How To Increase Your HDB BTO Ballot Chances: Application Rate & Priority Schemes Matter More Than You Think

Been applying for Housing Development Board’s (HDB) BTO flats but you’re always out of the queue?

I feel you, bruh.

Take the latest May 2022 HDB BTO Launch with 5,330 new units, almost everything was oversubscribed.

But, it’s not all too gloomy!

HDB just announced that more flats will be allocated to families and singles applying for the first time from the August 2022 HDB BTO launch!

So, it’s not too late to increase your chances of a successful HDB BTO ballot!

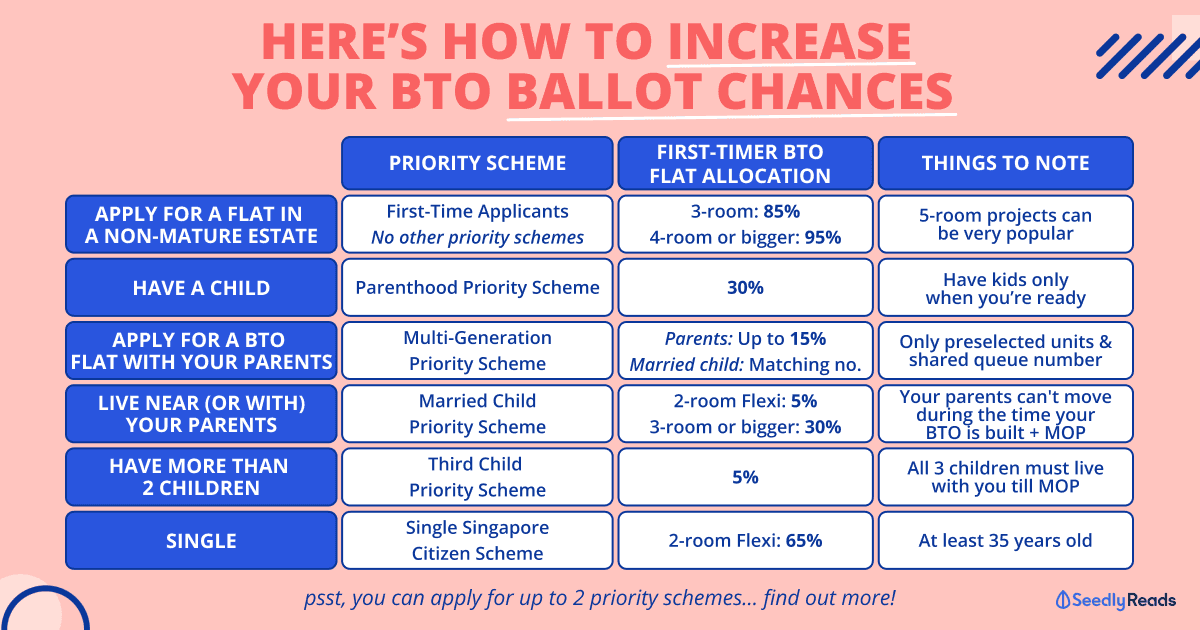

TL;DR: How To Improve My HDB BTO Ballot Chances

There are various HDB Priority Schemes to improve your BTO ballot chance.

Basically, if you’re an average, young, Singaporean couple or family looking to improve your BTO ballot chances. You may apply for up to 2 priority schemes if you are able to meet the eligibility conditions.

You’re not allowed to apply for two BTOs at the same time.

I’m gonna keep it real here so that you can make a proper and informed decision:

Ways to improve BTO ballot | Priority Scheme | HDB BTO Flat Allocation | Things to Note |

|---|---|---|---|

| Apply for a non-mature estate as First-Timer Applicants | First-timer Applicant with NO other priority schemes (note: Fiance-Fiancee scheme is technically not a priority scheme) | 85% (3-Room) 95% (4-Room and bigger) | Some non-mature estates (and flat types eg. 5-Room) can be pretty popular too |

| Have kids | Parenthood Priority Scheme (PPS) | 30% | Not a reason to have children especially if you are not financially or emotionally ready for the commitment |

| Apply for the same BTO and be neighbours with your parents | Multi-Generation Priority Scheme (MGPS) | Parents Up to 15% of 2-Room Flexi or 3-Room flats Married child Corresponding number of 2-Room Flexi or larger flats | Can only choose from preselected units which are spread across different blocks, and on both high and low floors Shared queue number so everything must be done together (eg. signing of option, lease agreement and etc.) |

| Live near (or with) your parents | Married Child Priority Scheme (MCPS) | First-timer families: 5% of 2-room Flexi 30% of 3-Room or bigger Second-timer families: 5% of 2-room Flexi and 3-room 3% of 4-Room or bigger | Your parents can't move for the time it takes for your BTO to be built + 5 years (until you reach MOP) For flats offered under the Prime Location Public Housing (PLH) model, the proportion of flats set aside for households applying for flats near their parents/ married children under the MCPS will be reviewed and adjusted depending on the location of the project. |

| Have more than 2 children | Third Child Priority Scheme (TCPS) | 5% | You must have at least 3 children to qualify and they all must continue living with you in the new flat (until you reach MOP) |

| For divorced or widowed persons with children | Assistance Scheme for Second-Timers (Divorced/ Widowed Parents) (ASSIST) | 5% (2-Room Flexi and 3-Room in non-mature estates) | Only applicable if your child is 18 years and below |

| For tenants of HDB rental flats wanting to purchase their own home | Tenants’ Priority Scheme (TPS) | 10% (2-Room Flexi and 3-Room) | Only applicable if you and your family have lived in an HDB public rental flat for at least 2 years If you choose a 4-Room flat or bigger, this scheme will not be applicable |

| For elderly | Senior Priority Scheme (SPS) | 40% (2-Room Flexi) | Your parents or married child must continue to live within 4km (until you reach MOP) or live with your parents/married child |

| For Singles | Single Singapore Citizen Scheme or Joint Singles Scheme | 65% (2-room Flexi) | You need to be at least 35 years old |

| For Unwed Singles with children | Single Singapore Citizen Scheme or Joint Singles Scheme | HDB will exercise flexibility in allowing unmarried parents aged 21 and above to buy up to a 3-room flat in a non-mature estate from HDB, or a resale flat. Those who cannot afford to buy a flat may be considered for public rental flats | You need to be at least 21 years old |

Click here to jump:

- What’s the balloting process, application rate and how does it work?

- How to increase my BTO balloting chances?

- What if I failed during my first attempt?

- What housing grants am I eligible for?

- What about Sales of Balance?

How Does the HDB BTO Application Ballot Work?

HDB manages HDB BTO applications through a computerised balloting system that randomly assigns you with a queue number.

You are then invited to book (or select) a flat based on the order of the queue number.

The smaller your queue number, the earlier you’re called up to book a flat.

And the earlier you can book a flat, it means the greater the selection of HDB units to choose from.

Oh, getting your queue number is only half the battle won…

BTO Application Rate

The application rate gives you an indication of the number of people vying for a unit.

To calculate, the formula is Application rate = Number of applications received / Number of units available

This largely depends on the demand and supply of flats, which just looking at past launches, demand mostly exceeds supply.

Just looking at Ang Mo Kio’s 5-room BTO launch in May 2022, the first-timer application rate was 21, and a 4-room BTO at Choa Chu Kang was 28.

If Your Queue Number is Within the Flat Supply of the BTO You Want

As long as the Ethnic Integration Policy (EIP) racial quota has not been met, you have a chance of securing a flat.

If Your Queue Number Exceeds the Flat Supply of the BTO You Want

You need to pray that enough people drop out and decide not to book a flat.

Maybe they’re picky and can’t get the high floor or unit they want when it gets to their turn to pick.

Or they changed their minds and would rather go for an HDB Resale flat instead.

Either way, the EIP racial quota will still apply.

So… How Do I Increase My HDB BTO Ballot Chances?

Since queue numbers are assigned randomly, there’s no way to get a better queue number.

However, HDB accords priority to first-timers as well as applicants under certain priority schemes by giving them more ballot chances.

For example, first-time applicants are given two ballot chances instead of one.

But if there’s an overwhelming demand for flats, even HDB cannot guarantee you’ll be successful.

If you’re suay and are unsuccessful for two or more BTO applications (as a first-timer) in non-mature estates.

You’ll get one additional chance for every subsequent BTO application in non-mature estates.

If you’re successful on the ballot and are invited to book a flat, don’t just reject it immediately if you see that your ‘ideal’ unit is taken.

For first-timers, rejecting two chances to book a flat means your first-timer priority will be suspended for one year.

FYI: you can still apply for an HDB BTO flat during that 1 year, you just don’t have your first-timer priority.

But if you reject another two more chances to select a flat within that year, your suspension will be extended for another year.

How To Improve My HDB BTO Ballot Chances

If you’re an average, young, Singaporean couple or family looking to improve your BTO ballot chances.

BUT before you decide to have children (or more children) or want to involve your parents in your application, take a minute to review your financial situation and consider the future implications of your decisions.

These schemes only improve your HDB BTO ballot chance…

1) Apply For a Non-Mature Estate

At the risk of sounding obvious, applying for a non-mature estate (read: not as popular) as compared to a mature estate should improve your HDB BTO ballot chance.

Yup, HDB has announced that at least 95% of four-room and larger flat supply in non-mature estates will be set aside for first-time family applicants. This is upped from 85% in previous launches!

For a three-room BTO flat, at least 85% of the quota will be set aside for these families, up from 70% now.

For first-time single applicants, the allocation of non-senior two-room flexi flats in non-mature estates will be upped from 50% to 65%.

However, it also depends on which non-mature estate are you applying to, and the flat type that is being offered.

2) Have Kids — Parenthood Priority Scheme (PPS)

If you’re expecting or already have a child, your application is prioritised because you obviously need the home more urgently.

That aside…

If you’re recently engaged or just married and haven’t decided what you would like to do in life as a couple…

The PPS is NOT a good reason to decide to have children just to improve your BTO ballot chances.

In fact, we’ve worked it out before that you’ll need something to the tune of $11,400 before having your first child!

So unless you’re financially and emotionally ready for the commitment.

Consider other options!

3) Apply For The Same BTO and Be Neighbours with Your Parents — Multi-Generation Priority Scheme (MGPS)

If your parents are also looking to BTO, then you can both apply to the same BTO project under the Multi-Generation Priority Scheme (MGPS) to increase your ballot chances.

What this means is that you’ll have to make a joint application for two separate flats. This essentially increases the ballot chances of both parties staying within the same precinct and even on the same floor!

Under the MGPS, your parents can only apply for a 2-Room Flexi or a 3-Room HDB BTO flat, while you can choose a 2-Room Flexi or bigger.

This means that the BTO project which both you and your parents decide on must have these unit types.

On top of that, MGPS applicants can only choose from preselected or preidentified units which might be spread across different blocks.

And are probably on both high as well as low floors.

This means that your choice of units will be further limited.

The fact that this is a joint application also means that you and your parents share a queue number.

So every step of the BTO process has to be done together (eg. signing of option, lease agreement and etc.).

In order to do that, you and your parents will need to coordinate closely and agree to be on the same schedule to make this work.

4) Live Near (Or With) Your Parents — Married Child Priority Scheme (MCPS)

Under the Married Child Priority Scheme (MCPS), you can either choose to live within 4km of your parents OR live with your parents.

Besides considering whether you (and your partner) can co-exist with your parents, or whether your parents even wanna live with you in the first place, there’s one key thing which you and your parents need to take note of.

Assuming you choose to live within 4km of your parents, they cannot relocate beyond this distance, for the time it takes for your BTO to be built. i.e., they still can move but must be within 4km of where you’ve applied.

Plus the five-year Minimum Occupation Period that you have to fulfil upon collecting the keys to your HDB BTO flat.

So… that’s anywhere between eight to 10 years (depending on how fast your flat is built).

The problem with this is that if your parents wish to downgrade their flat in order to fund their retirement…

Or they want to sell their flat and move to the Bahamas and enjoy their golden years.

They’re going to have to put that plan on hold for at least eight to 10 years.

5) Have More Than 2 Children — Third Child Priority Scheme (TCPS)

Read this carefully.

You need to have “more than two children”, meaning you must have at least three children to qualify for the Third Child Priority Scheme (TCPS).

Also, your three children must continue living with you for the entire five-year Minimum Occupation Period.

In addition, they must not:

- submit any application or be included as occupiers in an application to buy a flat from HDB, the open market, a DBSS flat, or an EC unit

- rent an HDB flat (including DBSS flat)

This is not really a problem if all of your kids are really young and rely on you for food, clothing, and shelter.

But if you have children who are ready to leave the nest, then this might be a problem.

What If I Qualify For the Parenthood Priority Scheme (PPS) Too?

If you qualify for both the Parenthood Priority Scheme (PPS) and the Third Child Priority Scheme (TCPS).

Your application will be balloted under the TCPS first.

If you’re unsuccessful, then it’ll be balloted again under the PPS.

6) Apply for a Place With Lower Median Application Rate

A lower median application rate simply means there’re lesser applications.

For example, if the application rate is 8 for a 4-room BTO flat, this means that there are 8 applicants vying for 1 unit in this project.

You can continue observing the rates until the last day before balloting for one, and this may improve your chances of securing a flat!

Additional HDB BTO Ballot Chances After Multiple Unsuccessful Attempts

If you’re damn suay and can’t seem to catch a break…

Don’t give up yet.

With each subsequent unsuccessful attempt (first timer and with two or more failed attempts), you will get one additional chance for an HDB BTO flat in a non-mature estate.

This is what I mean:

| Number of unsuccessful applications (for BTO in non-mature estates) | Total ballot chances accumulated as a first-timer applicant (for BTO in non-mature estates) |

|---|---|

| 0 to 1 | 2 |

| 2 | 3 |

| 3 | 4 |

| 4 | 5 |

Read that carefully, ya…

This is for non-mature estates only.

Note: An application is considered unsuccessful if you are not invited to book a flat, i.e. you did not receive a queue number, or the flats were all taken up before your queue number was due.

If you’re applying for super-hot mature estates like Bidadari, Bishan, Kallang, Geylang that kind…

You might wanna consider going the HDB Resale flat route instead.

Sales of Balance And Some Might Prefer This

Sales of Balance flats (SBF) are public housing flats that are under construction (i.e. BTOs), have been built and became leftovers, or repurchased flats by HDB.

Most couples opt for this became of these reasons:

- Shorter waiting time

- Budget constraints and resale flats are too expensive

- Lack of BTO choices that are near parents and SBF provides an opportunity as older flats might have been sold back to HDB

However, information regarding these flats is only made available during the launch itself, which is in May and November every year.

And, this also depends on your luck as you will need to ballot for it.

So, make sure to do your research before deciding on whether you want to get an SBF or BTO.

Check Out Housing Grants Before Applying

For first-timer applicants, you should be looking at these housing grants or Central Provident Fund (CPF) Housing Grant minimally:

- Enhanced CPF Housing Grant

- Enhanced CPF Housing Grant (Singles)

- Family Grant

- Proximity House Grant

Second-timer families with young children can access the Fresh Start Housing Grant and Step-Up CPF Housing Grant, and receive guidance from HDB’s Home Ownership Support Team, to help them own a flat.

For public rental households, those who are able and ready to move to homeownership will continue to enjoy priority under the Tenants’ Priority Scheme.

While you’re checking out the housing grants you’re eligible for, remember to also check if the house you’re applying for fits your budget.

After all, you don’t want to end up struggling with the mortgage.

With all that said, all the best to you!

Related Articles:

- The Ultimate Guide to the CPF Housing Grant for Executive Condos

- The Definitive Guide To The New Enhanced CPF Housing Grant

- Married To A Foreigner? You Can Get Up To $40,000 In Additional Housing Housing Grants Even At 21

- The Seedly HDB Grant Guide: A Complete Guide to CPF Housing Grants for HDB BTO, HDB SBF, and Resale Flats

- Things I Wished I Knew Before Buying My First BTO Flat

Advertisement