Lady's Solitaire Card | 10X UNI$ for every S$5 spent on two categories (including Beauty & Wellness, Fashion, Dining, Family, Travel, Transport & Entertainment) 1X UNI$ (or 2 miles) on other purchases | Bonus cap is S$3,000, i.e. 5,400 UNI$ | Singaporean/PR/Foreigners: S$120,000 | $406.60 (waived for first year) | No | |||

| For those who have big ticket items soon | OCBC Titanium | 10x Rewards (equivalent to 4 miles per S$1 spent) on eligible online and retail purchases like Apple, Shopee, H&M and more 1x Rewards on all other eligible purchases | Bonus OCBC$ are capped at 120,000 OCBC$ in each card anniversary year | e-Commerce Protection Additional 2% cash rebate at BEST Denki | Minimum spend of S$10,000 in one year | Singaporean/PR: S$30,000 Foreigner: S$45,000 | $192.60 a year (waived for the first 2 years) | - | Yes |

| Frequent shoppers in malls | AMEX CapitaCard | Earn 5X STAR$ for every eligible S$1 purchase at AMEX merchants Additional 25 STAR$ will be awarded, on top of the base 5 STAR$, on eligible purchases of goods and services, in blocks of S$1 at Bugis Junction, Bugis+, Funan, Plaza Singapura and Raffles City Additional 15 STAR$ will be awarded, on top of the base 5 STAR$, on eligible purchases of goods and services, in blocks of S$1 at Bedok Mall, Bukit Panjang Plaza, IMM Mall, JCube, Junction 8, Lot One, SingPost Centre, Tampines Mall & Westgate | Capped at S$1,200 per calendar month made on eligible purchases | Receive a complimentary 1-year Silver tier membership and a 15% one-time room discount voucher when you sign up for Ascott Star Rewards (ASR) membership or log in to your existing ASR account Enjoy from 20% off your food bill to a complimentary bottle of wine at over 400 specially selected restaurants from around the world. | Minimum spend of S$1,500 in the first 3 months | Singaporean/PR: S$30,000 Foreigner: S$45,000 | $171.20 (waived for first year) | Welcome Offer: Receive 150,000 STAR$ (worth $150 eCapitaVouchers) wen you spend a minimum S$1,500 within first 3 months Earn up to 45,000 STAR$ (worth $45 eCapitaVoucher) based on the above spending of S$1,500, capped at S$1,200 of eligible spend each month | Yes |

| High frequency social creatures and love dining out | HSBC Revolution | 10X Reward Points (or 4 miles) with online and contactless payments 1X Reward point for all other types of spending Additional 1% cashback with HSBC Everyday+ on your card spend with your HSBC Everyday Global Account | Capped at 10,000 Reward points (S$1,000) per calendar month on eligible purchases | No minimum spending Clock miles relatively fast through contactless payments | Higher-than-average conversion fee HSBC Points expire after 37 months and you can't pool points across cards | Singaporean/PR (Employed): S$30,000 Singapore/PR (Self-Employed and/or Commission-based): $40,000 Foreigner: S$40,000 | NIL | Samsonite Prestige 69cm Spinner Exp with built-in scale & S$150 cashback when you apply supplementary cards for your loved ones | Yes |

| Young Working Adults Who Spend At Least $500 to $800 Per Month | OCBC 365 Credit Card | 6% cashback on everyday dining and online food delivery 3% cashback on groceries 3% cashback on transport including private hire rides and taxis 3% cashback on utilities including recurring electricity bills and telco bills 3% cashback on online travel deals including purchase of tickets, hotels and tours online 0.3% cashback on all other expenses | $80 cashback per month | Wide variety of day-to-day transactions | Minimum spend of $800 per calendar month to enjoy full cashback | Singaporean/PR: S$30,000 Foreigner: S$45,000 | $192.60 (waived for first 2 years) | Get 8% cashback on all groceries and dining when you spend S$80 or more on either of these categories in a single transaction on Thursday, and have spent a minimum S$800 of qualifying spend | Yes |

| UOB ONE Card | Up to 10% cashback on transport - SimplyGo (additional up to 6.67% when you tap and pay directly using this card) Up to 10% cashback on Shopee Singapore and exclusive privileges Up to 10% cashback on groceries, health and beauty, convenience store, Grab (additional up to 6.67% when you tap and pay directly using this card) Up to 4.33% cashback on Singapore Power (SP) Utilities (additional 1% when you qualify for your quarterly cashback) Up to 3.33% cashback on all retail spend when you spend S$500, S$1,000 or S$2,000 (S$50, S$100 or S$200 per quarter) | 3.33% per quarter | Wide variety of day-to-day transactions | Minimum spend of S$500 To reap full 3.33% cashback on uncategorised retail spend requires consecutive spending of S$2,000 for the quarter | Singapore citizen/PR: S$30,000 Foreigners: S$40,000 | $192.60 (waived for first year) | Get S$250 Grab vouchers when you sign up | Yes | |

| Students, Stay-Home Parents | DBS Live Fresh Student Card (Up to 27 years old) | Up to 5% cashback on online shopping and Visa contactless transactions (Apple Pay, Samsung Pay and Google Pay) Additional 5% cashback on selected eco-eateries Doubles up as public transport card via SimplyGo (with up to 10% cashback on transport spend) 0.3% cashback on all spending | Each calendar month: S$15 on eligible Sustainable Spend S$15 on eligible Merchant Spend S$20 on All Other Spend | 0% Interest Instalment Payment Plan | The credit limit will be S$500 | N/A | $180 (5-year fee waiver) | Get S$300 cashback | Yes |

Click here to jump:

- Frequent online shoppers and those who love miles

- Luxury shoppers & foodies or high-income earners

- Big-ticket items

- Retail shoppers at Capital Malls

- Young working adults who can spend at least S$500 a month

- Students, Stay-home parents & freelancers

Disclaimer: The cards listed in this article exclude corporate, private, premier, and invite-only credit cards. The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any investment product.

For Women Who Love Online Shopping & Miles

The DBS Woman’s Card and DBS Woman’s World Card are perfect for those who love online shopping and miles!

When playing the miles game, you should have a strategy and have an ideal redemption in mind, and understand the concept of miles per dollar (mpd), which is how many miles you are getting per dollar spent.

Why People Choose These Cards:

- 5X DBS Points (or 10 miles) OR 10X DBS Points (or 20 miles) for every S$5 on online purchases regardless of currency i.e. two or four mpd respectively (2mpd or 4mpd)

- No minimum spend

- Its versatility and wide range of online transactions – Taobao, Lazada, hotel booking and buying air tickets, Grab ride, food deliveries etc.

- Men can apply too.

You shouldn’t use these cards for government business, insurance, charitable donations, utilities, healthcare, or top-ups for GrabPay. Similarly, for payment solutions CardUp/iPaymy, you won’t get any points even if things are handled online.

Do note that the function to earn DBS Points via Instarem Amaze has also been seized since 1 June 2022.

Ongoing promotion: Receive S$300 cashback when you apply online for your first DBS/POSB Credit Card

Citi Rewards Credit Card

The Citi Rewards card can be said to be a cult favourite due to its versatility in spending since it can be used in almost every situation, and allows you to clock miles easily!

Why People Choose This Card:

- 10X rewards (4 miles) on online and shopping purchases

- 10X rewards (4 miles) on rides with Grab, Gojek and more

- 10X rewards (4 miles) on online food delivery

- 10X rewards (4 miles) on online groceries

- No Minimum Spend

- Can pair with Instarem’s Amaze card to earn miles on almost all overseas transactions

There is, however, a cap of 10,000 points per statement month.

As a card user, you need to actively choose to pay via credit card transaction upon checkout, and not via Apply Pay, Google Pay or any other in-app mobile wallet to earn rewards points.

For Women Who Enjoy The Luxe Experience

UOB Lady’s Card & UOB Lady’s Solitaire

Why People Choose These Cards:

- Earn 10X UNI$ on one (Lady) or two (Solitaire) spending categories – Beauty & Wellness, Fashion, Dining, Family (including groceries), Travel, Transport (including petrol), Entertainment (nightlife, movies)

- No minimum spend

- The flexibility of changing a category

- Can clock miles easily

- Female cancer coverage for 6 female cancers with UOB Lady’s Savings Account (up to 55 years old, age last birthday)

- Get to enjoy Mastercard wine privileges

- One dines-free with Mastercard for selected restaurants

- You can pool UNI$ across UOB cards and redeem them one-shot

Do note that the minimum income requirement for Solitaire is $120,000 though.

This is a strictly-women card and the only one in this article.

If you’re an average or median income earner, the Lady’s card might be more suitable for your needs where the minimum income requirement is S$30,000 for Singapore Citizens and Permanent Residents.

Ongoing promotion: Get S$250 Grab Vouchers and up to S$120 cash credit

HSBC Revolution

Why People Choose This Card:

- 10X Reward Points (or 4 miles) with online and contactless payments

- No minimum spending

- Wide variety of online transactions and contactless payments, hence good for those who love to dine-out

Do note that, unlike the usual miles conversion where there is a fee applied to each conversion, HSBC charges an annual S$42.80 Mileage Programme fee which covers all conversions for the course of a year. This is usually higher than the average conversion fee of S$25 for other bank cards.

Also, the HSBC Points expire after 37 months and you can’t pool points across cards.

Ongoing promotion: Samsonite Prestige 69cm Spinner Exp with built-in scale & S$150 cashback when you apply supplementary cards for your loved ones

For Those Who Have Big-ticket Items

The OCBC Titanium is a close contender of the cards mentioned above, but it has a requirement of S$10,000 spend within a year.

Hence, for this purpose, it will be good for those who are looking at purchasing big-ticket items as they can clock this amount more easily.

- 10x Rewards (equivalent to 4 miles per S$1 spent) on eligible online and retail purchases like Apple, Shopee, H&M and more

- 1x Rewards on all other eligible purchases

- Minimum spend of S$10,000 in one year

- Bonus OCBC$ are capped at 120,000 OCBC$ in each card anniversary year

Frequent CapitaLand Mall Shoppers

For those who enjoy going on shopping sprees physically (CapitaLand Malls specifically), the AMEX CapitaCard is a potential card for you.

CapitaLand Malls can usually be spotted in the West, Central and East of Singapore – it should be easy to spot one as these malls usually will be donned with a huge “CapitaLand” logo.

Why People Choose This Card:

- Earn 5X STAR$ for every eligible S$1 purchase at AMEX merchants

- Additional 25 STAR$ when you spend at CapitaLand Malls in the central (Bugis Junction, Bugis+, Funan, Plaza Singapura and Raffles City)

- Additional 25 STAR$ when you spend at your neighbourhood CapitaLand malls (Bedok Mall, Bukit Panjang Plaza, IMM Mall, JCube, Junction 8, Lot One, SingPost Centre, Tampines Mall & Westgate)

- Complimentary bottle of wine and 20% discount at over 400 specially selected restaurants, 15% room discount when you sign up for Ascott Star Rewards

- Minimum spend of $1,500 in the first three months i.e., $500 per month

Do note that there’s a cap at S$1,200 per calendar month made on eligible purchases.

Young Working Adults

For those who’ve just first jobbers and intend to save a little more as you’ve just started paying bills, the OCBC 365 card is something that you might be familiar with.

Why People Choose This Card:

- 6% cashback on everyday dining and online food deliveries

- 3% cashback on groceries, transport including private hire rides and taxis, utilities including recurring electricity bills and telco bills, and online travel deals including the online purchase of tickets as well as booking of hotels and tours

- 0.3% cashback on all other expenses

It’s important to note that the cashback amount is capped at S$80 per calendar month.

To enjoy this full amount, you need to spend a minimum of S$800 based on posted transactions in a calendar month. If you spend less than S$800, a flat 0.3% cashback is awarded.

Ongoing promotion: Get 8% cashback on all groceries and dining when you spend S$80 or more on either of these categories in a single transaction on Thursday and have spent a minimum of S$800 of qualifying spend

UOB ONE Card

The UOB One Card is a close competitor to the OCBC 365 as it can be used for a variety of day-to-day transactions.

Its minimum spend is $500 per month.

Why People Choose This Card:

It offers up to 10% cashback on the following categories:

- Transport – SimplyGo (additional up to 6.67% when you tap and pay directly using this card)

- Shopee Singapore and exclusive privileges

- Groceries, health and beauty, convenience store, Grab (additional up to 6.67% when you tap and pay directly using this card)

The card can also be used for utilities and retail spend

- Up to 4.33% cashback on Singapore Power (SP) Utilities (an additional 1% when you qualify for your quarterly cashback)

- Up to 3.33% cashback on all retail spend when you spend S$500, S$1,000 or S$2,000 (S$50, S$100 or S$200 per quarter)

The cashback cap for this card is 3.33% per quarter, and to reap the full 3.33% cashback on uncategorised retail spending, you will need to spend S$2,000 for the quarter.

Ongoing promotion: Get S$250 Grab vouchers when you sign up

DBS Live Fresh Card For Students

For those who are students, this is an option for you.

This one’s popular amongst undergrads for how lenient they are with the criteria to own this card while offering a decent $500 credit limit.

Why People Choose This Card:

- No minimum income required

- Five-year fee waiver

- Credit limit of S$500

- Up to 5% cashback on online shopping and Visa contactless transactions (Apple Pay, Samsung Pay and Google Pay)

- Additional 5% cashback on selected eco-eateries

- Doubles up as public transport card via SimplyGo (with up to 10% cashback on transport spend)

- 0.3% cashback on all spending

While this card is for students, if you are a stay-home parent and are giving your children an allowance, you might want to use this card when doing groceries as you’ll be able to save some money.

Ongoing promotion: Get S$300 cashback for new sign-ups

What Are Some of the Cards You Are Using?

Do you know any other good cards that we should check out?

Share with us at Seedly!

Related Articles

Advertisement