I’m sure you’ve heard of people redeeming free flights. But how exactly do they do it?

By spending with miles credit cards and redeeming miles for flights!

But with a gazillion miles credit cards in Singapore, it’s extremely hard to suss out which cards you should sign up for.

Luckily, we’ve done the heavy lifting and sussed out the best miles credit cards in Singapore based on your spending habits.

Ready to earn miles and redeem some flight tickets? Read on!

Disclaimer: The cards listed in this article exclude corporate, private, premier, and invite-only credit cards. The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any investment product.

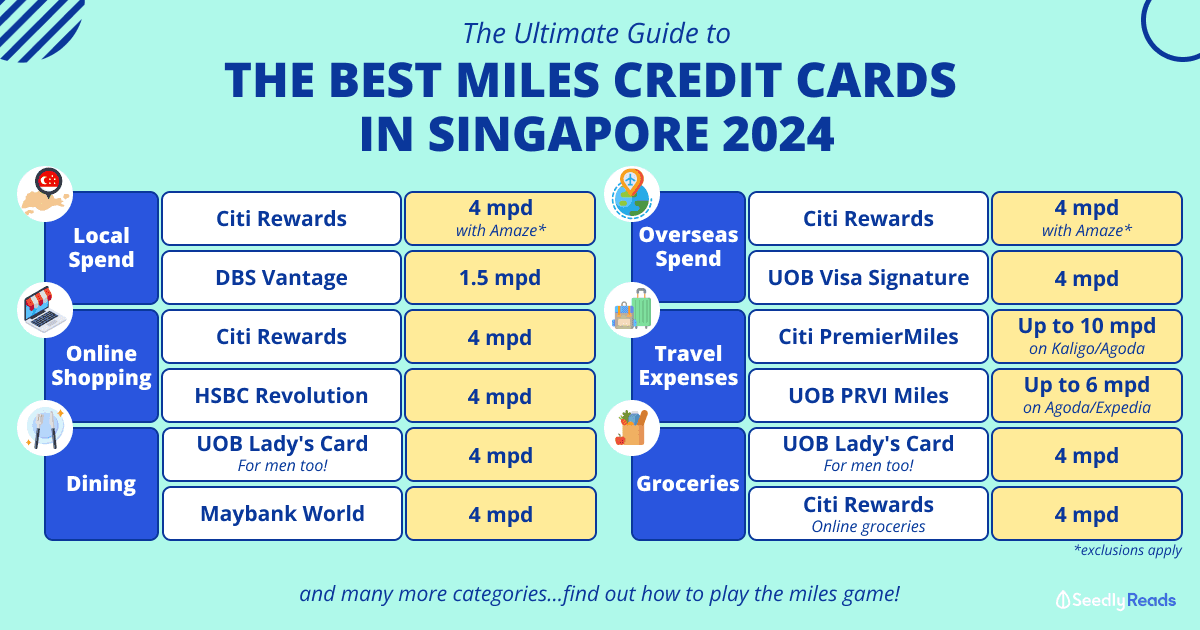

TL;DR: Best Air Miles Credit Cards in Singapore (2024)

Updates

Nerf(s):

- HSBC Revolution: With effect from 15 July 2024, the following changes will be made to the HSBC Revolution Credit Card 10X Reward Points Programme. Contactless transactions will no longer be rewarded with 9X bonus reward points. You can still earn 1X base reward point on all eligible contactless transactions. Eligible transactions made in travel-related categories will be rewarded with 1X base reward point and 9X bonus reward points up until 31 December 2024.

If you are completely new to credit cards, take some time to read through the ultimate guide to credit cards before coming back to read this article as there are a few things that you need to take note of such as fees and the danger of credit card debt.

In This Article:

- Which Card Earns the Most Miles?

- How to Earn Miles?

- How Much Is 1 Krisflyer Mile Worth?

- Is It Worth It to Get a Miles Card?

- What If I Just Want One Miles Card?

Which Card Earns the Most Miles?

If I could recommend just one card that beats every other card, I would. Sad to say, there’s no such thing, and maximising your miles earnings highly depends on how you spend.

Thus, I’ve narrowed it down to the top cards based on the earn rate for each category! Do note that many of these miles earn rates are awarded via bonus miles. You may click on the card’s name for more details on the card and read reviews left by the Seedly community.

Jump to:

- Local/General Spending

- Overseas Spend

- Travel Expenses (Flight Tickets and Hotel Bookings)

- Online Shopping

- Shopping

- Dining

- Groceries

- Petrol

- Public Transport

- Mobile Payments

Best Miles Credit Cards for Local Spend/General Spending

| Credit Card | Earn Rate | Min. Annual Income |

|---|---|---|

| Citi Rewards Card Apply Now | 0.4 mpd / 4mpd with Amaze (Limit of S$1k per statement month, excluding airlines, hotels, car rental, cruises and other travel transactions) | $30k |

| DBS Vantage Visa Infinite Card Apply Now | 1.5 mpd | $120k |

| UOB PRVI Miles Mastercard Apply Now | 1.4 mpd | $30k |

| UOB PRVI Miles Visa Card Apply Now | 1.4 mpd | $30k |

| UOB PRVI Miles AMEX Apply Now | 1.4 mpd | $30k |

| UOB Visa Infinite Metal Card | 1.4 mpd | $150k |

| OCBC 90°N Mastercard Apply Now | 1.3 mpd | $30k |

| OCBC 90°N Visa Card Apply Now | 1.3 mpd | $30k |

| AMEX Singapore Airlines Solitaire PPS Credit Card | 1.3 mpd / 1.5 mpd above S$3.8k spend per month | $30k |

| AMEX Singapore Airlines PPS Club Credit Card | 1.3 mpd / 1.4 mpd above S$3.8k spend per month | $30k |

| DBS Altitude Visa Signature Card Apply Now | 1.3 mpd | $30k |

| DBS Altitude American Express Card Apply Now | 1.3 mpd | $30k |

| SC Visa Infinite Credit Card | 1 mpd / 1.4 mpd above S$2,000 spend per statement month | $30k |

Best Miles Credit Cards for General Overseas Spend

| Credit Card | Earn Rate | Min. Annual Income |

|---|---|---|

| Citi Rewards Card Apply Now | 0.4 mpd / 4mpd with Amaze (no foreign currency conversion fees!) (Limit of S$1k per statement month, excluding airlines, hotels, car rental, cruises and other travel transactions) | $30k |

| UOB Visa Signature | 4 mpd with $1k min. spend | $50k |

| SC Visa Infinite Credit Card | 1 mpd / 3 mpd with S$2k min. spend | $30k |

| SC Rewards+ Card Apply Now | 2.9 mpd (Limit of S$2.2k foreign currency spending per membership year) | $30k |

| Maybank Horizon Visa Signature Card Apply Now | 2.8 mpd | $30k |

| UOB PRVI Miles Mastercard Apply Now | 2.4 mpd | $30k |

| UOB PRVI Miles Visa Card Apply Now | 2.4 mpd | $30k |

| UOB PRVI Miles AMEX Apply Now | 2.4 mpd | $30k |

| HSBC TravelOne Card Apply Now | 2.4 mpd | $30k |

| UOB Visa Infinite Metal Card | 2.4 mpd | $150k |

When spending overseas with credit cards, do note that there are foreign currency conversion fees (usually 3% to 3.5%). There is a way to avoid this fee with the amaze card. There are also credit cards that give even more miles per dollar for specific categories when paired with amaze for overseas spending. Read more in this article:

Best Miles Credit Cards for Travel Expenses (Flight Tickets and Hotel Bookings)

| Credit Card | Earn Rate | Min. Annual Income |

|---|---|---|

| Citi PremierMiles Mastercard Apply Now | 10 mpd on hotel transactions at Kaligo (Valid till 31 December 2024) Up to 7 mpd on hotel transactions at Agoda (Valid for bookings made now till 31 December 2024 and for stays until 30 April 2025) | $30k |

| Citi PremierMiles Visa Card Apply Now | 10 mpd on hotel transactions at Kaligo (Valid till 31 December 2024) Up to 7 mpd on hotel transactions at Agoda (Valid for bookings made now till 31 December 2024 and for stays until 30 April 2025) | $30k |

| UOB PRVI Miles Mastercard Apply Now | 6 mpd on vacation rentals and hotels worldwide via Agoda (Valid till 31 Dec 2024) 6 mpd on accommodations, flight, car rentals and activities worldwide via Expedia (Valid till 30 Apr 2024) | $30k |

| UOB PRVI Miles Visa Card Apply Now | 6 mpd on vacation rentals and hotels worldwide via Agoda (Valid till 31 Dec 2024) 6 mpd on accommodations, flight, car rentals and activities worldwide via Expedia (Valid till 30 Apr 2024) | $30k |

| UOB PRVI Miles AMEX Apply Now | 6 mpd on vacation rentals and hotels worldwide via Agoda (Valid till 31 Dec 2024) 6 mpd on accommodations, flight, car rentals and activities worldwide via Expedia (Valid till 30 Apr 2024) | $30k |

| DBS Altitude Visa Signature Card Apply Now | 4.3 mpd on hotel transactions on Agoda (Valid till 30 Jun 2024) | $30k |

| DBS Altitude American Express Card Apply Now | 4.3 mpd on hotel transactions on Agoda (Valid till 30 Jun 2024) | $30k |

| UOB Lady's Card Apply Now | 4 mpd (up to 10 mpd when you save with UOB Lady's Savings Account. Travel must be chosen as a preferred category, capped at S$1k per month) | $30k |

| UOB Lady's Solitaire | 4 mpd (up to 10 mpd when you save with UOB Lady's Savings Account. Travel must be chosen as a preferred category, capped at S$2k per month) | $120k |

| HSBC Revolution Apply Now | 4 mpd on online transactions (Limit $1K per month, excluding MCC 4722 (Travel Agencies and Tour Operators) and 7011 (Lodging – Hotels, Motels, Resorts, Central Reservation Services)) | $30k |

| DBS Woman’s World Card Apply Now | 4 mpd (Limit S$1.5k per month) | $50k |

Best Miles Credit Cards for Online Shopping

| Credit Card | Earn Rate | Min. Annual Income |

|---|---|---|

| OCBC Rewards Card Apply Now | 4 mpd on online and retail purchases (Limit S$1,110 per calendar month) | $30k |

| UOB Preferred Platinum Visa Card | 4 mpd on online shopping and entertainment (Limit S$1.1K per month) | $30k |

| HSBC Revolution Apply Now | 4 mpd on online transactions (Limit S$1K per month) | $30k |

| Citi Rewards Card Apply Now | 4 mpd on online transactions (Limit S$1k per statement month) | $30k |

| DBS Woman’s World Card Apply Now | 4 mpd on online purchases (Limit S$1.5k per month) | $80k |

Back to top

Best Miles Credit Cards for Shopping

| Credit Card | Earn Rate | Min. Annual Income |

|---|---|---|

| AMEX Platinum Charge Card Apply Now | 7.8 mpd (On the first $16K spent per year at 10XCELERATOR merchants, 3.9 mpd thereafter) | $30k |

| UOB Lady's Card Apply Now | 6 mpd (Fashion must be chosen as a preferred category, capped at $1k per month) | $30k |

| UOB Lady's Solitaire | 6 mpd (Fashion must be chosen as a preferred category, capped at $3k per month) | $120k |

| OCBC Titanium Rewards Card Apply Now | 4 mpd on retail purchases (Limit $1,100 per calendar month) | $30k |

| HSBC Revolution Apply Now | 4 mpd on contactless spending and online transactions (Limit $1K per month) | $30k |

| Citi Rewards Card Apply Now | 4 mpd on online transactions (Limit $1k per statement month) | $30k |

Best Miles Credit Cards for Dining

| Credit Card | Earn Rate | Min. Annual Income |

|---|---|---|

| UOB Lady's Card Apply Now | 4 mpd (up to 10 mpd when you save with UOB Lady's Savings Account. Dining must be chosen as a preferred category, capped at S$1k per month) | $30k |

| UOB Lady's Solitaire | 4 mpd ((up to 10 mpd when you save with UOB Lady's Savings Account. Dining must be chosen as a preferred category, capped at S$2k per month) | $120k |

| Maybank World Mastercard Apply Now | 4 mpd on selected merchants via TREATS SG app | $80k |

| SC Smart Credit Card Apply Now | 5.6 mpd on fast food | $30k |

Best Miles Credit Cards for Groceries

| Credit Card | Earn Rate | Min. Annual Income |

|---|---|---|

| UOB Lady's Card Apply Now | 4 mpd (Family must be selected as preferred category. Not applicable for Cold Storage, Giant, Jasons and Market Place. Capped at S$1k per month) | $30k |

| UOB Lady's Solitaire Card | 4 mpd on two of seven preferred categories (Family must be selected as preferred category. Not applicable for Cold Storage, Giant, Jasons and Market Place. Capped at S$2k per month) | $120k |

| Citi Rewards Card Apply Now | 4 mpd on online groceries (Limit S$1k per statement month) | $30k |

| UOB Preferred Platinum Visa Card | 4 mpd (online or in-store mobile payment. Limit S$1.1k per month) | $30k |

| DBS Woman’s World Card Apply Now | 4 mpd (Limit S$1.5k per month) | $50k |

| UOB Visa Signature Card | 4 mpd (in-store contactless payment. Min. S$1k, Max S$2k per statement month) | $50k |

| SC Journey Credit Card Apply Now | 3 mpd on online groceries (Limit S$1k per statement month) | $30k |

Best Miles Credit Cards for Petrol

| Credit Card | Earn Rate | Min. Annual Income |

|---|---|---|

| UOB Lady's Card Apply Now | 4 mpd (Transport must be selected as preferred category, capped at S$1k per month) | $30k |

| UOB Lady's Solitaire | 4 mpd (Transport must be selected as preferred category, capped at S$2k per month) | $120k |

| UOB Visa Signature Card | 4 mpd on petrol (except at Shell, SPC. Minimum S$1k local spend and S$1k overseas spend) | $50k |

| Maybank World Mastercard Apply Now | 4 mpd on petrol | $80k |

Best Miles Credit Cards for Public Transport

| Credit Card | Earn Rate | Min. Annual Income |

|---|---|---|

| Standard Chartered Smart Credit Card Apply Now | 5.6 mpd on public transport | $30k |

| UOB Lady's Card Apply Now | 4 mpd (Transport must be selected as preferred category, capped at S$1k per month) | $30k |

| UOB Lady's Solitaire Card | 4 mpd on two of seven preferred categories (capped at S$2k per month) | $120k |

| KrisFlyer UOB Credit Card Apply Now | 3 mpd on everyday spend categories with min. S$800 annual spend on KrisShop and Singapore Airlines Group | $30k |

Best Miles Credit Cards for Mobile Payments

| Credit Card | Earn Rate | Min. Annual Income |

|---|---|---|

| UOB Preferred Platinum Visa Card | 4 mpd on contactless spending (Limit $1.1K per month) | $30k |

| UOB Visa Signature Card | 4 mpd on contactless spending (Limit S$2K per statement month) | $50k |

Make Use Of SeedlyReviews To Further Narrow Down Your Choices

Alternatively, head over to SeedlyReviews and use the filters to further narrow down your card choices!

You can make use of the filters “card types” to find the best miles credit cards for your spending habits.

Read More

- 8 Best Travel Credit Cards to Book Flight Tickets and Hotels With

- Best Credit Cards for Complimentary Airport Lounge Access

- Best Credit Cards For Transport

How to Earn Miles?

Now that you have a rough idea of the best miles cards to use, there are a few things to take note when earning miles.

Firstly, you will need to be aware of what constitutes eligible spending. These can be found under the terms and conditions of your particular card.

Secondly, most cards except for KrisFlyer cards do not earn miles directly. Instead, they earn bank points which you can then convert to miles. Depending on the card and bank, you may also encounter conversion fees which range from $20 to $30 for a one-time conversion or a $40 to $50 a year option.

How Much Is 1 Krisflyer Mile Worth?

The short answer: a mile has an average value of 1.4 cents to 1.8 cents depending on who you ask.

The long answer? It really depends on you!

The value of a mile can vary greatly based on how you acquire your miles (purchasing outright) and what you redeem your miles for. We will use the KrisFlyer programme as it is the most common among Singaporeans.

If you choose to purchase miles, you can get them for about 1 cent per mile (cpm) to 2 cpm on average.

As for redemption, the value of a mile varies greatly depending on what you redeem it for. Here’s an example:

| London | Economy | Premium Economy | Business | Suites/First |

|---|---|---|---|---|

| Base Fare | $800.30 | $2,211.30 | $6,622.30 | $12,046.30 |

| Miles required to fully redeem flight | 42,000 | 71,000 | 103,500 | 141,000 |

| Value per mile (rounded to 3 d.p.) | 1.905 cents | 3.114 cents | 6.398 cents | 8.543 cents |

Based on a one-way ticket for 18 Oct 2022 and using the cheapest fares available.

As you can see, it becomes much more worth it when you use more miles to redeem upper-class flights.

If you’re unable to accumulate as many miles, you can opt to offset your flight ticket cost with miles (1.02 cpm) or redeem them for items (1.02 cpm or worse).

Things to Note About Earning Air Miles

Aside from air miles earn rates, you’ll also need to consider miles conversion fees and the number of transfer partners available.

Previously, Citibank held the crown for most transfer partners with 10 airlines and 1 hotel, plus a $25 one-time conversion fee.

That is up until recently when HSBC introduced its HSBC TravelOne Card with 9 airlines and 3 hotel partners. By the end of 2023, HSBC is expected to expand it to more than 20 partners!

Is It Worth It to Get a Miles Card?

The answer to this question depends as well.

Are you a frequent flyer or a high spender? If so, you should seriously consider getting a miles card to maximise your spending.

But for those of us who don’t fly as much and are more value-oriented, a cashback or rewards credit card is a better way to go.

The reason is that accumulating miles is a long and tedious process and if we were to look at the opportunity cost of using a miles card instead of a cashback card, most infrequent flyers would be better off with a cashback card in terms of value and flexibility (you can use cash for anything but only miles for flights/terrible redemption rates for items).

What If I Just Want One Miles Card?

With so many freaking categories to take note of, you may be quite overwhelmed. If you prefer a more fuss-free all-in-one miles card, here’s our pick:

Related Articles

- The Noob AF Guide: How to Apply for Credit Cards in Singapore

- A Step-by-Step Guide to Maximising Your Credit Card Usage

- How to Find Merchant Category Codes (MCC) in Singapore For Credit Card Users

- The Ultimate Guide to Waiving Credit Card Annual Fees

- Best Credit Card in Singapore

- Compare Travel Insurance in Singapore

Advertisement