I recently reviewed my parent’s finances as part of their year-end finances review.

This led us to look through the CPF Retirement Schemes.

We were considering the options between the different retirement sums.

And we came across the current retirement sum figures which looked like this…

| Retirement Sums for Members Reaching Age 55 In The Respective Years | ||||

|---|---|---|---|---|

| 55th Birthday In | 2024 | 2025 | 2026 | 2027 |

| Basic Retirement Sum (BRS) | $102,900 | $106,500 | $110,200 | $114,100 |

| Full Retirement Sum (FRS) | $205,800 | $213,000 | $220,400 | $228,200 |

| Enhanced Retirement Sum (ERS) | $308,700 | $426,000 | $440,800 | $456,400 |

Note: From 2025, the ERS will be raised to 4 times the BRS to provide members with an option to voluntarily top up more to their RA in order to receive even higher monthly payouts in retirement.

I can’t help but wonder how much CPF savings I would need when I turn 55 years old.

TL;DR: How Much Do You Need in Your CPF When You Turn 55 Years Old?

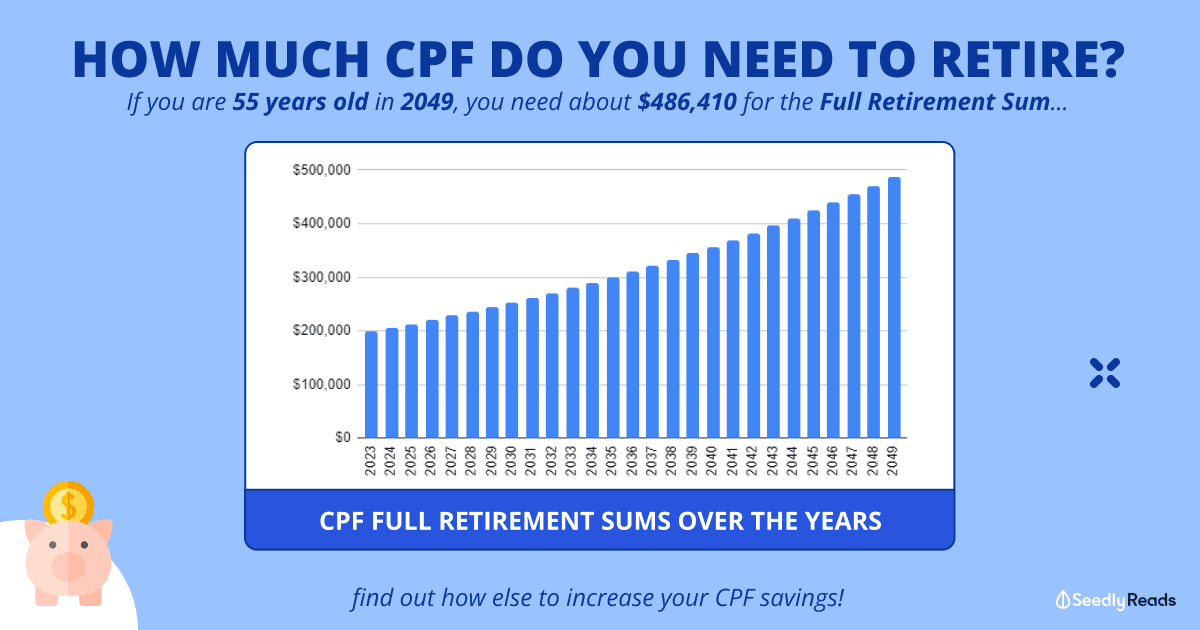

Long story short, as a 30-year-old in 2024, you need about $486,410 for the Full Retirement Sum (FRS) before you can withdraw the excess money.

Or about $243,205 for the Basic Retirement Sum (BRS) if you own a property in Singapore before withdrawing from your Retirement Account (RA) savings.

In this article:

- Introduction to CPF retirement sums

- Three types of CPF retirement sums – Basic, Full, and Enhanced Retirement Sum

- What else can you do to increase your CPF monies?

How Has the CPF Retirement Sums Increased Over the Years?

The Minimum Sum Scheme (MSS) was first introduced in 1987 to ensure that Singaporeans would not squander their savings and would still have money for their retirement.

This scheme specified a minimum amount in the CPF account when members reached their retirement age.

Back then, the minimum sum required was $30,000, and monthly payouts were around $230 once the member turned 60 years old and would last for about 20 years.

Due to longer life expectancy these days, the old MSS has been replaced by CPF LIFE to cater to these retirement needs.

Here’s a quick overview of how the minimum sum has changed over the years:

| Year | Retirement Sum |

|---|---|

| 1986 | Minimum sum scheme announced by Lee Yoke Suan |

| 1987 | $30,000 - could be fully covered by a property pledge |

| 1989 | $30,900 - minimum sum starts to be adjusted yearly for inflation (Minister Lee Yoke Suan, in reply to MP Charles Chong) |

| 1994 | Minister Lee Boon Yang announces changes to CPF, Minimum Sum to be raised to $40,000 in 1995 and by $5000 each year up to $80,000 in 2003. After 2003, increase will be pegged to inflation). |

| 1995 | $40,000 - Now only 50% can be covered by property pledge (announced in 1994, Lee Boon Yang) |

| 1996 | $45,000 |

| 1997 | $50,000 |

| 1998 | $55,000 |

| 1999 | $60,000 |

| 2000 | $65,000 |

| 2001 | $70,000 |

| 2002 | $75,000 (Minister Lee Hsien Loong announces that Minimum Sum will be raised beyond 80k in 2004, by an amount yet to be decided) |

| 2003 | $80,000 |

| 2004 | $84,500 (+$4,500) |

| 2005 | $90,000 (+$5,500) |

| 2006 | $94,600 (+$4,600) |

| 2007 | $99,600 (+$5,000) |

| 2008 | $106,000 (+$6,400) |

| 2009 | $117,000 (+$11,000) |

| 2010 | $123,000 (+$6,000) |

| 2011 | $131,000 (+$8,000) |

| 2012 | $139,000 (+$8,000) |

| 2013 | $148,000 (+$9,000) |

| 2014 | $155,000 (+$7,000) |

| 2015 | $161,000 (+$6,000) |

| 2016 | $161,000 (no change because date of change of minimum sum changed from July to January) |

Note: For 2017 and beyond, see the full table of CPF sums below.

The payout eligibility age was also adjusted over the years given the increase in life expectancy too.

| 1987 | Monthly payouts can start from 60 |

|---|---|

| 1999 | raised to 62 |

| 2012 | raised to 63 |

| 2015 | raised to 64 |

| 2018 | raised to 65 |

From Jan 2018, CPF members could ‘opt-in’ for retirement payouts to begin at 65.

If there were no applications submitted, members would receive payouts at 70 years old instead.

If a later payout age is chosen (e.g. at 70 years old), these CPF savings will continue to enjoy 6% per annum interest in the account.

Read more:

- Ultimate Guide to CPF Interest Rates: Latest Rates, Calculation Methodology & Additional CPF Interest Explained

- Have You Started Your Retirement Planning? 54% Of Middle-Aged Singaporeans Have Not

- Guide to CPF LIFE: Plans, Payouts, and What Happens to My CPF When I Die?

CPF Retirement Sums: BRS, FRS & ERS

One of the confusing aspects of the CPF system is that there are three different types of CPF retirement sums, namely: Basic, Full, and Enhanced Retirement Sums.

When you turn 55, you’ll receive a set of documents and forms regarding CPF, and you’ll need to indicate if you’d like to set aside the Basic, Full, or Enhanced Retirement Sum.

| CPF Retirement Sums | Basic Retirement Sum (BRS) | Full Retirement Sum (FRS) | Enhanced Retirement Sum (ERS) |

|---|---|---|---|

| What Is It | The monthly payouts in retirement that cover basic living expenses | The maximum amount that would be transferred to your Retirement Account at age 55 and the maximum we can top up our Special Account before the age of 55 | The upper limit of what we can top up our Retirement Account (RA) and the upper limit of our CPF Life payouts |

| How Does It Work | If you own a property in Singapore with a remaining lease that can last you to at least 95 years old, you can set aside the BRS in your Retirement Account and withdraw the excess amount of the BRS by using your property (pledging your property) | If you don't own a property, or wish to receive the full monthly payouts, you can set aside the FRS | Can only top-up the ERS after you turn 55 |

| Notes | BRS is half of FRS and your monthly payout will be halved as a result. If the property is co-owned, you can only pledge as much as your share of the house. Since the goal of the property pledge is to ensure that your assets will enable you to pay the Full Retirement Sum, your part of the pledged property must be worth at least $99,400 in 2023 | Once you have met the FRS, you can withdraw more than $5,000 from your CPF at 55 years old, and withdraw any amount that is above the FRS | Putting the monies into our RA to meet the ERS has its merits |

If you choose the Basic Retirement Sum (BRS), you’ll need to pledge a property you own or have sufficient property charge.

Don’t worry, when you pledge your property, the ownership is unaffected, and you can continue to sell or rent out your house as usual.

The only thing that happens is that, if you sell the asset, the pledged sum will be returned to your CPF account along with the CPF monies, its accrued interest that was used to pay for the property.

During Budget 2022, it was also announced that the BRS will be raised by 3.5% per annum from 2023 to 2027 to combat inflation and rising costs.

For the uninitiated, the Full Retirement Sum (FRS) is set at two times the BRS.

And the Enhanced Retirement Sum (ERS) is three times the BRS.

Based on a projected 3.5% year-on-year increase, here’s how much we might need in our CPF accounts before we can withdraw the excess funds when we turn 55.

Do bear in mind that the projection might change depending on the economic conditions.

| 55th Birthday in | Basic Retirement Sum (BRS) | Percentage Increase From Previous Year | Full Retirement Sum (2 x BRS) | Enhanced Retirement Sum (3 x BRS till 2024, 4 x BRS from 2025) |

|---|---|---|---|---|

| 2017 | $83,000 | 3.11% | $166,000 | $249,000 |

| 2018 | $85,500 | 3.01% | $171,000 | $256,500 |

| 2019 | $88,000 | 2.92% | $176,000 | $264,000 |

| 2020 | $90,500 | 2.84% | $181,000 | $271,500 |

| 2021 | $93,000 | 2.76% | $186,000 | $279,000 |

| 2022 | $96,000 | 3.22% | $192,000 | $288,000 |

| 2023 | $99,400 | 3.52% | $198,800 | $298,200 |

| 2024 | $102,900 | 3.50% | $205,800 | $308,700 |

| 2025 | $106,500 | Projected 3.5% increase p.a. | $213,000 | $426,000 |

| 2026 | $110,200 | $220,400 | $440,800 | |

| 2027 | $114,100 | $228,200 | $456,400 | |

| 2028 | $118,094 | $236,188 | $472,376 | |

| 2029 | $122,227 | $244,454 | $488,908 | |

| 2030 | $126,505 | $253,010 | $506,020 | |

| 2031 | $130,932 | $261,864 | $523,728 | |

| 2032 | $135,515 | $271,030 | $542,060 | |

| 2033 | $140,258 | $280,516 | $561,032 | |

| 2034 | $145,167 | $290,334 | $580,668 | |

| 2035 | $150,248 | $300,496 | $600,992 | |

| 2036 | $155,507 | $311,014 | $622,028 | |

| 2037 | $160,949 | $321,898 | $643,796 | |

| 2038 | $166,583 | $333,166 | $666,332 | |

| 2039 | $172,413 | $344,826 | $689,652 | |

| 2040 | $178,447 | $356,894 | $713,788 | |

| 2041 | $184,693 | $369,386 | $738,772 | |

| 2042 | $191,157 | $382,314 | $764,628 | |

| 2043 | $197,848 | $395,696 | $791,392 | |

| 2044 | $204,772 | $409,544 | $819,088 | |

| 2045 | $211,940 | $423,880 | $847,760 | |

| 2046 | $219,357 | $438,714 | $877,428 | |

| 2047 | $227,035 | $454,070 | $908,140 | |

| 2048 | $234,981 | $469,962 | $939,924 | |

| 2049 | $243,205 | $486,410 | $972,820 |

This means that if you were 30 years old in 2024, you would need approximately $486,410 to hit the FRS.

Things to Do to Increase Your CPF Savings

Now, this sum doesn’t seem small at all.

It’s almost half a million.

What happens if I do not meet the BRS when I turn 55?

You do not have to top up your CPF accounts with cash or sell your property. However, you will have lower CPF Life payouts as the premium used to buy the annuity will be smaller.

While it seems like a lot of money now, fret not.

If you can start early and maximise your CPF account at an earlier stage, this amount can be attained through compound interest.

Retirement Sum Topping-up Scheme

While our CPF accounts are outstanding as a part of our retirement nest egg, I personally would not prefer solely depending on it as my retirement fund.

With the intimidating amounts required for retirement and the rising living costs, it’s always good to have more as our retirement buffer.

Especially if you would like to look into early retirement and how we could only start withdrawing it as a monthly payout from 65 years old onwards.

Since CPF is an involuntary savings scheme that would provide us with our basic retirement income, I would still aim to maximise it to form my retirement safety net.

Read more

Investing Your CPF Funds

Meanwhile, I would aim to increase my income streams and focus on other areas like investing and growing my own savings.

There are also low-risk investment options such as Treasury Bills and Fixed Deposits.

Alternatively, you can invest in a wide range of investment products using your Ordinary Account (OA) and Special Account (SA) savings under the Central Provident Fund (CPF) Investment Scheme (CPFIS).

Read more

- CPF Investment Scheme (CPFIS): Should You Invest Your CPF Money?

- Should You Use Your CPF Funds to Buy T-Bills or Fixed Deposits

Are You Ready For Retirement?

You’re not alone when learning the ropes of CPF.

There are too many terms and processes to understand, so why not learn from the real pros?

Related Articles:

- A Self-Employed Individuals’ Guide To CPF Contributions

- Gig Workers, You Will Have to Make CPF Contributions From 2024

- CPF Basic Healthcare Sum (BHS) 2023 Guide

- CPF Contribution Rates: All You Need To Know About the Latest Rates & Contribution Caps

- CPF Matched Retirement Savings Scheme (MRSS): Get Dollar-To-Dollar Matching for Cash Top-Ups

Advertisement