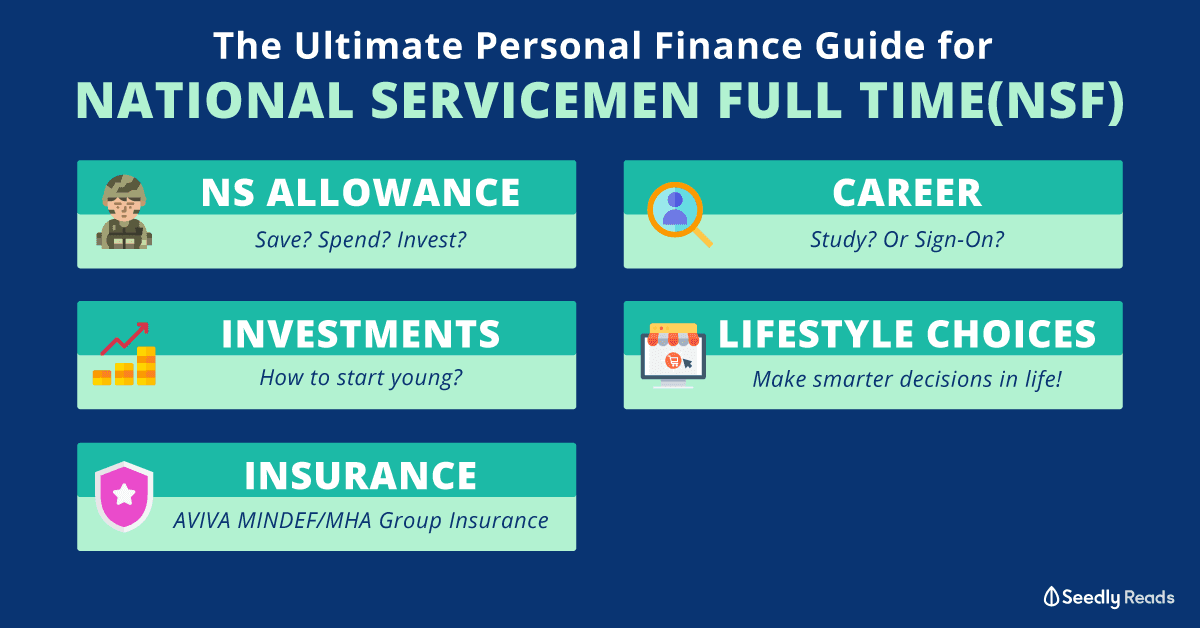

National Servicemen Full-time (NSFs): Your Personal Finance Guide While Serving The Nation (16 - 23 Years Old)

Winning The Personal Finance Game While Serving The Nation

National Service (NS) in Singapore is a statutory requirement for all male Singaporean citizens and second-generation permanent residents, and we understand how much of a drag the “Ah Boys To Men” journey can be.

In search of that little positivity in life, here are some ways to get your personal finance game in shape while serving the nation.

*Click me! Click me!*

*Click me! Click me!*

The power of NS Allowance

There is a saying which says that serving the NS is like getting paid to keep fit and look at memes. This is true to a certain extent!

On top of the allowance we will be getting, here are some of the benefits we tend to overlook when in NS:

- Gym for free! (Most of us end up paying for a gym membership when at work)

- Meals are provided for (if you stop skipping the cookhouse for canteen)

- Save on transport fees when you stay in camp

- Save money on fashion since you wear uniform on weekdays

We did a calculation on how much one can save during his NS days in total:

With that, think of the money you can save during your NS days.

A simple rule of thumb for allocating your monthly allowance is as such:

Of course, while in NS, the rate of savings should be higher.

- Working Adults: How To Allocate Your Monthly Salary?

- The Guide To Your First Pay

- How To Survive On $500/Month In Singapore

NS Guide to Investing

When serving National Service, one can actually make better use of his time investing a small sum of his allowance.

We understand that the monthly allowance may not exactly that high, but the best time to kick-start our investment journey is as young as possible!

” The best time to plant a tree was 20 years ago. The second best time is now.” – Warren Buffett

Content on investing for NSF

Firstly, one can use his free time and the weekends to gain knowledge about investing. Making smarter investment decisions involve getting the right knowledge and mindset to do so.

- Read real user reviews on the best investment courses in Singapore

- Financial Blogs That Singaporeans Should Be Reading

- Working Adults: When Should I Begin Investing?

- Absolutely Essential Books for Beginners to Learn Investing in Stocks

- Age vs Risk Profile: What Investments Should You Hold At Your Age

- Three Simple Steps To Start Your Investment Journey

Once you are ready to start investing your first stock or investment products, here are some content which can help you out.

- Working Adult: Investment Products That Requires Less Than S$1,000 To Invest

- Investment Products Backed By The Singapore Government: SSB vs SGS Bond vs Treasury Bills

- Cheat Sheet: What Are The Common Investment Products in Singapore?

- Best Investments In Singapore That Caters To Every Risk Profile, For Short, Medium and Long-Term Investors

- Working Adults: Easiest Ways To Invest A Monthly Sum For Beginners

- Stocks Analysis of individual stocks (Updated Weekly!)

- Ask the Seedly Personal Finance Community for advice!

You can also check out the Robo-advisors in Singapore. At least you know that someone is looking after your portfolio while you are busy doing those push-ups and serving extras.

Insurance: Aviva MINDEF/MHA Group Insurance

Most of us got introduced to insurance when we enter National Service.

I remember sitting in a lecture hall listening to an ex-army regular turned insurance agent talk about the benefits of Aviva MINDEF/ MHA Group Insurance.

Turns out years later, that is actually one of the cheapest Term policy around!

Coverage and premium rates of Aviva Group Term Life

| Coverage Amount | Monthly Premium (S$) Member/ Affiliate Member/ Spouse/ Children |

|||||

|---|---|---|---|---|---|---|

| 65 Years Old and Below | 66* | 67* | 68* | 69* | 70* | |

| S$100,000 | 4.10 | 70.90 | 78.00 | 86.50 | 95.60 | 106.00 |

| S$200,000 | 8.20 | 141.80 | 156.00 | 173.00 | 191.20 | 212.00 |

| S$300,000 | 12.30 | 212.70 | 234.00 | 259.50 | 286.80 | 318.00 |

| S$400,000 | 16.40 | 283.60 | 312.00 | 346.00 | 382.40 | 424.00 |

| S$500,000 | 20.50 | 354.50 | 390.00 | 432.50 | 478.00 | 530.00 |

| S$600,000 | 24.60 | 425.40 | 468.00 | 519.00 | 573.60 | 636.00 |

| S$700,000 | 28.70 | 496.30 | 546.00 | 605.50 | 669.20 | 742.00 |

| S$800,000 | 32.80 | 567.20 | 624.00 | 692.00 | 764.80 | 848.00 |

| S$900,000 | 36.90 | 638.10 | 702.00 | 778.50 | 860.40 | 954.00 |

| S$1000,000 | 41.00 | 709.00 | 780.00 | 865.00 | 956.00 | 1,060.00 |

Preparing for life after National Service (Career)

NS allows young male Singaporeans to mature and think about the next phase of their life better.

There are usually 3 scenarios when it comes to this:

- NSF signs-on when he is in national service.

- NSF finishes his national service and continues to further his studies.

- NSF finishes his national service and pursues his career.

NSF signs-on when he is in national service

If you are thinking of signing on with the Singapore Armed Forces or Home Team, we did a compilation of all the sign-on bonus and starting salary.

- Singaporean’s Guide: Sign-on Bonus and Starting Salary of Schemes In The Singapore Armed Forces (Army, Air Force, Navy)

- Sign-on Bonus and Starting Salary for Home Team (Police, Civil Defence, ICA, Prison Service and Central Narcotics Bureau)

NSF finishes his national service and continues to further his studies

Should one decides to further his education after NS, the time in NS might be the best time to save up a bit of saving for school.

We understand that it is difficult to balance National Service commitment while having to worry about things in school such as education loan, hence, here are some content to help you out.

- Student Loans: Should You Take Up The MOE Tuition Loan From Banks Or Use Your Parents’ CPF?

- Best Education Loan for University Students

- Tuition Fee Loan for Local Universities in 5 minutes

- These Young Singaporeans Cleared Their Student Loans Within 2 Years. Here’s How They Did It.

- Studying Overseas in | A Quick Guide on Personal Budgeting

- Scholarships You Should Know About Before Applying For University

Nsf Finishes His National Service and Pursues His Career

Should one decides to head out to the real world to pursue his career after NS, here are some guides to help you out.

- Interview Preparations: The Hows, The Whys, The Whats

- Know Your Rights! Employee Benefits: Off-in-lieu, Paid Leaves, Overtime Pay

- The Ultimate Salary Guide For Singaporeans

Making Even Smarter Personal Financial Decisions On Lifestyle Choices

Simple lifehacks to your lifestyle choices can actually help you save in the long-run.

Here is some content to make better lifestyle choices:

- Ultimate Movie Ticket Price Guide

- The Ultimate Comparison: Electricity Retailer In Singapore

- Which Singapore Telco Plan Is The Best For You: Data vs Price

- Ultimate Guide: Supermarket’s Price Comparison

- Which Singapore Fibre Broadband Plan Is Best For You

- Singtel TV vs Starhub TV: Which Package Should You Get?2020

- Best Dating Apps in Singapore: Which Is The Cheapest of Them All?

Tools to help you:

Advertisement