Best Credit Cards for Families (2024): Vacations, Groceries, Dining, Petrol & More

Are you doing your weekly groceries and planning on bringing your kids out for a meal?

Or are you organising a family gathering soon?

While you are already spending on so many things at once, why not earn some rebates, cashback or miles so that you can optimise your spending?

Let’s find out which cards are the best for families in Singapore!

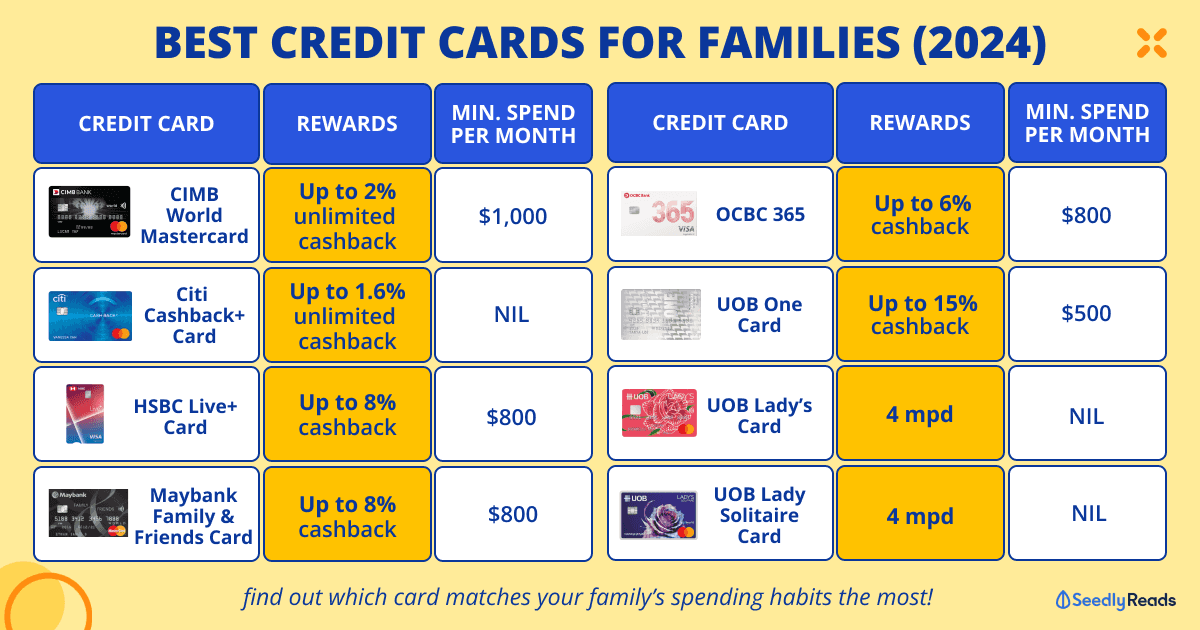

TL;DR: Best Cards For Families

| Credit Cards | What It Does | Cashback cap / Bonus points cap (per month) | Min. spend (per month) |

|---|---|---|---|

| CIMB World Mastercard Apply Now | Up to 2% unlimited cashback on Wine & Dine, Online Food Delivery (Deliveroo, Foodpanda, GrabFood, WhyQ, and AirAsia Food), Movies & Digital Entertainment, Taxi & Automobile, and Luxury Goods | Nil | To hit unlimited 1% cashback: $500 local spends To hit unlimited 2% cashback: $1,000 local spends |

| Citi Cash Back Plus Card Apply Now | Unlimited 1.6% cashback on any eligible spends | Nil | Nil |

| Maybank Family & Friends Card Apply Now | Up to 8% on groceries, dining and transport across Singapore and Malaysia | Up to $125 in total per calendar month, capped at $25 per category | $800 local spends |

| HSBC Live+ Apply Now | Up to 8% on dining, entertainment, and shopping spend | $800 local spends | |

| OCBC 365 Card Apply Now | 6% on petrol 5% on online food delivery and all local and overseas dining 3% cashback on groceries, land transport rides, pharmacies, streaming, EV charging, and utilities | $80 cashback cap / $160 cashback cap | $800 local spends / $1,600 local spends |

| UOB One Card Apply Now | Up to 15% cashback | $50, $100, or $200 per quarter; Will get even more cashback with some merchants based on the amount you earned | $500, $1,000 or $2,000 local spends |

| UOB Lady's Card Apply Now | 6 miles per dollar | Up to $1,000 | Nil |

| UOB Lady's Solitaire Card | Up to $3,000 | Nil |

Jump to:

Disclaimer: The various credit cards have their respective terms and conditions. Please read through them before deciding which credit card to get! Note that information is accurate as of 12 July 2024 and that promotions are subject to change without prior notice.

Best Credit Cards With Unlimited Cashback

CIMB World Mastercard

The CIMB World Mastercard offers an unlimited 2% cashback on spending in categories such as Wine & Dine, Online Food Delivery (Deliveroo, Foodpanda, GrabFood, WhyQ, and AirAsia Food), Movies & Digital Entertainment, Taxi & Automobile, and Luxury Goods with a minimum spend of $1,000.

This makes CIMB World Mastercard a good choice for those who enjoy social outings and dining out.

For all other spends, card users can receive an unlimited 1% cashback with a minimum spend of $500, and there is no cashback cap.

Lastly, cardholders can access over 1,000 lounges in more than 60 airports globally via LoungeKey!

Eligibility

- Age: 21 years old and above

- Citizenship: Singaporeans and PRs only

- Minimum annual income: S$30,000 and above per annum

Citi Cashback+ Card

The Citibank Cash Back+ Card is a no-frills cashback credit card. With it, you can earn 1.6% cashback on eligible spending!

This option is especially suitable for families with low expenditures, as there is no minimum spend to meet. There is also no cap on any cashback earned i.e., unlimited cashback.

There is also an easy way to redeem your cashback for cash rebates: simply send an SMS via the Citibank app.

If you’re an existing Citi Plus member (Citibank’s Premier Banking customer), you can also earn 0.4% Bonus Cash Back on your spending.

Eligibility

- Age: 21 years old and above

- Citizenship: Singaporeans, PRs & Foreigners

- Minimum annual income: $30,000 and above for Singaporeans and Singapore PRs; $42,000 and above for foreigners

Best Credit Cards for Families: High Cashback Rates

HSBC Live+

The HSBC Live+ Card is the new kid in the market!

This cashback card replaces the HSBC Visa Platinum Card (and possibly the HSBC Revolution, hence all the nerfs). It provides 8% cashback on Dining, Shopping, and Entertainment until the end of the year but requires a minimum monthly spend of $600.

For fuel, the cashback is available only at Caltex or Shell stations in Singapore, and the rate is 5%.

The cashback applies to specific Merchant Category Codes (MCCs), so if you plan to use this card for dining, streaming services and entertainment, check its exclusion list.

HSBC Live+ Cashback Cap

Also, the card operates on a quarterly cashback mechanism.

To qualify for the cashback, you must consistently spend at least $600 for three months. The cashback is capped at $250 per quarter. This cap means you can spend up to $3,125 per quarter at the 8% rate without exceeding the cashback limit.

Note: *For new cardholders in their first quarter, the minimum spending required to earn up to 8% cashback is $1,000 for the entire quarter rather than $600 each month. For instance, if your card is approved on 23 June 2024, you must spend $1,000 between 23 and 30 June 2024 to qualify for up to 8% cashback for the second quarter of 2024. Starting from the third quarter of 2024, you will need to spend $600 per month, every month of the quarter.

Unlike other cards, the HSBC Live+ does not impose category sub-limits, allowing cardholders to allocate their spending freely across the eligible categories. This flexibility benefits users who may concentrate their spending on one area, such as dining, to maximize their cashback.

Eligibility

- Age: 21 years old and above

- Citizenship: Singaporeans, PRs & Foreigners

- Income Requirement:

- $30,000 for Singapore Citizens or SPRs

- $45,000 for foreigners

HSBC Live+ Promotion

HSBC’s promotion for new credit card holders offers a choice of valuable gifts such as a FLUJO SmarTrax Standing Desk, Dyson AM07 fan, Sony WF-1000XM5 earbuds, or a $300 eVoucher for Shopee and Grab. To qualify, new cardholders must activate their card and spend at least $500 by the end of the following month after account opening. This offer, valid from 24 June to 21 July 2024, can be combined with ongoing standard offers and requires applicants to consent to HSBC’s marketing.

Additionally, you can upgrade your rewards to premium items like a Sony HT-AX7 Portable Theatre System, Sony ZV-1M2 Vlog Camera, or Apple iPhone 15 Pro by paying a top-up ranging from $200 to $1,099.

Moreover, under the HSBC Live+ standard offer, new cardholders can receive an extra $100 cashback if they make at least one qualifying transaction by the end of the month following their card approval. This promotion is valid until 30 September 2024, subject to the bank’s terms and conditions.

Maybank Family Friends Card

Maybank’s Family and Friends Credit Card offers cash rebates of up to 8% on daily essentials like groceries, dining and transport across Singapore and Malaysia.

Some crowd favourite merchants from supermarkets like DON DON DONKI, RedMart, Deliveroo or Foodpanda for food delivery, Grab / GOJEK rides for Transport, Disney+ and Netflix for Streaming services.

By using this card, you can earn up to 8% cashback on five preferred categories among these lifestyle categories:

- Groceries

- Dining & Food Delivery

- Transport

- Data Communication & Online TV Streaming

- Retail & Pets

- Online Fashion

- Entertainment

- Pharmacy

- Sports & Sports Apparel

- Beauty & Wellness.

Maybank Family and Friends Credit Card Cashback Cap

There is a cashback cap of up to $125 per calendar month, capped at $25 per category.

How Can You Maximise Cashback on Maybank Family and Friends Credit Card?

To earn the 8% cashback, you must spend a minimum of $800 in local purchases per calendar month.

But even if you do not meet this minimum spending, you can still receive unlimited 0.3% cashback. After reaching the monthly cashback cap for a selected category, 0.3% cashback is applied to all other spending on non-selected categories.

Also, if you plan on paying bills using this card via AXS, you can earn an additional 0.3% cashback, with no minimum spend required. The cashback is capped at a maximum bill payment of S$50 per transaction.

Eligibility

- Age: 21 years old and above

- Citizenship: Singaporeans, PRs & Foreigners

- Minimum annual income:

-

- $30,000 for Singapore Citizens or Singapore Permanent Residents

- $45,000 for Malaysia Citizens in employment for at least 1 year

- $60,000 for other nationalities in employment for at least 1 year

OCBC 365 Credit Card

The OCBC 365 is an all-rounder card for car-owning families and those who dine out or order food deliveries often.

It offers up to 6% monthly cashback for all petrol stations and up to 5% cashback for local/overseas dining and online food delivery, such as GrabFood and FoodPanda!

You can even pay bills with this card and still earn cashback.

Do note that there is a minimum local spend of $800 per calendar month, so this is for families that spend minimally this amount.

Here’s a glance at the cashback you can earn across various categories:

| Category | Cashback |

|---|---|

| Petrol | 6% monthly cashback for all petrol stations Caltex: Up to 22.92% fuel savings Esso: Up to 21.04% fuel savings |

| Dining | 5% monthly cashback for local/overseas dining, and online food delivery |

| Grocery | 3% monthly cashback for local and online grocery merchants |

| Land Transport | 3% monthly cashback for local/overseas private hire, and local/overseas taxi |

| Pharmacy | 3% cashback monthly for all purchases made at pharmacies such as Guardian or Watson |

| Bill Payment | 3% monthly cashback on recurring electricity bills (e.g Geneco, Keppel Electric, Sembcorp Power, Senoko Energy, and Singapore Power) |

| 3% monthly cashback on recurring telco bills (e.g. StarHub, Singtel, M1, MyRepublic, and Circles.Life) | |

| Travel | Online ticket purchases (air and cruise): 3% cashback monthly |

| Online bookings (hotels and tours): 3% cashback monthly | |

| Others | 0.3% cashback on all other transactions |

| Promotion Valid till 30 Aug 2023 | Receive an Apple iPad 9th Gen 10.2 Wifi 64GB (worth S$503.65), an Apple Bundle [AirPods Pro (Generation 2) + MagSafe Charger] (worth S$421.90), or S$350 eCapitaVoucher or S$250 Cash via PayNow when you make a min. $500 local spend within 30 days of card approval |

| Sign Up | OCBC 365 Card Apply Now |

OCBC 365 Credit Card Cashback Cap

OCBC has recently increased its cashback cap for the OCBC 365 from $80 to $160 per calendar month—in a two-tier approach.

If you spend $800 in the calendar month, you can get up to $80 cashback, and if you spend S$1,600 within the month, you can unlock the tier of up to $160 cashback. If you don’t meet any of the two minimum spends, you will receive the base 0.25% cashback.

Say you meet the $800 minimum spend, this is the specific category caps:

- Dining: $40

- Petrol: $48

- Groceries, Transport, Watsons, Streaming, EV Charging, Utilities: $24

That said, OCBC has increased its cashback cap to S$160 per calendar month for those who meet the minimum spend of S$1,600 per calendar month.

Eligibility

- Age: 21 years old and above

- Citizenship: Singaporeans, PRs & Foreigners

- Minimum annual income:

- $30,000 and above for Singaporeans and Singapore Permanent Residents (PR)

- $45,000 and above for Foreigners

UOB One Card

The UOB One Credit Card stands out for its generous cashback rewards, particularly for those who can meet the minimum spending requirements. With up to 15% cashback for bonus categories and additional perks like fuel savings and dining discounts, it caters to various lifestyle needs.

But, to get this cashback rate, you have to jump through a few hoops.

The UOB One Credit Card offers up to 15% cashback, which is contingent on meeting certain spending thresholds. Here’s how it breaks down:

- Base Cashback: 3.33% on all spending.

- Additional Cashback:

- Spend at least $2,000 per month for 3 consecutive months:

- 6.67% additional cashback on Grab rides and Dairy Farm Group merchants (Cold Storage, Giant, etc.)

- 5% additional cashback on other spending

- Spend $1,000 per month for 3 consecutive months:

- 5% additional cashback on Grab and Dairy Farm Group

- 6.67% additional cashback on other spending

- Spend $500 per month for 3 consecutive months:

- 5% additional cashback on other spending

- Spend at least $2,000 per month for 3 consecutive months:

To maximise the 15% cashback rate, you must spend at least $2,000 per quarter for three consecutive quarters on the UOB One Credit Card, which gives you 10% cashback at Grab and major grocers like Cold Storage and Giant, plus 5% on all other spending.

And to be honest, it’s not THAT difficult to hit the minimum spending if you use the card for family expenses, considering you will have to spend more on dining, groceries, and other lifestyle needs.

Do note that the UOB One Card cashback rewards are credited to your account every quarter, so there is some delayed gratification.

UOB One Cashback Cap

The base 3.33% cashback is capped at $50, $100 or $200 per quarter, depending on your minimum spend of $500, $1,000 or $2,000, respectively. Any additional bonus cashback earned is credited to the top of this base amount.

Eligibility

- Age: 21 years old and above

- Citizenship: Singaporeans, PRs & Foreigners

- Minimum annual income:

- $30,000 for Singapore citizens and Permanent Residents

- $40,000 for foreigners.

Best Credit Cards for Miles

From 1 April 2024, the UOB Lady’s series underwent some changes, including a card facelift!

You can choose Family as a bonus category to earn quarterly bonus miles.

UOB Lady Card

With the UOB Lady’s Card, you can earn four (4) miles per dollar and enjoy one quarterly bonus category, which is capped at $1,000 per calendar month.

Additionally, UOB introduced the UOB Lady’s Savings Account in April 2024, allowing account holders to earn up to 15X UNI$ per S$5 spent (6 miles per S$1) when they save with UOB Lady’s Savings Account, based on how much monthly account balance you have:

| Monthly Balance | UNI$ from Lady’s Savings Account | UNI$ from Lady’s or Lady’s Solitaire Card | Total UNI$ |

| <$10,000 | — | 10X UNI$ (4 mpd) |

10X UNI$ (4 mpd) |

| $10,000 – $49,999 | 5X UNI$ (2 mpd) |

15X UNI$ (6 mpd) |

|

| $50,000 – $99,999 | 10X UNI$ (4 mpd) |

20X UNI$ (8 mpd) |

|

| ≥$100,000 | 15X UNI$ (6 mpd) |

25X UNI$ (10 mpd) |

You can choose ONE bonus category:

- Beauty & Wellness

- Fashion

- Dining

- Family (including groceries)

- Travel

- Transport (including petrol)

- Entertainment (nightlife, movies).

UOB Lady’s Card Eligibility

- Age: 21 years and above

- Citizenship: Singaporean/PR

- Minimum annual income: $30,000

UOB Lady Solitaire Card

With the UOB Lady Solitaire Card, you can earn four (4) miles per dollar and enjoy two (2) quarterly bonus categories, which are capped at $2,000 per calendar month.

Previously, this cap was $3,000, but from April 2024, the cap is now $2,000. Mind you, the $2,000 cap on the UOB Lady’s Solitaire Card is shared between both bonus categories.

The difference between the two cards is the income requirement, and UOB Lady’s Solitaire allows you to choose TWO bonus categories.

If you travel frequently as a family, it’s ideal to select ‘Travel’ for all travel-related expenses.

Remember to get travel insurance before you fly off, too!

UOB Lady’s Card Eligibility

- Age: 21 years and above

- Citizenship: Singaporean/PR

- Minimum annual income: $120,000

UOB Lady Solitaire Metal Card

LIke the UOB Solitaire, this card earns you four (4) miles per dollar and has two bonus categories for spending.

But it’s only available by invitation.

UOB Lady Solitare Card Eligibility

- Age: 21 years and above

- Citizenship: Singaporean/PR/Foreigners

- Minimum annual income: $120,000 or Fixed Deposit collateral of at least $30,000.

Related Articles:

- Best Credit Cards for Public Transport (2023)

- Best Credit Cards for Complimentary Airport Lounge Access

- SIM-Only Family Plans vs Individual SIM-Only Plans: Which Plan is More Worth it?

- Best Credit Cards For High-Income Earners (120K Annual Income): Which Card Is Right For You?

- Best Credit Cards That Pawsitively Reward Pet Owners (2023)

Advertisement