Update: NS men will progressively receive their NS LifeSG Credits from 1 to 30 November 2024.

Government Payout 2024 / 2025: When & How Much Is the Next GST Payout?

If you conducted a general search for Goods and Services Tax (GST) Vouchers, you’d find a boatload of skeptical comments left by Singaporeans on social media.

Some of the more interesting comments we came across are:

- “The more they give you, the more they take back”

- “Give you chicken wing; take back the whole chicken.”

While some of these comments may indeed have some truth to them.

I decided to look at the GST Vouchers (GSTV) and the other benefits the Government gives as something positive.

Do you know the expression about a glass being half empty or half full?

The way I see it, it’s better than getting nothing right…

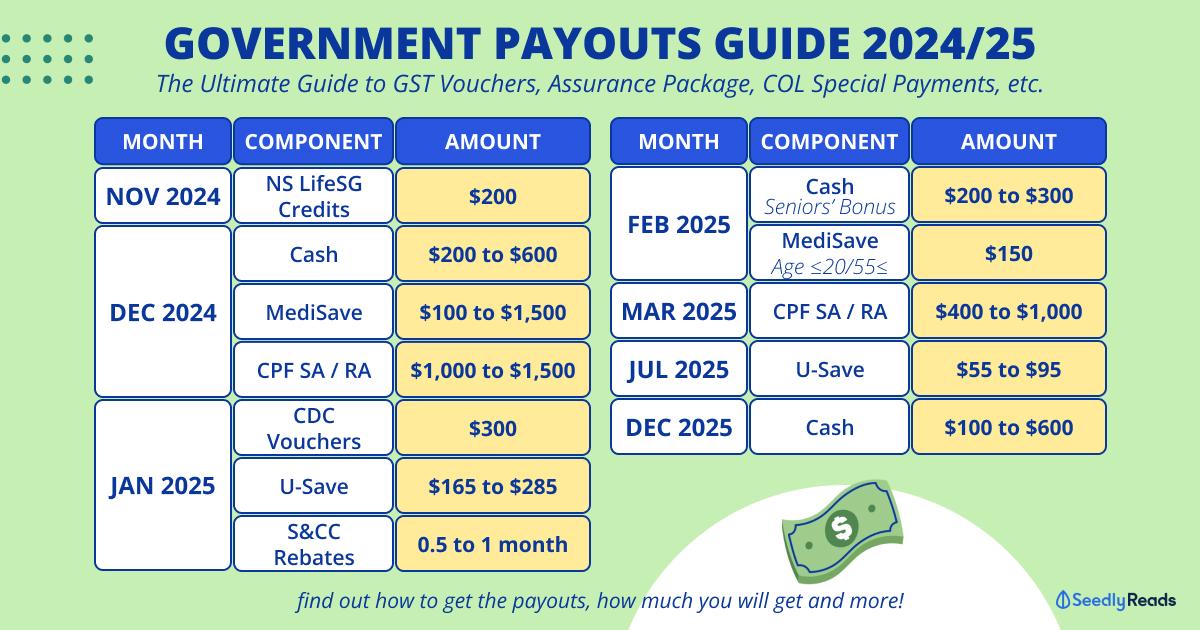

TL;DR: Government Payout 2024/2025 Guide- GST Vouchers, Assurance Package & More

The government has introduced various packages/schemes mainly to help lower to middle-income Singaporean households cope with the rising cost of living, as well as the GST hikes; from 7% to 8% on 1 Jan 2023 and 8% to 9% on 1 January 2024.

If you’re a little overwhelmed, here is a quick summary of government payouts that you will receive in the future:

Government Payout 2024 & 2025 Payout Dates

Click on the component to jump to the relevant sections:

| When? | Permanent GST Voucher (GSTV) Scheme & Assurance Package (AP) Components | How Much Will You Get? | Who Is Eligible? |

|---|---|---|---|

| Oct 2024 | U-Save Rebates | $110 - $190 | Eligible Singaporean households with at least one Singaporean as the owner, occupier, or tenant of the HDB flat; Household members cannot own more than one property |

| S&CC Rebates | 0.5 to 1 month | ||

| Nov 2024 | NS LifeSG Credits | $200 | All past and present NSmen |

| Dec 2024 | Cash (AP) | $200 - $600 | Singaporeans: -Aged 21 and above in 2024 -Depends on Annual Income & Property Ownership |

| CPF MediSave Bonus (Budget 2024 One-Time MediSave Bonus) | $100 - $300 | Singaporeans born in 1974 – 2003 | |

| CPF MediSave Bonus (Majulah Package MediSave Bonus) | $750 - $1,500 | Singaporeans born in 1973 or earlier | |

| CPF Retirement Account or Special Account Top-Up (Retirement Savings Bonus) | $1,000 - $1,500 | Singaporeans born in 1973 or earlier will receive the RSB if they meet the following criteria: (i) CPF retirement savings below the 2023 Basic Retirement Sum (“BRS”) of $99,400 as at 31 December 2022; (ii) Live in a residence with Annual Value (“AV”) of $25,000 and below as at 31 December 2023; and (iii) Own not more than one property as at 31 December 2023. |

|

| YA 2024 | Personal Income Tax Rebate | 50% tax rebate up to $200 | All tax resident individuals |

| Jan 2025 | CDC Vouchers | $300 | Every Singaporean Household |

| U-Save Rebates | $165 - $285 | Eligible Singaporean households with at least one Singaporean as the owner, occupier, or tenant of the HDB flat Household members cannot own more than one property |

|

| S&CC Rebates | 0.5 to 1 month | ||

| Feb 2025 | CPF MediSave Top-Up (AP MediSave) | $150 | Singapore Citizens aged 20 years and below, or 55 years and above from 2023 to 2025 |

| AP Seniors’ Bonus [Previously known as GSTV – Cash (Seniors’ Bonus)] | $200 - $300 | Elderly Singaporeans aged ≥55; Annual Assessable Income (AI) ≤$34,000; Annual Value (AV) of home: ≤$25,000; and Do not own more than one property |

|

| Mar 2025 | CPF Retirement Account or Special Account Top-Up (Earn and Save Bonus) | $400 - $1,000 | Singaporeans born in 1973 or earlier will receive the ESB if they meet the following criteria: (i) Work and have an average monthly income of between $500 and $6,000; (ii) Live in a residence with Annual Value (“AV”) of $25,000 and below; and (iii) Own not more than one property. |

| Jul 2025 | U-Save Rebates | $55 - $95 | Eligible Singaporean households with at least one Singaporean as the owner, occupier, or tenant of the HDB flat; Household members cannot own more than one property |

| Dec 2025 | Cash (AP) | $100 - $600 | Singaporeans: -Aged 21 and above in 2024 -Depends on Annual Income & Property Ownership |

Pro Tip: Just want to know what you will be eligible for and when you will receive government payouts? Use the Support For You Calculator for a quick TL;DR!

Disclaimer: This article has been corrected and updated with the latest information as of 28 Oct 2024.

Government Packages

Over the years, new packages or schemes have been introduced, while existing ones have been enhanced, especially during Singapore’s annual Budget.

You’ll most likely be familiar with terms such as the GST Voucher (GSTV) Scheme, Assurance Package (AP), and Cost-of-Living (COL) Package. More recently, you may have also come across the Majulah Package.

Instead of focusing on each package or scheme, which can be confusing due to various overlaps, I’ll focus on the components we receive. These will be divided into:

- Cash Payouts

- CPF MediSave Top-Ups/Bonuses

- CPF Special Account or Retirement Account Top-Ups/Bonuses

- U-Save (for HDB households)

- Service and Conservancy Charges (S&CC) Rebates (for HDB households)

- CDC Vouchers (for all Singaporean households)

- NS LifeSG Credits (for past and present NSmen)

But for those of you who are interested in what each package or scheme is about:

GST Voucher (GSTV) Scheme: First introduced in Budget 2012 to help lower, and middle-income Singaporeans cope with GST.

Assurance Package (AP): Cushion the impact of the GST rate increase for all Singaporeans.

Cost-of-Living (COL) Package: Provide relief for all Singaporean households, with more support for lower- to middle-income families.

Majulah Package: Government initiative aimed at boosting the retirement and healthcare savings of Singaporeans born in 1973 or earlier.

Government Cash Payouts 2024 / 2025

In 2024, you can expect three cash payouts. These will be given in August 2024 under the GST Voucher Cash Component, September 2024 under the Assurance Package B2024 COL Special Payment, and December 2024 under the Assurance Package Cash.

For February 2025, seniors can expect a cash bonus under the Assurance Package Senior’s Bonus, previously known as the GST Voucher Cash Seniors’ Bonus.

How to Receive Government Payouts?

Cash benefits from the GSTV Scheme and Assurance Package will be credited to your PayNow-NRIC-linked bank account. If you do not have a PayNow-NRIC-linked bank account, the benefits will be credited to the latest account you have provided.

Otherwise, GovCash will replace cheques as the mode of payment for citizens who have not provided their bank accounts or linked their NRICs to PayNow.

Citizens on GovCash can withdraw their cash at OCBC ATMs islandwide by entering their Payment Reference Number (PRN), which will be sent to them by the end of August 2024 and NRIC, and after passing the facial verification.

They do not require an OCBC bank account to withdraw the payment at the OCBC ATMs. GovCash recipients can also use the LifeSG app to pay merchants by scanning their PayNow or NETS QR code or transfer payments to their bank accounts via PayNow if they subsequently register for PayNow-NRIC.

GST Voucher Cash 2024 /2025

First up, we have the GST Voucher – Cash component.

Enhanced GST Voucher 2024 Eligibility: Who is Eligible for GST Voucher?

Here are the updated criteria for the Enhanced GSTV – Cash payouts in 2024:

- Must be a Singapore Citizen residing in Singapore;

- Aged 21 or above in 2024;

- Income earned in 2022 as assessed by IRAS (Assessable Income) for the Year of Assessment (YA) 2023 must not exceed $34,000;

- Annual Value (AV) of home (as indicated on NRIC) must not exceed $25,000;

- Does not own more than one property.

If you want to double check your GST Voucher eligibility, simply head over to the GST voucher site and log in to your Singpass.

What is the cash payout for GSTV? When is the next GST Voucher Payout 2024?

All eligible Singaporeans can receive $850 or $450 in GSTV Cash payouts from Aug 2024.

GST Voucher Cash 2024 Amount

| Singaporeans Aged 21 Years and Above in Reference Year With AI of $34,000 and Below in YA2022 | Owns 0 to 1 Property | |

| AV of Property | ||

| AV ≤ $21,000 | $21,000 < AV ≤ $25,000 | |

| GSTV – Cash 2024 | $850 | $450 |

Source: MOF

Assurance Package Cash 2024 /2025

For this component, all Singaporeans aged 21 years and older will be receiving additional cash payouts up to $650 over the remaining years of the AP, in December every year, with the amount determined by their assessable annual income and property ownership status in the table below.

This will bring the total AP Cash payments adult Singaporeans receive to between $700 and $2,250 over five years.

Adult Singaporeans aged 21 and above in 2024 received cash payouts in December 2023 under the AP Cash. Eligible adult Singaporeans would have also received a one-off AP Cash Special Payment. The total amount ranges from $200 to $800. About 2.9 million adult Singaporeans receives AP Cash annually.

Assurance Package: Cash Payouts Amount and Timeline

| Singaporeans Aged 21 Years and Above in Reference Year |

Disbursement Period

|

Owns 0 to 1 Property |

Owns > 1 Property

|

||

| Assessable Income (AI)* | |||||

| AI ≤ $34,000 | $34,000 <AI ≤ $100,000 | AI > $100,000 | |||

| 2023 | Dec 2022 | $200 | $150 | $100 | $100 |

| 2024 | Dec 2023 | $600 (+$200) |

$350 (+$100) |

$200 | $200 |

| 2025 | Dec 2024 | $600 (+$200) |

$350 (+$100) |

$200 | $200 |

| 2026 | Dec 2025 | $600 (+$200) |

$350 (+$100) |

$100 | $100 |

| 2027 | Dec 2026 | $250 (+$50) |

$150 | $100 | $100 |

| Total | $2,250 (+$650) |

$1,350 (+$350) |

$700 | $700 | |

| Notes: The disbursement of AP Cash in December 2023 is based on your Assessable Income for Year of Assessment 2022 (income earned in 2021). | |||||

Source: MOF

Note: The assessment year (YA2022) for the AP cash payout will remain the same from 2022 to 2026.

Assurance Package B2024 Cost-of-Living (COL) Special Payment

Second, we have the COL special payment recently announced in Budget 2024.

Assurance Package B2024 Cost-of-Living (COL) Special Payment Eligibility

To qualify, you need to be an eligible Singaporean:

- who are aged 21 years and above in 2024,

- residing in Singapore,

- who do not own more than one property, and

- with Assessable Income of up to $100,000

When and how much is the cash payout for COL special payment 2024?

Eligible Singaporeans will receive a one-off cash payment of between $200 and $400 in September 2024.

| Singaporeans Aged 21 and Above in 2024, and Own No More than One Property | Assessable Income | ||

|---|---|---|---|

| Up to $22,000 | More than $22,000 and up to $34,000 | More than $34,000 and up to $100,000 | |

| B2024 COL Special Payment | $400 | $300 | $200 |

Source: MOF

AP Seniors’ Bonus (Previously GST Voucher Cash Seniors’ Bonus) [Announced at Budget 2023]

In addition, the Government is giving cash payouts ranging from $600 to $900 for about 850,000 lower-income Singaporean seniors through the AP Seniors’ Bonus component.

This payout will be made over three years, from February 2023, 2024, and 2025, benefiting about 850,000 lower-income Singaporean seniors.

AP Senior’s Bonus Payout Amounts and Timeline

This bonus will be paid out over three years, with the next and final payout in February 2025.

| Property Ownership | Owns 0-1 property | |||

|---|---|---|---|---|

| Assessable Income (AI) | AI≤$34,000 | |||

| Age of Singaporeans in Payout Year | 55 to 64 years | 65 years and above | 55 to 64 years | 65 years and above |

| Annual Value (AV) of home | Up to $13,000 | More than $13,000 and up to $21,000 | ||

| Feb 2023 | $250 | $300 | $200 | |

| Annual Value (AV) of home | Up to $21,000 | More than $21,000 and up to $25,000 | ||

| Feb 2024 | $250 | $300 | $200 | |

| Feb 2025 | $250 | $300 | $200 | |

| Total | $750 | $900 | $600 | |

| Note: Individuals who own more than one property are not eligible for AP Seniors’ Bonus. | ||||

Personal Income Tax Rebate YA2024

While not technically a cash payout, all tax resident individuals will get a personal income tax rebate of 50% of tax payable for the Year of Assessment 2024. The rebate will be capped at $200 per taxpayer.

This will be automatically granted to eligible taxpayers in their Notices of Assessment for the Year of Assessment 2024.

CPF MediSave Top-Ups/Bonuses 2024 /2025

Upcoming MediSave top-ups/bonuses come in August 2024 under the GSTV – MediSave, December 2024 under the One-Time MediSave Bonus and Majulah Package and February 2025 under Assurance Package MediSave.

GST Voucher MediSave

The GSTV – MediSave component will benefit elderly Singaporeans aged 65 and above. Eligible Singaporeans would have received the payout in August each year.

GST Voucher – MediSave Eligibility

All elderly Singaporeans who met the following criteria would have received the GSTV – MediSave top-up:

- Are aged 65 and above

- Whose residential address is a property that does not exceed an AV of $25,000

- Do not own more than one property.

GST Voucher – MediSave Amount

| Age of Singaporean in 2024 (Payout Happening in Aug 2024) | Owns 0 to 1 Property | |

|---|---|---|

| AV ≤ $13,000 | $13,000 < AV ≤ $25,000 | |

| 65 to 74 | $250 | $150 |

| 75 to 84 | $350 | $250 |

| 85 and above | $450 | $350 |

| Note: Individuals who own more than one property are not eligible for GSTV – MediSave | ||

Source: MOF

One-Time MediSave Bonus

As announced in Budget 2024, the government will provide a one-time MediSave Bonus in December 2024 to all adult Singaporeans between the ages 21 and 50 (born in 1974 – 2003).

One-Time MediSave Bonus Amount

| Singaporeans born in | Own not more than 1 property | Own more than 1 property | |

|---|---|---|---|

| AV of residence | |||

| Not more than $25,000 | More than $25,000 | ||

| 1974-1983 | $300 | $200 | |

| 1984-2003 | $200 | $100 | |

Source: MOF

Majulah Package MediSave Bonus

Under the Majulah Package, all Singaporeans born in 1973 or earlier will receive the MediSave Bonus (MSB).

The MSB will be tiered by their year of birth, the Annual Value of their residence, and whether they own more than one property as at 31 December 2023, and will be credited to their CPF MediSave Account in December 2024.

Majulah Package MediSave Bonus Amount

| Singaporeans born in | Own not more than 1 property | Own more than 1 property | |

|---|---|---|---|

| AV of residence | |||

| Not more than $25,000 | More than $25,000 | ||

| 1959 or earlier | $750 | ||

| 1960-1973 | $1,500 | $750 | |

Source: MOF

Assurance Package MediSave

The Assurance Package MediSave is a MediSave top-up of $150 annually from 2023 to 2025 for Singapore Citizens aged 20 years and below or 55 years old and above.

Top-ups will be credited in February from 2023 to 2025.

CPF Special Account or Retirement Account Top-Ups/Bonuses 2024 /2025

There are two upcoming CPF Special Account (SA) and/or Retirement Account (RA) top-ups. The first is in December 2024 under the Retirement Savings Bonus, while the second is in March 2025 under the Earn and Save Bonus.

CPF Retirement Account or Special Account Top-Up (Majulah Package Retirement Savings Bonus)

As announced in Budget 2024 under the Majulah Package, eligible Singaporeans will receive $1,000 or $1,500 in their RA or SA in December 2024.

Majulah Package Retirement Savings Bonus (RSB) Eligibility

Singaporeans born in 1973 or earlier will receive the RSB if they meet the following criteria:

(i) CPF retirement savings below the 2023 Basic Retirement Sum (BRS) of $99,400 as at 31 December 2022;

(ii) Live in a residence with Annual Value (AV) of $25,000 and below as at 31 December 2023; and

(iii) Own not more than one property as at 31 December 2023.

Majulah Package Retirement Savings Bonus Amount

| CPF retirement savings | Bonus |

|---|---|

| Less than $60,000 | $1,500 |

| At least $60,000 but less than $99,400 (2023 BRS) | $1,000 |

| Notes: Based on the sum of the RA and CPF LIFE balances, or the sum of Ordinary Account and SA balances if RA has not yet been created. Paid to the RA, or the SA if the RA has not been created. |

|

Source: MOF

CPF Retirement Account or Special Account Top-Up (Majulah Package Earn and Save Bonus)

In addition, there is an Earn and Save Bonus to be disbursed in March 2025.

Majulah Package Earn and Save Bonus (ESB) Eligibility

Singaporeans born in 1973 or earlier will receive the ESB if they meet the following criteria:

- (i) Work and have an average monthly income of between $500 and $6,000;

- (ii) Live in a residence with Annual Value (AV) of $25,000 and below; and

- (iii) Own not more than one property.

Eligibility for the ESB will be assessed annually, based on income from the preceding Year of Assessment (employment and trade income) as well as AV and property ownership in the preceding year.

Majulah Package Earn and Save Bonus Amount

| Average Monthly Income | Annual Bonus |

|---|---|

| $500 to $2,500 | $1,000 |

| Above $2,500 to $3,500 | $700 |

| Above $3,500 to $6,000 | $400 |

| Notes: - Refers to the average monthly income based on the number of months worked in the year. - Persons with disabilities, workers who qualify for ComCare Short-to-Medium Term Assistance and caregivers of care recipients (generally include caregivers residing with care recipients who are medically certified to have permanent moderate to severe disabilities) will qualify for concessionary ESB of $400/year, even if they earn less than $500/month. - Paid to the CPF RA, or the SA if the RA has not been created. |

Source: MOF

U-Save Rebates 2024 /2025 (Utilities Rebate)

Next up, we have U-Save Rebates that comprise the GSTV – U-Save component, Assurance Package U-Save, and a one-off B2024 COL U-Save.

These rebates are meant to help offset your costly utility bills (look at SP group) and will benefit the 950,000 Singaporean households that stay in Housing and Development Board (HDB) flats.

U-Save Eligibility

But, these Singaporean households need to meet the following criteria:

- If the flat is partially rented out or not rented out, there must be at least one Singaporean owner or occupier in the household to be eligible for U-Save. If the entire HDB flat is rented out, there must be at least one Singaporean tenant.

- Household members cannot own more than one property.

If your U-Save rebate is higher than your actual monthly utility bill, the unused portion will be rolled over to next month’s bill.

By the way, you don’t have to do anything or register for this payout.

U-Save Rebates in FY2024

You’ll automatically receive the U-Save rebates on your utility bills if you qualify:

| HDB Flat Type and Disbursement Month | 1- and 2-room | 3-room | 4-room | 5-room | Executive / Multi-generation |

|

|---|---|---|---|---|---|---|

| Apr 2024 | GSTV – U-Save | $95 | $85 | $75 | $65 | $55 |

| B2024 COL U-Save | $95 | $85 | $75 | $65 | $55 | |

| Jul 2024 | GSTV – U-Save | $95 | $85 | $75 | $65 | $55 |

| AP U-Save | $95 | $85 | $75 | $65 | $55 | |

| B2024 COL U-Save | $95 | $85 | $75 | $65 | $55 | |

| Oct 2024 | GSTV – U-Save | $95 | $85 | $75 | $65 | $55 |

| B2024 COL U-Save | $95 | $85 | $75 | $65 | $55 | |

| Jan 2025 | GSTV – U-Save | $95 | $85 | $75 | $65 | $55 |

| AP U-Save | $95 | $85 | $75 | $65 | $55 | |

| B2024 COL U-Save | $95 | $85 | $75 | $65 | $55 | |

| Total | $950 | $850 | $750 | $650 | $550 |

Source: MOF

Assurance Package U-Save Rebates

Eligible HDB households will receive additional U-Save rebates under the Assurance Package from 2023-2026. These AP U-Save is on top of the regular GSTV – U-Save under the GSTV scheme, and will be credited together with households’ regular GSTV – U-Save in the relevant months.

| HDB Flat Type and Disbursement Year | 1- and 2- room | 3-room | 4-room | 5-room | Executive/Multi-Generation |

|---|---|---|---|---|---|

| January and July 2025 | $190 | $170 | $150 | $130 | $110 |

| January 2026 | $95 | $85 | $75 | $65 | $55 |

| Total | $570 | $510 | $450 | $390 | $330 |

| For Reference: Regular GSTV – U-Save per year | $380 | $340 | $300 | $260 | $220 |

Source: MOF

Note: You will get half the amount in January and the remaining half in July.

Service and Conservancy Charges (S&CC) Rebate 2024 /2025

The S&CC rebate has become a permanent fixture of the GSTV scheme from FY2022.

This component benefits about 950,000 eligible Singaporean households that stay in Housing and Development Board (HDB) flats yearly.

In Budget 2024, an additional one-off B2024 COL S&CC Rebate was announced to offset 0.5 months of S&CC in January 2025.

In total, households will receive up to 4 months of S&CC rebates in FY2024.

GSTV S&CC Rebates Eligibility

But, these Singaporean households need to meet the following criteria:

- Households must have at least one Singaporean as the owner, occupier, or tenant of the HDB flat

- Households with a member owning or having any interest in a private property or having rented out the entire flat are not eligible for the S&CC rebate.

GSTV S&CC Rebates Amount and Timeline

| HDB Flat Type | No. of Months of S&CC Rebate in FY2024 | ||||

|---|---|---|---|---|---|

| April 2024 | July 2024 | October 2024 | January 2025 | Total for FY2024 | |

| 1- and 2-room | 1 | 1 | 1 | 0.5 + 0.5 | 4 |

| 3- and 4-room | 1 | 0.5 | 0.5 | 0.5 + 0.5 | 3 |

| 5-room | 0.5 | 0.5 | 0.5 | 0.5 + 0.5 | 2.5 |

| Executive / Multi-Generation | 0.5 | 0.5 | 0.5 | + 0.5 | 2.0 |

| Notes: - Number of months of S&CC Rebate in January 2025 includes the B2024 COL S&CC Rebate. - Households with a member owning or having any interest in a private property, or have rented out the entire flat, are not eligible for the S&CC Rebate. |

|||||

Source: MOF

Understanding Service and Conservancy Charges (S&CC)

If you’re looking at the number of months of S&CC rebates, you’re eligible for and are going, “Chey… 4 months only. Like nothing really much, leh…”

WRONG.

Let’s say you live in a 4-room flat in Toa Payoh-Bishan, and your reduced S&CC charges are about ~$860 ($71.60X12) a year.

With the rebates, you would save $214.80 ($71.60 x 3) a year!

CDC Vouchers 2024 /2025

Under the Assurance Package, the government has announced an additional $600 worth of CDC Vouchers in Budget 2024! The CDC Vouchers will be disbursed in two tranches of $300 – on 25 Jun 2024 and Jan 2025.

This is on top of the $500 worth of CDC Vouchers that can be claimed by all Singaporean households from 3 Jan 2024. In total, all Singaporean households will receive $800 worth of CDC Vouchers in 2024.

- Of the $800 Vouchers that all Singaporean households will receive in 2024, half can be used at participating supermarkets such as HAO Mart, NTUC FairPrice, Prime Supermarket, Sheng Siong, Giant Singapore, Cold Storage, Ang Mo Supermarket and U-Stars Supermarket

- The other half can be spent at participating hawkers and heartland merchants

CDC Voucher Expiry, How to Redeem CDC Voucher, Where to Use CDC Voucher & How to Use CDC Voucher

Click on our ultimate guide to CDC vouchers to find out all you need to know:

NS LifeSG Credits

Last but not least, Budget 2024 revealed that all past and present national servicemen, including those enlisting by 31 December 2024, will receive $200 in LifeSG credits!

The NS LifeSG Credits will be disbursed progressively to eligible national servicemen in November 2024, and are valid for one year from the date of issue. Eligible national servicemen will be notified via an SMS.

The NS LifeSG Credits are accessible via the LifeSG mobile application, which can be downloaded on smartphones and other digital devices. The credits can be spent at over 100,000 online or physical merchants accepting payments via PayNow UEN QR or NETS QR.

You may also encash your credits with a YouTrip account!

GST Voucher FAQs

Also, we will be answering some commonly asked questions about GST vouchers on the internet.

How to Appeal for GST Voucher

In a parliamentary reply, Deputy Prime Minister and Finance Minister Tharman Shanmugaratnam said:

‘The GST Voucher scheme is a broad-based scheme to help lower- and middle-income households with their expenses, in particular, what they pay in GST. The criteria for the GST Voucher – Cash takes into account an individual’s Assessable Income (AI), the Annual Value (AV) of his place of residence, and how many properties he owns.

We receive an average of 120 appeals a year from senior citizens (those aged 65 and above) who are below the income threshold and do not own any properties but are living in properties with AVs exceeding $25,000. To put this in context, properties with AVs exceeding $25,000 make up the top 15% of owner-occupied homes in Singapore.

There is no perfect way of assessing a person’s financial situation. However, a person living in a high-value property with his family is in general more likely to be supported by adequate family resources, even if he or she does not own the property. While there will certainly be exceptions, this approach is broadly equitable and progressive.

The Member can be assured that appeals by those who are unable to qualify for the GST Voucher but are in financial difficulty will be carefully considered. We will continue to review the GST Voucher from time to time, to ensure that it continues to reach those who need it most.’

Members of the public who have queries on the GSTV scheme can contact the GST voucher team via this email: [email protected]

Where Can I Use My GSTV Cash Payout

For the GSTV cash payouts, you can basically use the money any way you wish. As for the MediSave top-ups, you can only use it to pay your medical bills. Whereas for utility rebates, they can only be used to offset your utility bills.

How Do I Transfer My GST Voucher to My Bank Account?

The Ministry of Finance (MOF) has stated that:

‘If you have linked your NRIC to PayNow, your future GSTV Cash benefit (if any) will be automatically credited to your PayNow-NRIC-linked bank account. You may contact your bank to check if you are registered on PayNow-NRIC. Alternatively, you can choose to receive your payments via crediting to your bank account.

Otherwise, the GSTV – Cash will be credited to you via GovCash. GovCash is a payment mode that allows Singaporeans to receive their benefits from Government agencies more quickly and conveniently. Starting from 2022, MOF will not issue cheques for the GSTV – Cash. You are encouraged to link your NRIC to PayNow with a PayNow-GIRO-participating local or foreign bank in Singapore to receive your benefits earlier.

GovCash is a payment mode that allows Singapore citizens to withdraw their Government benefits in cash from over 500 OCBC ATMs located across Singapore, at any time of the day. They are no longer restricted by the bank’s operating hours. Singaporeans needing assistance with their GovCash withdrawals can visit the ATMs located within OCBC’s branches during operating hours, where OCBC Digital Ambassadors will be present to guide them.

GovCash allows recipients to use the scan-and-pay function and PayNow transfer option through the LifeSG mobile app.’

How to Check Government Payout: How Much Payout You Can Recieve?

If you are a Singaporean citizen, you may also check your government payouts using our Step-by-Step Guide to Checking Your Government Benefits for 2023 and Beyond:

Related Articles

Advertisement