HDB Prime Location Public Housing (PLH) Model Explained: All You Need to Know

●

If you throw a stone in any direction in Singapore, there’s a high chance that you will hit someone who lives in a Housing and Development Board (HDB) flat as according to HDB, ~80 per cent of Singaporeans live in HDB flats, of which ~90 per cent own their own homes.

These high ownership numbers are a testament to Singapore’s public housing programme, which is powered by the values of affordability, accessibility and inclusivity.

But recently, we have seen an increase in the prices of public housing.

In addition, The Straits Times reported in September there has been a record-breaking 266 million-dollar HDB resale flats transactions in the first nine months of 2022, with many of the flats located in prime locations.

With that in mind, it is clear that if we leave things to market forces, it is more than likely that only those who are more affluent will be able to afford to buy a house in a prime location.

In a bid to reverse this, the Ministry of National Development (MND) and HDB have just announced details of the new Prime Location Public Housing (PLH) model.

This model was developed after consulting the public extensively through the gathering of ‘feedback and suggestions from diverse groups of Singaporeans.’

Here is all you need to know about the PLH!

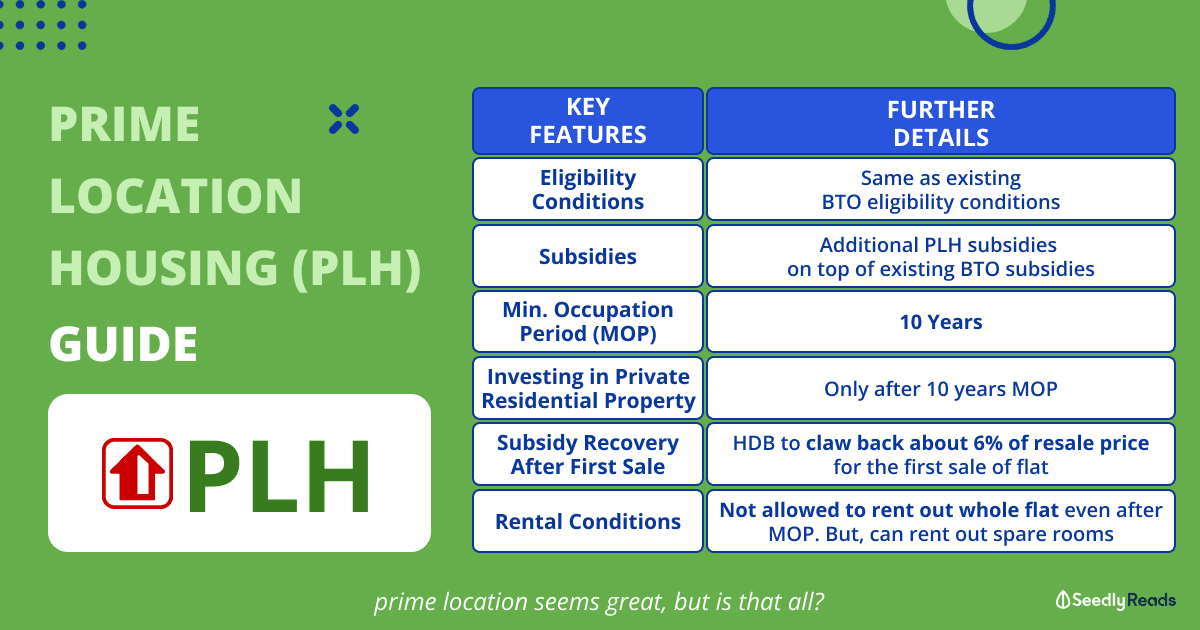

TL;DR: Prime Location Public Housing (PLH) Flats Guide

| Key Measures of PLH Model | Details |

|---|---|

| Eligibility Conditions | Same as existing BTO eligibility conditions |

| Subsidies | Additional PLH specific subsidies on top of existing BTO subsidies |

| Minimum Occupation Period (MOP) | 10 Years |

| Investing in Private Residential Property | Only after 10 years MOP |

| Subsidy Recovery After First Sale | Varies between PLH projects but ~6% of resale price for first sale of flat so far |

| Rental Conditions | Not allowed to rent out whole flat even after MOP. But, can rent out spare rooms |

- The eligibility conditions to buy PLH flats from HDB will be the same as the prevailing eligibility conditions for buying BTO flats

- The allocation for those applying under the Married Child Priority Scheme (MCPS) may be reviewed and adjusted for PLH flats to ensure that those whose family members do not live near prime locations have a better chance of getting a flat in a prime location

- There will also be additional subsidies for new PLH flats on top of the existing HDB BTO flat grants buyers enjoy today. But, a percentage of these additional subsidies will be clawed back when buyers sell their PLH flat

- PLH flat owners will only be able to sell or rent out their flats after a 10-year Minimum Occupation Period (MOP) and cannot rent out the whole flat.

- There are also restrictions on those buying PLH flats related to criteria like citizenship, family nucleus, an income ceiling and private property ownership.

Click here to jump:

- What is Prime Location Housing (PLH)?

- Who is eligible to apply?

- What happens when you secure a PLH flat?

- What happens when you buy a PLH resale flat?

What Is the Prime Location Public Housing (PLH) Model?

This new PLH model is a new initiative implemented to ensure that public housing in prime locations will remain affordable, accessible and inclusive for all Singaporeans.

HDB will implement this PLH model for public housing projects located in the city centre and surrounding areas. This will include areas like the Greater Southern Waterfront.

An important thing to note is that this PLH model will only apply to new public housing projects and will not affect existing HDB flat owners.

In addition, HDB will build public rental flats near PLH flats where possible for lower-income households.

This is done to ensure that public housing and HDB towns will remain diverse and include people from all walks of life.

At the time of writing, BTO projects under the PLH are located at Bukit Merah, Queenstown, Kallang Whampoa and Rochor:

- River Peaks at Rochor (November 2021 HDB build-to-order (BTO) launch)

- King George’s Heights at Kallang/Whampoa (February 2022 BTO launch)

- Bukit Merah Ridge at Bukit Merah (May 2022 BTO launch)

- Ghim Moh Ascent at Queenstown (May 2022 BTO launch)

- Alexandra Vale @ Alexandra View (Aug 2022 BTO launch)

- Havelock Hillside @ Bukit Merah (Aug 2022 BTO launch)

- Ghim Moh Natura (Nov 2022 BTO launch)

- Ulu Pandan Banks (Nov 2022 BTO launch)

- Kallang Horizon (Nov 2022 BTO launch)

Who Can Buy PLH Flats?

The eligibility conditions to buy such flats from HDB will be the same as the prevailing eligibility conditions for the purchase of BTO flats:

Reduced Priority Allocation Quota for Married Child Priority (MCPS) Scheme

If you qualify to buy a new PLH flat, and your parents do not live near these prime locations, fret not.

Hopefully, this will give Singaporeans whose parents don’t live near these prime location neighbourhoods a better chance to live there.

Buying a New PLH HDB BTO Flat

As the name suggests, this PLH model will apply to new BTO flats located in prime locations determined by HDB.

As such, these flats will typically fetch a higher price in the housing market compared to their non-prime location counterparts.

To keep these flats affordable, HDB will tag additional subsidies for these new PLH flats:

These subsidies will be given on top of the existing HDB BTO flat grants buyers can enjoy today.

As an existing or future ‘normal’ BTO flat owner, you might feel a bit short-changed as you will not be able to enjoy the additional new PLH flat subsidies.

But fret not, as there is actually a clause for the additional PLH flat subsidies you need to be aware of.

When you first sell your new freshly MOPed PLH flat, HDB will claw back a percentage of the resale flat’s price to recover some of the additional subsidies.

This will go some way to curb the ‘lottery effect’ of buying these new PLH flats.

How much, you ask?

This so-called Subsidy Recovery* upon resale varies between PLH projects and will only be revealed at launch.

So far, most projects have a Subsidy Recovery of 6 per cent.

| Prime Location Housing Projects | Subsidy Recovery |

|---|---|

| River Peaks at Rochor | 6% |

| King George’s Heights at Kallang/Whampoa | 6% |

| Bukit Merah Ridge at Bukit Merah | 6% |

| Ghim Moh Ascent at Queenstown | 6% |

| Havelock Hillside @ Bukit Merah | 6% |

| Alexandra Vale @ Alexandra View | 6% |

| Ghim Moh Natura | 6% |

| Ulu Pandan Banks | 6% |

| Kallang Horizon | 6% |

More importantly, this Subsidy Recovery will only apply to the first sale and not any subsequent sales.

*Not applicable to 2-room Flexi flats sold on a short lease. Where HDB assesses that a flat valuation is required, the subsidy recovery will be a percentage of the higher of the valuation and the resale price of the flat.

Overview of Ownership Conditions for PLH Flats

There are also a few ownership conditions prospective PLH flat owners need to be aware of:

| BTO Model | PLH Model | |

|---|---|---|

| Resale of flat | Allowed after MOP (5 years) | Allowed after MOP (10 years) |

| Investment in private property | ||

| Renting out of whole flat | Not allowed | |

| Renting out of spare rooms | Allowed | Allowed |

Selling PLH HDB Flats: 10-Year MOP

When it comes to selling PLH flats, you need to be aware that the MOP for PLH flats is 10 years. This is double the MOP for the existing HDB BTO flat scheme.

For the uninitiated, the MOP refers to the amount of time you need to physically stay in your flat before you can either sell it or rent it out.

Also, according to HDB, ‘the MOP is calculated from the date you collect the keys to your flat. It excludes any period where you do not occupy the flat, such as when the whole flat is rented out or when there has been an infringement of the flat lease.’

Renting Out PLH HDB Flats: Flat Owners Cannot Rent Out Entire PLH Flat

There is also another condition for PLH flats.

For better or worse, PLH flat owners cannot rent out their entire flat at any juncture even though the MOP for their flats have ended.

But, they still can rent out their spare rooms.

An important thing to note is that the selling and rental conditions of PLH flats apply to those buying a new PLH flat from HDB and those buying resale PLH flats on the open market.

In other words, you have to be comfortable with the longer MOP and rental restrictions if you want to buy a PLH flat.

Buying a Resale PLH HDB BTO Flat

If you are looking to buy a PLH flat from the resale market, you need to fulfil the following conditions:

| Conditions | Buying New PLH BTO Flats & PLH Resale Flats* | Typical Resale Flats |

|---|---|---|

| Citizenship | Household must comprise at least one Singapore Citizen (SC) applicant and one Singapore Permeant Resident (PR) | At least one applicant is a SC or SPR A households can comprise of only SPRs |

| Family nucleus | Must have an eligible family nucleus, e.g. married couple | Must have an eligible family nucleus; or if single, must be aged 35 and above |

| Income ceiling | Prevailing (currently $14,000^) | Not applicable. |

| Private property ownership | Must not own or have an interest in a private property and have not disposed of any in the last 30 months | Allowed, but must dispose of private property within six months of buying the resale flat |

Source: HDB

Note: * With or without CPF housing grants. | ^ Or $21,000 if purchasing with an extended/multi-generation family.

And according to The Straits Times, ‘these resale restrictions will be in place for at least half of the 99-year tenure of each prime location flat before HDB considers whether to review them.’

Excited About The PLH Model Flats?

Simply put, even though these projects might be in good locations, they might be away from the city centre, such as the Ghim Moh project.

What if travelling becomes inconvenient, even though you live in a prime estate? (Just imagine changing buses all the time).

Similarly, the long wait for MOP completion may not cater to a growing family’s housing needs, especially when our parents retire and want to live with us.

What are your thoughts?

Share them with fellow community members on Seedly here:

Advertisement