Central Provident Fund (CPF): The Bedrock Of The Singapore Dream

Here are some facts.

There are 4.1 million CPF members in Singapore as of December 2021. In other words, based on Singapore’s population of 5.45 million (as of end June 2021, about four in five people have a CPF account.

Also, most salaried employees in Singapore would have 37% of their income going to their CPF accounts. When broken down, that’s 20% contributed by yourself and 17% from your employer.

As a quick recap, here’re the three main uses of CPF:

- Healthcare

- Housing

- Retirement.

They are all really big-ticket items, so you’re probably wondering… are there any tips for me to maximise my CPF?

There is!

In fact, I covered this topic with Hariz Maloy, a top Seedly contributor, as part of our MONEY FM 89.3 x Seedly Radio Series.

Here’s the full podcast if you’re interested.

If you prefer actionable tips that you can refer to and act on immediately, here’s what Hariz and I put together, which I updated for 2022 and beyond!

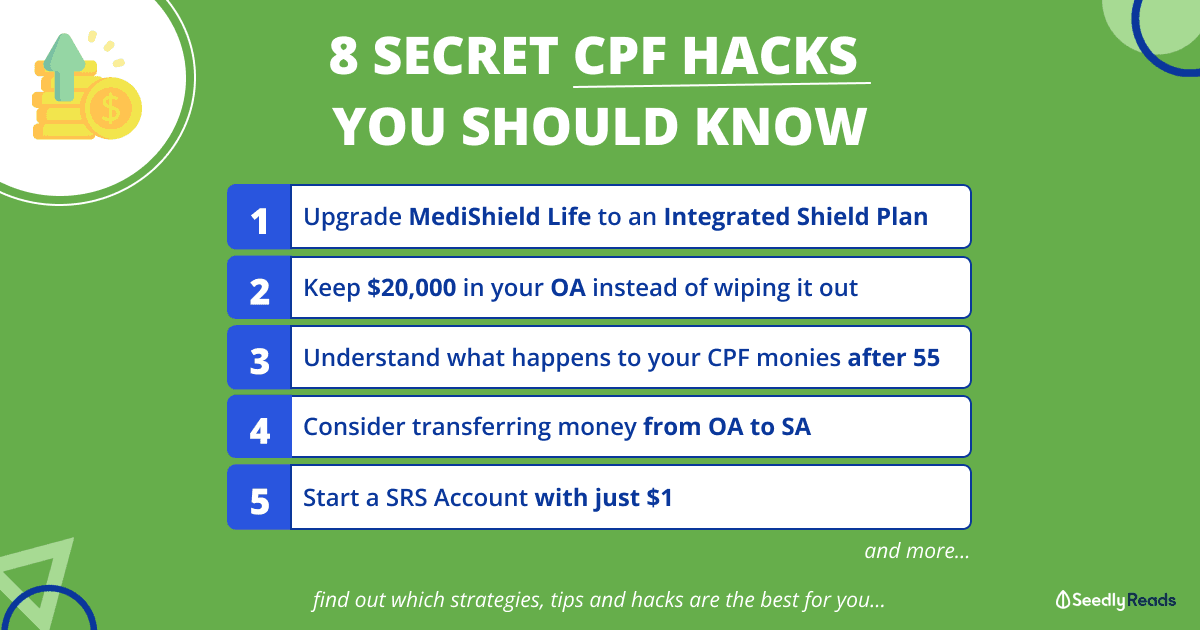

TL;DR: Here Are The 8 CPF Hacks To Get You Ahead

- Upgrade your MediShield Life to an Integrated Shield Plan (ISP) from a private insurer

- Understand the new CareShield Life for everyone who turns 30 (disability insurance)

- Keep $20,000 in your CPF Ordinary Account (OA) instead of wiping it all out when you purchase your first home

- Consider using cash payments for mortgage payments instead of OA monies

- Invest your OA money with CPFIS (CPF Investment Scheme) or transfer money from OA to SA

- Top up your CPF Special Account (SA) with cash

- Understand what happens to your CPF monies at 55

- Start a Supplementary Retirement Scheme (SRS) account with just $1

How Can I Hack My CPF?

Disclaimer: The following tips and hacks are merely guides for individuals looking to maximise their CPF. Do note that the information provided by Seedly serves as an educational piece and does not constitute an offer or solicitation to buy or sell any investment product(s). It does not take into account the specific investment objectives, financial situation or particular needs of any person. Readers should always do their own due diligence and consider their financial goals before investing in any investment product(s).

Healthcare

The first two aren’t necessarily ‘hacks’.

But they are extremely important and play a huge part in ensuring we can focus on the other hacks without worries.

Hack 1: Enhance Your MediShield Life With An Integrated Shield Plan From A Private Insurer

MediShield Life is like basic healthcare, which every Singaporean has.

Once you understand it, you can consider enhancing it with an Integrated Shield Plan (ISP) from a private insurer.

This is really important because you get access to higher class non-subsidised wards*

You don’t have to opt for private hospital cover if it does not make financial sense for you. But, a Class A ward policy in a government hospital should be considered, especially if you’re increasing the yearly claim limit from $100,000 (under MediShield Life)

With this, if you do get hospitalised, the benefit of ISPs is that if you choose to stay in a non-subsidised ward, the higher coverage of your ISPs will help reduce the amount you would need to pay from their MediSave Account (MA).

*Note: For normal MediShield Life, treatment will also not be delayed for urgent cases for those who visit subsidised settings.

If you’re someone who hasn’t looked into your insurance coverage, you might want to look at the key insurance policies that you need to get as well:

Hack 2: Auto-Enrolment Into The Upcoming Careshield Life For Everyone Who Turns 30 (Disability Insurance)

There is also Careshield Life.

Careshield Life is the new iteration of Eldershield, a policy that you could only get when you turn 40.

But unlike Eldershield, you will be automatically enrolled into CareShield Life from 1 October 2020 or when you turn 30, whichever is later.

For the uninitiated, CareShield Life is a long-term care insurance scheme that provides basic financial support should Singaporeans become severely disabled, especially during old age, and need personal and medical care for a prolonged duration (i.e. long-term care).

Severe disability is defined as needing assistance in at least three of these activities of daily living (ADLs):

- eating

- getting dressed

- using the toilet

- bathing

- moving

- walking around, and

- getting from the bed to a chair or vice versa.

You will receive lifetime cash payouts as long as you are found to be severely disabled.

These payouts will increase over time — starting from S$600 a month in 2020 at a rate of 2 per cent per year for the first five years (2020 to 2025).

FYI: The rate at which it will increase for subsequent years will be decided again by the CareShield Life Council.

But you will have to pay premiums from the age you join until age 67 (inclusive of the year you turn age 67).

From 1 October 2020, all Singapore residents between 30 to 40 years old have started paying premiums and will be included in this national long-term care insurance scheme.

The premiums are fully payable via MediSave, and there are Government subsidies available if you need help paying for the premiums.

You can check your personalised premiums and subsidies here.

The good news is that you will continue to be covered for life once you have completed paying your premiums, which will happen when you turn age 67 or 10 years after you join the scheme, whichever is later.

And from 6 Nov 2021 onwards, Singaporeans and permanent residents born 1979 or earlier and who are not severely disabled can opt to sign up for CareShield Life.

There is also an option to increase coverage via a private insurer’s CareShield Life supplementary plans if you want to consider more coverage:

Housing

Fun fact: Singapore has one of the world’s highest homeownership rates, at about 88.9 per cent as of 2021, to be precise.

Hack 3: Keep $20,000 in Your OA Instead of Wiping It All Out When Purchasing Your First Flat

HDB has a new rule that allows you to keep $20,000 in your OA instead of wiping it all out when purchasing your first flat.

It was introduced in 2018, and personally, I also did this because I would want the flexibility to also have that extra reserve just in case I got retrenched and I still would have to service my CPF mortgage.

This new rule is fantastic because your first $20,000 in your OA earns a base interest of 2.5% per annum (p.a.). and earns additional interest of 1% p.a. on the first $60,000 of combined CPF balances (capped at $20,000 for OA).

Here’s a breakdown of the bonus interest (via CPF):

If you are younger than 55, you will earn an extra interest of 1% p.a. on the first $60,000 of your combined CPF balances (capped at $20,000 for OA). The extra interest earned on your SA and MA balances will go to the respective accounts, while the extra interest earned on your OA balances will go into your SA to enhance your retirement savings.

If you are 55 years old and above, you will earn an extra interest of 2% p.a. on the first $30,000 and 1% p.a. on the next $30,000 of your combined CPF balances (capped at $20,000 for OA). The extra interest earned on your RA, SA and MA balances will go to the respective accounts, while the extra interest earned on your OA balances will go into your RA to enhance your retirement savings.

This grants you flexibility (as described above for most couples who bought their first property).

Hack 4: Consider Using Cash Payments For Mortgage Payments Instead Of OA Monies

We first need to understand CPF Accrued Interest as it comes into play when you use your OA Monies for your home purchase.

CPF is meant for retirement, and that means any monies used for your home have to be returned to your own CPF with interest.

Think of it this way, if you hadn’t used money in your OA, it would earn an interest paid by CPF.

But since it’s not there, it lost out on that interest, so you have to compensate and pay that interest.

But don’t worry, upon the sale of your home, the accrued interest will be deducted from the proceeds of your flat to your OA, but if you were to purchase another flat right after, you could use that money immediately again.

So here’s the flexibility.

If you do decide to use cash to pay your mortgage, and one day you might be unable to for whatever reason, you can then switch to paying via OA and tap on the money you have kept aside there.

So if you are confident in investing your cash at hand and believe you can probably earn higher than a 2.5% per annum (p.a.) return, it may be better to use your OA money.

But if you aren’t that confident in investing cash, you can then pay with cash and start accumulating your OA and take advantage of that 2.5% guaranteed return.

Also, you might want to check out our article that explores the cash vs CPF debate in more detail:

Retirement

Your nest egg and the main reason why CPF was created in the first place.

Hack 5: Invest Your OA Money With CPFIS (CPF Investment Scheme) Or Transfer Money From OA To SA

Now you have two options here.

Both of them can provide potentially higher returns in comparison to just leaving money in your CPF OA.

Option 1: CPF Investment Scheme (CPFIS) – Riskier

With the CPFIS, you can invest your excess OA monies above $20,000 in your OA into a few approved investment products.

The good news is that from 1 October 2020, CPF has reduced the sales charge on Unit Trust and ILP products to 0% and the ongoing advisory/management fee to 0.4%.

With a curated list of products from CPF, a good portfolio allocation and a choice of funds, you can potentially perform better than the 2.5% provided by your CPF OA. But of course, this requires you to take on investment risk with your CPF OA monies where you could potentially lose your capital.

In comparison, the CPF OA give you virtually guaranteed returns of 2.5% p.a. and your capital is guaranteed.

Option 2: Transfer from OA to SA – Less Risky

The second and safer option is to transfer your OA monies to your SA.

Your SA has a higher based interest rate of 4% p.a. and earns additional interest of 1% p.a. on the first $60,000 of combined CPF balances (capped at $20,000 for OA).

Here’s a breakdown of the bonus interest (via CPF):

If you are younger than 55, you will earn an extra interest of 1% p.a. on the first $60,000 of your combined CPF balances (capped at $20,000 for OA). The extra interest earned on your SA and MA balances will go to the respective accounts, while the extra interest earned on your OA balances will go into your SA to enhance your retirement savings.

If you are 55 years old and above, you will earn an extra interest of 2% p.a. on the first $30,000 and 1% p.a. on the next $30,000 of your combined CPF balances (capped at $20,000 for OA). The extra interest earned on your RA, SA and MA balances will go to the respective accounts, while the extra interest earned on your OA balances will go into your RA to enhance your retirement savin

However, do note that this transfer is irreversible, and you will lose out on the ability to use that money to pay for your mortgage or child’s education in the future.

But if you’re not transferring monies from OA to SA, you can choose another option.

Hack 6: Top Up Your Special Account (SA) With Cash

There are a few ways to top up your CPF monies.

1. CPF Voluntary Contribution Scheme

One way would be through the Voluntary Contribution (VC) scheme, which allows you to top up all three of your CPF accounts (OA+SA+SA) up to the CPF Annual Limit of $37,740 less the mandatory contributions you and your employer have to make.

2. Retirement Sum Top Up (RSTU) Scheme

The other way would be via the Retirement Sum Top Up (RSTU) scheme, where you can make CPF transfers or cash top-ups for you and your loved ones’ CPF accounts up to these limits:

In 2022, the retirement sums are:

- Basic Retirement Sum (BRS): $96,000

- Full Retirement Sum (FRS): $192,000

- Enhanced Retirement Sum (ERS): $288,000.

CPF Top-Up Tax Relief

There are also tax relief benefits.

From 1 Jan 2022, you will enjoy annual tax relief of:

- Up to $8,000 (previously $7,000) for cash top-ups to your own SA/Retirement Account (RA) and/or MA*

- And up to $8,000 (previously, $7,000) for cash top-ups to your loved ones’ SA/RA and/or MA*.

This cap is shared between the Retirement Sum Topping-up (RSTU) scheme and voluntary contributions to employees’ MediSave Account (MA).

*The changes related to top-ups to MA do not apply to self-employed persons (SEP).

A few things to take note of:

- Only cash top-ups to the SA/RA within the current FRS ($192,000 in 2022) are eligible for tax relief

- You can only top up your MA up to the Basic Health Sum (BHS) cap of $66,000 for all CPF members aged 65 years old and below in 2022; this figure will be adjusted upwards in light of increasing life expectancy and healthcare costs until you turn 65.

- But, if you turn 65 in 2022, the BHS that applies to you will be $66,000 for the rest of your life

- The amount of tax relief you get from RSTU top-ups is limited by the $80,000 annual personal income tax relief cap.

There are also some cons of topping up via RSTU to consider.

These RSTU monies are set aside for your retirement needs and can only be used for monthly payouts under the Retirement Sum Scheme or CPF LIFE.

Any amount topped up to your SA/RA is irreversible and cannot be withdrawn till you hit the retirement age. You get a more generous 4% p.a. because your money is put aside for the long term.

For this reason, CPF does not allow you to withdraw RSTU Monies except for the schemes mentioned above.

This also means you will not be able to withdraw RSTU monies for other purposes like education, investment, insurance premium payments, and housing.

Again, this top-up is irreversible, but it provides you with a safety net as you know you’ll have money in your retirement years.

Hack 7: Understand What Happens To Your CPF Monies At 55

There’s a big misconception that money in CPF cannot be withdrawn or that we will get a small amount back every month. This can be further from the truth.

When you turn 55, a new CPF account, i.e. the RA is created for you.

The retirement account is then filled up by withdrawing your SA and OA Account monies to build the FRS which is $192,000 in 2022.

Generally, any excess monies above the FRS that are not RSTU monies can now be fully withdrawn.

CPF BRS Pledging Property

Alternatively, if you own property in Singapore with a lease that will last you at least till you are aged 95, you can pledge your property and withdraw your CPF savings above the current BRS of $96,000.

How it works is that you are essentially allowing CPF to include your property’s value as a portion of your total retirement savings.

Note that once you have pledged your property, you will have to refund your CPF account up to the current FRS if you sell it.

In addition, the amount you can withdraw does not include any RSTU top-ups.

Hack 8: Start A Supplementary Retirement Scheme (SRS) Account With Just $1

If you’re bored by now and can only walk away remembering one hack, we hope it’s this one.

All you have to do is to open a Supplementary Retirement Scheme (SRS) Account and top up $1:

This single dollar will ‘lock in’ the current statutory retirement age (62) for SRS withdrawals for your SRS account.

This is important as we can only make penalty-free withdrawals from our SRS when we hit the current statutory retirement age.

However, the statutory retirement age will be increased from 62 to 63 from 1 July 2022. Not to mention that the Singapore Government announced that they will be raising the statutory retirement age. to 65 by 2030.

So skip buying a KitKat, open an SRS account and top up $1 today to lock in your SRS withdrawal age at 62 today.

What Is the SRS Account?

If you were wondering, the main use of the account is to help reduce taxable income by up to $15,300 every year, potentially saving you thousands of dollars in tax every year.

Not to mention that the $15,300 can also be invested in SRS approved stocks, Real Estate Investment Trusts (REITs), Exchange Traded Funds (ETFs), and Singapore Savings Bonds (SSBs), or with digital wealth advisors like Endowus or Moneyowl and more.

You need to do a little research and do your due diligence here, but if you learn how to utilise SRS well, you can save on tax and have tax-free withdrawals after you retire.

Conclusion: Start Early, Start Now To Maximise Your CPF

That’s all we have for you! Here are the eight hacks to maximise CPF and plan for your retirement created by yours truly and Hariz Maloy.

If you want to check out our answers and many more answers from the other top contributors on Seedly, head over to Seedly!

Advertisement