7 Best Cashback Cards in Singapore (2024): Here Are The Credit Cards You MUST Own!

When deciding the best credit card in Singapore to get.

You must usually decide between earning credit card points, miles or cashback:

With points, you’ll often find that you need to accumulate 40,000 points (or $4,000 spent) just to get an eco-friendly reusable coffee cup.

And with miles, it’ll be hard to obtain that elusive first-class ticket if you aren’t a frequent traveller or big spender.

Credit Cards With Cashback: Is Getting a Cashback Credit Card Worth It?

This… brings us to cashback credit cards, which basically give you ‘free’ money.

Let’s find out the best cashback credit card, shall we?

Disclaimer: The various credit cards have their respective terms and conditions. Please read through them before deciding which credit card to get! Note that information is accurate as of 27 June 2024 and that promotions are subject to change without prior notice.

TL;DR: Best Cashback Credit Card in Singapore (2024): Which Credit Cards Give You More Cash Back?

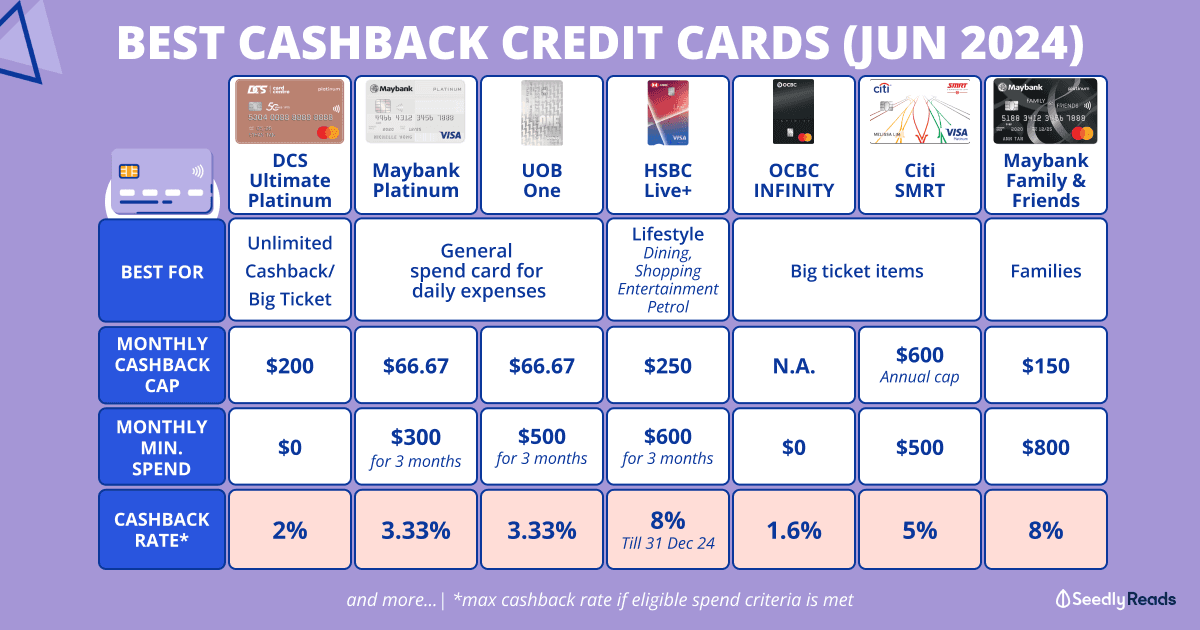

These are the best cashback credit cards that you should be using:

| Cashback Credit Card | Cashback Rate | Total Monthly Cashback Cap | Min. Monthly Spend | Best For? |

| DCS Ultimate Platinum Mastercard | 2% on virtually all spend (usual exclusions apply) |

$200 $10,000 monthly spend |

$0 | Unlimited cashback card |

| Maybank Platinum Visa | 3.33% on local & foreign currency spend | $66.67 $2,000 monthly spend |

$300 for three months |

General spend card for daily expenses ($300 & $500 min. spend)

|

| UOB One Apply Now |

3.33% base cashback Up to 10% for bonus categories |

~$66.67 $2,000 monthly spend |

$500 for three months | |

| HSBC Live+ | Up to 8% on Dining, Shopping, Entertainment (Till 31 Dec 24. Will revert to 5% thereafter) 5% on Petrol |

$250 $3,125 quarterly spend |

$600 for three months | Lifestyle card for those who spend more on dining, shopping & entertainment |

| Citi SMRT | 5% on online (Exclude mobile wallet and travel-related transactions) 5% on groceries 5% on taxis, private-hire rides & SimplyGo public transport |

$600 annual cap | $500 |

Big-ticket items

|

| DCS Ultimate Platinum Mastercard | 2% on virtually all spend (Usual exclusions apply) |

$200 $10,000 monthly spend |

$0 | |

| OCBC INFINITY Card Apply Now |

1.6% on virtually all spend (Usual exclusions apply) |

No cap (Use if you spend more than $10,000 per month) |

$0 | |

| Maybank Family & Friends Apply Now |

8% on 5/10 selected categories 8% on all Malaysian Ringgit spend on top of 5 preferred categories |

$150 ($25 for each bonus category) $1,875 monthly spend |

$800 | Families |

If you’re wondering how I put together this list… I basically took advantage of countless work hours on research. So the next time you walk into a bank or any credit card roadshow, this will be you:

You’re welcome.

Click to Teleport

- What Are Cashback Credit Cards?

- Unlimited cashback cards

- General daily expenses card (Min. monthly spend of $300 and $500)

- Lifestyle credit card (Dining, Shopping and Entertainment)

- Big-ticket items

- Groceries, Petrol, Food Delivery & more.

What Are Cash Back Credit Cards? Why Would The Banks Give Us Free Money?

The answer is in the fine print.

Most cash rewards programmes have a minimum spend requirement and a cashback cap.

So, while a card might offer you a generous 20% cashback. You’ll probably need to spend around $10,000 a month to qualify. And the maximum amount of cashback you can probably get is $50 a month.

Also, if you were wondering what cashback is, it often comes as an offset of your credit card bill.

FOR EXAMPLE ONLY, PLEASE.

No such card exists.

However, most consumers do not take the time to read the fine print.

How Does Cashback Work? Which Bank Is Best for Cashback?

So, there is a chance that they might use a credit card under the impression that the cash rewards programme is more generous or applicable to a broader range of expenditures than they actually are.

And how many of us really track how much we spend to truly maximise our cashback rewards?

Plenty of consumers might also be under the impression that they can ‘afford to’ spend more because they’re getting cashback.

WRONG!

That’s awful news if you can’t make the payment on time.

The banks will charge high-interest rates (~28% p.a. that compounds daily) on credit, and the late fees for balances that are carried over are usually damn siao.

The lesson to take away here?

Only get a credit card if you are conscientious about your spending habits and can pay your credit card bills on time.

Please don’t chase credit card bonuses if you don’t need to spend on anything.

What Are the Best Cash Rebate Credit Cards in Singapore (2024)?

To make your life easier, I decided to sort the various cashback credit cards into different categories that I think people would care about:

- Unlimited cashback card

- General spend card for daily expenses (Min. monthly spend of $300 and $600)

- Best lifestyle credit card (Dining, Shopping and Entertainment)

- Big-ticket items

- Groceries, Petrol, Food Delivery & more.

I’ve also listed the following:

- Cashback rate

- Monthly minimum spend

- Maximum cashback cap.

That’s not all.

As a value-added service, I’ve also included links to real user reviews left by our SeedlyCommunity to help you better decide which cashback credit card you should apply for.

Another essential thing to note is that there is no objectively best credit card.

The best credit card is the one that compliments your spending habits and allows you to maximise the cashback you can earn.

Best Unlimited Cashback Credit Card

First up on the list are no-frills and unlimited cashback credit cards. These cards have no minimum monthly spend requirement and no cashback cap. Aside from the standard exclusions like payments made via AXS, educational institutions, e-wallet top-ups, payments to financial institutions, etc., the card of choice covers most categories.

1. DCS Ultimate Platinum Mastercard Review (2024)

For the unlimited cashback category, the choice is clear as, unfortunately, 2023’s pick, a combination of the AMEX True Cashback Card (1.5% cashback) or the UOB Absolute Cashback Card (1.7% cashback) with the GrabPay Mastercard has been nerfed to oblivion.

Enter the DCS Ultimate Platinum Mastercard, a credit card which offers 2% cashback on almost all purchases without a minimum spending requirement.

DCS Ultimate Platinum Mastercard Basics

- Cashback:

- 2.00% on local and foreign currency spend

- Min. Monthly Spend: $0

- Cashback Cap: $200 a month ($10,000 monthly spend)

- Annual Fee: $196.20 (first year is waived)

- Effective Interest Rate: 26.90% p.a.

- Income Requirement:

- $30,000 for Singapore Citizens or SPRs 55 & below

- $15,000 for Singapore Citizens or SPRs 55 & above

- $60,000 for foreigners

- Minimum Age: 21

However, there are two things you need to take note of. Firstly, the cashback is capped at $200 per month, which is reached with a monthly spend of $10,000. For higher spenders, alternatives like the OCBC INFINITY card may be preferable as they offer unlimited cashback. Secondly, the cashback does not apply to certain transactions, such as insurance payments and mobile wallet top-ups:

As the card uses Mastercard for its network, you’ll find that it is widely accepted, and you’ll enjoy Mastercard Priceless™ Specials privileges:

- With One Dines Free, you can enjoy one complimentary main course at partner restaurants in Singapore and major cities across Asia Pacific

- Enjoy One Night Free with your Mastercard at participating hotels

- E-Commerce Protection coverage up to USD 200 annually when you shop online with your DCS Ultimate Platinum Mastercard.

You’ll also enjoy complimentary travel insurance coverage of up to $1 million.

General Spend Cards for Daily Expenses

If you can afford to spend more, here are two general-spending cards for your daily expenses with a low-ish minimum spend requirement.

UOB EVOL vs DBS LiveFresh vs OCBC Frank

If you were wondering, I have removed the UOB EVOL, DBS LiveFresh and OCBC Frank cards from this list as they have been nerfed.

The OCBC Frank card, included in 2022, was nerfed heavily. Before November 2022, online and contactless spending had separate cashback caps of $25 each.

Now, online and contactless spending share the same $25 cap, which, frankly, is a bit mediocre.

On 1 February 2024, DBS announced the following changes to the DBS Live Fresh card, which take effect from 1 March 2024. The minimum monthly spend requirement has been raised from $600 to $800 to qualify for higher cashback. Additionally, the range of transactions eligible for increased cashback has been restricted to shopping and transportation, excluding dining and groceries. Furthermore, the extra 5% Green Cashback has been removed.

- Cardmembers will earn unlimited 0.3% base cashback on all eligible spend.

- Upon hitting the minimum spend requirement of $800 per calendar month, Cardmembers will enjoy up to 6% cashback on Shopping and Transport spend (includes instore, contactless and online transactions made in Singapore and overseas):

- 6% cashback (0.3% + 5.7% bonus) cashback on Shopping spend (capped at $50 per calendar month and ~$877.20 monthly spend)

- 6% cashback (0.3% + 5.7% bonus) on Transport spend (capped at $20 per calendar month and $333.33 monthly spend)

- The card benefits of up to 5% cashback on Contactless and Online Spend, and the extra 5% Green Cashback on Sustainable Spend will cease.

The UOB EVOL Card’s cashback benefits have also been reduced, effective 7 June 2024 for new cardholders and 7 August 2024 for existing cardholders. The main changes include a new spending cap of $800 (up from $600), combined cashback categories and a lower cashback cap of $30 for both online and mobile contactless when it used to be $40 ($20+$20) for both. The effective cashback rate for online and mobile contactless spend has decreased from an estimated 6.7% to approximately 3.75%, significantly impacting the card’s attractiveness.

In light of the above, here are two alternatives.

First, we have the Maybank Platinum Visa credit card:

Maybank Platinum Visa Basics:

- Cashback:

- 3.33% on local and foreign currency spend

- 3.33% on insurance payments, but do note that insurance payments can be accumulated as eligible spending for only half of the monthly spending amount for each tier

- Min. Monthly Spend: $300 | $1,000 | $2,000

- Quarterly Cashback Cap: $30 | $100 | $200 (Up to $6,000 quarterly spend)

- Annual Fee: No annual credit card fee for the first three years

- A quarterly service fee of $20 is waived under the three-year fee waiver. Subsequently, the quarterly service fee is waived when you charge to your Card once every three months

- Effective Interest Rate: 27.90% p.a.

- Income Requirement:

- $30,000 for Singapore Citizens or Singapore Permanent Residents (SPR)

- $45,000 for Malaysia Citizens in employment for at least 1 year

- $60,000 for other nationalities, in employment for at least 1 year

- Minimum Age: 21

If you’re more conservative in your spending, the Maybank Platinum Card might be just right for you. It requires a minimum quarterly spend of $300 and offers up to 3.33% cashback, with a cap of $30 per quarter. For those who spend more, the card provides $100 or $200 in quarterly cashback when spending at least $1,000 or S$2,000 per month, respectively:

|

Tier

|

Min. monthly spend in the quarter |

Maximum cashback

awarded ($) |

||

| July | August | September | ||

| 1 | $300 | $300 | $300 | $30 |

| 2 | $1,000 | $1,000 | $1,000 | $100 |

| 3 | $2,000 | $2,000 | $2,000 | $200 |

| The above table is for illustrative purposes only. | ||||

This card is notable for its minimal exclusions and rare feature of rewarding insurance premium payments. These payments can constitute up to half of the monthly spend required for each tier. For example, if your monthly spend is $2,000, up to $1,000 of that can be insurance payments.

Additionally, the Maybank Platinum Card has a relatively low quarterly annual fee of $20, which is waived for the first three years. Regular use of the card—just one charge every three months—ensures an automatic waiver of this fee.

Beyond these financial benefits, the card offers 20.05% fuel savings when linked to a Diamond Sky Fuel Card and complimentary travel insurance coverage of up to $500,000, provided the entire travel package is charged to the card.

However, a quirk with Maybank is that, unlike other credit cards, Maybank’s billing cycles are based on the calendar month and not the statement month. So, your billing cycles will be from the days of the month and not your billing cycle. For example, for January, the minimum monthly spend must be between 1 -31 January 2024.

Maybank Credit Card Promotion

Also, here are the offers availble for new Maybank credit cardmembers (T&Cs apply):

However, if you spend more than $500 monthly on your credit card, you can earn more cashback with the UOB One Card.

3. UOB Credit Cards: UOB One Card Review (2024)

UOB One Basics

- Cashback:

- Base 3.33% cashback on all retail spend [$500, $1,000 or $2,000 per month (min. five purchases a month) consecutively for three months]

- Up to 10% cashback for spending on bonus categories for existing UOB credit cardmembers

- Min. Monthly Spend for one Quarter: $500 | $1,000 | $2,000

- Cashback Cap:

- $50, $100 or $200, respectively, per quarter for base cashback (Up to $6,000 quarterly spend)

- Additional cashback is capped at $100 a month

- Annual Fee: $196.20

- Effective Interest Rate: 27.80% p.a.

- Income Requirement:

- $30,000 per year for Singaporeans

- $40,000 for Foreigners

- Able to provide fixed deposit collateral of at least $10,000 if you don’t meet the above income requirement

- Minimum Age: 21

The card offers a relatively high cashback rate of up to 3.33% on almost all purchases with a minimum spend of $500 / $1,000 / $2,000 per month and a minimum of five transactions per statement month for a qualifying quarter.

To qualify for this cashback, you must also spend $500 / $1,000 / $2,000 monthly for three consecutive months.

But remember that this is a flat rate, and the minimum spending requirements are relatively high.

Bonus UOB One Cashback: Shopee Cashback Singapore, Dairy Farm Cashback and More

In addition to the base quarterly rebate of 3.33%, you will receive additional cashback depending on your spending at certain merchants.

Cardmembers who spend $500 or $1,000 monthly for three months and are awarded the $50 or $100 quarterly cashback will get an additional 5.0% cashback or 6.33% cashback in total.

Whereas cardmembers spending $2,000 for three months and are awarded $200 quarterly will get an additional 6.67% cashback or 10% cashback in total from these merchants:

- McDonald’s

- Dairy Farm Retail Group such as Cold Storage, CS Fresh, Giant, Guardian, 7-Eleven, Marketplace, Jasons, Jasons Deli,

- Grab (excludes mobile wallet top-ups)

- Shopee Singapore transactions (excludes ShopeePay), SimplyGo (bus and train rides)

- UOB Travel (excludes online and flight-only bookings)

Also, all card members awarded the quarterly cashback will get an additional 1% cashback on the Singapore Power utility bill (excluding payments via AXS) successfully charged and posted to the Card Account in each statement month. They will also get an additional 1.67% cashback on each statement month of Shell transactions successfully charged and posted to the Card Account and up to 24% fuel savings at SPC and Shell.

All additional cashback will be capped at $100 per month.

Here’s an example of how this works:

For the example above, the person qualified for the quarterly tier rebate as they spent precisely $500 each month for the whole quarter (three months) and got $72 cashback.

In addition, the person also spent on these additional categories and got $22 more on top of the base cashback of $50, for a total of $72 cashback for the quarter.

Not to mention that this card pairs with the UOB One high interest savings account for bonus interest when you spend $500 monthly and credit your salary.

UOB One Credit Card Promotion: Get S$350 Cash Credit

That’s not all. The first 200 eligible new-to-UOB credit card members per month during the promotional period will receive $350 in cash credit after making a min. spend of $1,000 per month for two consecutive months from the card approval date to be eligible for rewards.

This promotion is valid from now until 30 June 2024. Terms and Conditions apply.

Apply Now

Best Lifestyle Credit Card (Dining, Shopping and Entertainment)

If you are looking to live it up to the fullest, the HSBC Live+ should be high on your list.

4. HSBC Live+ Review (2024)

Here’s what you need to know about this lifestyle credit card.

HSBC Live+ Basics

- Cashback:

- 8%* on Dining, Shopping and Entertainment (valid till 31 December 2024. Rate will revert to 5% thereafter)

- 5% on Petrol

- 0.3% on other spend

- Min. Monthly Spend: $600 per month every quarter

- Cashback Cap: $250 per quarter (Up to $3,125 quarterly spend)

- Annual Fee: $196.20(waived for first year)

- Effective Interest Rate: 27.78% p.a.

- Income Requirement:

- $30,000 for Singapore Citizens or SPRs

- $45,000 for foreigners

- Minimum Age: 21

Note: *For new cardholders in their first quarter, the minimum spending required to earn up to 8% cashback is $1,000 for the entire quarter rather than $600 each month. For instance, if your card is approved on 23 June 2024, you must spend $1,000 between 23 and 30 June 2024 to qualify for up to 8% cashback for the second quarter of 2024. Starting from the third quarter of 2024, you will need to spend $600 per month, every month of the quarter.

The HSBC Live+ credit card provides an 8% cashback on Dining, Shopping and Entertainment till the end of the year but requires a minimum monthly spend of $600. The cashback applies to specific Merchant Category Codes (MCCs), such as dining (including restaurants and fast food) but excludes 5814 alcohol-selling establishments, shopping (covering departmental stores and various speciality shops), and entertainment (including streaming services and digital media). For fuel, the cashback is available only at Caltex or Shell stations in Singapore, and the rate is 5%.

The card operates on a quarterly cashback mechanism. To qualify for the cashback, you must make a consistent monthly spend of at least $600 for three months. The cashback is capped at $250 per quarter. This cap means you can spend up to $3,125 per quarter at the 8% rate without exceeding the cashback limit.

Note: *For new cardholders in their first quarter, the minimum spending required to earn up to 8% cashback is $1,000 for the entire quarter rather than $600 each month. For instance, if your card is approved on 23 June 2024, you must spend $1,000 between 23 and 30 June 2024 to qualify for up to 8% cashback for the second quarter of 2024. Starting from the third quarter of 2024, you will need to spend $600 per month, every month of the quarter.

Unlike other cards, the HSBC Live+ does not impose category sub-limits, allowing cardholders to allocate their spending freely across the eligible categories. This flexibility is beneficial for users who may concentrate their spending on one area, such as dining, to maximize their cashback.

HSBC Live+ Promotion

HSBC is offering a promotion for new credit card holders that includes a choice of high-value gifts such as a FLUJO SmarTrax Standing Desk, Dyson AM07 fan, Sony WF-1000XM5 earbuds, or a $300 eVoucher redeemable at merchants like Shopee and Grab. To qualify, new cardholders must activate their card and spend a minimum of $500 by the end of the month following the account opening. This offer, valid from 24 June to 21 July 2024, can be combined with ongoing standard offers (BAU offer), and requires applicants to provide marketing consent to HSBC.

Additionally, customers have the option to upgrade their rewards to more premium items by topping up with additional cash. Available premium gifts include a Sony HT-AX7 Portable Theatre System, a Sony ZV-1M2 Vlog Camera, or an Apple iPhone 15 Pro, with top-up amounts ranging from $200 to $1,099.

Moreover, under the HSBC Live+ Business as Usual (BAU) Offer, new cardholders can receive an extra $100 cashback if they make at least one qualifying transaction by the end of the month following their card approval. This particular promotion runs until 30 September 2024, and like all promotions, it is subject to the bank’s terms and conditions.

Best Credit Cards for Big Purchases

Need to renovate your brand-new BTO?

Planning to get a laptop?

Check out these cards to save BIG.

5. Citibank Credit Cards: Citi SMRT Card Review 2024

For any big-ticket online purchases, you’ll want to get the Citi SMRT Credit Card.

Citi SMRT Card Basics

- Cashback:

- 5% cashback on online purchases (excludes mobile wallet and travel-related transactions) | Supermarkets & grocery stores | Taxis and private hire rides & SimplyGo transactions for public transport

- 0.3% savings on all other qualifying retail spend

- No monthly cap on how much SMRT$ you can earn

- Min. Monthly Spend: $500

- Cashback Cap: No monthly cap on how much SMRT$ you can earn but an annual cap of 600 SMRT$ earned, i.e. $12,000 spent in 12 months (Every 1 SMRT$ shall, unless otherwise specified, represent $1 in cash value)

- Annual Fee: $196.20 (Waived for the first two years)

- Effective Interest Rate: 27.90% p.a.

- Income Requirement:

- $30,000 per year for Singaporeans / PRs

- $42,000 for foreigners

- Minimum Age: 21

Citi SMRT Card Cashback

With this card, you’ll get a pretty decent 5% cashback rate on the following spend categories:

- All supermarkets and grocery stores

- Taxi and public transport rides (including private-hire rides)

- Online purchases

But do note that bonus cashback will not include online purchases as follows:

- Mobile Wallet purchases from merchants like IPAYMY, CARDUP, YOUTRIP, EZ-LINK and EZL AUTO TOPUP

- Travel-related transactions include but are not limited to transactions that bear the following MCCs:

- MCC 3000 to 3350 Airlines, Air Carriers

- MCC 3351 to 3500 Car Rental Agencies

- MCC 3501 to 3999 Lodging – Hotels, Motels, Resorts

- MCC 4112 Passenger Railways

- MCC 4411 Cruise Lines

- MCC 4511 Airlines, Air Carriers (Not Elsewhere Classified)

- MCC 4722 Travel Agencies and Tour Operators

- MCC 5962 Direct Marketing – Travel-Related Arrangement Services

- MCC 7011 Lodging – Hotels, Motels, Resorts (Not Elsewhere Classified)

- MCC 7512 Car Rental Agencies (Not Elsewhere Classified).

Citi SMRT Card Monthly Minimum Spend and Cashback Cap

However, you must spend at least $500 monthly to unlock this 5% cashback rate (SMRT$).

| Cash rebate redemption amount | SMRT$ required | SMS keyword |

| $10 | 10 | SMRT10 |

| $50 | 50 | SMRT50 |

| $100 | 100 | SMRT100 |

This means that you will have to have at least $10 worth of SMART$ before you can redeem any rebate.

If your total monthly statement of retail purchases falls below $500, the eligible rebate rates will be reduced to 0.3%.

The beauty of this card for big-ticket online purchases lies in how Citi arranges the cashback cap. Remember to use the card directly to pay for your stuff, as the card does not support mobile wallets. This card should not be used for travel transactions.

Unlike most cards with a monthly cashback cap, the Citi SMRT card has an annual cashback cap of $600.

This means that at any point within 12 months, you can spend up to $12,000 and get 5% or up to $600 cashback on eligible spending.

Note that the annual cashback cap resets every 12 months. So you might want to apply for the card now, as the earlier you apply, the faster it refreshes the cap.

For example, if you only need to buy your big ticket nine months later, you can fully utilise the $12,000 cap within three months until it is refreshed.

6. OCBC Credit Cards: OCBC Infinity Cashback Card Review (2024)

The Citi SMRT card may be suitable for online transactions, but there’s a gap for in-store transactions.

To fill this gap, we recommend the above-mentioned DCS Ultimate Platinum Master Card, which offers a straightforward 2% cashback on nearly all purchases. However, standard exclusions like insurance and bills remain.

This card doesn’t require a minimum spend and allows for a maximum cashback of $200 per month on up to $10,000 in spending. Additionally, the cashback earned is applied directly to offset that month’s credit card bill charges, making it simple and convenient.

However, if your big-ticket purchases exceed $10,000 a month, the next best alternative would be the OCBC INFINITY Cashback Credit Card: a fuss-free unlimited cashback card that allows you to earn 1.6% cashback on local and foreign currency spend.

Unlike the DCS Ultimate Platinum Mastercard, the OCBC does not have a minimum spend or cap. The great thing about this card is that the cashback earned will be automatically credited to your OCBC INFINITY card account.

OCBC Infinity Card Basics

- Cashback:

- 1.60% on local and foreign currency spend

- Min. Monthly Spend: $0

- Cashback Cap: N.A.

- Annual Fee: $196.20

- Spend $10,000 in one year, starting from the month after your OCBC INFINITY Cashback Card was issued to get your annual service fee automatically waived

- Effective Interest Rate: 27.78% p.a.

- Income Requirement:

- $30,000 for Singapore Citizens or SPRs

- $45,000 for foreigners

- Minimum Age: 21

OCBC INFINITY Cashback Card Promotion

Receive a Samsonite Volant Spinner 68/25 EXP + 1x Apple AirTag bundle (worth S$525.40) or Apple AirPods 3rd Gen with MagSafe charging case (worth S$274) or S$220 eCapitaVoucher or S$200 Cash via PayNow

Do note that the promotion is valid for new OCBC credit card members only, and you will need to apply through Seedly/SingSaver and make a min. spend of $500 within 30 days of card approval.

This promotion is valid until 30 June 2024. Terms and Conditions apply.

Apply Now

Best Cashback Credit Card For Families

Everybody must visit the supermarket to get stuff like milk, diapers, bananas, soy sauce, and bread… You get the picture.

Even driving out will cost petrol, which costs money. And for days that you are too tired to cook, you might order food delivery occasionally.

Why not save a bit while making these necessary purchases with the Maybank Family and Friends Card:

7. Maybank Credit Cards: Maybank Family and Friends Card Review (2024)

Maybank Family and Friends Card Basics

- Cashback:

- 8% on five out of 10 selected categories

- Minimum Monthly Spend: $800

- Cashback Cap: $125 ($25 for each bonus category) on up to $1,875 monthly spend

- Annual Fee: $180 (first three years waived)

- Effective Interest Rate: 26.90% p.a.

- Income Requirement:

- $30,000 per year for Singaporeans or SPR

- $45,000 for Malaysians in employment for at least 1 year

- $60,000 for Foreigners in employment for at least 1 year

- Minimum Age: 21

Maybank Family and Friends Cards Categories

With this card, you can earn 8% cashback globally on five out of these 10 cashback categories:

| Eligible Categories For Local, Overseas and Online Spend | Description |

|---|---|

| Groceries | NTUC FairPrice/Finest/X‐tra, Cold Storage, Giant, Market Place, Jasons, Sheng Siong, DON DON DONKI, HAO Mart, RedMart, Amazon Fresh and all other grocery stores and supermarkets globally |

| Dining & Food Delivery | Restaurant dining, Foodpanda and Deliveroo globally |

| Transport | Petrol stations, Contactless bus and train rides, Limousines, Taxi, Grab/GOJEK rides, other passenger transportation services and automotive-related services globally |

| Data Communication & Online TV Streaming | StarHub, Singtel, M1 Limited, Circles.Life, MyRepublic, Disney+, Netflix and/or other telecommunication, pay television, cable and radio services globally. |

| Retail & Pets | POPULAR Bookstores, Toys 'R' Us and Yamaha Music, pets and veterinary related services globally |

| Online Fashion | Online purchases on Apparels, Shoes, Accessories, Leather goods, Luggage and other fashion purchases globally |

| Entertainment | Bars, Drinking places, Cinemas, Motion Picture Theatres, Theatrical Producers and Ticketing agencies globally |

| Pharmacy | Guardian, Watsons, Unity, GNC/LAC, other drug stores and pharmacies globally |

| Sports & Sports Apparels | Sports/Riding apparels, Sporting goods, Bicycle shops, Recreation & sporting camps, Athletic fields, Commercial sports, Professional sport club, Golf courses, Country clubs and Membership (Athletic/Recreation/Sports) globally |

| Beauty & Wellness | Massage parlors, Health & beauty spas and Barber shops globally |

FYI: Selected Categories will take effect on the first day of the following calendar month. The Selected Categories will apply to the Cardmember for three months from the effective date (“Lock-In Period”). Maybank reserves the right to amend the length of the Lock-In Period from time to time without prior notice or liability to any person.

To get the 8% cash rebates, cardholders must spend a minimum of $800 per calendar month.

Any monthly spending from $0 – $799 will only receive 0.3% in cashback.

Also, after reaching the monthly cashback cap for a selected category, the 0.3% cashback will be applied to further spending that month and the 0.3% cashback applies to all other spend on non-selected categories.

There is also a total cashback cap of $125 ($25 for each category).

Bonus Category for Maybank Family and Friends: Additional 8% cashback on Malaysian Ringgit Spend

Those who love going to Johor Bahru for a weekend getaway can now earn an additional 8% cashback on top of your five preferred categories!

After reaching your monthly cashback cap, the 8% cashback will be applied to the Malaysian Ringgit for the selected category spending that month and all other Malaysian Ringgit spend on non-selected categories in the month:

| Min. monthly spend | Cashback on five selected categories | Cashback on Malaysian Ringgit on other spends (above and/or outside of selected categories) |

| $800 | 8%

(Up to $125 in total per calendar month, capped at $25 per category) |

8% (Additional cap of $25) |

| $0 – $799 | 0.3% | 0.3% |

More specifically, according to the card’s terms and conditions, the Malaysian Ringgit bonus category and cap applies to:

- Eligible retail transactions charged in Malaysian Ringgit on his/her Card that are not transactions which fall under Cardmember’s Default Categories or Selected Categories (as the case may be); OR

- Eligible retail transactions charged in Malaysian Ringgit on his/her Card which also fall under one of the Cardmember’s Default Categories or Selected Categories (as the case may be) after the Cardmember has charged more than $312.50 to that Default Category or Selected Category (as the case may be) during that calendar month.

However, note that Malaysian Ringgit transactions will incur a 3.25% foreign transaction fee. But, the 8% cashback if you hit the minimum spend of $800 more than covers it.

Maybank Credit Card Promo

Maybank Welcome Offer: Get a Samsonite ENOW Spinner 69/25 EXP (worth S$570) or AirPods (3rd generation) with Lightning Charging Case (worth $263.80) or S$200 cashback.

Here’s what you need to take note of:

- The promotion is valid for new Maybank credit card members and CreditAble accounts only

- Apply and get approved for a new Maybank credit card and accumulate at least $650 of credit card spend and/or CreditAble account withdrawals every month for two consecutive months from card approval date to be eligible for rewards

- Promotion is valid until the date determined by Maybank at its absolute discretion

- Terms and Conditions apply.

Apply Now

So… Which Credit Card is the Best Benefit for You?

Have a favourite cashback credit card?

Believe that you’ve found a way to game the cashback credit card system to get the most amount of cashback?

Share with the community on Seedly lah…

Related Articles:

Advertisement