Start Making Smarter Personal Finance Decisions Today!

The first step towards financial literacy is ALWAYS the hardest.

But rest assured that you are not alone.

Seedly is here to help.

Think of this as a Personal Finance 101: Everything School Didn’t Teach Or Prepare You For.

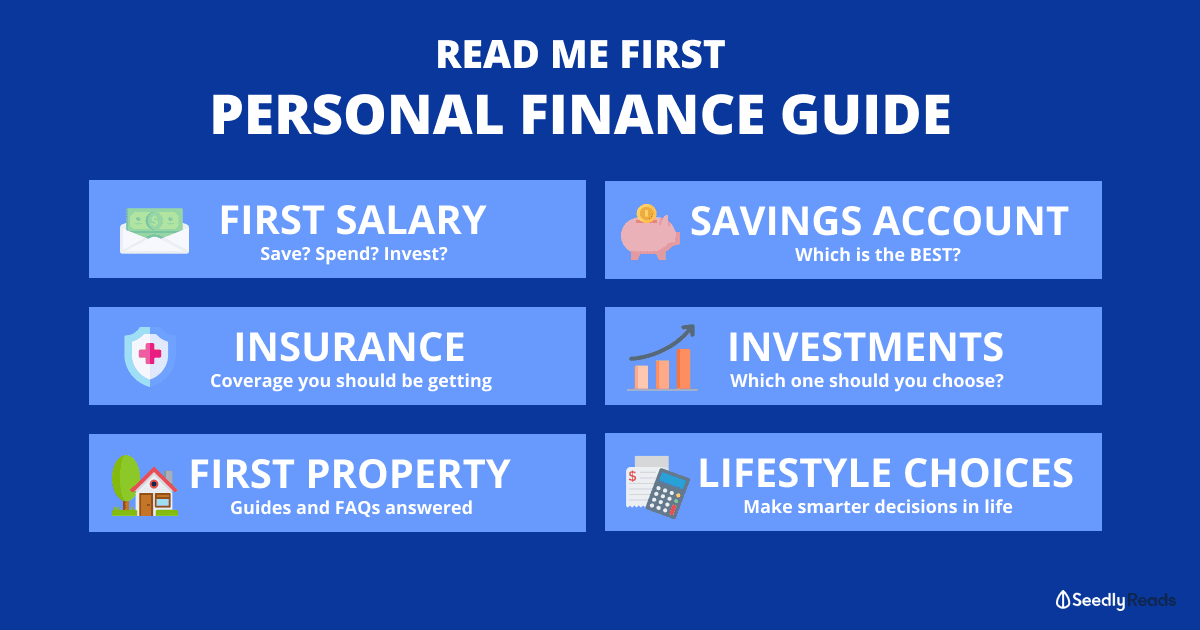

Topics To Learn More About

There is always a first for everything.

Here is a list of firsts when it comes to personal finance:

Tip: Bookmark this page so that you can refer to it whenever you need it!

If Reading About Personal Finance Bores You…

Why not watch an episode of SeedlyTV, where Kenneth and Xinyi from Seedly cover the basics of finance that is applicable to everyone?

SeedlyTV EP01: A Beginner’s Guide to Personal Finance

What Should I Do With My First Pay Cheque?

Getting your first paycheque is probably the best feeling ever.

You no longer have to rely on your parents to give you an allowance and you can finally buy whatever you want.

OR SHOULD YOU?

Before you start spending your hard-earned money, you need to learn about allocating your monthly salary.

Here’re some ways to manage your monthly salary, budget better, and get out of debt fast!

- Working Adults: How To Allocate Your Monthly Salary?

- Hacks To Clear Your Debts Fast And Effectively

- 6 Steps To Repaying Your Student Loan

Tools to help you make smarter personal finance decisions:

- The Ultimate Consumer Journey Guide: Tools To Help You Choose The Best Financial Product

- Real User Reviews Platform on Financial Products

- Calculators That Take Away The Stress In Personal Finance

- Personal Finance Community To Discuss Personal Finance Questions

Choosing The Best Savings Account And Credit Cards

The most immediate thing to do upon getting your first paycheck should be opening a savings account that gives you the best possible interest rates.

Holding on to your first savings account is definitely not the best decision.

In fact, the difference in interest rates for holding on to your first savings account can pay for your trip to Iceland.

The tedious part of this process is that as banks are competing against one another, they end up with too many terms and conditions which ultimately end up confusing every normal Singaporeans.

What You Need To Help You Choose the Best Savings Account in Singapore:

- Cheat Sheet: Best Savings Accounts For Students

- Cheat Sheet: Best Savings Accounts In Singapore For Working Adults

- Bank Account In Singapore For Expats

Tools To Help You Choose the Best Savings Account:

While getting on the right savings account can help one earn extra interest on his savings, proper use of credit cards can help one save even more!

Here’s How You Can Choose the Best Credit Cards:

- The Noob AF Guide: How to Apply for Credit Cards in Singapore

- A Step-by-Step Guide to Maximising Your Credit Card Usage

- Cheat Sheet: Best Credit Cards For Students

- Best Credit Cards To Use Overseas

Cashback vs Miles Cards:

- Which Should You Choose? Cashback vs Miles

- An Intro To Cashback Credit Cards: What You Need To Know + Which Is Best?

- The Complete Guide To The Best Cashback Credit Cards In Singapore 2020 Edition

- Cheat Sheet: What Is The Best Miles Cards For Working Adults

Best Credit Cards You Can Use Based on Categories:

- Best Credit Cards for Utilities Bills in Singapore 2020

- Best Grocery Credit Cards in Singapore 2020

- Best Cashback Credit Cards with No Minimum Spend In Singapore

- Best Credit Cards for Online Shopping and Online Payment in Singapore 2020

Here’s a hack where you can get more than $800 per year in terms of interest, as a couple:

Tools To Help You Choose the Best Credit Cards:

- Understanding The Different Types Of Credit Cards: Cashback vs Cash Rebates vs Air Miles vs Rewards

- Real User Reviews On Credit Cards

- Guide To Redeeming SQ Business Class Tickets To NZ With Big Purchases (Wedding, Renovation Or Baby) in 2019/2020

You might also be interested to find out how credit cards make money!

Fun fact: VISA and Mastercard are both generating a net revenue in billions of dollars.

Getting Your First Insurance: What Insurance Coverage Should You Be Getting?

There is no one-size-fits-all solution to getting sufficient coverage for yourself.

Hence, it is important to understand your own needs and how much are you willing to spend on coverage before getting your insurance policy:

In this section, we list out insurance guides and content that will come in handy when looking to get your first insurance.

- Working Adults: What Are The Key Insurance Policies You Should Get In Singapore?

- Working Adults: 4 Frequently Asked Insurance Questions

- All You Need To Know About Insurance Nomination In 5 Minutes

Content on Health Insurance

- Singaporean’s Ultimate Integrated Shield Plan Comparison, Am I On The Best Plan?

- The Ultimate Female Insurance Plans (With Free Health Checkup) Comparison

- Integrated Shield Plan Rider Comparison: How Can I Cover Myself More?

- Best CareShield Life Supplement Comparison

- Health Insurance for Expats in Singapore Made Easy

Content On Life Insurance

- How Much Is My Life Worth? Here’s How Much You Need To Be Covered For Life Insurance

- The Working Adult Guide: Term Life vs Whole Life Insurance. Which Should I Get?

- Working Adults: The Ultimate Guide To Understanding Your Endowment Plan

- Should You Cancel Your Aviva MINDEF/MHA Group Insurance After Your ORD?

- A Beginner’s Guide To Participating Whole Life Insurance VS Investment Linked Policies (ILPs)

Content On Claiming Insurance

- How To Do Your Own Insurance Claims Should You Be UNLUCKY Enough To Get A Lousy Agent?

- How Can You Fully Insure Your Child with Child Insurance?

- What Should You Do When You Get Into A Car Accident?

Making Your First Investment

Though we strongly recommend one to start investing as early as possible, it is important to make sure that you are financially ready!

To determine if you are ready to embark on your investment journey, here’s a checklist for you.

This section aims to help Singaporeans get started on their investment journey by providing sufficient knowledge on investing.

To familiarise yourself with some of the terms used when it comes to investing, you can check out our Investing Dictionary, where we answer all your “what is” questions.

Investing should never be a rash decision.

One should get to know his financial health and his investing mindset such as risk preference better.

If you’re looking to start investing, you can begin your journey with our ultimate guide to investing!

Below are some articles to read up while understanding your personal investing mindset.

- Working Adults: When Should I Begin Investing?

- Working Adults: Should I Pick Dividend or Growth Investing?

- Working Adults: Should I Invest A Small Sum Regularly Or A Big Sum At One Go

- Age vs Risk Profile: What Investments Should You Be Holding?

- 3 Common Investment Methods: DIY vs Active vs Passive Funds

- Best Investments In Singapore That Caters To Every Risk Profile, For Short, Medium and Long-Term Investors

- Cheat Sheet: What Are The Common Investment Products In Singapore?

- $12,000 Dividend Per Year: Here’s How Much You Need To Invest!

- Best Investment Blogs And Websites In Singapore

Now that you are ready, it is time to open that CDP account or get on a brokerage:

- CDP vs Custodian Account? Which Should I Use and Why?

- Step-by-step Guide: Opening A CDP and Stock Trading/ Brokerage Account In Singapore

- Ultimate Cheatsheet: Cheapest Stock Trading/ Brokerage House In Singapore

- Real User Reviews On Online Brokerage

Content on Singapore Savings Bond:

- Step-by-step Guide To Investing In Your First Singapore Savings Bond

- Singapore Savings Bonds (SSB): Interest Rates And How To Buy

Content on Fund Investing:

Content on Investing With Your CPF:

- How To Invest Using Your CPF

- Should You Invest Your CPF Money? Here’s A Guide On CPF Investment Scheme (CPFIS)

Content on Stocks Investing:

- The Ultimate Guide To Investing In Singapore

- 4 Forces That Move A Stock Price

- Singapore Shares To Lookout For

- Initial Public Offering Prospectus: What Should Investors Look Out For?

- Here’s How You Can Pick Great Stocks Just Like Warren Buffett

- Your 3-Step Cheat Sheet To Prepare Yourself For The Next Bear Market

- Stocks Analysis Of Individual Stocks

Content on Regular Savings Plan:

Kicking off with a Regular Savings Plan helps cultivate a habit of investing and set aside a portion of your salary automatically.

It is a good way to force yourself to save should you be a spendthrift by nature.

- Working Adults: Easiest Ways To Invest A Monthly Sum For Beginners

- Which Regular Savings Plan Is The Cheapest? POSB vs OCBC vs POEMS vs Maybank Kim Eng

Content on Exchange Traded Funds Investing:

- How To Choose The Right Exchange Traded Fund (ETF) To Invest In?

- STI ETF: A Simple Way To Invest In Singapore’s Top 30 Companies

- A Singaporean’s Guide To STI ETF: Nikko AM Vs SPDR STI ETF Which Is Better?

- A Dummies Guide To Investing In Ireland-Domiciled S&P 500 ETFs

- How To Pick ETFs And Assemble A Portfolio Like A Pro

Content on Real Estate Investment Trusts (REITs) Investing:

If you are looking to add REITs to your investment portfolio, here are some articles that can help you out.

- Working Adults: Guide to REITs Investing In Singapore

- How To Choose The Right REITs To Invest In?

- The Ultimate Review Of All The REITs In Singapore And Here’s How You Can Learn To Invest.

- Living In Singapore: Should You Invest In REITs Or Properties?

Alternative Investments: P2P Lending Platforms, Cryptocurrencies and Robo-Advisors

- P2P Lending Platforms Comparison

- Robo-Advisor Comparison

- A Quick Guide: Cryptocurrencies and Factors Affecting The Price

- Investing In Luxury Watches

- Should You Invest in Bitcoin?

Tools To Help You Get Started On Your Investment Journey

- Seedly’s Guide: Courses To Guide You On Your Investment Journey

- The Complete List: Investment Portfolio Tracking Apps and Platforms

- Discussions on Investments

Getting Your First Property

For couples looking to get their first HDB BTO, stay up to date with the latest BTO launches.

For most Singaporeans, getting a property is going to be their first big-ticket purchase. Knowing the type of HDB flat you can really afford will be the first step to the whole buying process.

While the process can be quite an experience and stressful, nothing beats a go-to place to get all the information.

- Is Your HDB Flat Potentially Worth $0?

- A Singaporean’s Ultimate Guide to HDB Lease Buyback Scheme

- Answering Singaporean’s Question On: EC vs BTO

- A Guide To Buying Your First Property In Singapore: BTO vs EC vs Resale

- We Answer 10 Commonly Asked Questions On Getting Your First Property

- What Happens To My HDB After I Die? Understanding The CPF Home Protection Scheme

Content on getting your first BTO:

- The Checklist You Need To Applying For Your First BTO

- Things I Wished I Knew Before Buying My First BTO Flat

Content on Housing Loan:

- Bank Loan vs HDB Loan, Which Is Better?

- The Ultimate Compilation of Housing/Mortgage Loans In Singapore

Content on Renovation:

- The First-Time Home Owner’s Guide To Home Renovation Loans

- Renovation Shopping Hacks: Based On Real Community Reviews

- Interior Design Experts: Cost of Renovating A HDB Flat and Tips To Save Money On Renovation

Making Even Smarter Personal Financial Decisions On Lifestyle Choices

While it is important to save, invest, get protected with insurance coverage and etc… There is more to that when it comes to personal finance.

You could also relook your daily and monthly expenses to find hacks and ways to save even more.

I mean, who would want to pay more for something right?

Save On Your Monthly Bills

We do have tools to help you choose the best SIM Only and Open Electricity Plan in less than 10 seconds!

- Cheapest SIM Only Mobile Plans In Singapore: Data vs Price Comparison

- Which Electricity Retailer Is The Cheapest In Singapore?

- Which Is The Best Fibre Broadband Plan?

- CapitaStar Vs ShopFarEast Vs Frasers Experience Vs Lendlease Plus, Which Loyalty Programme Is The Best?

- What Is The Best Rewards Programme For Groceries?

- FairPrice On Vs RedMart Vs Cold Storage Vs Amazon Prime Now Vs Giant Vs Allforyou, Which Is The Best?

- Are All FairPrices Created Equal?

- These Household Items Have Expiration Dates That Cost You Up To $320 A Year

Save On Entertainment

Save On Food

- Maximise Your Ma La Xiang Guo Order

- Ultimate Compilation Of Best High Tea Promos

- Top Halal Buffets Promotions In Singapore For All Budgets

- Best Dim Sum Buffet Promotions In Singapore

- Complete List Of 1-For-1 Buffet Promotions

- Craving For Sushi? Check Out These Sushi Buffets Under $50!

- Ultimate Buffet Guide: Cheap Buffets Under $15 In Singapore

Tools to help you:

Advertisement