Robo Advisors Singapore: 6 Reasons Why You Should Invest With Robos And 3 Reasons Why You Should Not

●

Whatever your thoughts and feelings on technology, it is clear that it is a big disrupting force that is here to stay.

Already, technology has fundamentally changed many aspects of our lives and disrupted many industries.

One such industry is the wealth management industry which was disrupted by robo advisors that introduced previously exclusive wealth management services to a wider audience at a lower cost (in comparison to traditional human advice).

For the uninitiated, robo advisors are financial advisors that provide people with digital financial advice and investment management with little to no human interaction.

This digital financial advice and investment management is backed by mathematical rules or algorithms concocted by a team of financial experts and coded into software.

Robo advisors use their software to automatically manage, allocate and optimize clients’ portfolios based on their personal risk tolerance, investment horizon, target return and financial goals.

Best Robo Advisor Singapore

Before you decide on the best robo advisor for you, here is an overview of the robo advisor scene. In Singapore, there are over 15 robo advisors which can be divided into two main categories:

- Robos that mainly use exchange-traded funds (ETFs) like StashAway, Syfe, AutoWealth, OCBC RoboInvest, Kristal.AI, DBS digiPorfolio, SquirrelSave, Phillip SMART Portfolio, UOBAM Invest and Utrade Robo (UOB Kay Hian).

- Robos that mainly use mutual funds (e.g. Dimensional Fund Advisors) like Endowus, MoneyOwl and CONNECT (for accredited investors)

As a client of a robo advisor, you will pay the fees charged by those ETFs and funds — called expense ratios — in addition to the robo advisor’s management fee.

For beginner investors, this can feel overwhelming. We have already done the work by comparing robo advisors so that you can make better investment decisions.

6 Reasons Why You Should Invest With Robos And 3 Reasons Why You Should Not

Reasons For:

- Low Minimum Investment Requirements And No Lock-In Fee or Period

- Low Fees

- Professional Portfolio Management

- Personalised Portfolio Recommendations

- Automatic Rebalancing of Portfolio And Reinvesting of Dividends

- Benchmark Like Returns (So Far)

Reasons Against:

- Little to No Control Over How Portfolio is Constructed And Rebalanced

- More Expensive Than Do it Yourself (DIY) Investing

- Most Robo-Advisors Use US-Domiciled ETFs

Reasons to Invest With Robo Advisors

To start things off, we will talk about some of the benefits of investing with robo advisors.

1. Low Minimum Investment Requirements And No Lock-In Fee or Period

In the past, investing in Singapore was not as accessible to the public as those investment products typically had high initial minimum investment requirements, long lock-in periods and/or imposed early withdrawal penalties.

This is not the case with robo advisors in Singapore as most of them have little to no initial minimum investment requirements and have no lock-in fees/periods or early withdrawal penalties.

In other words, you are able to start investing easily and are free to cash out your investments at any time.

2. Low Fees

Another advantage of robo advisors is that they charge lower fees than a human financial advisor you can meet in real life.

Financial advisors typically charge anywhere a 1% to 2% per annum (p.a.) fee (or sometimes more) on the value of your portfolio, while robo advisors charge about 0.2% – 0.88% p.a.

More specifically, the fees that robo advisors charge are a percentage of your assets under management (AUM) under the robo advisor’s care. Also, this fee is generally lower if you have more money invested with the robo advisor.

For example, if your portfolio is worth $10,000 you might pay about $20 a year in fees. Generally, the fee is auto deducted from your account, prorated and charged either monthly, quarterly or annually.

Also, another benefit of robo advisors is that, unlike standard brokerage accounts, you do not have to pay the minimum commission fee when buying or selling investments.

Although these fees are a one-off transaction, they can really accumulate if you invest in multiple ETFs like the Robos do as you might have to trade regularly to rebalance your do it yourself (DIY) investment portfolio.

Also if you use the dollar cost averaging (DCA) investing strategy, it may be more cost-effective to use a robo advisor as most brokerages still do not offer $0 commissions. Thus, DCA-ing monthly will cost more since we incur a flat minimum commission fee.

For investors who want to DCA but have a smaller capital to start with, some robo advisors are more cost-effective.

As an investor, you’ll want to keep these fees as low as possible.

Because in the long run, they’ll eventually eat into your returns.

As such, robo advisors have the advantage here as they are a low-cost alternative to financial advisors.

But on balance, financial advisors can also provide additional services such as insurance, tax planning, retirement planning and estate planning.

If you need help with investing with your CPF or Supplementary Retirement Scheme (SRS), they can also provide advice and guidance.

Basically, a financial advisor is more than just an investment manager.

The good ones also act as life coaches, educators, and planners to help you succeed in life.

Naturally, these value-added services are also why financial advisors cost more than robo advisors.

It’s up to you to decide if the value-added services they provide are worth the fee you pay.

3. Professional Portfolio Management

Another benefit of robo advisors is that you get access to professionally managed portfolios put together by expert financial advisors, investment managers and data scientists.

In Singapore, robo advisors construct broadly diversified portfolios that give you access to different asset classes like:

- Equities

- Bonds

- Property/ Real Estate Investment Trusts (REITs)

- Commodities

- Cash.

You can even choose between passive asset allocation strategies (e.g. ETFs that track the index) or active asset management styles (e.g. actively managed ETFs and mutual funds).

4. Personalised Portfolio Recommendations

Typically, the first step when signing up with a robo advisor will be a series of questions designed to assess your risk tolerance, goals and investing preferences.

In general, most robo advisors in Singapore will give you a choice of portfolios that range from defensive to aggressive.

Although the algorithm will give you a portfolio recommendation based on your answers, you have the choice of ignoring the recommendation and picking another portfolio.

5. Automatic Rebalancing of Portfolio And Reinvesting of Dividends

In addition, robo advisors use algorithms to help you rebalance your portfolio by buying and selling your assets automatically at fixed intervals — for example, quarterly.

This is done to ensure that your portfolio will stick to its target asset allocation.

Occasionally, the robo advisor’s team will also change the ETF or fund selection during these rebalancing exercises.

Another benefit of robo advisors is that for most portfolios, dividends that are paid out are automatically reinvested.

This is great if you want to build up your capital and take advantage of compound interest.

6. Benchmark Like Returns (So Far)

How about their performance.

To get a sense of how the robo advisors are performing, let’s take a look at this comparison done by Kyith from Investment Moats.

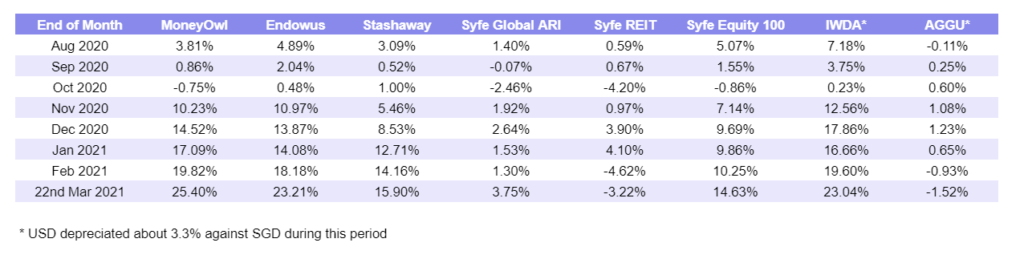

Kyith started tracking the annualised returns of these portfolios for an eight-month period from 20 July 2020 to 22 March 2021.

- MoneyOwl’s Equity Portfolio: 25.4%

- Endowus’s Very Aggressive Portfolio: 23.21%

- Stashaway’s 36.0% Risk Portfolio: 15.90%

- Syfe Global ARI: 3.75%

- Syfe REIT portfolio with Risk Management: -3.22%

- Syfe Equity 100: 14.63%

- iShares Core MSCI World UCITS ETF USD (Acc) IWDA: 23.04% (adjusted for currency, this should be 19.70%)

Here is the data in table form.

Source: Investment Moats

A few caveats:

- This comparison period is only eight months which is very short.

- The comparison period does not take into account last year’s Black Monday March 2020 crash. But, it does factor in quite a bit of volatility in October and the first quarter of 2021.

- Past performance is no guarantee of future results.

But, from the comparison above, you can see that the robo advisors have been delivering benchmark like returns comparable or even outperforming the returns of the IWDA ETF which is an indicator that their portfolios are sound.

Reasons Not to Invest in Robo Advisors

However, there are few reasons why you might not want to invest your money with robo advisors.

1. Little to No Control Over How Portfolio is Constructed And Rebalanced

When investing with robo advisors, you do not get as much flexibility compared to the DIY approach where you construct and manage your own investment portfolio using your own brokerage account.

Also, when the robo advisors automatically rebalance your portfolio to bring it back to the portfolio’s target allocation or change the ETF or fund selection; you have little to no control over the changes.

Although, there are some robo advisors like Kristal.AI and Endowus that allow more customisation.

If you value autonomy and disagree with the robo advisors’ choices, the rebalancing will not be good for you.

But, if you trust what the robo advisor is doing, you will consider this as a value-added service they offer for the management fee they charge.

2. More Expensive Than Do it Yourself (DIY) Investing

Another downside of investing with robo advisors is that there is really nothing stopping you from investing directly into the ETFs.

In fact, the fees would be lower in the long term since you won’t be paying the management fees to the robo advisor.

But on balance, you will have to spend your own time researching to construct the portfolio, managing and keep tracking of your investments and doing your own rebalancing.

Thus, you can say that you are paying for the convenience and expertise.

3. Most Robo Advisors Use US-Domiciled ETFs

Also, one thing you might want to take note of is the ETFs that the robo advisors use to construct their portfolios.

Most robo advisors use US-domiciled ETFs which means that they will have to pay a higher 30 per cent withholding tax rate on dividends compared to just 15 per cent for Irish-domiciled ETFs.

Not to mention the US estate tax implications for US-domiciled ETFs held by investors in Singapore.

However, there are some robo advisors like Syfe that use Irish domiciled ETFs to construct their portfolios.

Still Want to Invest With Robo Advisors?

Why not sign up or log-in to your FREE Seedly account and check out real user reviews for the robo advisors in Singapore to find the best one!

Advertisement