We recently featured several Singapore-listed companies to consider buying for the new year.

They were hand-picked from a universe of stocks listed here and in the US as they have certain characteristics that I like.

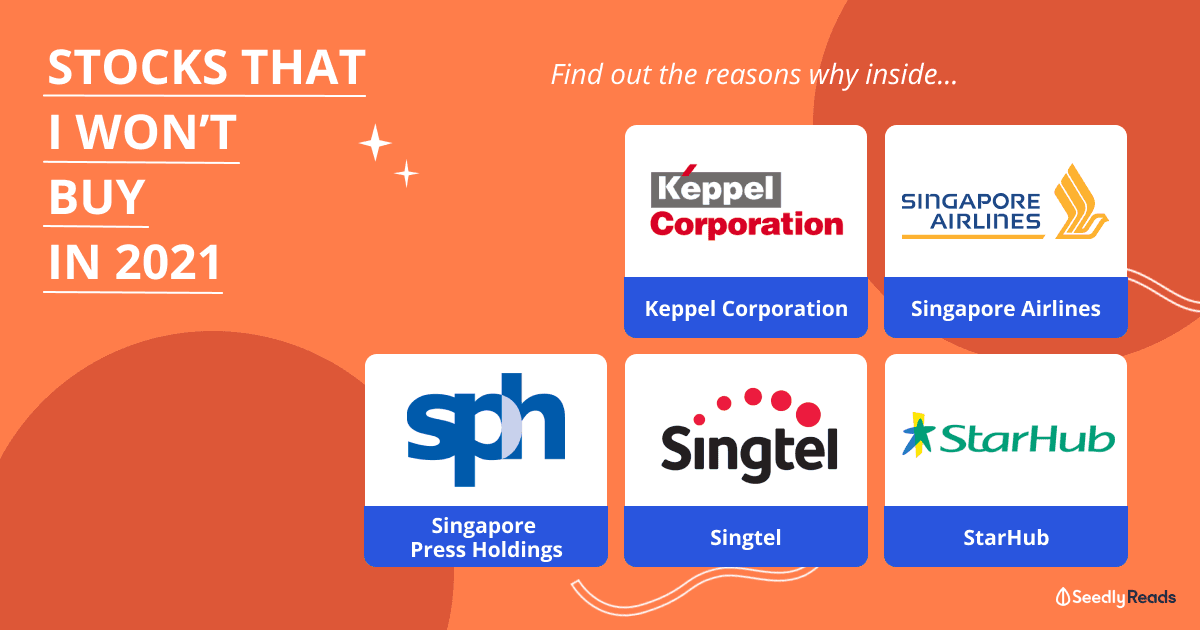

Flipping that logic around, there are also companies I wouldn’t touch with a ten-foot pole.

With that, let’s explore five Singapore stocks that I would avoid in 2021.

Singapore Stock #1: Keppel Corporation

Keppel Corporation Limited (SGX: BN4) is a conglomerate with four main business divisions — Offshore & Marine (O&M), Property, Infrastructure, and Investments.

Over the past five years, both revenue and net profit have fallen drastically.

Revenue declined from S$10.3 billion in 2015 to S$7.6 billion in 2019 while net profit more than halved from S$1.5 billion to S$707 million.

The plunge in oil price back in 2014 has impacted Keppel’s O&M business segment, dragging down the whole group.

To add on to its woes, Keppel doesn’t have a strong balance sheet. I like companies with more cash than debt as it allows them to weather through any tough economic conditions.

As of 30 September 2020, the conglomerate had a net gearing ratio of close to 1x, increasing from 0.5x at end-2015.

Looking ahead, the blue-chip company is planning to transform itself into an integrated business and a powerhouse of solutions for sustainable urbanisation with its Vision 2030.

It’ll be putting its O&M business under strategic review to explore various options, both organic (eg. restructuring) and inorganic (eg. disposal).

Even though Vision 2030 may sound promising, I’d rather be watching from the sidelines to see how well the company can execute on its plans and revive the overall business.

At Keppel’s share price of S$5.70, it has a price-to-book ratio of 1x and a forward dividend yield of 1.1% (annualising its 2020 interim dividend).

Both valuation metrics are unattractive to me considering the risks that I have to take on.

Singapore Stock #2: Singapore Airlines (SIA)

Singapore Airlines (SGX: C6L) just made news for raising US$500 million via its first US dollar-denominated bond issue.

The issue is part of SIA’s S$10 billion multicurrency medium-term note programme.

Net proceeds from the issue will be used by SIA for aircraft purchases, aircraft-related payments, and general corporate or working capital purposes, including refinancing of its existing borrowings.

Even though the airline has extra financial lifeline from the bond issue, over the long run, I’m not too fond of SIA as an investment in my stock portfolio.

The company, similar to other airlines, is operating in a price-sensitive industry without much pricing power.

(Who won’t go for the cheapest plane tickets when they can start travelling again?)

SIA also has to constantly use cash to keep its fleet young. The proceeds from the latest bond issue are likely to be channelled for this purpose.

Since early November 2020, SIA share price has jumped over 30% to $4.42, but I’m not jumping onboard its business.

Singapore Stock #3: Singapore Press Holdings (SPH)

Singapore Press Holdings (SGX: T39) is the publisher of well-known local newspapers such as The Straits Times and The Business Times. The company has three business segments — media, property and others.

SPH’s media business is the main revenue contributor to the company, contributing around 51% of FY2020 revenue.

Revenue FY2020

(S$'000)FY2019

(S$'000) % Change

Media 445.2 576.9 (22.8)

Property 327.2 296.5 10.3

Others (Incl. Aged Care) 93.3 85.9 8.7

Total 865.7 959.3 (9.8)

Source: Singapore Press Holdings FY2020 earnings presentation

The media segment makes money largely through print advertisements. For FY2020, SPH’s newspaper print ad tumbled around 33% year-on-year.

The downtrend has been continuing for the past couple of years, as seen from the chart below:

With the proliferation of online advertising mainly through Facebook and Google, the media segment has been severely disrupted.

The availability of free news from websites has not helped things either.

SPH is increasing its digitalisation efforts and trying its best to diversify its business by investing in other asset classes.

However, I’m unsure if the initiatives would help to turnaround the overall company. Therefore, I will skip investing in SPH for now.

Singapore Stock #4: Singapore Telecommunications Limited (Singtel)

Being Singapore’s largest telco, it would seem that Singapore Telecommunications Limited (SGX: Z74) has a wide economic moat, but that’s not the case.

Over the past decade, Singtel has been struggling to grow its business as seen from its declining revenue and earnings.

FY2010 FY2020 Change in percentage terms

Total revenue (S$ million) 16,871 16,542 -2.0%

Net profit (S$ million) 3,907 1,075 -72.5%

Underlying net profit (S$ million) 3,910 2,457 -37.2%

Diluted earnings per share (Singapore cents) 24.46 6.56 -73.2%

Source: Singtel annual reports

It’s not hard to see why.

With the proliferation of internet-enabled messaging and voice services, such as Viber and WhatsApp, and over-the-top service providers like Netflix, Singtel doesn’t have the stronghold it once had.

Furthermore, competition is heating up with the entry of Singapore’s fourth telco TPG Telecom, which just launched a value-for-money SIM-only plan at S$18 for 80GB worth of data.

Who knows what else TPG and the mobile virtual network operators (MVNOs) such as Circles.Life have up their sleeves.

(MVNOs do not own nor operate any network infrastructure but lease it from the incumbent telcos.)

Singtel and Grab were jointly picked as one of the winners of the digital full banking licences, but it would take some time before the entity becomes a fully-functioning digital bank.

Therefore, I’ll hang up on Singtel shares for now and watch how things unfold.

Singapore Stock #5: StarHub

Just like Singtel, Singapore’s second-largest telco StarHub Ltd (SGX: CC3) is also struggling to grow its business.

StarHub’s net profit has fallen from S$372 million to around S$186 million over the last five years.

2015 2016 2017 2018 2019

Net profit (S$' million) 372.3 341.4 272.9 201.7 186.3

StarHub was recently awarded the 5G spectrum rights by Singapore’s regulator to build and operate a 5G standalone network together with M1.

That would require StarHub to leverage upwards to fund the capital expenditure (capex) for the newest mobile network.

As of 30 September 2020, StarHub had a net gearing ratio of 1.5x, and it’s likely to go up due to the 5G investment.

In my opinion, it’s alright if a company has been growing its earnings over the long-term and is investing more money to propel its business to the next level.

But this is not the case for StarHub.

And with an already-leveraged balance sheet, I’m even more wary.

Want More In-Depth Analysis And Discussion?

You can participate in the lively discussion regarding stocks here at Seedly and get your questions answered right away!

Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any stock.

Advertisement