It’s that time of the year again!

No, not the time of the year when you are looking forward to Christmas and holidays with your family.

It’s a different type of present in the form of tax relief from the government!

While tax season isn’t here yet, you need to know how much income tax you need to pay and start preparing for the assessment period in the Year of Assessment (YA) 2025. Year of Assessment 2025 is for income earned from 1 Jan 2024 to 31 Dec 2024.

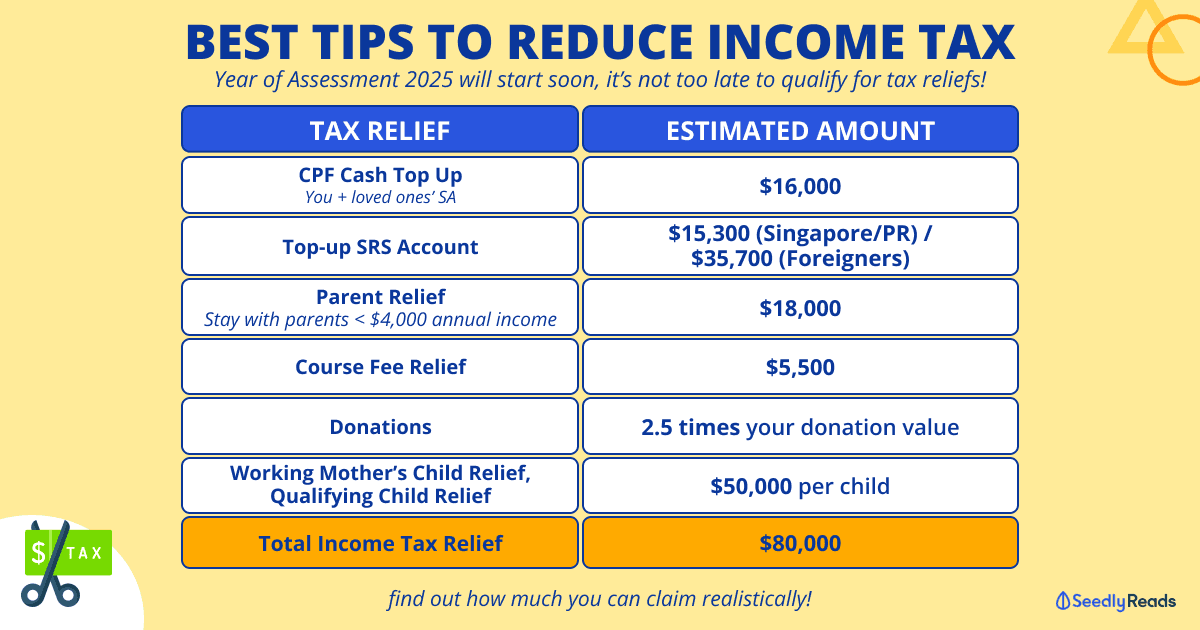

Here are the top seven ways you can use to reduce your income taxes as much as possible!

TL;DR: How to Reduce Income Tax in Singapore

There are various schemes aimed at reducing your income tax in Singapore.

Note: Year of Assessment (YA) 2024 is over, you should be looking to reduce your taxable income for Year of Assessment (YA) 2025.

Click here to jump:

- How much tax relief can you expect?

- Deadline for tax relief applications for YA 2025

- Tips to reduce personal income tax in Singapore

What’s The Maximum Tax Relief You Can Get?

First and foremost, I feel obliged to tell you that we’ve written a detailed guide for the Year of Assessment (YA) 2024 and all you need to know about paying income tax in Singapore.

If you want to know exactly how much income you have to pay…

You can use the IRAS Personal Tax Calculator to find out! But to give you an overview of how much you will need to pay from YA 2024 onwards…

But keep in mind that the income tax relief is capped at $80,000!

Singapore Tax Resident Tax Rates From YA 2024 Onwards

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

|---|---|---|

| First $20,000 Next $10,000 | 0 2 | 0 200 |

| First $30,000 Next $10,000 | -3.5 | 200 350 |

| First $40,000 Next $40,000 | -7 | 550 2,800 |

| First $80,000 Next $40,000 | -11.5 | 3,350 4,600 |

| First $120,000 Next $40,000 | -15 | 7,950 6,000 |

| First $160,000 Next $40,000 | -18 | 13,950 7,200 |

| First $200,000 Next $40,000 | -19 | 21,150 7,600 |

| First $240,000 Next $40,000 | -19.5 | 28,750 7,800 |

| First $280,000 Next $40,000 | -20 | 36,550 8,000 |

| First $320,000 Next $180,000 | -22 | 44,550 39,600 |

| First $500,000 Next $500,000 | -23 | 84,150 115,000 |

| First $1,000,000 In excess of $1,000,000 | -24 | 199,150 |

As you can tell, the tax rate for high-income individuals will increase to make Singapore’s individual income tax regime more progressive from YA 2024.

Tax Relief Applications for YA 2025

Keep in mind that the tips below are for tax deductions applicable to YA 2025.

Start early so that you can save more on taxes!

Also, you will receive the notification to file your taxes somewhere between February to March each year, and you will be able to file between March and April.

As you’re filing or declaring your taxes, you will see menu buttons below that allow you to add the reliefs you intend to claim.

Tip 1: Top Up Your Supplementary Retirement Scheme (SRS) Account

Planning for your retirement?

If you are not, then it’s time you should be. Open up an SRS account and start saving for your retirement now!

Fun fact, you can contribute up to $15,300 to your SRS account yearly and the best part, the amount contributed can be deducted from your taxable income.

Saving for retirement and reducing taxes, I see it as a win-win for us.

Find out how you can lock in your retirement age at 63 with as little as $1 now!

Tip 2: Top Up Your Central Provident Fund (CPF) Special Account

On the topic of planning for retirement, the government has initiatives such as CPF in place to ensure that we have money to spend when we’re old.

As a matter of fact, since 1 Jan 2022, you can receive up to $8,000 of tax relief depending on the amount of money you top up into your CPF special account! (read here: changes to CPF rules in 2022)

Remember the old adage, “Sharing is caring”?

Show your family members you care when you top up money into their CPF special accounts, and they can also receive up to a maximum of $8,000 in tax relief. This brings the total tax relief to up to $16,000!

Note: Individuals may continue to enjoy tax relief of up to $16,000 (maximum $8,000 for self and maximum $8,000 for family members) a year for eligible CPF cash top-ups that do not attract MRSS grants.

However, you must remember that the money you top up into your CPF can only be withdrawn when you’re 65 years old, so don’t get too carried away trying to reduce your income tax.

Always ensure you have some cash in case of emergencies!

I know I’ve mentioned opening an SRS account in Tip 1, but all of us only have that much disposable income to put aside, right?

If you’re wondering whether you should go with SRS or CPF top-up, the short answer is you can save more on tax every year with a higher contribution amount compared to topping up your CPF SA, i.e. reducing your taxable income by up to $15,300 every year for Singaporeans and $35,700 a year for foreigners.

The caveat is that you get 0.05% p.a. like a regular bank savings account, instead of a 4% p.a. guaranteed by the Singapore government.

So here’s a detailed comparison between the two accounts:

Tip 3: Claim Your WFH Expenses Under Employment Expenses

While COVID-19 is a thing of the past now, most of us continue our Work-From-Home (WFH) arrangement.

Even as I am typing out this article, I am sitting comfortably at home instead of being in the office.

Unfortunately, this comfort doesn’t come for free. I got a huge shock when I received my electricity bills last month, and I couldn’t believe how much higher they had gotten compared to when I was still studying.

But what if I told you, the increase in expenses, such as electricity bills, telecommunication bills, and wifi bills, are all eligible for a tax deduction?

However, do take note that these expenses do not account for personal usage, installation costs, or the costs of purchasing furniture, computers, etc.

What you need to do is calculate the difference between the period when you were not working from home and the period you were.

If you’re looking for a detailed illustration of how to calculate, IRAS has an FAQ section that addresses these questions.

Tip 4: Donations Through Money, Artefacts, Shares

Time to do something nice for the people in need!

I don’t know about you, but giving back to the community feels good. It’s a good reminder that we are doing well and can give back.

Just like Uncle Ben always said, “With great power comes great responsibility.”

But you know what feels even better? Knowing that as an additional incentive to donate to the Donations to Institutions of a Public Character (IPC) – for every $1 you donate, $2.5 will be deducted from your taxable income, and that’s 2.5 times the donation value!

Of course, make sure you donate within your means. After all, if you can’t help yourself, how can you help others, don’t feel pressured to donate if you’re not financially able to.

Tip 5: Parent Relief & Grandparent Caregiver Relief

Sometimes, staying with your parents is such a fantastic thing, don’t you agree?

I get nice, warm meals from my mother, and whenever something breaks in the house, my father and I would help repair it together.

For those of you with children, don’t you feel a sense of relief knowing that your kids are safe at home with your parents taking care of them?

I’m not saying it doesn’t get frustrating with parents breathing down your neck constantly, but there are its benefits.

Did you know that you can claim Parent Relief for your income tax?

If you’re living in the same household with your parents who are above the age of 55 and have an annual income of less than $8,000, then I have some good news for you!

You will be eligible for a tax reduction of up to $9,000 per dependant staying with you (up to a maximum of two dependants).

Similarly, you can claim up to $3,000 Grandparent Caregiver Relief if your parents are no longer working in the previous assessment year, and are helping you to care for your children.

I guess that’s one more benefit of staying with your parents, time for a long-term family reunion!

Tip 6: Course Fee Relief – Upskill But Not Under SkillsFuture

Upskilling comes with many benefits and this includes tax relief!

The Course Fees Relief is designed for individuals who have pursued courses relevant to their current employment.

You can seek reimbursement for the amount spent on course and exam fees, which will be subtracted from your chargeable income. The maximum limit for Course Fee Relief is $5,500, irrespective of the number of courses and exams undertaken.

The caveat is that any amount paid or reimbursed by your employer or any other organisations (including the use of SkillsFuture Credit) cannot be claimed as Course Fees Relief.

Also, the course, seminar, or conference provider should be a Singapore-registered entity with the Accounting & Corporate Regulatory Authority (ACRA).

Tip 7: Get Married And Have More Kids – Qualifying Child Relief & Working Mother Child Relief

I know I know, as much as we know how expensive raising kids can be in Singapore, we can’t help but include this because the reliefs are substantial.

For starters, parents can already enjoy tax relief, and there are more when you’re a working mother:

| Type of Relief | Amount |

| Qualifying Child Relief / Handicapped Child Relief | $4,000 per child / $7,500 per handicapped child |

| Working Mother’s Child Relief | $8,000 for 1st child, $10,000 for 2nd child, $12,000 per child from 3rd child onwards |

But do note that there is a combined tax relief cap for Qualifying Child Relief and Working Mother’s Child Relief at $50,000 per child.

How Much Income Tax Reduction Can You Get For YA 2025?

Let’s be realistic, some of us are not going to fulfill all conditions for the tax relief.

If you’re single and are a caretaker for your parents with a projected take-home salary (excluding CPF contributions per month) of $70,000 this year… this is also your chargeable income BEFORE any tax reliefs.

So what do you do?

Do everything in your power to maximise the tax reliefs so that you can bring down your chargeable income.

| Tax Reliefs For Singles | Estimated Amount |

| Earned Income Relief (below 55 years old) | $1,000 |

| CPF Cash Top Up (your SA) | $8,000 |

| CPF Cash Top Up (your loved ones’ SA) | $8,000 |

| Top-up SRS Account | $10,000 |

| Parent Relief (one parent whose annual income is < $4,000, sharing with one sibling) | $4,500 |

| Donations of $500 to any registered IPC | $1,250 |

| Total Relief: | $32,750 |

| Total Chargable Income: | $70,000 – $32,750 = $37,250 |

| Tax Computation: | First $30,000: $200

Next $7,250 @ 2%: $253.75 Total: $453.75 |

From the table, you can tell that your total chargeable income will be $37,250.

And with the new rates starting from YA 2024, your total tax payable would be around $453.75, as compared to before your tax relief, and that is quite a lot.

And if you actually go for courses, this amount can be lowered further!

Need More Tips to Reduce Your Income Tax?

Don’t worry, here at Seedly, we do not support anything that goes against Singapore law. (We also want to siam fines, okay?)

But on to the main topic, these are some of the best tips to help you reduce your income taxes!

Still wanna stretch the tax relief out even further? Feel free to hop by Seedly’s community and post your questions there.

Our community members will be glad to share with you their tips and tricks for reducing income tax.

Still on the lookout for a new job or changing careers? Here are some tips for writing an amazing resume for your job search!

Happy holidays, and happy savings!

Related Articles:

Advertisement