Best $500 Credit Card For NSFs, Students And Non-Working Adults

Y’know, I wish I knew about credit cards when I was still schooling because I can get to save some money.

Besides paying for an expensive university degree, we often hear things about credit card debts and whatnot, and I belonged to the group of people who were fearful of credit cards.

Do you know you can also apply for a credit card even without an income?

Having a credit card is extremely beneficial to a student as you will be able to earn cashback, cash rebates, or even use it for overseas exchange?

Let’s find out!

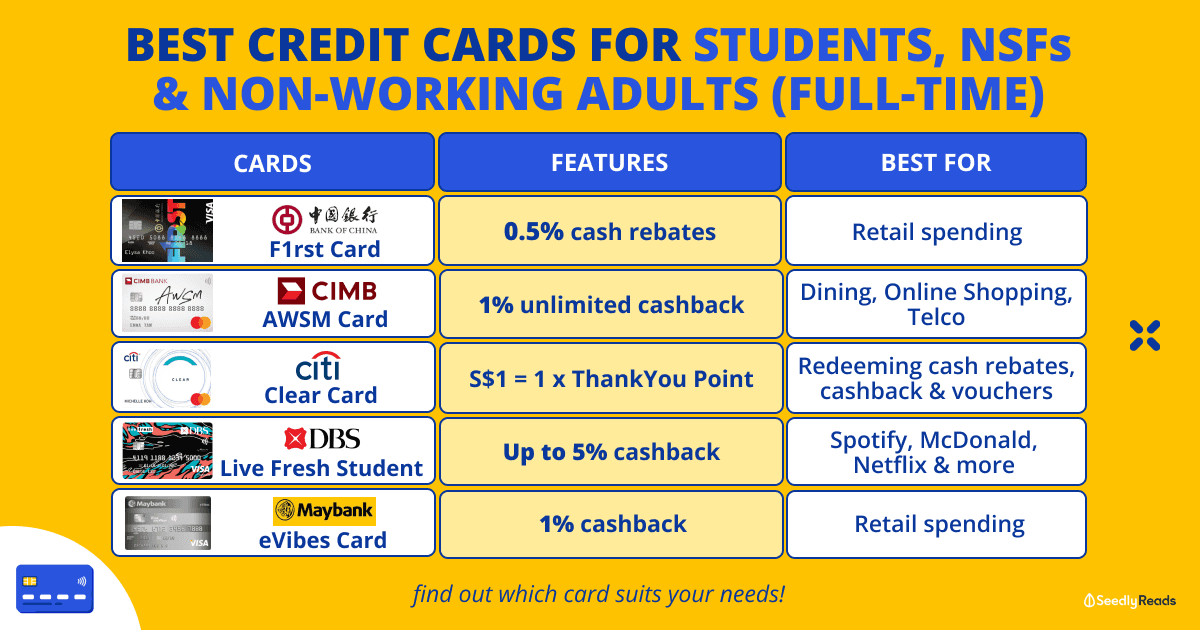

TL;DR: Best $500 Credit Cards For Students, NSFs, Lower Income & Non-Working Adults

| Credit Cards | Credit Limit | Features | Best For | Ongoing Promotion |

|---|---|---|---|---|

| BOC F1RST Card | $500 | 0.5% cash rebate | Retail spending | - |

| CIMB AWSM Card Apply Now | $500 | Unlimited 1% cashback on Dining & Entertainment, Online Shopping & All Things Telco | Dining & Entertainment, Online Shopping & All Things Telco | Get $30 eCapitavouchers when you apply for your first CIMB AWSM card and spend S$100. Valid till 1 Oct 2023. |

| Citi Clear Card | $500 | 1X ThankYou Reward Point for every S$1 spent. Points can be redeemed to for miles (0.4 mpd), cash rebates, vouchers and deals | Online fashion, lifestyle, and travel exclusives | - |

| DBS Live Fresh Student Card | $500 | Up to 5% cashback with eligible merchants Up to 5% cashback with eco-merchants Up to 0.3% on All Other Spends | Spotify, Golden Village, McDonald's/McDelivery, Netflix, Starbucks | - |

| Maybank eVibes Card | $500 | 1% cashback on all retail spends | Retail spending | - |

| OCBC Frank Debit Card | - | 1% unlimited cash rebate on all eligible transactions | Online shopping Taobao, SHEIN, Lazada Convenience stores Cheers, 7-Eleven Transport Comfort and CityCab, Go-Jek, Grab, Ta-da, SimplyGo, SBS Transit Drinking Zouk, Harry's, Stickies, Cash Studio Eco-friendly merchants BluSG, Scoop Wholefoods, Ugly Food & more | - |

Click here to jump:

- BOC F1RST Card

- CIMB AWSM Card

- Citibank Clear Student Credit Card

- DBS Live Fresh Student Card

- Maybank eVibes Student Credit Card

- OCBC Frank Credit Card

BOC F1RST Card

| Eligibility | Students | Working Adults |

| Nationality | Singapore Citizens, Permanent Residents, or Foreigners | Singapore Citizens, Permanent Residents |

| Age | 18 & above | 21 and above |

| Minimum Annual Income Requirement | NIL

*Applicants under 21 years old require the consent of their Parent/Legal Guardian |

$18,000 |

| Bank Status | Must not be an existing Bank of China Principal Credit Cardmember | |

| Credit Limit | S$500 | |

| Features | 0.5% cash rebate on the total monthly statement of account | |

| Min. Spend | NIL | |

| Annual Fees | $205.20 (incl. GST), first 2 years waived | |

| Annual Fee waiver | First 2 years | |

| Min. Monthly Payment | 3% of the monthly balance outstanding, plus any outstanding Minimum Payment Sum, plus the amount in excess of the Credit Limit, or ^¥/S$50, whichever is greater | |

| Best For | Across all categories | |

The BOC F1RST Card by the Bank of China is applicable to all Singaporeans, Singapore PR, and foreign students aged 18 and above, and there’s no minimum income requirement for students!

For those who are into cash rebates, this card offers a 0.5% cash rebate for the total amount billed in your monthly statement, at a credit limit of S$500.

It’s also good for you if you do not hit the regular income requirement for the other awesome credit cards as you just need to earn S$18,000 per year to qualify for this card as a working adult.

Once you’ve applied for this card, you can rest assured that you will not be required to pay any annual fees for the first two years.

I know it doesn’t look very impressive…

With a 0.5% cash rebate and a $500 credit limit, the maximum you can get per month is $2.50.

But since it’s applicable to all spending, at least you don’t have to monitor which category you’re spending on.

You’ll also soon notice that the BOC F1RST Card is one of the two student cards available for foreign students. Sorry guys, y’all don’t have that many options to choose from.

CIMB AWSM Card

| Eligibility | Students / NSFs | Working Adults |

| Nationality | Singapore Citizen or Permanent Resident | |

| Age | 18 – 29 years old | 18 and above |

| Minimum Annual Income Requirement | NIL

*Applicants under 21 years old require the consent of their Parent/Legal Guardian |

|

| Bank Status | Must not be an existing CIMB Principal Credit Cardmember | |

| Credit Limit | S$500 | |

| Features | Unlimited 1% cashback on Dining & Entertainment, Online Shopping & All Things Telco | |

| Min. Spend | – | |

| Annual Fees | – | |

| Min. Monthly Payment | 3% of the outstanding balance or S$15, whichever is higher, plus any outstanding overdue amount from the previous statement | |

| Promotion | Get $30 eCapitavouchers when you apply for your first CIMB AWSM card and spend S$100. Valid till 1 Oct 2023. | |

| Sign Up Now | Apply Now | |

Did you know… AWSM stands for AWESOME?

But hey, the CIMB AWSM Card is really a pretty awesome card given that there’s no minimum income requirement for students!

NSFs can apply for this card too, we didn’t forget about you!

Similarly, if you are a working adult below the age of 29 and you’re unable to apply for the more popular credit cards due to your annual income, this will be helpful!

Whew, 1% cashback on the major categories that you’ll spend very often!

If you’re on a SIM Only plan, just take note that the current participating telcos are Singtel, M1, Starhub, Circles.Life and MyRepublic.

There are over 1,000 CIMB Deals & Discounts across dining, retail, and lifestyle outlets in Singapore, Malaysia, and Indonesia!

It might not look like much if you compare it to the best cashback cards, but hey, you’ll never have to pay an annual fee for this card!

Citi Clear Card

| Eligibility | Students |

| Nationality | Singapore Citizens, Permanent Residents, or Foreigners |

| Age | 18 & above |

| Schools | NTU, NUS, SMU, SIM, SUTD, SIT, SUSS, University of Chicago Booth School of Business, DigiPen, ESSEC, GIST-TUM Asia, INSEAD, S P Jain, Tisch, UNLV, Nanyang Polytechnic, Ngee Ann Polytechnic, Republic Polytechnic, Singapore Polytechnic, Temasek Polytechnic, LASALLE-SIA, NAFA, EDHEC-Risk Institute and Sorbonne-Assas International Law School |

| Minimum Annual Income Requirement | NIL

*Applicants under 21 years old require the consent of their Parent/Legal Guardian |

| Bank Status | Not an existing primary / basic Citi Credit Card / Citibank Ready Credit customers (supplementary Cardmembers are eligible) |

| Credit Limit | S$500 |

| Features | 1X ThankYou Point for every S$1 spent (0.4 mpd) |

| Min. Spend | NIL |

| Annual Fees | S$30.52 inclusive of 9% GST (First Year waived) |

| Min. Monthly Payment | Full payment of card balance specified in the statement of account |

| Best For | Online fashion, lifestyle, and travel exclusives |

The Citi Clear Card is probably the best card if you are concerned about the income requirement because there’s none, even for working adults!

Plus, if you’re not studying in mainstream educational institutions, don’t worry, Citi Clear Card is here for you.

You can start chasing miles with this card by earning a 1X ThankYou Point for every S$1 spent (0.4 mpd) across online fashion, lifestyle, and travel exclusives at your favourite online brands.

For a more detailed look at the qualifying spends, refer to the exclusions list of Merchant Category Codes.

Have fun spending and accumulating points for a good life!

DBS Live Fresh Student Card

| Eligibility | Students |

| Nationality | Singapore Citizen or Permanent Resident |

| Age | 21 – 27 years old |

| Schools | National University of Singapore (NUS), Nanyang Technological University (NTU), Singapore Management University (SMU), Singapore Institute of Management (SIM), Singapore University of Technology and Design (SUTD), Singapore Institute of Technology (SIT), Singapore University of Social Sciences (SUSS), Nanyang Polytechnic (NYP), Ngee Ann Polytechnic (NP), Temasek Polytechnic (TP), Singapore Polytechnic (SP) or Republic Polytechnic (RP) |

| Minimum Annual Income Requirement | NIL |

| Bank Status | Not have an existing DBS/POSB Credit Card and/or other unsecured facilities with DBS/POSB |

| Credit Limit | $500 |

| Features | S$15 on eligible Merchant Spend

S$15 on eligible Sustainable Spend S$20 on All Other Spend for each calendar month |

| Min. Spend | NIL |

| Annual Fees | S$196.20, first 5 years waived |

| Min. Monthly Payment | 3% of the statement balance (or S$50, whichever is greater) plus any amount that is overdue and/or exceeds your credit limit. |

| Best For | Spotify, Golden Village, McDonald’s/McDelivery, Netflix, Starbucks |

| Sign Up Now | – |

DBS Live Fresh Student is a card that most students are familiar with.

The card is known for its cashback as students can earn up to 5% from shopping PLUS an additional 5% green cashback when they use the card on selected eco-eateries, retailers, and transport services!

This means that you can easily earn the green cashback you’re using the card when taking public transport in Singapore.

Maybank eVibes Card

| Eligibility | |

| Nationality | Singapore Citizen or Permanent Resident |

| Age | 18 to 30 years old |

| Schools | LASALLE, NAFA, NIE, NP, NTU, NUS, NYP, RP, SIT, SMU, SP, SUSS, SUTD, TP & SIM |

| Minimum Annual Income Requirement | Must not be earning S$30,000 and above per annum |

| Bank Status | Not be an existing Maybank Principal Credit Cardmember or CreditAble customer |

| Credit limit | $500 |

| Features | 1% cashback on all eligible retail transactions |

| Min. Spend | NIL |

| Annual Fee | $5 quarterly service fee, first 2 years waived |

| Min. Monthly Payment | 3% of the statement balance (or S$50, whichever is greater) plus any amount that is overdue and/or exceeds your credit limit |

| Best For | All retail spending |

The Maybank eVibes Card is the credit card I wished I had when I was a student…

The number of educational institutions it covers is slightly fewer than the Citi Clear Card, but it’s still good for those not enrolled in local schools.

Hi, NSFs. This one is for you too!

The best part? The quarterly fee of $5 is soooooooo easy to waive, as long as you charge to the card every three months. Also, it’s automatically waived for the first two years.

This is another card that gives you 1% cashback and drumroll please, it’s on all retail spending!

Bonus: OCBC Frank Debit Card

Though OCBC Frank Debit Card is not a credit card, it’s worth mentioning as it’s targeted at students, full-time National Serviceman (NSFs) and non-full-time working adults.

| Eligibility | |

| Nationality |

Singapore Citizens, Permanent Residents, or Foreigners |

| Age |

16 – 25 years old |

| Schools | Not specified |

| Minimum Annual Income Requirement | NIL |

| Bank Status | New FRANK Debit Cardmember who has successfully signed up for a FRANK Debit Card |

| Credit limit | – |

| Features | 1% unlimited cash rebate on all eligible transactions: Selected online shopping, convenience stores, transport, drinking establishments, and eco-friendly merchants

1% bonus cashback at Apple & Samsung stores till 31 Oct 2023 |

| Min. Spend | $400 |

| Annual Fee | – |

| Min. Monthly Payment | – |

| Best For |

Online shopping: Taobao, SHEIN, Lazada Convenience stores: Cheers, 7-Eleven Transport: Comfort and CityCab, Go-Jek, Grab, Ta-da, SimplyGo, SBS Transit Drinking establishments: Zouk, Harry’s, Stickies, Cash Studio Eco-friendly merchants: BluSG, Scoop Wholefoods, Ugly Food & more |

OCBC Frank is another contender that frequents schools in Singapore.

The OCBC Frank Debit Card allows you to earn unlimited 1% cashback on selected online shopping, convenience stores, transport, drinking establishments, and eco-friendly merchants!

While most cards have a standard design, you can choose one design out of the 60 designs available!

Afterthoughts

Now that you’ve caught a glimpse of the #adulting life, spend wisely and pay your credit card bills on time!

Trust me, you’ll thank yourself for cultivating good financial habits from a young age.

Also, remember to check the terms and conditions for the cards as every bank will have exclusions for their cashback or rewards programme.

For any comments or queries regarding credit cards, hop over to Seedly Community to ask away!

Related Articles:

- Best Credit Cards For Petrol in Singapore (2023): Latest Petrol Prices & Discounts

- Best Credit Cards for Complimentary Airport Lounge Access

- Visa Credit Card Surcharge Fees in Singapore: Avoid These to Protect Your Hard Earned Money!

- Best Women’s Credit Card in Singapore 2022: UOB Lady’s Card, DBS Woman’s Card & More

- Only Want One Credit Card? Here Are The Ones That Cover The Most Categories!

Advertisement