Credit cards are handy tools for us to maximise our spending.

Aside from excellent sign-up promotions and earning cashback or miles as we spend, some credit cards even give us complimentary travel insurance, airport lounge access, 1-for-1 deals, and more.

BUT.

There will come a time when we have to pay for these perks in the form of annual fees, which are about $195 for most entry-level credit cards.

Depending on how much you spend or utilise said perks, these fees may cost you instead of allowing you to save.

Luckily, you can waive credit card annual fees simply by contacting your card issuer, which is typically a bank!

Intrigued? Here’s how you can do it, along with some useful tips to achieve success with a waiver!

TL;DR: Waive Credit Card Annual Fees Singapore Guide

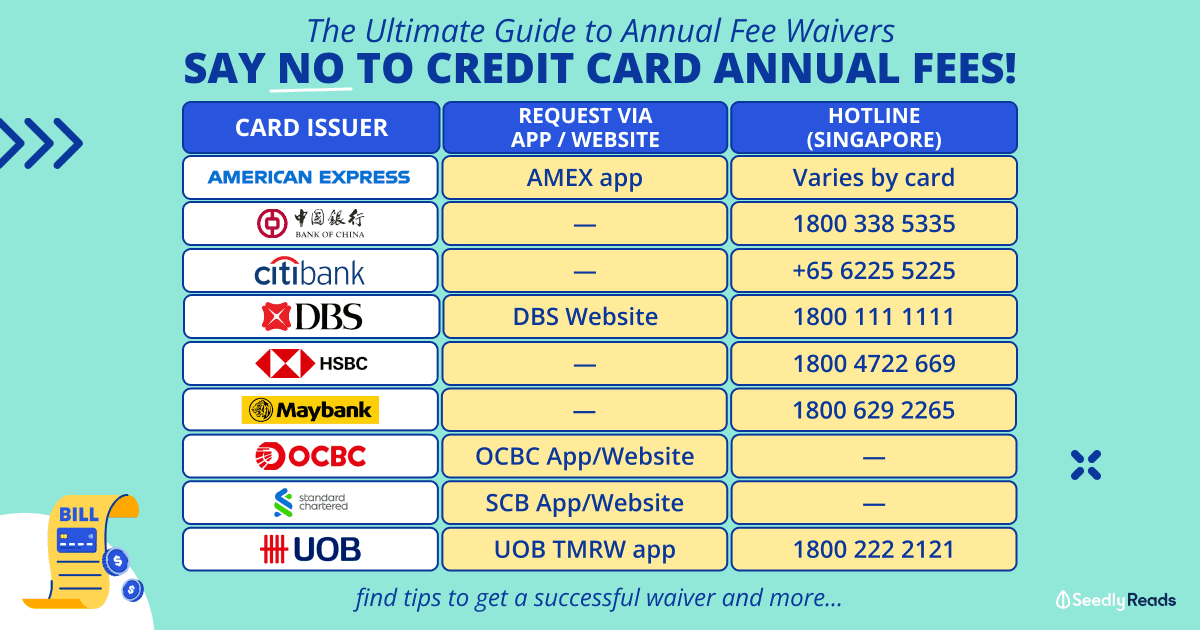

| Credit Card | Request via bank app or Internet Bank |

Bank Hotlines (From Singapore) |

| American Express | AMEX app | Here |

| Bank of China | – | 1800 338 5335 |

| CIMB | No annual fee | No annual fee |

| Citibank | – | 6225 5225 |

| DBS/POSB | DBS Digibot via DBS digibank app or the DBS website | 1800 111 1111 |

| HSBC | – | 1800 4722 669 |

| Maybank | – | 1800 629 2265 |

| OCBC | OCBC digibank app or OCBC website | 1800 363 3333 |

| Standard Chartered | Standard Chartered mobile app or website | – |

| UOB | UOB TMRW app | 1800 222 2121 |

Jump to:

- Essential Knowledge for Banks to Waive Your Annual Fee

- American Express Credit Cards

- Bank of China Credit Cards

- CIMB Credit Cards

- Citibank Credit Cards

- DBS/POSB Credit Cards

- HSBC Credit Cards

- Maybank Credit Cards

- OCBC Credit Cards

- Standard Chartered Credit Cards

- UOB Credit CardsCredit Card

- Annual Fee Waiver FAQ

Essential Knowledge for Banks to Waive Your Annual Fee

In general, you will have to call your credit card issuer or bank’s hotline to request a fee waiver. However, the annual fee waiver is not guaranteed!

No one really knows how banks or card issuers grant annual fee waivers, except those that give you an automatic waiver if you hit certain minimum spends ($10,000, $15,000, or even $25,000) within the year.

To save you the trouble of calling the bank, these are the banks you can request an annual fee waiver without calling!

American Express (AMEX) Annual Fee Waiver for Credit Cards

AMEX In-app Fee Waiver:

You can request a fee waiver via the chat function on the AMEX app:

- Open up and log in to your AMEX app

- Select the chat icon (top right)

- Select Chat With Us

- Type “fee waiver”

- You’ll be connected with a Customer Service Officer (CSO) to confirm the card you’re requesting a waiver for

Unlike other card issuers, there are specific hotlines to call depending on which American Express credit card you have.

AMEX Hotline

Simply search your credit card hotline in the table below and call the number to request a fee waiver.

Lucky for you, AMEX customer support is well known for its top-notch services, and calling them shouldn’t be a hassle.

| Toll-free Hotline | For Overseas Callers | |

|---|---|---|

| American Express CapitaCard | 1800 723 1339 | +65 6880 1343 |

| American Express Platinum Credit Card | 1800 396 6000 | +65 6396 6000 |

| American Express Platinum Reserve Credit Card | 1800 392 1181 | +65 6392 1181 |

| American Express Rewards Card | 1800 296 0220 | +65 6296 0220 |

| American Express Singapore Airlines KrisFlyer Ascend Credit Card | 1800 392 2000 | +65 6392 2000 |

| American Express Singapore Airlines KrisFlyer Credit Card | 1800 392 2000 | +65 6392 2000 |

| American Express Singapore Airlines PPS Club Credit Card | 1800 396 6888 | +65 6396 6888 |

| American Express Singapore Airlines Solitaire PPS Credit Card | 1800 396 6888 | +65 6396 6888 |

| American Express True Cashback Card | 1800 295 0500 | +65 6295 0500 |

If you’re looking for an AMEX card, here are some to consider:

Bank of China Annual Fee Waiver for Credit Cards

Bank of China does not offer an annual fee waiver via an app or online.

You will have to call its hotline to ask for it by:

- Dial 1800 338 5335

- Press 1 > 2 > Key in 16 digit credit card number > Key in mobile number

Do note that it will take about two weeks for the bank to process your fee waiver request.

CIMB Annual Fee Waiver for Credit Cards

Lo and behold. CIMB does not charge annual fees for any of its cards!

Sounds like a good deal? You can apply for one without thinking about these pesky fees:

Citibank Credit Card Annual Fee Waiver for Credit Cards

Unfortunately, Citibank has no in-app option to raise a waiver request.

You can still call the hotline, though, and it’ll direct you to confirm the fee waiver without speaking to a customer support officer.

Simply follow these steps:

- Call 6225 5225

- Follow and choose your menu options accordingly

- Wait for the bank to send an SMS or notification to update you on the status of your request to waive the annual fee for your credit card.

If you’re not a Citibank cardholder, perhaps it’s time to consider having one because we all know the Citi Rewards card is a game-changer for miles chasers!

POSB / DBS Annual Fee Waiver for Credit Cards

DBS/POSB customers can submit credit card annual fee waivers through the DBS digibot or phone banking, so you won’t need to go through the hassle of speaking to a customer service officer.

DBS Digibot digibank

1. On your DBS digibank app or the DBS website, look for the following icon and click it to access the DBS digibot.

DBS Digibot digibank

DBS digibot Website

2. Type “Fee Waiver” into the chat

3. After authentication, select ‘Credit Cards Fee Waiver’

4. Select the credit card account to be waived

5. Review and tap on ‘Confirm’

6. DBS will review your waiver eligibility, and an email/SMS will be sent to you within three working days.

DBS Phone Banking

1. Call 1800 111 1111 (from Singapore) or +65 6327 2265 (from Overseas).

2. Follow and choose the menu options accordingly

3. DBS will review your waiver eligibility, and an email/SMS will be sent to you shortly.

| DBS Altitude Visa Signature Card |

| DBS Live Fresh Card |

| DBS Altitude American Express Card |

| DBS yuu American Express Card |

| DBS yuu Visa Card |

| POSB Everyday Card |

Also here are some important things to take note of according to DBS:

- Fee waiver requests are only accepted via the automated system.

- Fee waiver request via DBS digibot and Phone Banking is unavailable between 11.45pm to 12.30am and 2.30am hrs to 2.45am daily (excluding Sundays and Public holidays).

- An email/SMS will be sent to you as per your registered bank record on the status of your waiver request within 3 working days.

- For DBS Altitude Credit Card/DBS Vantage, a bonus of 5,000/12,500 DBS Points were credited to your account when the annual fee was charged. Please ensure that you have 5,000/12,500 DBS Points before requesting a waiver and DBS Points will be reversed within three working days. However, if there are insufficient DBS Points in your account, you will be charged $0.0388 per DBS Point.

HSBC Annual Fee Waiver for Credit Cards

HSBC is another bank that only allows you to call to request for an annual fee waiver.

Follow these steps:

- Dial 1800 4722 669

- Select 8 > 1 > 2 > Enter 16 digit credit card number > Mobile phone number.

With all that said, the HSBC Revolution is a versatile rewards card that can be used for online spending, dining, and entertainment and easily earn 4 miles per dollar!

Maybank Annual Fee Waiver for Credit Card

By calling the hotline, you should be able to get a waiver for your Maybank credit cards:

By calling the hotline, you should be able to get a waiver.

Follow these steps to ask for a waiver:

- Dial 1800 629 2265

- 1 > 1 > 1> 1> 1> Key in your 16 digit credit card number > 1 > Key in your mobile number > 1

Also, here are some Maybank credit cards to consider:

| Maybank Manchester United Platinum Visa

|

| Maybank FC Barcelona Visa Signature |

| Maybank Horizon Visa Signature |

| Maybank World Mastercard |

OCBC Annual Fee Waiver for Credit Cards

How to Waive OCBC Credit Card Annual Fee

OCBC customers can submit credit card annual fee waivers through the OCBC Digital app, OCBC Internet Banking website, or OCBC’s phone banking service.

OCBC Digital App and OCBC Online Banking

Step 1: Log in with your access code and PIN, fingerprint ID:

Step 2: Navigate to “Request fee waiver” / “Credit card fee waiver”

Step 3: Select the card that you would like to request a waiver for and submit a request:

Step 4: And you’re done!

OCBC Phone Banking

- Have your credit card at hand

- Call 1800 363 3333 or +65 6363 3333 from overseas, and when prompted, say “credit card fee waiver”

- Key in your 16-digit card number when prompted

- OCBC will notify you of the outcome immediately.

Standard Chartered Annual Fee Waiver for Credit Cards

For Standard Chartered customers, you can submit your fee waiver requests via Standard Chartered’s mobile app or Online Banking service.

1. Log in via Standard Chartered Online Banking or the mobile app

2. Select ‘Help & Services’ and navigate to ‘Service request by category’

3. Select ‘Card Management’, followed by ‘Credit Card Fee Waiver’

4. Select up to five fees waiver-eligible card(s)

5. Select ‘Next’, agree on the terms and conditions, then select ‘Yes’

6. Select the annual fee transactions you would like waived

7. Check your fee waiver request details

8. You will see an acknowledgment screen where you can check the status of your fee waiver request

UOB Annual Fee Waiver for Credit Cards

Important: Besides the UOB PRVI Miles AMEX (min. S$50,000 spent per membership year) and the UOB EVOL (min. 3 transactions per month each month of a membership year), UOB automatically deducts your UNI$ from your rewards balance! It’s usually at 6,500UNI$ and that’s A LOT because 1 UNI$ is worth about 2 airline miles.

Thankfully, you can request a fee waiver via the TMRW app:

- Go to the UOB TMRW app

- Tap Accounts

- Select the card you wish to request a fee waiver for

- Tap Settings, then Waive Fees

- Select Annual Fee and confirm

You may do this within three months of being charged the annual fee.

Once you’re successful, there should be a crediting of new UNI$ which has a new two-year expiration time!

UOB Hotline:

If you want to call, you just have to dial: 1800 222 2121

That said, for those who’re new to the miles game, the UOB Preferred Platinum and UOB Lady’s card are hardly missed.

And for cashback chasers, the UOB Absolute Cashback card is one that you shouldn’t miss too.

Get yours today!

| UOB PRVI Miles Visa Card |

| UOB EVOL Card |

| UOB Krisflyer Credit Card |

| UOB PRVI Miles Mastercard |

| UOB PRVI Miles AMEX Card |

Credit Card Annual Fee Waiver FAQ

In addition, here are some frequently asked questions about credit card annual fee waivers, which may prove helpful.

How to Increase Your Chances of Getting a Credit Card Annual Fee Waiver?

- Concentrate your spending on one credit card: If you happen to have multiple cards, try to spend more on the credit card that is due for an annual fee payment, and remember to pay your credit card bills on time! You’ll be in good standing in the eyes of your card issuer and have a higher chance of getting a fee waiver.

- Be polite: When calling the hotline to speak to a representative, be as polite as possible when requesting a waiver! The representative may be more inclined to DEcline your waiver request if you’re being a prick.

- Be persistent: When on the call with a representative, you’ll also want to be persistent regarding your request. If you get hit with a rejection initially, try to plead your case tactfully.

What Do I Do if My Fee Waiver Request Is Still Unsuccessful?

If you’ve applied the tips above but to no avail, you may consider cancelling the card. But before you do so, ensure you don’t have any leftover cashback, points, or miles in your account.

If cash rebates are deposited into your account monthly, they are regarded as your money and cannot be retained by the bank. Typically, this money is utilised to reduce your final bill or be returned to you upon closing your account.

Additionally, ensure that you don’t have any existing instructions for recurring payments such as utilities, telecommunications, insurance premiums, etc. Before contacting the bank, establish new arrangements for recurring payments.

But If you feel that you are getting more out of the card than the annual fee itself (e.g. you get $500 cashback in a year far exceeding the annual fee of ~$195), you can simply pay the fee instead.

Some may just lan lan suck thumb (Hokkien: slang for sucking it up) and pay the annual fee for the sake of maintaining a good credit score, which helps you get a better chance of loan approvals with banks.

Credit Cards With No Annual Fees in Singapore

In Singapore, the majority of credit cards have annual fees.

However, all CIMB cards like the CIMB World Mastercard, the Standard Chartered Smart Credit Card and the HSBC Revolution Credit Card come with no annual fees!

But do ensure that your accounts are in good standing to enjoy zero annual fees on these credit cards.

Applying for or thinking of getting a credit card soon? Get a free iPhone or iPad bundle while you’re at it! (if you’re fast enough)

All you need to do is be the first 10 applicants of select credit cards at 12pm, 3pm, and 6pm each day!

By the way, you’ll also be entered into a Grand Lucky Draw, where you might walk away with a pair of Business Class round trip tickets to Japan! Promotion ends 18th Mar, so don’t wait! T&Cs apply.

Advertisement