“Eh, prices keep rising leh, how ah?”

Sound familiar?

If you’ve ever wondered when inflation would simmer down and what to do about the GST hike…

It’s high time that you take control of your finances!

All you need is The Seedly Money Framework and just a few hours to sort out your money.

This framework is for everyone and can still be used for conducting a regular financial health check. Even our government has to do it annually with the Budget!

Ready to get your life in order? Let’s go!

TL;DR: Personal Finance Planning For The Layman, Money Management & How to Save Money

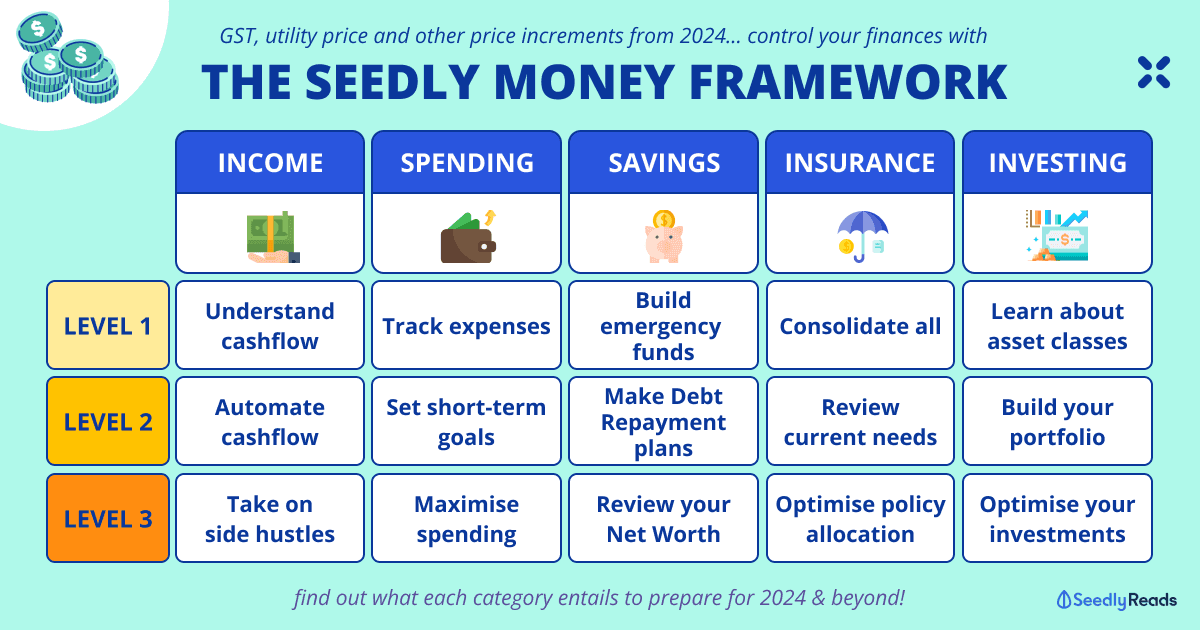

The Seedly Money Framework was specially created to help everyone start their personal finance journey on the right track.

It was distilled after many hours of pouring through complicated money concepts and discussions with the Seedly community.

How to Use The Seedly Money Framework

This is a really simple checklist with 15 key actionable items across 5 different categories.

In each category, there are three items to choose from, starting from the easiest to the hardest.

Here’s how to use The Seedly Money Framework:

- Block out 5 hours (preferably on a Saturday or Sunday, so you can really dedicate yourself to it)

- Bookmark this page

- Read and understand what the key actionable items are

- Choose at least 5 key actionable items you wish to accomplish by the end of the year

- Paste The Seedly Money Framework somewhere where you can see it every day

- Follow the instructions listed for the key actionable items you chose

Yes, it’s really that simple!

With this simple framework, your personal finances could go from ZERO to HERO.

To make it more entertaining (and helpful) for you, we have also included podcasts that we did on MONEY FM 89.3, as well as relevant SeedlyTV episodes.

Jump to:

Income

This category focuses on where our money comes from.

Income Level 1: Monthly Income & Cash Flow Management

- Why: Tracking your monthly cash flow will help you prioritise your needs, put aside savings and still be able to enjoy your life. This also prevents overspending.

- What: Use a simple Excel sheet or the Seedly app (on iOS and Android) to help you keep track. Adjust your setting to roll over the money you didn’t spend this month.

- How: Refer to your latest 3 months’ worth of bank and credit card transactions to determine how much goes in and out of your bank account. This can be segmented into Fixed and Variable expenses.

Besides having a bank savings account, don’t forget that you’ve also got money going into your CPF account.

Want to find out more about CPF?

Check out this MONEY FM 89.3 podcast where we talked about how to maximise your CPF savings:

Income Level 2: Automate Your Income Distribution

- Why: Use the 50-30-20 rule to allocate your income. It will be ideal to have three bank accounts so that you consistently will have money parked in these categories.

- What: Look for savings accounts that have high-interest rates.

- How: Set up a Standing Instruction (SI) to transfer money out automatically (from the account to which your salary is credited) to your ‘Savings’ and ‘Wealth’ account.

Income Level 3: Take on Side Hustles and Upskill to Earn Extra Income

- Why: If you have hobbies like photography or practising yoga after work, why not take this chance to earn an extra income? Besides, the digital world has made things easier for people to have side hustles. What you need to do is to spend one to two hours per day on it.

- What: Side hustles should be something up your alley where you’ve already attained a certain level of expertise in utilising your skills for real work.

- How: Look out for low-hanging opportunities such as website testing and doing online translations for companies.

Read more:

- Financial Minimalism: How to Spend Less and Live More

- Side Hustle Ideas for Students: How To Earn Extra Money While Studying

- How I Turned My Hobby Into a Side Hustle

Spending

This category focuses on where and how you spend your money.

Spending Level 1: Monitor My Expenses (Weekly or Monthly)

- Why: It’s important to understand this as our money will not come back as we spend.

- What: Ask yourself what’s the recurrence level of the category where you tend to overspend (e.g. eating out every day), and if there is a need to cut down, or find alternatives to minimise your spending.

- How: Since you would be tracking your cash flow, take this chance to observe if there is a category in which you tend to overspend.

Remember to check every nook and cranny of your transaction histories to ensure that you don’t have a ‘hidden’ subscription that you’re unnecessarily paying for!

Spending Level 2: Set Attainable Short-Term Goals (Weekly or Monthly)

- Why: In financial planning, knowing that we’ve attained our goals will motivate us further.

- What: Before making any purchases, ask yourself if the item is a ‘Need’ or ‘Want’. Do you need to spend $20 for every meal? Probably not.

- How: This could be as easy as reducing your shopping, changing to the cheapest subscription plans, and drinking instant coffee instead of Starbucks.

For starters, start looking for the cheapest electricity retailer!

Read more:

- Best Mobile Apps That Every Singaporean Foodie Should Have

- Best Broadband in Singapore For Your Household Needs: Singtel vs M1 vs StarHub vs MyRepublic & More

- Best SIM-Only Plans in Singapore: Singtel, M1, Starhub, GOMO and More

- Grabpay Hacks You Need To Know To Maximise Miles, Cashback and Rewards!

Make sure you always use these mobile apps or food delivery promo codes to get a discount!

Spending Level 3: Maximise My Rewards by Using a Cashback or Miles Card

- Why: You should only be in the ‘Credit Card game’ if you have control of your spending.

- How: Go through the SeedlyReviews to compare and choose the best credit card, and pick one or two cards (max!) to use.

- What: Figure out if you are a cashback, rebates, miles, or rewards person based on your goals and lifestyle.

For a start, you might want to check out our Ultimate Guide to Credit Cards in Singapore.

Read more:

- Know Your Credit Card: Cashback vs Cash Rebates vs Air Miles vs Rewards

- Best Cashback Credit Card Singapore: Here Are The Credit Cards You MUST Own!

- The Best Air Miles Credit Cards in Singapore

Savings

This category focuses on savings for emergencies, financial goals and how to clear and manage your debt.

FYI: we spoke about this at length on this MONEY FM 89.3 podcast:

Savings Level 1: Optimise My Savings Accounts And Emergency Fund for the Highest Interest

- Why: On top of the 20% income you save aside monthly, you should always have an emergency fund (6 – 12 months of your monthly expenses) because you’ll never know when you might be retrenched or get involved in an accident. Savings are also useful for short-term (e.g. renovating your new home) and long-term goals (e.g. paying for your children’s university education).

- How: Don’t leave your money in your bank account — which gives you a paltry 0.05% p.a. interest — because you’ll lose your money to inflation.

- What: Put your emergency funds into high-interest savings accounts or cash management accounts.

If you want some easy strategies to save up for your emergency fund, check out SeedlyTV S2E07 – Easy Strategies for Beginners to Save Up to learn the basics and even some special hacks!

Savings Level 2: Plan out Your Debt Repayment Schedule and Re-Finance Loans

- Why: In Singapore, it’s almost impossible to survive without taking on any debt (e.g. education loans & home loans). And, if you don’t pay down your principal, the interest will slowly take a toll on your finances.

- How: Plan ahead and start saving up to avoid taking a loan, or taking a smaller one.

- What: Before taking up one, come up with a Debt Repayment Plan first. This will tell you if you can afford the purchase. If you’re on an existing loan and are out of your lock-in period, find out the latest rates and try to reprice or refinance to a loan with a lower interest rate.

If you’re planning to buy your first HDB BTO, figure out whether a CPF Housing Loan or a Bank Loan works better for you, use a home loan calculator like HDB’s Monthly Instalment Calculator first.

Alternatively, you can approach your bank for assistance.

If you have any unsecured or personal debt, here are the best hacks to clear your debts fast and effectively.

Savings Level 3: Review Your Overall Net Worth (Assets and Liabilities)

- Why: Take stock of what you have and figure out your net worth to get a better sense of your financial progress and goals.

- How: List out all your assets (savings accounts and investments) and liabilities (home loan, student loan, etc.).

- What: You can use this simple template to list down and calculate what is your net worth.

Read more:

- Here’s How Much You Need to Save According to Your Age

- The Foolproof Checklist to Paying Your Income Tax in Singapore

- Best Ways For Repaying Debts

- How I Repaid My $28,000 Student Loan In Full After Graduation

- 6 Steps To Repaying Your Student Loan

Insurance

This category focuses on protecting your finances and your dependents on rainy days.

Insurance Level 1: Consolidate Your Insurance Policies

- Why: The weather, like life, can sometimes be very unpredictable; Understanding how insurance works can help you to protect yourself and your family from possible financial woes.

- What: Determine the key insurance policies needed for you and your dependents based on current circumstances.

- How: Ask yourself these questions:

- How many policies do you have?

- Are all your basics covered? i.e. Hospitalisation, Critical Illness, Life, Personal Accident & Disability

- Do you understand what your current policies can do for you?

Insurance Level 2: Review The Policies Yourself or Find A Financial Advisor

- Why: Figure out if you need to buy more coverage or if should you trim off the excess so that you’re not just paying insurance premiums for nothing.

- How: Understand if your current policies sufficiently cover you and your dependents, and identify protection gaps.

A common insurance-related question that we see on Seedly is whether you should get term or whole life insurance.

Do I need an Integrated Shield Plan?

Insurance Level 3: Compare Insurance Policies And Aim For The Lowest Premium With Best Coverage

- Why: For every dollar of coverage you get there are (sometimes) better alternatives you can consider.

- How: You want to spend the least amount of money, to get the most amount of coverage for you and your dependents (more bang for your buck).

- What: Fully consider all aspects before purchasing any form of insurance (for eg. the company’s reputation, level of service, ease of claims process and etc.).

The best way is to read real-user reviews about health insurance products left on SeedlyReviews to find out for yourself!

Read more:

- Insurance: How To Review & Why You Should

- Insurance For Undergraduates: What Are You Covered For?

- Health Insurance for Expats in Singapore Made Easy

- Freelancer Insurance Guide: So That You Get Paid Even When Sh*t Happens

- Best Critical Illness Insurance Plans in Singapore (2023)

Investing

Many of us have heard that putting your money inside the bank will only let it depreciate because the interest rates for savings accounts are quite measly.

This is especially true when we’re looking at rising inflation, and some of you would want to retire early or retire without worrying about finances.

Before you start investing, you’ll want to make sure that you have your Savings and Insurance sorted out!

Protecting your downside is WAY more crucial when it comes to proper financial planning.

We’ve talked about this on the MONEY FM 89.3 podcast:

Investment Level 1: Learn About the Different Asset Classes

- Why: Only invest in what you know. Period. Investing always comes with risks, so you’ll need to know how to manage them.

- How: Attend investment courses, read books about investing, read investment-related articles, and watch SeedlyTV episodes about investment.

- What: There are too many to name; Blue Chips, REITs, Stocks, STI ETFs, Singapore Savings Bonds, Cryptocurrencies, and Unit Trusts.

In essence, there are various asset classes that you can pick from based on your risk level such as:

- Equities (Stocks)

- Bonds

- Property/ Real Estate Investment Trusts (REITs)

- Commodities

- Cash

- Speculative/Alternatives/Others

Having a diversified portfolio helps to reduce your risks, which is great for beginner investors who just want to dip their toes into the investment world.

If you’re too lazy or simply do not have the time to do the research, you can also opt to invest with Robo-advisors that will create portfolios for you.

Investment Level 2: Build Your Portfolio Using Your Wealth Account

- Why: This will be your first step into the investment journey.

- What: Think about your investment horizon, if it’s long or short, how you wish to build it, and be realistic about the expected returns you hope to achieve.

- How: Once you’ve read about the different risk levels and how returns will differ, you build a portfolio that’s suitable for your risk appetite and age using the wealth account (30% of your salary). This prevents you from putting all eggs into one basket.

Investment Level 3: Optimise Your Investments for Better and Higher Returns

Once you are in the market and have received your first quarter of dividends or results, you’ll want to figure out how to beat the market and push for higher returns.

- Why: This is the next level and how far you go and how good you get at investing will depend on your years of practice and experience.

- How: You can use our REITs Tool or online stock screeners to help you invest better while continuing to invest and read widely.

An even faster way would be to ask questions and have active investment-related discussions with our friendly SeedlyCommunity!

Read more:

- Low-Risk Investments in Singapore to Grow Your Money

- Robo Advisors vs S&P 500: Which Should You Pick As Your First Investment?

- $10,000 Dividend Income Per Month: Here’s How Much You Need To Invest!

- Singapore Savings Bonds Interest Rate Guide: How Is the Interest Rate for the Singapore Savings Bond (SSB) Determined?

- Budget 2023 Singapore Summary

Start Sorting out Your Personal Finances Today

It’s NEVER too late to start getting your finances in order.

In fact, the earlier you start, the easier it will be for you to retire comfortably in the future.

As the saying goes, the best time to start was yesterday.

And the next best time to start doing something about it… is TODAY.

Use The Seedly Money Framework as a starting point to help you learn important money habits and lessons on your personal finance journey.

If you’d like to receive comprehensive guides, useful tips, and money hacks, find out about the latest Seedly events and updates.

Make sure to sign up for a FREE Seedly account too!

This way you’re part of a community of like-minded peers who can help you reach your personal finance goals even faster.

We promise to only send you the good stuff!

Advertisement